Intelligent Driving: No Pause Mid-Game, Just Unending Conflict

![]() 01/28 2026

01/28 2026

![]() 362

362

Author | Liu Xi

Editor | Dexin

In 2025, as assisted driving technology rapidly advances in the Chinese market, high-level intelligent driving, epitomized by urban Navigation on Autopilot (NOA), has undergone a significant transformation.

On one hand, companies like Haomo.ai and Dazhuo Intelligence have exited the market. On the other, the "HuaYuanMo" trio—Huawei, AutoX, and Momenta—has emerged as a leading group among third-party intelligent driving suppliers.

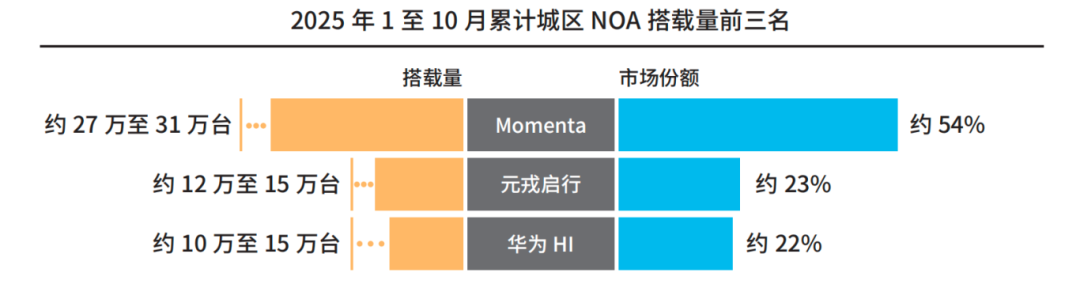

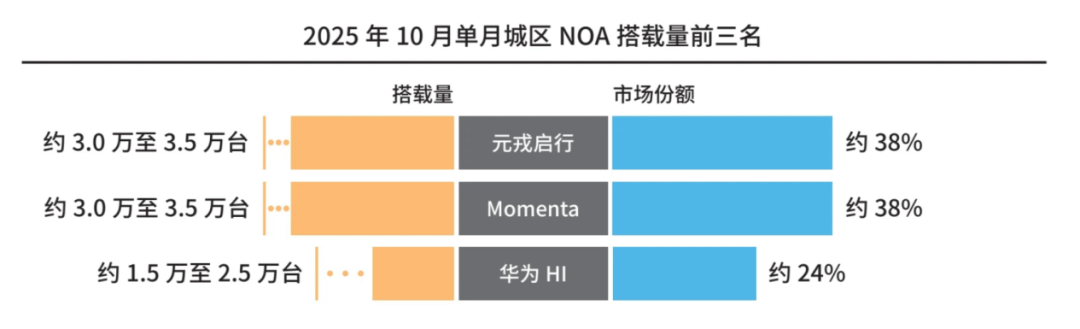

According to the "China Intelligent Driving Industry Trends White Paper (2025)" (hereinafter referred to as the "White Paper"), from January to October, Momenta, AutoX, and Huawei HI ranked as the top three in urban NOA adoption (third-party market), with market shares of 54%, 23%, and 22%, respectively. Notably, in October alone, AutoX stood out as the industry leader in urban NOA adoption.

This transformation was inevitable; the question was who would gain the "divine favor" to stay in the game.

The White Paper indicates that the penetration rate of urban NOA is expected to exceed the critical threshold of 10% in 2025. Industry estimates suggest that this rate could soar to 22% by 2026, with the market size approaching million-unit levels.

It is clear that the urban NOA shakeout has just concluded, and a new, unending war centered around "mass production in the millions" has already begun.

I. Urban NOA Transformation: The "HuaYuanMo" Trio Leads the Way

Urban NOA has become the core benchmark for evaluating the mass production capabilities of intelligent driving suppliers.

According to White Paper data, the "HuaYuanMo" trio collectively accounted for 99% of the domestic third-party urban NOA market from January to October 2025.

Huawei HI, with its deep capabilities in full-stack self-research, software-hardware ecosystem synergy, and scalable implementation, is a solid leader. Momenta leverages its extensive mass production experience and influence among international manufacturers, partnering with automakers such as BYD, GAC, Toyota, Mercedes-Benz, BMW, Audi, and General Motors.

AutoX, however, has rapidly emerged as a dark horse over the past year. In August 2024, its intelligent assisted driving solution was first deployed in the new WEY Blue Mountain, officially marking its entry into the commercialization phase as an assisted driving solution provider. Subsequently, it secured mass production projects for the WEY Gaoshan and Geely Galaxy M9, quickly surpassing 20,000 units in mass production scale. By the end of 2025, its solutions had been deployed in over 15 mass-produced models, with cumulative deliveries exceeding 200,000 units for the year.

From a growth multiplier perspective (calculated as October 2025 installations divided by the monthly average installations from January to October 2025), AutoX stands out as a significant "dark horse" with a 2.7x multiplier, compared to 1.6x for Huawei HI and 1.0x for Momenta.

The varying growth rates stem from differing market strategies among the three players.

Huawei HI primarily serves mid-to-high-end models like Avita and VOYAH (LanTu), enjoying high brand premiums and correspondingly high assembly rates. Momenta covers a broad range of brands, with a large partnership base. AutoX, on the other hand, pursues scalable data accumulation by partnering with high-volume models from mainstream brands like Great Wall Motors and Geely.

