Rumors of Listing Resurface: How Will 'Pingtouge' Shake Up the AI Chip Market?

![]() 01/28 2026

01/28 2026

![]() 528

528

By Wang Huiying

Edited by Ziye

On January 23, Alibaba's Hong Kong-listed shares opened at a high of HKD 171 per share, marking a new peak since November last year.

The surge in Alibaba's stock price was triggered by rumors surrounding its low-profile chipmaking business, Pingtouge, for the past eight years. On January 22, Bloomberg reported that Alibaba plans to reorganize Pingtouge into an independent entity with employee stock ownership, followed by an IPO.

Although the independent listing is still in the rumor stage, given the investments in AI computing power and capitalization moves by domestic and foreign tech companies, Pingtouge's listing has long been anticipated by the market.

Pingtouge, initially a chip project under Alibaba's DAMO Academy, was spun off during the 2018 Cloud Town Conference and embarked on a journey to conquer core semiconductor technologies.

Image source: Pingtouge's official website

Bearing Alibaba's ambitions in chipmaking, Pingtouge's development trajectory is highly representative: from its first AI inference chip, the "Hanguang 800," to general-purpose chips like CPUs, GPUs, and memory chips, Pingtouge aims to build a full-stack self-developed chip architecture and meet a broader industry ecosystem through open-source collaboration.

After "eight years of sharpening a sword," numerous rumors have surfaced about Pingtouge's spin-off. Chips have always been a sensitive nerve for Alibaba. In September last year, Alibaba's stock price also surged due to its chipmaking initiatives. With Alibaba's AI strategy becoming clearer, a successful listing would signify Pingtouge standing at a new starting point.

Throughout its journey, Pingtouge has not only supported Alibaba's internal needs but also faced the vast market to build an independent business ecosystem. On this arduous path of self-developed chipmaking, Pingtouge has consistently risen to challenges, and now, the moment for results may have arrived.

1. Full-Stack Self-Development: Pingtouge Made the Right Bet

When it comes to Pingtouge, consumer awareness largely dates back to 2018.

At the Alibaba Cloud Town Conference in September of that year, amid Alibaba's ambitious chipmaking endeavors, what left a lasting impression was the name of the chip business itself.

At first glance, one might think it refers to an approachable "big brother," but it is actually derived from the nickname of the animal "honey badger"—known for its tenacity and fearlessness in challenging opponents far larger than itself.

The moral (implication) of the name is self-evident. This company is set to exhibit an indomitable fighting spirit in the tech battleground of chips, widely recognized as the most "hardcore" and high-threshold field.

Just as the name is unexpected, Pingtouge's first move surprised the market at the time.

In the chip market back then, NVIDIA and Intel monopolized cloud AI computing power, while domestic companies were largely trapped in a passive "bottleneck" situation. Chinese enterprises spent hundreds of billions of dollars annually on importing chips, becoming the weakest link in the industrial chain.

Chinese companies' determination to make chips was strong, and their routes were concentrated. Huawei's Ascend series began to gain momentum, and professional AI chip companies like Cambrian also emerged. Most manufacturers chose to focus on GPUs.

To break through the encirclement, route selection was crucial. Pingtouge understood that launching a single AI chip would inevitably lead to a homogeneous competition centered on performance and parameters. Instead, Pingtouge chose a relatively blue ocean route—the RISC-V open-source instruction set architecture—aiming to create a chip design platform and lower industry design barriers.

More importantly, Pingtouge implemented a full-stack strategy. In 2019, after more than a year of hard work, Pingtouge released three products within 90 days. In July, it launched the XuanTie 910; in August, it introduced the "Wujian," a one-stop chip design platform; and in September, at the Cloud Town Conference, the Hanguang 800 made its debut.

In particular, the unveiling of the Hanguang 800, along with the XuanTie and Wujian platforms, formed an ecological closed loop (closed loop)—the Wujian platform provided rapid iterative research and development support for the Hanguang 800, while the XuanTie IP empowered terminal devices through the Wujian platform, creating a computing power linkage with the cloud-based Hanguang 800.

This was a highly ambitious route selection. Facts have proven that Pingtouge made the right bet.

As of 2025, Pingtouge has established a comprehensive product system covering AI inference, general-purpose CPUs, GPUs, SSD controllers, and IoT end-side chips, achieving shipments in the hundreds of millions and a presence covering both cloud and terminal markets.

