Sacrificing Model S/X for 1 Million Robots: Has Tesla Made a Wise Move?

![]() 01/30 2026

01/30 2026

![]() 420

420

Tesla's Next Chapter: A Robot-Centric Future

As a frontrunner in the global new energy sector, Tesla faced a disappointing 2025: its full-year net profit plummeted by 46%, nearly halving to a five-year low, while revenue experienced its first annual decline, snapping a 15-year growth streak.

Tesla attributed this downturn to two main factors: a decrease in global deliveries and a significant cut in regulatory subsidy income.

Global deliveries dipped by 8.6%, and tightening subsidy policies in Europe and the U.S. exerted considerable pressure on Tesla's performance.

However, Dianchetong views this outcome as an inevitable consequence of Tesla's own strategic decisions.

Image Source: Tesla Official

Over the past year, Elon Musk has not heavily focused on the automotive business, with Tesla gradually redirecting resources towards emerging fields such as humanoid robots, Robotaxi, and SpaceX.

From a corporate development standpoint, Tesla's move is understandable—following emerging trends. Yet, within the automotive industry, amid fierce competition from domestic brands like BYD and XPENG, Tesla's decision to scale back investment in its core automotive business has directly impacted its product update cycle, technological advancement speed, and market competitiveness. The resulting performance decline may have already been anticipated by the market.

While many expected Tesla to unveil new automotive products, Musk's remarks during the earnings call seemed to indicate a strategic pivot: he no longer appears intent on solely focusing on reviving the automotive business.

