How Does Baillie Gifford View the AI Bubble After a Century: 'Certainty Is a Low-Level Temptation'

![]() 01/23 2026

01/23 2026

![]() 397

397

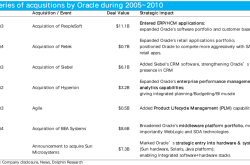

Just entering 2026, perhaps the biggest divergence in global capital markets is whether AI has reached the brink of a bubble burst. Over the past few months, Nvidia's market value once surpassed the $5 trillion mark, accompanied by controversy over 'capital recycling' — with massive transactions among giants like Nvidia, OpenAI, and Oracle accused of inflating each other's valuations. Elon Musk's xAI secured a new round of funding with a valuation exceeding $200 billion, while Anthropic's latest funding round valued it at $350 billion.

The Chinese AI market is equally fervent: Cambricon's stock price surpassed Kweichow Moutai to become the 'most expensive stock' on the A-share market, while Moore Threads and MetaX listed on the Science and Technology Innovation Board, each reaching market values exceeding 300 billion yuan. Large language model companies Zhipu AI and MiniMax subsequently listed on the Hong Kong Stock Exchange, with the latter seeing oversubscription by 1,848 times in its public offering, surging 109% on its debut, and surpassing a market value of HK$100 billion.

On the opposite side of capital enthusiasm, skepticism is equally resounding.

On January 6, 2026, Ray Dalio, founder of Bridgewater Associates, warned on X: 'Clearly, the current AI boom, which is in the early stages of a bubble, is having a significant impact on everything.' In a previous CNBC interview, Dalio bluntly stated that he believes the AI bubble has reached 'about 80% of the frenzy level seen before the 1929 stock market crash or the 2000 dot-com bubble.'

As a global leader in the AI industry, Nvidia CEO Jensen Huang holds an opposing view: 'There has been a lot of discussion about an AI bubble. From our perspective, what we see is very different.'

However, the AI bubble theory has brought tremendous pressure on him. During an internal all-hands meeting in November 2025, Huang admitted to employees that the company has been pushed into a 'no-win' situation by fears of an AI bubble: 'If we deliver a poor quarterly report, it's evidence of an AI bubble. If we deliver an outstanding quarterly report, it's evidence that the bubble is about to burst.'

Faced with such a historic technological and capital phenomenon, 'The Baillie Gifford Approach' may offer another perspective. Baillie Gifford, a century-old investment institution managing over £200 billion in assets, has outperformed Warren Buffett over the past two decades with its 'long-term global growth strategy.' The largest contributor to this strategy has been tech growth stocks — Nvidia, ASML, Tesla, Amazon, Alibaba, Baidu, and other current AI leaders, have all had Baillie Gifford's presence behind them.

And the 'long-term global growth strategy' was born right after the burst of the previous dot-com bubble.

01

Starting with the Previous Dot-Com Bubble

Kristalina Georgieva, Managing Director of the International Monetary Fund, recently stated: 'Driven by optimism about AI's potential to boost productivity, global stock prices are surging. Today's valuations are approaching levels seen during our optimism about the internet 25 years ago. If a sharp adjustment occurs, tightening financial conditions could drag down global growth.'

Twenty-five years ago, it was the burst of the dot-com bubble that left devastation in its wake.

In interviews, Baillie Gifford fund managers have revealed: 'In the two years following the dot-com bubble burst, the market plummeted. The Anderson team spent considerable time analyzing Perez's research.' ('The Baillie Gifford Approach')

This mentions two key figures: Anderson and Perez.

Anderson is the soul of Baillie Gifford's 'long-term global growth strategy,' officially stepping onto the stage as a new generation leader in the early 21st century. Taking over as fund manager of SMT (Baillie Gifford's flagship fund) in 2000 was no easy feat, as the burst of the dot-com bubble in tech stocks marked the beginning of a disheartening bear market, with Baillie Gifford's portfolio holdings experiencing significant declines in value.

