Trump Falls in Love with Small Cars, But Will Americans Approve?

![]() 01/28 2026

01/28 2026

![]() 518

518

The future of the American automotive industry may hinge on balancing 'big' and 'small.'

The United States is renowned for its large vehicles and SUVs, but Trump's vision might change that.

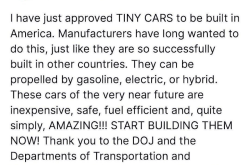

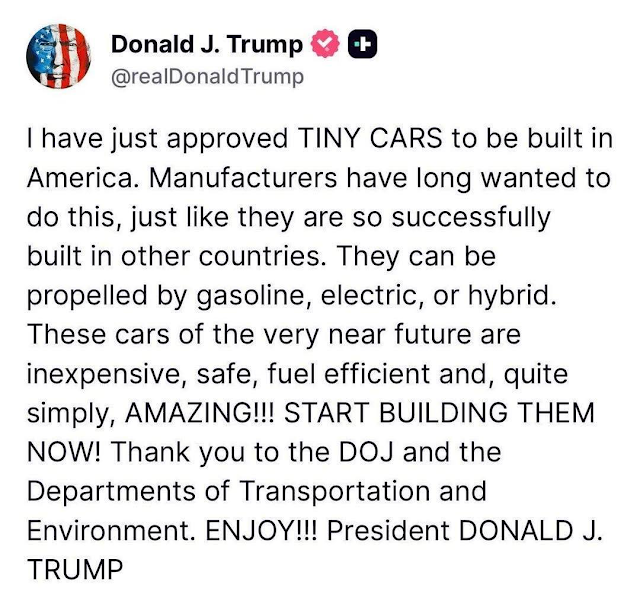

'I have approved the production of light vehicles in the United States.' After visiting Japan in December last year, Trump posted online: 'These upcoming cars will be affordable, safe, fuel-efficient, and absolutely fantastic. Start production now!'

Moreover, Trump has shown keen interest in K-Cars. Reports indicate he praised these vehicles as 'cute and compact,' believing they have potential to succeed in the U.S. market.

U.S. Transportation Secretary Duffy confirmed receiving presidential directives to lift regulations and permit the production and sale of small, fuel-efficient vehicles in the U.S. 'The president instructed me to remove regulatory barriers in this area, and we've done so. If Toyota or other automakers want to produce smaller, cheaper, and more fuel-efficient cars, we've paved the way for them to manufacture and sell in the U.S.'

The U.S. automotive industry is well-known for its large pickup trucks and SUVs, which have become the top choice for American consumers' daily commutes and family trips due to their spacious interiors, powerful engines, and suitability for long-distance driving.

From the Ford F-150 to the Chevrolet Suburban, these 'behemoths' not only embody Americans' yearning for freedom and power but also form the core competitiveness of the U.S. automotive industry.

However, with growing environmental awareness, fluctuating fuel prices, and increasing urban traffic congestion, this traditional preference faces unprecedented challenges. Trump's proposed 'light vehicle' introduction plan signals a potential profound transformation in the U.S. automotive industry. This vision involves not just technical adjustments but also touches the core of American automotive culture.

Tradition and Challenges in American Automotive Culture

The U.S. automotive market has long favored large vehicles, particularly pickups and SUVs.

According to the American Automobile Association, pickups and SUVs account for over 65% of new vehicle sales in the U.S. This preference stems from the country's unique circumstances: vast land area, diverse terrain, and relatively relaxed fuel price policies. Large vehicles not only offer higher safety and practicality but also serve as important symbols of the American lifestyle.

From an economic perspective, the high profit margins of large vehicles provide automakers with a stable source of income. Take the Ford F-Series pickup, for example, which has been America's best-selling vehicle for many years, contributing over 40% of Ford's profits. This 'bigger is better' market structure has led U.S. automakers to invest relatively little in the small car segment.

In recent years, with growing environmental awareness and fluctuating fuel prices, consumer attention to fuel efficiency has risen significantly.

Data from the U.S. Environmental Protection Agency shows that average fuel efficiency of U.S. vehicles has improved by about 30% over the past decade. Meanwhile, urban traffic congestion has worsened, especially in major cities like New York and Los Angeles, where parking difficulties and high traffic costs have become increasingly prominent. These changes have created potential demand for small cars.

However, due to long-standing market rejection of small cars in the U.S., along with infrastructure limitations (such as parking space design) and regulatory barriers (such as safety standards), small cars remain a niche market in the U.S., primarily limited to imported older models that must comply with strict regulations for vintage vehicles.

'Microcars might be useful in crowded urban areas, but in the U.S., they're simply not a viable option for most use cases.'

In 2019, the Smart brand withdrew from the U.S. market due to sluggish sales, as consumers preferred larger vehicles.

'If Smart's fate tells us anything, there might be little demand for small cars in the U.S. except among enthusiasts,' said Mosulay, an importer at Tokyo Auto's Washington, D.C., branch. This situation seems to apply to most U.S. customers considering light vehicles.

Nevertheless, outside observers believe Trump's enthusiasm for small cars stems primarily from their price advantage. A U.S. Department of Transportation spokesperson stated that this move would help Americans afford vehicles that meet their needs, whether electric, gasoline-powered, or 'mini vans' and 'microcars.'