During this period, Pingtouge also embarked on the more challenging development of general-purpose CPU chips. As the brain of computing systems, CPU design represents a technological mountain in the semiconductor industry, and Pingtouge took the lead. At the 2021 Cloud Town Conference, Pingtouge released Alibaba's first general-purpose server chip, the Yitian 710, which outperformed the industry benchmark by 20% in performance and improved energy efficiency by over 50%.

Currently, the Yitian 710 has been widely applied in video encoding and decoding, high-performance computing, gaming, and other fields through Alibaba Cloud services.

Amidst a red ocean, Pingtouge has carved out an interconnected route, demonstrating to the outside world the ambition of this dark horse and forging a unique differentiated development path amidst the competition from industry giants.

2. Internal Priority, Cloud-Chip Integration: Pingtouge Continuously Expands Its 'Circle of Friends'

Within Alibaba's ecosystem, Pingtouge was born with a silver spoon.

Unlike independent chip companies like Maxio Technologies and Moore Threads, which "make chips first and then find customers," Pingtouge, from its inception, used Alibaba Cloud as a testing ground, developing a series of product lines centered around cloud scenarios based on customer needs.

This not only pointed out Pingtouge's technological route but also clarified its commercialization direction, making Pingtouge a dark horse in the chip industry chain.

For instance, upon the launch of the Hanguang 800, Pingtouge clearly defined its end-to-cloud integration strategy with internal priority. As emphasized by Alibaba, the Hanguang 800 would not be sold separately but would output computing power through Alibaba's AI cloud services, aligning with the growth of Alibaba Cloud's business.

Image source: Pingtouge's official website

The reason for adopting an internal priority strategy was that Pingtouge had long recognized the characteristics of the semiconductor industry—"high investment, long cycles, and high risks." The maturation of semiconductor chips relies on refinement in large-scale practical scenarios, and Alibaba's ecosystem, with its massive demand, provided Pingtouge with a low-cost, high-fidelity verification platform.

In other words, one of Pingtouge's core advantages is its ability to better understand customer scenarios and cloud computing power demands, shortening the cycle from chip design to application deployment.

This also represents the core business logic behind its technological route selection—cloud-based chips serve Alibaba Cloud's computing power needs, while terminal chips are adapted for IoT and new retail scenarios within the ecosystem, forming an endogenous cycle of "research and development-verification-iteration."

For example, the successful application of the Hanguang 800 during Alibaba's 2019 Double 11 not only verified the practical capabilities of this inference chip but also directly created value for other Alibaba businesses by improving search efficiency and reducing energy consumption.

More specialized scenario verifications came from Alibaba's "City Brain" team. This business requires real-time processing of video streams from thousands of cameras in Hangzhou's main urban area, demanding astronomical computing power. Traditional GPU solutions were prohibitively expensive, whereas now, four Hanguang 800 chips can support the required computing power.

The Yitian 710 server CPU further deepened internal commercial integration. After its release, this chip was first deployed on a large scale in Alibaba Cloud's data centers, replacing a significant number of Intel Xeon chips. Through Alibaba Cloud's ECS instances, it served internal business segments like e-commerce and logistics, enhancing Alibaba Cloud's computing power foundation while accumulating core data and experience for Pingtouge's large-scale commercialization.

This "cloud-chip integration" model shares similarities with Amazon's self-developed Graviton chips, which customize computing power based on their cloud ecosystem and optimize software-hardware collaboration. Both aim to reduce reliance on external chip suppliers and achieve dual breakthroughs in cloud service computing efficiency and cost control.

More crucially, this model of empowering internal scenarios and having scenarios feed back into technological iteration has allowed Pingtouge's "circle of friends" to expand continuously.

After validating technologies and business models in internal scenarios, Pingtouge has been rapidly expanding its commercial circle of friends, maintaining core technological barriers while expanding revenue boundaries through ecological cooperation.

Among them, the open-sourcing of the XuanTie series IP has become a core driver of its ecological openness.

At the 2023 XuanTie RISC-V Ecosystem Conference, Pingtouge announced its ecological plan. Addressing 150,000 developers in the chip open community, Pingtouge launched the online learning platform "RISC-V Academy Plan" for the first time, encouraging participation in global RVFA certification. For industry partners, Pingtouge introduced the "XuanTie Preferred Chip" program to promote the implementation of ecological chips.