Born in England, Anderson has lived in Edinburgh for 40 years. A history graduate from Oxford University, he embodies the typical Baillie Gifford scholarly demeanor, enjoying conversations with intelligent minds. He can discuss Elon Musk, Jeff Bezos, Jensen Huang, Jack Ma, and Zhang Yiming with ease, while casually chatting about renowned writers in Anglo-American literary history. To outsiders, Anderson's demeanor resembles that of a professor rather than a fund manager, with curiosity and intellectual hunger always shining in his eyes. Under his leadership, the 'long-term global growth strategy' has forged a new legendary development for Baillie Gifford. ('The Baillie Gifford Approach')

In 2003, Baillie Gifford established a team led by Anderson to build a long-term global growth strategy... Amazon, Nvidia, Moderna, and Tesla in the United States; Baidu, Tencent, Alibaba, and ByteDance in China; BioNTech in Germany; and ASML in the Netherlands — all these companies have had a long-term shareholder behind them: Baillie Gifford.

This, of course, is closely related to the long-term global growth strategy proposed by Anderson. Despite starting in a difficult market environment and weathering the 2008 global financial crisis and the 2020 COVID-19 pandemic, Anderson achieved tremendous success during his 21-year tenure, with the flagship fund SMT entering the FTSE 100 index in March 2017, achieving an annual return rate of 12.9% during his tenure. In April 2022, Anderson, who had worked at Baillie Gifford for 40 years, officially retired. ('The Baillie Gifford Approach')

The core of the long-term global growth strategy can be roughly summarized as 'global perspective + long-termism + high concentration':

Through a global perspective, it seeks 'a few companies capable of sustained high-speed growth and reshaping industry landscapes' to achieve higher compound returns than traditional indices. The investment horizon spans 5–10 years or even longer, emphasizing the compounding effect of time and in-depth tracking of company fundamentals.

Starting from first principles, it focuses on technological transformations, globalization, and macroeconomic structural trends to identify the most explosive industries and companies in the next 10–20 years. The portfolio holds a limited number of companies but with significant weights, fully embodying the 'critical few' philosophy. It transcends geographical boundaries, allocating across markets based on growth potential and technological tracks, such as simultaneously holding heavy stakes in Amazon and Tesla in the United States and Alibaba and Tencent in China.

As long as the growth logic remains intact, it adheres to patient holding, even if short-term drawdowns exceed 40%, avoiding interference from market noise with long-term compounding.

02

Technological Revolution and Bubbles

Carlotta Perez, who greatly inspired Anderson, was born in Venezuela in 1939. She is a renowned innovation economist and Neo-Schumpeterian economist, known for her research on the interaction between technological change and economic and social development.

Her 2002 book 'Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages' became her magnum opus. In 2022, renowned economic historian Barry Eichengreen selected it as one of the three most important works in economics of the century in the centennial edition of 'Foreign Affairs.'

Perez studied the five technological revolutions that have occurred over the past 200 years — the Industrial Revolution, the Steam and Railways Era, the Steel and Electricity Era, the Mass Production and Automobile Era, and the current Information Revolution. Each revolution lasts approximately 50–60 years, divided into four phases: the Irruption Phase: the era of the technology; the Frenzy Phase: the era of finance (when bubbles emerge); the Synergy Phase: the era of production; and the Maturity Phase: the era of questioning complacency.

The first two phases constitute the introduction period, while the latter two form the deployment period. The transition from the introduction to the deployment period involves a turning point. Perez analyzed the varying roles financial capital plays in each phase of a technological revolution.

Baillie Gifford has established partnerships with many research institutions and scholars, with Perez being one of the frequently engaged scholars. Anderson believes she has done more than anyone in explaining technological eras, deepening his understanding of technological revolutions and cycles.

A year after the publication of 'Technological Revolutions and Financial Capital,' Baillie Gifford's 'long-term global growth strategy' was officially born. Perez's theory inspired Baillie Gifford at the right moment, not only at the cognitive level but also enabling the 'long-term global growth strategy' to successfully seize the 'golden pit' before the golden age of the information technology revolution, marking the beginning of a new era for Baillie Gifford.

Technological transformation industries represent the most important investment direction for the 'long-term global growth strategy.' Over the past two decades, the strategy's investment focus has primarily centered on technological transformation fields shaping the world: heavily investing in Amazon, Google, Tencent, and Alibaba in the internet and mobile internet sectors. Many of these companies are now major players in the AI field.