Despite Trump's enthusiasm for light vehicles, U.S. importers and car owners remain uncertain about their feasibility in this vast country.

First are regulatory barriers. Currently, these vehicles do not meet U.S. federal standards for new cars, especially regarding crash safety and emissions. U.S. regulations require vehicles to pass stringent crash tests (such as frontal and side impacts), which K-Cars often struggle to meet due to their compact size and lightweight design. This directly limits the import and sale of new models.

However, a '25-year rule' in the regulations provides a workaround. The law allows the import of vehicles over 25 years old, even if they do not meet current safety standards. Originally intended to facilitate classic car collections, this rule now opens a backdoor for K-Car imports. Many K-Car models produced in the 1990s are now over 25 years old and can legally enter the U.S. through this channel.

Even so, state-level regulations add complexity—some states impose speed limits on such imports (such as banning them from highways), while others completely prohibit their use on public roads.

For example, in California, strict emissions regulations make it difficult to register many older K-Cars, whereas Florida has relatively lenient rules.

U.S. Transportation Secretary Sean Duffy also acknowledges that small cars 'might' not be well-suited for American highways. However, Duffy told CNBC that for city drivers, these vehicles could be an 'excellent solution.'

Thus, if the Trump administration wishes to promote K-Cars, it may need to push for federal-level regulatory adjustments, such as creating special categories or exemptions. However, this could face significant political and automotive industry lobbying resistance.

Last year's draft of the U.S. government's new tariff policy included a favorable clause: exempting vehicles manufactured over 25 years ago from tax increases. This is good news for JDM importers and enthusiasts, potentially stimulating more K-Car imports into the U.S., but it does not address fundamental safety compliance issues.

Smaller Cars, Lower Prices?

Purchase cost is the primary factor determining whether K-Cars will be accepted by most consumers.

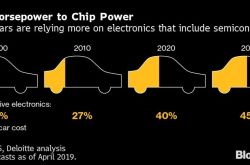

With the global computer chip shortage being one of the factors driving up car prices, U.S. vehicle prices have not yet returned to pre-pandemic levels.

Meanwhile, American households face rising living costs.

Data shows that average U.S. vehicle prices have increased by about 15% over the past two years, while small cars face greater difficulty in cost control due to weaker economies of scale. Trump's tariff policies and changes to electric vehicle subsidies could further drive up prices. Automakers warn that these policy changes might compress the market space for small cars.

For example, imposing tariffs on imported components will directly increase production costs, while the cancellation of electric vehicle subsidies could weaken consumer willingness to purchase small electric vehicles.

Due to stringent U.S. safety standards, microcars require redesigns to meet crash test and protection requirements. Industry analysts point out that meeting U.S. safety standards could increase manufacturing costs by about 30%, significantly eroding the price advantage of small cars.

However, automakers have shown varying strategic responses to Trump's initiative.

Companies like Suzuki, Daihatsu, or Honda have already evaluated the U.S. market and deemed investing in K-Car production lines or sales networks too risky. Historically, Suzuki attempted to sell small cars in the U.S. but withdrew in 2012, partly due to poor sales.

Trump's initiative might change the calculation if the government provides subsidies or policy support, prompting manufacturers to reconsider. Currently, however, there are no signs that major Japanese automakers plan large-scale action.

Among U.S. automakers, Ford declined to comment. A General Motors spokesperson stated that the company has no product news to announce but mentioned that six of its models have starting prices below $30,000 (approximately RMB 212,000).

Fiat's parent company, Stellantis, announced plans to begin selling the Topolino microcar in the U.S. within the next few months, with a top speed below 30 mph (48.3 km/h).

A Stellantis spokesperson said the company is 'always looking for opportunities to adjust its product mix to meet customer needs' and enable them to choose desired models 'at affordable prices.' However, the spokesperson clarified that this announcement is unrelated to Trump's remarks.

Auto industry investor Steve Greenfield believes Trump's statement will not have a significant impact. He noted that modern microcars cannot meet U.S. safety regulations, requiring automakers to invest heavily in redesigns to comply with U.S. standards. Greenfield added that doing so would 'offset their cost and efficiency advantages.'

Undoubtedly, Trump's vision for light vehicles marks a potential turning point toward diversification in the U.S. automotive industry, challenging the deeply ingrained culture of large vehicles. However, its success depends on whether manufacturers can balance cost, safety, and consumer education.

In the short term, microcars may remain a niche choice, primarily serving specific groups. In the long run, if urbanization and environmental trends accelerate, they might find a foothold. This transformation is not just about vehicle types but also reflects a rethinking of transportation efficiency and lifestyle in American society.

For automakers, the key lies in finding the right positioning for microcars in the U.S. market, balancing cost, safety, and consumer demand. For the government, policy guidance is needed to create a more favorable environment for microcar development. For consumers, it requires gradually shifting traditional preferences for large vehicles and embracing diverse transportation solutions.

'Trump's statement is like free advertising for us because more people are starting to learn about microcars,' an industry insider said. 'But even so, I believe Americans are accustomed to large vehicles. This will still be a niche market.'

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-