Image source: XuanTie's official website

The expanding customer circle of friends provides Pingtouge with vast amounts of data and scenarios, which in turn feed back into its technological iteration. Regardless of chip architecture, a chip's market position is determined by how many downstream customers are willing to pay for it.

Through a "basic licensing fee + volume production royalty" model, Pingtouge has licensed the RISC-V architecture IP to companies like ThinkSilicon and MegaChips. To date, cumulative shipments have exceeded 4 billion, with over 300 licensed customers.

On the other hand, products like the Hanguang 800 and Yitian 710 have validated Pingtouge's cost-effective AI computing power services, attracting a large number of AI developers and B2B customers.

During the analyst conference call following Alibaba's Q1 FY2026 earnings report in August last year, global enterprise software giant SAP officially collaborated with Alibaba Cloud to support customers in running and managing their core software systems on Alibaba Cloud.

From internal use to ecological expansion, Pingtouge has continuously tested market boundaries, laying the groundwork for its independence.

3. Spin-Off and Listing: Does Pingtouge Face New Opportunities?

Over the years, rumors about Pingtouge's spin-off and listing have surfaced periodically.

LatePost reported that around the 2021 Cloud Town Conference, Alibaba began considering spinning off Pingtouge to enable independent financing, thereby securing more development funds and a more independent market position as a chip supplier.

Especially driven by the recent surge in large models, capital market sentiment has soared, and chips have become a hot commodity, leading to increasing speculation about Pingtouge's independence.

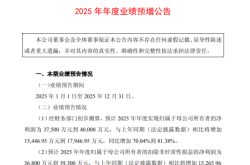

From the end of 2025 to the present, several domestic GPU companies have gone public in rapid succession.

Moore Threads went public on December 5, 2025, setting a record for the fastest IPO approval on the STAR Market; on December 17, 2025, Maxio Technologies listed on the STAR Market; on January 2, 2026, Biren Technology went public in Hong Kong, and on the same day, Baidu officially announced that its "Kunlun Core" business had submitted a listing application to the Hong Kong Stock Exchange in a confidential manner.

The market's enthusiasm has undoubtedly accelerated Pingtouge's spin-off and listing process, heightening market expectations.

In reality, compared to Alibaba's e-commerce, cloud, and other businesses, Pingtouge has maintained a low profile. Its last moment in the spotlight was the leak about its PPU chip in September 2025.

At that time, The Information reported that the first-generation PPU developed by Pingtouge could match the performance of NVIDIA's H20, while the upgraded version outperformed NVIDIA's A100. According to The Information, Pingtouge's PPUs had been used in training some small-scale large models at Alibaba, placing it ahead of other domestic chip companies.

That same month, CCTV's "Xinwen Lianbo" briefly flashed two frames showing specific performance metrics of Pingtouge's PPU—the PPU featured 96GB of HBM2e memory, inter-chip interconnect bandwidth of 700GB/s, PCIe 5.0×16 interface, and power consumption of only 400W. On these key parameters, it surpassed NVIDIA's A800 and mainstream domestic GPUs, with overall performance comparable to the H20.

According to 36Kr, this PPU completed research and development and scenario verification as early as the end of 2022 and early 2023. By 2025, Pingtouge's PPU chips had become one of the highest-shipping self-developed GPUs in China.

Both market sentiment and Pingtouge's technological strength indicate that its independent listing is a natural outcome.

Looking at the domestic market, compared to the early sense of technological urgency, China has now become the world's largest chip consumer market. Immense and structural chip demands have emerged in cutting-edge fields like AI training, new energy vehicles, and autonomous driving. If it successfully lists independently, Pingtouge will be able to respond more flexibly and neutrally to these widespread market demands, transitioning from serving a single conglomerate to empowering diverse industries.

Secondly, the industry requires long-term capital support. Chips are a typical "high investment, long cycle, high technological barrier" industry. From the advanced processes of Pingtouge's Yitian 710 to the massive investments by companies like Maxio Technologies in developing high-performance general-purpose GPUs, sustained and substantial financial support is essential.

Independent listing opens up direct financing channels, not only attracting long-term capital optimistic about China's chip future but also ensuring talent acquisition through transparent equity incentive plans.

Of course, for this company, performance is just the first step. What truly determines success and customer retention lies in a complete development toolkit and ecosystem. Pingtouge has made the right first step; now, the question is how steadily it can proceed on this path.

(The header image of this article is sourced from Pingtouge's official website.)