What stage is AI currently at? Perez stated in a recent frontier dialogue hosted by the Luohan Academy:

Today, we are in the midst of the information revolution. On one hand, this revolution continues to modernize and 'creatively destroy' old systems; on the other hand, it nurtures and constructs entirely new technological systems. Therefore, while the 'Mass Production Revolution' is being reshaped by the information revolution, the new revolution, in terms of institutions and organizations, is still in a formative stage.

Understanding this is crucial. Because focusing solely on 'how to better leverage AI for economic growth or social welfare' is far from sufficient. AI is not an isolated technological revolution but an increasingly critical and inseparable revolutionary technology within the information revolution. Only by placing AI within the historical trajectory of the entire information revolution can we truly grasp its potential and boundaries.

Han Shenghai, author of 'The Baillie Gifford Approach,' believes:

According to Perez's definition, AI is currently at the turning point from the 'introduction period' to the 'deployment period' (golden age). Thus, investments should clearly focus on companies capable of navigating this transition, such as core AI technology providers, infrastructure companies, and those capable of generating technological synergies, particularly paying attention to 'dynamic demand' potentially sparked by institutional innovations.

For investors adhering to long-term growth beliefs, the 'AI bubble' may not be the most worthy concern, as the concentration of capital driven by technological revolutions is a necessary stage in Perez's defined 'S-curve.' More importantly, the essence of technological revolutions is 'holistic transformation.' For long-term growth investors, true investment lies in identifying winners representing the 'vectors of change' based on an understanding and insight into the overall ecosystem of technological revolutions, rather than narrowly confining themselves to the AI label.

03

Increasing Returns Theory and Arthur's Insights on AI

'Perez has shown us that the advent of historical technological revolutions follows distinct patterns, and the economy responds in predictable stages. Her perspective offers a novel lens not only for history but also for our own era, especially the information technology revolution era.' This is how Brian Arthur, author of 'The Nature of Technology,' evaluates Perez.

Arthur himself is another thinker who has significantly influenced Baillie Gifford's investment philosophy. Born in Northern Ireland in 1945, Arthur became Stanford University's youngest Morrison Professor of Economics and Population Studies in 1983. He received the Guggenheim Fellowship in 1987, the International Schumpeter Economics Prize in 1990 for his research on increasing returns, and the inaugural Lagrange Prize in Complexity Science in 2008.

Arthur's groundbreaking paper on increasing returns was rejected by four top journals for six years, with the reasoning that increasing returns 'seemed rare and esoteric — not quite 'economics.'' However, history has proven his foresight. This theory remains crucial today: it forms the core of the success of Google, Facebook, Uber, Amazon, and Airbnb.

Arthur overturned the fundamental assumptions of traditional economics. Traditional theory is based on Alfred Marshall's diminishing returns hypothesis from over a century ago: products or companies leading in the market will eventually encounter limitations, reaching a predictable equilibrium in price and market share. However, Arthur points out that as the economy shifts from resource processing to information processing and from primitive energy applications to thought applications, the mechanisms determining economic behavior have transitioned from diminishing returns to increasing returns.

What Arthur refers to as increasing returns means that leaders become increasingly dominant, while those losing advantage further decline. These are positive feedback mechanisms operating within markets, enterprises, and industries, reinforcing success or exacerbating failure.

Baillie Gifford's encounter with Arthur marked a turning point in fate. One of Baillie Gifford's most important intellectual sources is the Santa Fe Institute. Founded in the 1980s by a group of Nobel laureates, this research institution specializes in studying complex adaptive systems. The institute's first research project was precisely 'the economy as an evolving complex system,' led by Arthur.

'The Baillie Gifford Approach' documents how this collaboration shaped Baillie Gifford's investment philosophy.

Increasing returns represent one of the important intellectual sources of complexity economics, profoundly explaining the rise of tech giants like Microsoft and Google, and widely accepted in Silicon Valley as the underlying logic for investment and innovation. Leveraging increasing returns, Baillie Gifford also gained a deeper understanding of the extraordinary growth logic behind tech companies like Amazon, Tencent, and Alibaba.

