Dahua or Opting for an IPO Spin-off: Huirui Technology's Dual Challenge in Machine Vision + AMR

![]() 01/22 2026

01/22 2026

![]() 428

428

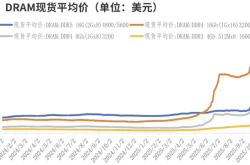

Over the past three years, China's manufacturing sector has weathered a challenging period of structural transformation. Fluctuations in the new energy supply chain, recurring cycles in the semiconductor industry, and a decline in consumer electronics demand have directly impacted the order patterns of upstream automation and intelligent equipment enterprises.

It is amidst this imperfect market window that Huirui Technology has chosen to file for a listing on the Hong Kong Stock Exchange. On January 19, the Hong Kong Stock Exchange revealed that Zhejiang-based Huirui Technology, a spin-off from Dahua Technology, has submitted its prospectus for an IPO on the Hong Kong Main Board.

Echoing the adjusted landscape of the industry, Huirui Technology's financial trajectory does not present a clear upward trend on paper. The company incurred substantial losses in 2024, and as of the first three quarters of 2025, it has not fully regained profitability.

However, from an industrial perspective, Huirui Technology stands out as one of the few enterprises simultaneously positioned in the mid-to-upper tiers of both the 'machine vision' and 'Autonomous Mobile Robots (AMR)' sectors.

Through this IPO application, we can further evaluate whether Huirui Technology has secured a sufficiently robust ecological niche as manufacturing intelligence delves deeper into uncharted waters.

Dahua's Incubated Dual-Business Platform: Ranked Among the Top Three in Both Categories!

According to publicly available information, Huirui Technology was established in 2016, emerging from Dahua Technology's industrial vision and robotics business division. In 2020, it completed the integration of Dahua Robotics' AMR business; in 2021, Dahua Technology first announced its spin-off and listing plans; after subsequent adjustments to the listing location, it formally submitted its prospectus to the Hong Kong Stock Exchange in January 2026.

The advantage of this 'incubation-spin-off' approach lies in its ability to rapidly launch by leveraging the parent company's technological, channel, and brand resources. Over the past decade, Huirui Technology has successfully developed two core business lines: machine vision and Autonomous Mobile Robots (AMR).

From a capital structure standpoint, as of the IPO, Dahua Technology retains a 32.58% stake, maintaining its position as the controlling shareholder of Huirui Technology; while Fu Liquan and Chen Ailing, a married couple, collectively control 33.69% of the voting rights. Additionally, CITIC, CICC asset management plans, and several industrial funds hold stakes.

This structure implies two practical assessments. Firstly, Huirui is not a 'startup' but a specialized platform spun off from a mature manufacturing system; secondly, its technological routes and customer bases have been repeatedly 'validated' by real-world manufacturing scenarios.

In its prospectus, Huirui Technology explicitly positions itself as 'one of the few enterprises globally with leading capabilities in both machine vision and AMR simultaneously.' This self-assessment is not just rhetorical but is backed by certain data.

According to a Frost & Sullivan report, based on industrial camera sales revenue in 2024, Huirui Technology ranked fifth globally and third in China; based on manufacturing AMR product and solution sales revenue, it ranked seventh globally and third in China.

Its core business logic revolves around constructing a synergistic closed loop of 'AI + vision + robotics.' The machine vision business serves as the 'eyes' and 'brain' in industrial settings, responsible for perception, recognition, and decision-making; while the AMR business functions as the 'hands' and 'feet,' executing material handling and mobility tasks.

Sharing underlying AI algorithms, software platforms, and supply chains, the two theoretically form a '1+1>2' solution capability, addressing manufacturing clients' complex needs for end-to-end automation.

Industry Undercurrents Amidst Sluggish Growth and Synergistic Potential

Huirui Technology's core financial data authentically mirrors the manufacturing cycle. From 2023 to the first nine months of 2025, its revenues were 1.05 billion, 902 million, and 824 million yuan, respectively, indicating that its growth trajectory has not been smooth, with even a year-on-year decline in 2024.