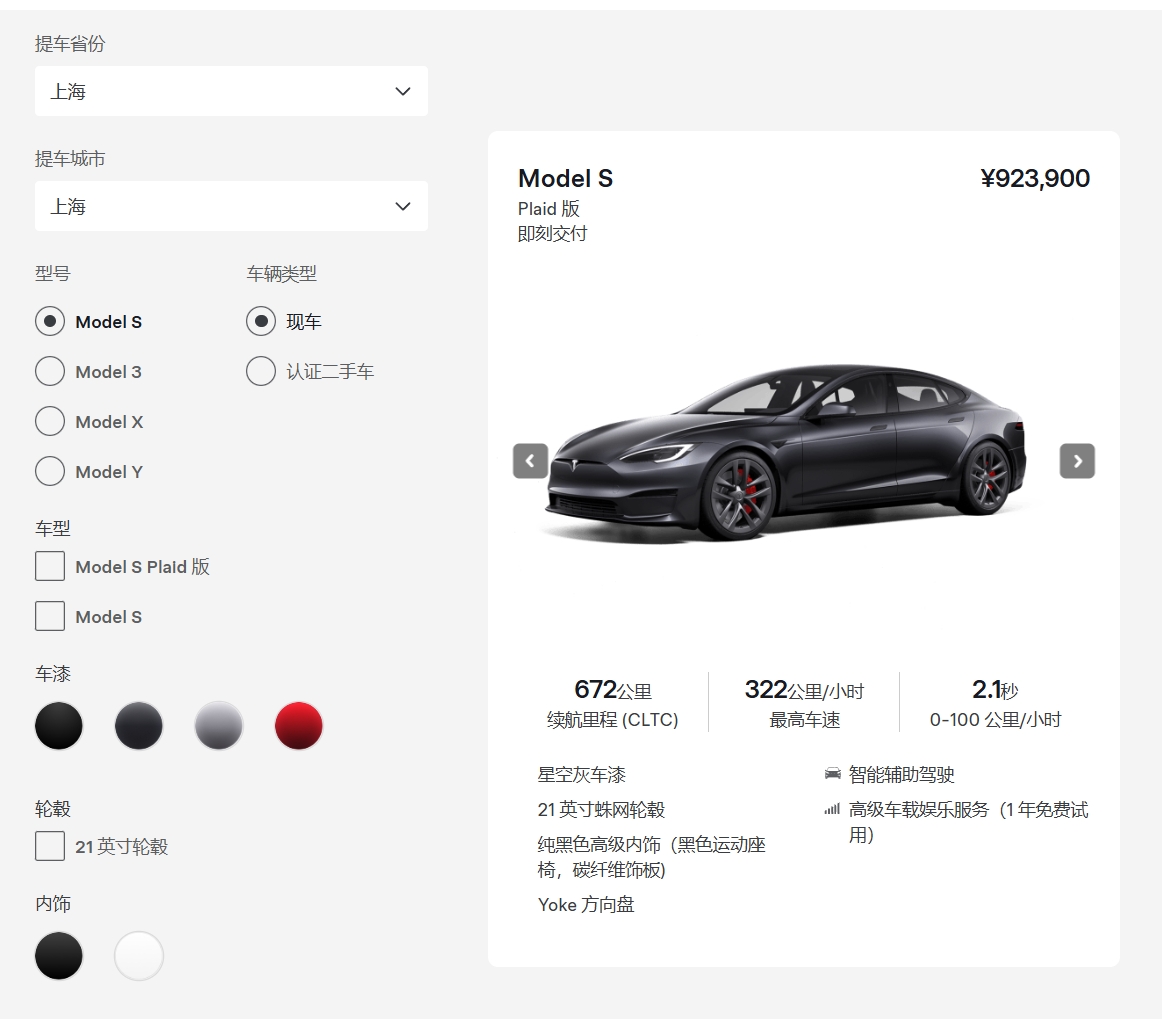

Sacrificing Model S/X for 1 Million Robots?

During the earnings call, Musk further elaborated on Tesla's stance: the company will officially cease production of the Model S and Model X flagship models by the second quarter of 2026. The Fremont factory, previously a key production hub for these models, will be repurposed to manufacture the Optimus humanoid robot.

This announcement sparked numerous doubts, with many netizens attributing the halt to sluggish sales. Indeed, the lackluster sales of the Model S and Model X were a significant factor in Tesla's decision, but not the primary reason.

The fundamental reason for their discontinuation is that they have already fulfilled their product mission.

The Model S was Tesla's milestone vehicle that opened the door to electric vehicles, while the Model X's innovative Falcon Wing doors became a classic symbol of Tesla's technological prowess. These flagship models also demonstrated that electric vehicles could outperform fuel-powered vehicles (internal combustion engine vehicles) in terms of performance, range, and intelligence through their luxury positioning and supercar-like capabilities.

Consequently, Tesla successfully established its high-end brand image and global industry influence.

Image Source: Tesla Official

Today, Tesla's product strategy no longer centers around high-end offerings. Musk has consistently believed that affordable, high-value products are key to capturing global markets. As a result, Tesla's product upgrades have long focused on high-volume models like the Model 3 and Model Y, while the Model S and Model X have seen particularly slow updates.

At present, Tesla boasts sufficient scale and a deeply ingrained brand value, no longer needing high-end flagship models to prove its industry standing.

Incidentally, in April of the previous year, Tesla China's official website removed the "Order New Car" option for the Model S and Model X, leaving only "View Available Cars" and "Schedule Test Drive" as options. It now appears that Tesla's plan to halt production of these two flagship models had been quietly in the works at that time.

Screenshot: Tesla China Official Website

During the earnings call, Musk stated that Tesla's future investments will concentrate on two areas: AI and robotics, and battery and energy infrastructure.

Among these, the Optimus robot, as a physical AI carrier, occupies a central position. Musk ambitiously plans to achieve annual production of 1 million units.

It seems Musk's vision remains steadfast, and his decisive move to halt production of the two flagship models aims to pave the way for Tesla's next objective.

Over the past decade, Tesla has been a hardware-driven tech company, generating profits through the research, development, production, and sales of electric vehicles. Now, it is transitioning into a comprehensive tech enterprise centered around physical AI technology, with the automotive business serving as one of the application scenarios for physical AI, while the robotics business is positioned as the second growth driver for the future.

Musk emphasized that the application scenarios for physical AI extend far beyond the automotive industry, with Optimus's potential market size expected to surpass that of the automotive business in the future. This bold strategic choice may unlock broader development opportunities for Tesla, but in the short term, it will leave Tesla without the brand support of high-end models and expose it to greater performance pressures.

