Net Profit Set to Soar Up to 81%! Optical Industry Leader Plans Private Placement to Boost Production and Embrace a New Growth Cycle

![]() 01/27 2026

01/27 2026

![]() 376

376

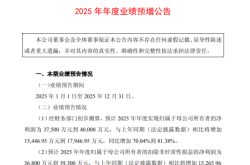

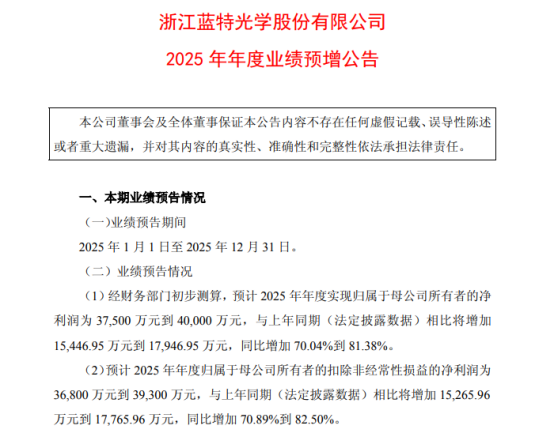

On January 27, Lante Optics revealed that, according to preliminary calculations by its finance department, it anticipates achieving a net profit of between RMB 375 million and RMB 400 million for 2025. This represents a significant year-on-year increase of 70.04% to 81.38%. The expected net profit after deducting non-recurring gains and losses for 2025 is projected to range from RMB 368 million to RMB 393 million, marking a year-on-year rise of 70.89% to 82.50%.

When discussing the reasons behind the performance fluctuations, Lante Optics stated that during the reporting period, the company maintained its focus on its core business. It capitalized on the strengths of its core customer base and the diversified product portfolio it had built up in previous stages. By seizing opportunities in industry development, the company achieved rapid performance growth.

Specifically, in the optical prism business, the terminal demand for micro-prism products used in smartphone periscope camera modules saw further expansion, which contributed to the performance growth.

In the glass aspherical lens segment, the business benefited from the expansion of downstream application markets. These markets include automotive electronics, optical communications, smartphones, and handheld imaging creation devices, leading to a substantial surge in product sales.

In the glass wafer business, the company experienced rapid growth. This was due to the further deepening of strategic cooperation with major clients and the continuous expansion of downstream demand driven by cutting-edge technology applications.

Signs of the significant projected increase in annual performance were already evident in the third quarter. In the first three quarters of 2025, Lante Optics reported revenue of RMB 1.051 billion, up 33.7% year-on-year, and a net profit attributable to shareholders of RMB 250 million, up 54.68% year-on-year. In the third quarter of 2025, the company's revenue reached RMB 474 million, up 16.2% year-on-year, and the net profit attributable to shareholders was RMB 147 million, up 30.4% year-on-year.

The record-high quarterly revenue in the third quarter of 2025 was primarily driven by significant growth in the glass aspherical lens business. This growth was fueled by demand from optical communications, action/panoramic cameras, and smartphones. Notably, the company's quarterly performance fluctuations closely align with the cyclical characteristics of the consumer electronics industry. During investor exchanges, Lante Optics pointed out that downstream demand is significantly influenced by new product launch cycles. The third quarter typically serves as the peak season for concentrated supply chain deliveries, providing additional seasonal momentum for the company's performance growth.

Meanwhile, with the gradual release of the company's planned expanded capacity for glass aspherical lenses and sustained growth in downstream demand for glass wafers in AR and semiconductor applications, Lante Optics' various business segments are facing considerable development opportunities. This has enabled effective business growth in the third quarter of 2025.

As a leading enterprise in the precision optical components sector, Lante Optics has continuously expanded its industrial layout in recent years by leveraging its core technologies. It is capitalizing on market opportunities brought about by intelligent upgrades across multiple industries and has established three core product matrices centered around optical prisms, glass aspherical lenses, and glass wafers. These products find wide applications in high-growth areas such as consumer electronics, automotive optics, LiDAR, 5G optical communications, semiconductors, and smart home devices.

In terms of customer collaboration, Lante Optics is not only a core supplier of micro-prisms for Apple's smartphone periscope lenses but has also successfully entered the supply chains of leading mobile phone brands like Huawei and Xiaomi. Simultaneously, the company has made in-depth forays into the AR/VR sector, providing diffractive waveguide lenses and key structural components for terminal products such as Microsoft HoloLens, Meta Quest 3, and Ray-Ban Meta smart glasses. It has also forged partnerships with industry technology firms like Magic Leap and DigiLens.

Currently, with the deep integration of technologies such as artificial intelligence and 5G communications with the augmented reality industry, coupled with the recovery of the consumer electronics market and the acceleration of automotive intelligence, the precision optical components industry is entering a new growth cycle, which Lante Optics is closely monitoring and embracing.

Through this private placement, Lante Optics is expected to further diversify its product mix, expand its business scale, and solidify its competitive position in the global optical supply chain.