The law of increasing returns aligns with the market evolution of high-tech industries, including the design and manufacturing of computers, medicine, missiles, aircraft, automobiles, software, telecommunications equipment, and even fiber optics, as well as the aerospace sector. The development cost of the first B-2 stealth strategic bomber was $21 billion, after which the marginal cost per additional bomber dropped significantly to $500 million. Arthur notes: 'Developing Java may have cost Sun Microsystems $200–300 million, but once the software is created, the replication cost is nearly zero. It can essentially be downloaded from the internet, meaning there are no distribution or production costs. Therefore, once the initial investment is made, revenues increase rather than decrease with each copy sold.'

Baillie Gifford's investment philosophy on increasing returns differs from traditional industrial thinking. Arthur refers to traditional industrial thinking as the 'production floor,' such as in traditional manufacturing, where increasing market share or expanding the market eventually leads to rising costs and diminishing marginal returns as competitors enter, commonly known as 'involution.' In contrast, Arthur calls tech industry thinking the 'technology game.' Precisely because of the positive feedback and locking effects brought by increasing returns, new technologies can replace old ones, and innovative companies can displace slow-moving traditional enterprises.

In Baillie Gifford's portfolio, whether it's Amazon, Tesla, or Tencent, significant upfront investments were made to gain market share, forming positive feedback loops that widened the gap with competitors and locked in the market. Baillie Gifford partner James Anderson has publicly stated that Arthur's theory provides crucial support for his investment framework, especially in identifying early signals of 'winner-takes-all' companies. ('The Baillie Gifford Approach')

Arthur deeply contemplated AI's economic transformations over a decade ago. As early as 2011, in an article titled 'The Second Economy' published in the 'McKinsey Quarterly,' Arthur stated: 'Digitalization is creating a second economy — an autonomous economy — that is vast, silent, interconnected, and invisible. It operates remotely and globally, always online. It constantly reconfigures itself instantaneously and increasingly possesses self-organizing, self-structuring, and self-healing capabilities.'

He compared this transformation to the Industrial Revolution: “With the Industrial Revolution—starting roughly from the appearance of Watt’s steam engine in the 1760s to around 1850 and beyond—the economy developed a muscular system in the form of machine power. Now, it is developing a nervous system.”

In a 2023 McKinsey interview, Arthur spoke about generative AI: “Generative AI means that many thoughtful questions about 'white-collar' work can be automated. This will profoundly change how the service sector and white-collar jobs operate, and in ways we don’t yet know. But it’s not just the vast amount of labor-intensive tasks in white-collar work that will change. Generative AI will transform how the economy itself operates: it will alter existing industries and introduce new ones. But how this will happen is uncertain. We cannot say for sure.”

Arthur believes that the primary economic challenge is shifting from “producing prosperity” to “distributing prosperity.” “The Second Economy will undoubtedly serve as the engine of growth and provider of prosperity for this century and beyond, but it may not provide employment opportunities. As a result, there could be a situation where prosperity exists, yet many are unable to fully partake in it. This indicates that the primary economic challenge is shifting from producing prosperity to distributing it.”

04

Baillie Gifford’s Response

As an institution heavily invested in AI, Baillie Gifford directly responds to the AI bubble theory. Not long ago, Baillie Gifford released an article by investment manager Ben James titled

The current situation is delicately complex. We believe that AI-related stocks exhibit both genuine and sustained progress in digital infrastructure and software, while also presenting several potential overheating risks that warrant caution. Today, as long-term growth investors in this field, we must be more selective than ever, maintain valuation discipline, and be willing to support founder-led companies with efficient cultures that consistently seize opportunities amid market noise.

……

By historical standards, the U.S. market appears expensive, but the composition matters: a handful of global platform companies now control the computing, data, and distribution infrastructure on which AI relies. Their scale advantages resemble oligopolies more than gold rushes. This concentration makes their spending—and by extension, some of their valuations—more rational than the frenzies seen at the end of historical cycles. For example, NVIDIA’s fundamentals have significantly improved, with valuations only slightly above their 2022 lows and well below their five-year average. In contrast, during the dot-com bubble, Cisco Systems saw its profitability continuously deteriorate while its stock price soared parabolically, with valuation metrics climbing steadily before the crash.