Image Source: Tesla Official

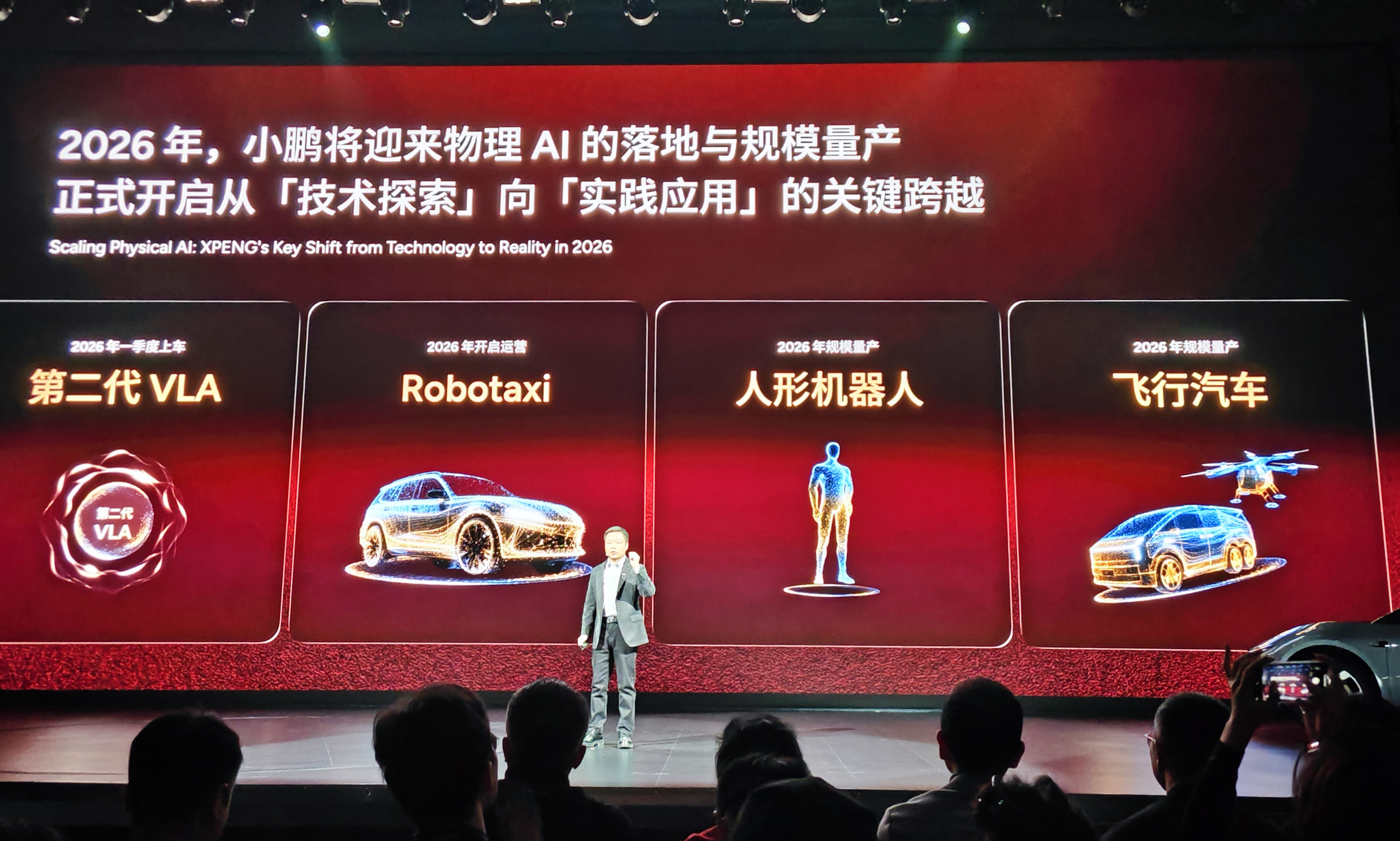

Musk Goes All-In, While XPENG Pursues a 'Two-Pronged' Strategy to Outpace Tesla

Tesla is not the only automaker venturing into physical AI. In the global new energy vehicle market, particularly in China, competition around physical AI has already commenced.

Among these contenders, XPENG Automotive has taken the lead in proposing a physical AI strategy, positioning itself not just as an automaker but as an "explorer of mobility in the physical AI world and a global embodied intelligence company." Similarly, Li Xiang, founder of Li Auto, barely mentioned the automotive business during a recent online company-wide meeting, instead repeatedly discussing AI, embodied intelligence, and humanoid robots, explicitly stating the need to expedite the development and deployment of robots.

However, a closer look reveals that both XPENG and Li Auto have adopted a "two-pronged" approach at this stage: unwilling to abandon their profitable automotive businesses while also seeking to gain an early foothold in future markets. This pragmatic, even cautious, strategy appears less decisive than Tesla's all-in gamble of halting flagship production for future opportunities.