Profitability also fluctuated accordingly. In 2024, Huirui Technology reported a net loss of 152 million yuan. According to the company, this significant loss primarily resulted from high R&D investment, gross margin pressure due to intense market competition, and strategic investments for market expansion.

The situation improved somewhat in the first nine months of 2025. Revenue reached 91% of the full-year 2024 total, with the loss narrowing significantly to 25.97 million yuan, and adjusted EBITDA turning positive at 20.61 million yuan, indicating potential efforts in cost control and operational efficiency.

In terms of business structure, machine vision is the dominant revenue contributor, accounting for 66.2% of revenue in the first nine months of 2025; AMR contributed 33.8%. This structure reflects machine vision's status as a relatively mature and standardized business, while AMR, as a promising but currently capital-intensive sector, remains in its cultivation and expansion phase, even to some extent affecting gross margins.

However, referencing the experiences of peers like Hikrobot, achieving balance in dual sectors typically requires 3-5 years of refinement. Huirui is currently in its investment phase, aligning with normal cyclical patterns.

Expanding the perspective to the entire market, Huirui Technology faces a complex battlefield of both opportunities and challenges. On one hand, the demand for intelligentization in strategic industries like new energy, semiconductors, and automotive continues to surge, providing vast penetration space for machine vision and AMR.

On the other hand, market competition has intensified. In machine vision, international giants like Keyence and Cognex dominate the high-end market, while domestic players like Hikrobot and Luster Light also possess strong capabilities.

In the AMR sector, besides dedicated AMR players like Geek+, Quicktron, and Hai Robotics, traditional AGV manufacturers, logistics integrators, and even internet giants are entering, leaving the industry landscape far from stable.

Huirui Technology's uniqueness lies in its 'dual-line battle,' which serves as the foundation for its synergistic narrative but also means it must contend with strong competitors on both fronts simultaneously, posing extremely high demands on the company's resource allocation and strategic resolve.

Imperfect, but at Least Positioned Correctly

The core narrative Huirui Technology presents to the capital market is undoubtedly the synergistic effect of its machine vision and AMR businesses. The company claims to have established a shared R&D and technological foundation, capable of providing solutions covering the entire value chain from 'visual perception - intelligent decision-making - autonomous execution.'

Theoretically, this full-stack capability offers a unique advantage in providing integrated solutions to top clients in complex processes like lithium battery and automotive manufacturing, enhancing client stickiness and project value.

According to the prospectus, the company has served over 5,700 clients across 59 countries, including over 50 industry leaders in new energy, automotive, and electronics manufacturing, with a client satisfaction rate of 96.4% and extremely high repurchase rates among core clients.

This to some extent validates the market acceptance of its products and solutions. In January 2026, Huirui Technology was selected for KPMG China's 'Top 50 Smart Manufacturing Technology' list, providing third-party endorsement of its technological prowess.

However, the true synergistic value requires more rigorous and long-term validation. Significant differences remain in product forms, sales channels, and delivery models between the two business lines. Achieving efficient internal synergy rather than simple business aggregation poses a substantial management challenge. At least from the financial data, significant economic benefits from synergistic effects are not yet clearly visible.

According to the prospectus, the funds raised will primarily be used for technological R&D upgrades, capacity expansion, ecosystem construction, and supplementing working capital. Specifically, they will target core technologies like 3D vision chips, AI algorithms, and robot navigation, as well as the construction of domestic and international production capacity and marketing networks. Clearly, Huirui Technology recognizes that in the technology-intensive high-end equipment sector, sustained and focused R&D investment is the lifeline for maintaining competitiveness.

Overall, Huirui Technology is not without flaws; it has experienced losses and is still adjusting amidst cyclical challenges. However, its growth value lies in simultaneously securing the intersection of machine vision and AMR and having already achieved large-scale implementation in real manufacturing scenarios.

In an era where 'manufacturing no longer grows at high speeds but is extremely sensitive to efficiency,' such a company warrants serious consideration.