In this context, the primary risk to focus on is capital intensity: if investment growth outpaces returns, or if oligopolistic dynamics widen significantly, industry profitability could narrow, replaying the overcapacity scenario in the telecom sector after the dot-com bubble burst. However, we currently see no widespread signs of an imminent market bubble; instead, we observe concentrated market characteristics—with premiums rooted in unique industry composition and exceptional profitability.

……

Thus, the possibility that we are in a frenzy stage of AI infrastructure construction—akin to the development phases of railroads, personal computers, or the early internet—cannot be ruled out. During such periods, overinvestment and exceptional companies can coexist; the key variable for creating long-term wealth is not the narrative itself but execution: consistently generating cash flow, reinvesting it into vast and enduring opportunities, while maintaining portfolio discipline around valuations. This remains our constant focus.

In such an environment, selection is paramount. At the foundational layer of AI, the potential winners are already clear: in cloud computing, we have Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform; in accelerated computing, NVIDIA stands out. Moving up to the application layer, companies with distribution capabilities, proprietary data, and rapid iteration cycles will hold an advantage. We find these traits most commonly in founder-led, product-first cultures. This logic underpins our positioning in companies demonstrating AI-driven growth and substantial improvements in operating leverage. (

In the current environment, Baillie Gifford focuses on three key questions:

The return on investment in AI capital expenditures—will industry leaders continue to earn high incremental returns on their investments in computing and models? Or will competition force all parties into uneconomical arms races?

Penetration into the application layer—as AI’s transformation shifts from infrastructure to daily workflows, distributed architectures and proprietary data will become increasingly important. We favor companies with adaptive cultures capable of embracing new technologies and business models.

Changes in consumer behavior—currently, we see a divergence in consumer demand: weakness in some areas and strength in others. We will continuously monitor and adjust our portfolio positioning accordingly.

During this period of AI prosperity, we do not need to declare a bubble to invest prudently. We will allocate our clients’ capital to companies that can translate technology into lasting economic benefits, rather than those relying solely on conceptual hype without fundamental profitability. Facing a market dominated by AI enthusiasm, we will continue to uphold this seemingly ordinary yet vital principle, always focusing on the future and creating long-term excess returns for our clients with patience beyond the norm. (

05

"Certainty Is a Low-Grade Temptation"

The “Long-Term Global Growth Strategy” emphasizes understanding markets and companies over decade-long timeframes. Baillie Gifford regards “imagination” as an investment skill—a required course.

For Baillie Gifford, imagination matters because the future is what truly counts, and because they believe the core challenge of investing is understanding change—what is changing, how it is happening, and its subsequent impact. Thus, change and the nature of change are the topics most frequently discussed by Baillie Gifford’s investment team.

The imagination emphasized by Baillie Gifford aligns closely with philosopher David Hume’s definition in . According to Hume, imagination serves as a mediator representing how people envision objects, actions, and their interconnections, but imagination itself is not direct or real; its correctness can only be verified by reducing it to sensory impressions. Only knowledge that withstands scrutiny through sensory impressions can be considered truth. The central task of philosophy is to reduce imagination to direct sensory impressions.

In investment scenarios, Baillie Gifford’s imagination functions as a tool to explore connections between things—“thinking boldly at a macro level while remaining meticulous at a micro level.” Good investment ideas are often sown by curiosity and nurtured by imagination. They can reveal the boundaries of known information, avoiding the limitations of empiricism, while also challenging existing capabilities and indicating areas worth exploring. This process demands both rigor and relentless effort. The more one imagines, the better one understands actual relationships and the closer one gets to the goal.

Imagining the future is not easy. For most of humanity’s long development, survival required immediate reactions, leaving little time to contemplate long-term, exponential changes. As Bill Gates said, “People tend to overestimate what will happen in three to five years and underestimate what will happen in ten years or more. Imagining the future is difficult for many.”