Zhou Guang, CEO of AutoX, stated that the company does not pursue a large number of partnership models but rather focuses on "selecting a few models and turning them into bestsellers," adopting an almost on-site ALL IN approach for core projects.

"We prefer deep collaboration with clients to jointly create bestselling models. Typically, the truly scalable models are those ranked around the top 50 in sales. Instead of spreading resources too thin across too many models, it's better to concentrate on serving top projects. The broader your business scope and the more diverse your partnership models, the less likely clients are to entrust you with their premium models, as it's difficult to build long-term, deep trust," Zhou explained.

AutoX's ALL IN strategy has proven highly effective. In just eight months, it achieved full-scenario urban NOA mass production. The launch of the Blue Mountain model, supporting urban NOA, drove its monthly sales to soar to 6,019 units, a nearly threefold increase month-on-month. The WEY Gaoshan, equipped with AutoX's intelligent driving, saw sales grow 5-10 times to nearly 10,000 units. The Galaxy M9, featuring AutoX's urban NOA, exceeded 10,000 deliveries in its third month on the market...

A little over a year ago, AutoX was barely visible in the mass-produced urban NOA market. Today, three bestselling partnership models (Blue Mountain, Gaoshan, Galaxy M9) have propelled it into the top three.

As we enter 2026, AutoX's mass production pace will continue to accelerate. This month, AutoX announced a collaboration with a leading international automaker on an L3-level autonomous driving project, sparking industry-wide discussions.

Additionally, there are reports that the Leapmotor D19 will incorporate AutoX's developed VLA model.

In 2025, Leapmotor delivered 597,000 units and set a goal to reach annual sales of one million units by 2026.

If these reports are true, AutoX will ignite another mass production catalyst. Combined with the continued sales growth of "bestselling" models from Great Wall Motors and Geely, its position in the intelligent driving landscape will undergo dramatic changes.

II. The New Battlefield of "Mass Production in the Millions" Has Begun

The formation of the "HuaYuanMo" landscape is the result of multiple forces working together, but the decisive factor lies in technological foresight, or what some call technological intuition. The departure of many intelligent driving players in 2025 is also related to this factor.

Industry insiders believe that these players overly relied on rule-driven technical routes, depending on fixed-scenario rule libraries. They were unable to adapt to complex scenarios such as urban congestion and intersection negotiations through data closed-loop iterations, leading to difficulties in product deployment and low client recognition. Ultimately, they were eliminated during commercial validation.

In contrast, the "HuaYuanMo" trio led the way in technological innovation. Especially AutoX, which progressed from a "mapless" solution to an end-to-end model and then to the introduction of a VLA model, staying ahead of the industry at every key node.

AutoX is the first third-party intelligent driving supplier to mass-produce a VLA technical route, with mass-produced models equipped with its self-developed VLA model already on the market.

Although the "HuaYuanMo" landscape is taking shape, the war is far from over. The next phase of competition will unfold at a higher dimension, with the core being the qualification round for "mass production in the millions."

Reaching the million-unit level represents a safe zone, indicating that a company has sufficient revenue to support long-term R&D and has established a vast data feedback network.

The significance of large-scale mass production for revenue is self-evident, but even more crucial is the access to vast amounts of data. Intelligent driving models require massive amounts of high-quality data for training to address insufficient coverage of long-tail scenarios. Otherwise, technology cannot iterate and will ultimately be eliminated in the final round.

Meanwhile, after years of market education, user attitudes toward intelligent driving have shifted from "trying it out" to genuinely finding it useful. This shift also requires massive data to support algorithm improvements, transitioning from pursuing "pass rates" to pursuing "reliability rates," rebuilding user trust, and optimizing user experiences.

The White Paper points out that the efficiency of the data closed loop has become a more core competitive advantage than the algorithm model itself. Therefore, "HuaYuanMo" is making every effort to reach "mass production in the millions." It is estimated that by 2026, the annual shipments of models with high-level intelligent driving capabilities in China could reach the 5 million unit level.

Zhou Guang has set an internal performance target for AutoX to achieve mass production at the million-unit level by 2026. This also means that competition in the intelligent driving industry will intensify further in 2026.

Today, the remaining players are stocking up on ammunition, as evidenced by the financing efforts in 2025. According to statistics, the autonomous driving sector raised nearly 60 billion yuan in financing throughout 2025, a significant rebound compared to recent years and nearly three times the amount raised during the 2023 "cold period." From a funding flow perspective, most investments are concentrated on leading players and projects with clear commercialization paths.

"The strong will only get stronger." Those who can easily obtain external funding are often those with strong self-sustaining capabilities. Ultimately, to remain in the game, a player must possess both technological depth and engineering capabilities, maintaining a leading technological edge while crossing the thresholds of scale and data closed loop.

The intelligent driving landscape of 2025 is just a mid-game chapter in the long march toward artificial intelligence.

Huawei, Momenta, and AutoX have defined three survival paradigms for the current market through their respective paths. As the war moves to the new battlefield of "mass production in the millions," the deciding factors will extend beyond current installation figures.

It is foreseeable that future competition will be multi-dimensional and ruthless. No single advantage can ensure long-term success. Only players who establish systematic competitiveness in technological insight, engineering, commercialization, and ecological cooperation will be able to navigate this unending war toward the "intelligent soul" of automobiles and go the distance.

The transformation never stops; the next elimination round may have already quietly begun.