Normally, humans process information based on the past and present, but Baillie Gifford seeks companies with sustainable competitive advantages and revenue growth rates far exceeding market averages, investing over five- or even ten-year horizons. These companies must sustain growth at “unreasonable prices,” imposing high demands on Baillie Gifford’s investment team’s comprehension and imagination. (

How does Baillie Gifford cultivate this “large-scale” imagination?

First, Baillie Gifford collaborates deeply with academia to gain long-term insights. Anderson once said, “By working with scholars, Baillie Gifford gains insights into long-term industry developments over the next 10 to 20 years. Scholars think in terms of changes 10 or 20 years ahead, aligning perfectly with Baillie Gifford’s philosophy of ‘thinking in decade-long timeframes.’ Market analysts focus on next quarter’s earnings, while scholars gaze toward the next era—their perspectives are entirely different.” (

Besides Arthur and Perez, another scholar who profoundly influenced Baillie Gifford is Hendrik Bessembinder, a professor of finance at Arizona State University. His 2018 research revealed that between 1926 and 2016, all net wealth creation in the U.S. stock market was attributable to the top 4% of performing stocks. This study deeply influenced Baillie Gifford’s investment philosophy, leading them to place greater emphasis on bottom-up stock selection and reinforcing their belief in long-term holding of valuable growth companies.

Second, close ties and communication with entrepreneurs. Especially, engaging with the management teams of invested companies is a crucial avenue for Baillie Gifford to conduct in-depth AI research and gain differentiated insights. Baillie Gifford has had in-depth discussions with entrepreneurs from AI-related companies such as Jensen Huang, Morris Chang, Elon Musk, Jeff Bezos, Robin Li, and Kai-Fu Lee. During a 2016 exchange, a Baillie Gifford participant asked Li Yanhong, “What truly interests you?” Li systematically elaborated on AI’s potential in the era of intelligent computing, prompting Baillie Gifford to re-examine AI.

Third, the “Ten Due Diligence Questions” framework systematizes future imagination. Baillie Gifford has developed a unique evaluation framework called the “Ten Due Diligence Questions,” with the second question best reflecting their imagination training: “What will change for the company in ten years?” Answering this question employs scenario analysis, envisioning optimistic, neutral, and pessimistic scenarios, assigning probabilities to each, identifying key driving parameters, and dynamically adjusting. Traditional financial metrics focus on the past and present, while Baillie Gifford’s investment horizon looks toward enterprise growth over the next five to ten years.

Fourth, embracing uncertainty through complex economics thinking. From a complex economics perspective, the stock market is a complex adaptive system characterized by uncertainty, volatility, nonlinear changes, and unpredictability. Investors interact extensively, with each strategy and trade altering the trading environment for others. Markets are constantly evolving, uncertain, and unmeasurable.

Anderson argues, “Certainty is a low-grade temptation; striving for correctness can interfere with proper decision-making.” This means rejecting linear predictions of short-term gains, cash flows, or stock prices, accepting uncertainty as the norm in investing, and willing to engage in bold “imagination” amid high uncertainty.

Take Tesla as an example. Baillie Gifford first bought 2.3 million shares of Tesla in early 2013, when the stock price was below $8. By August 2020, Baillie Gifford had earned $16 billion in profits from Tesla alone. In 2013, Tesla’s massive R&D investments baffled many investment firms. Investing in it required not only courage but also the ability to deduce and imagine the future.

Amazon’s case is even more representative. When Amazon was still losing money and its future was uncertain, Baillie Gifford imagined the possibility of it becoming the “everything store” and a cloud computing giant. This imagination was built on a profound understanding of increasing returns—Amazon’s e-commerce platform perfectly embodied network effects: more sellers attracted more buyers, and vice versa, creating a flywheel effect.

Now, with AI’s “delicately complex” situation, it is time to once again test the effectiveness and adaptability of this strategy that has created miracles over two decades.

After all, as Perez said, we are at a turning point of the information revolution. This turning point may be long and painful, but history tells us that every technological revolution’s turning point is followed by a golden age. The question is not whether AI is in a bubble but who will remain standing after it bursts and who will reap the fruits when the golden age arrives.