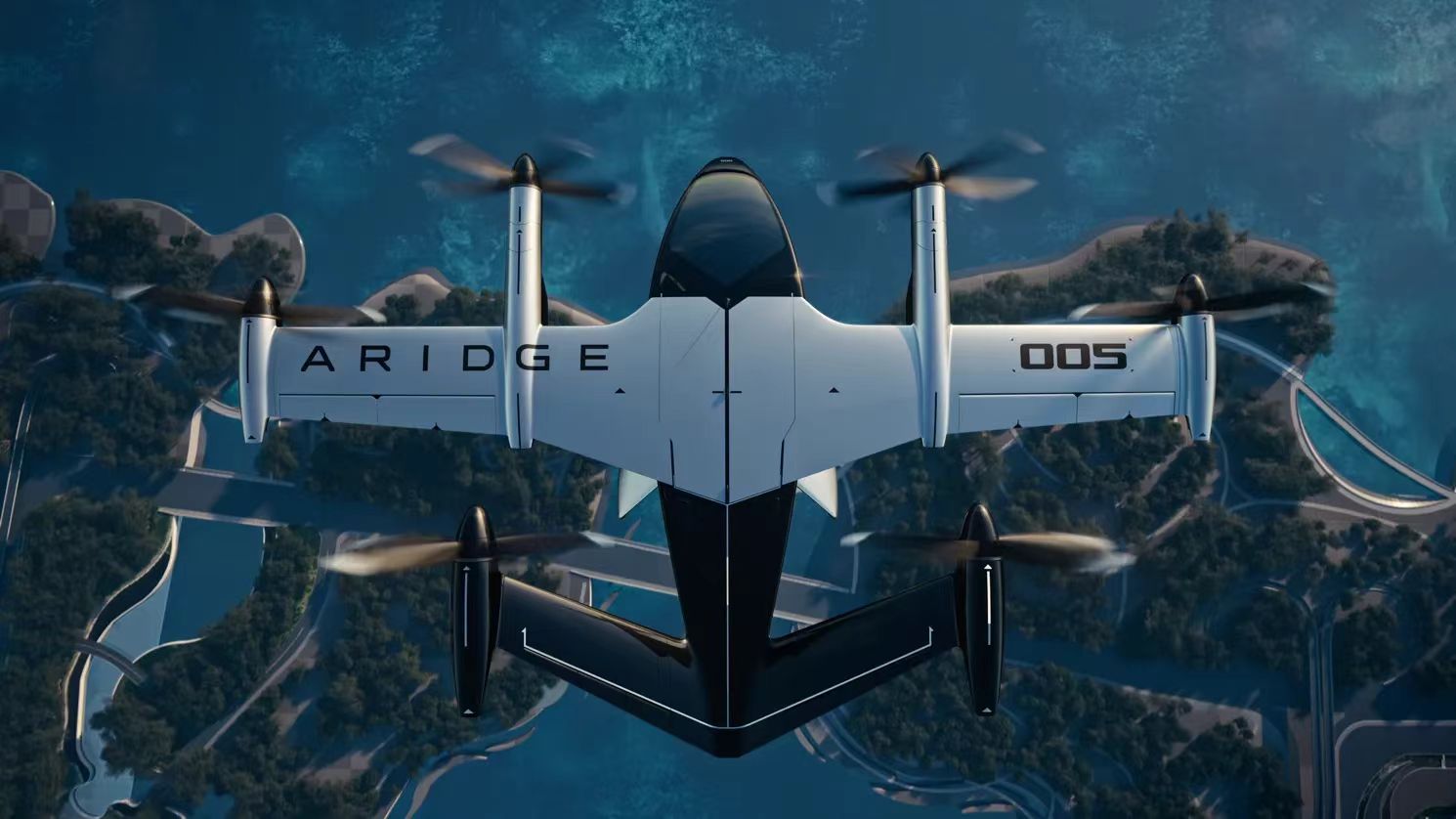

XPENG has set its sales target for this year at 550,000 to 600,000 units, representing approximately 28% growth over last year, while also planning to launch at least four new SUV models. On the other hand, its physical AI business is expected to "take root," with humanoid robots and flying cars set for mass production this year, and Robotaxi services slated to begin operations.

Image Source: Dianchetong Production

Li Auto is no less ambitious, targeting 500,000 to 600,000 units in sales this year, with plans to introduce 4 to 6 new or updated models covering a wide price range from 200,000 to over 500,000 yuan, even prioritizing "regaining leadership in the extended-range market" as a crucial objective.

Dianchetong believes that XPENG is likely to emerge as Tesla's most direct competitor for an extended period. Whether in core automotive operations or future bets on the physical AI track, the strategic layouts of both companies heavily overlap, increasing the likelihood of future clashes.

In the primary automotive battleground, XPENG's main models overlap significantly in price with Tesla's Model 3 and Model Y, both emphasizing intelligent driving and tech-savviness. With four new SUVs launching this year, XPENG is poised to go head-to-head with Tesla in the market.

In the new realm of physical AI, XPENG's planned humanoid robots, flying cars, and Robotaxi services align perfectly with Tesla's strategy of halting flagship production to bet on Optimus robots and explore the future of autonomous driving.

Image Source: XPENG Aeroht

While Tesla has fully shifted its focus to robotics, the automotive business remains the most mainstream demand, and the robotics trend has not yet fully arrived. Musk is unlikely to easily abandon Tesla's core business. In contrast, XPENG is maintaining its automotive foundation while rapidly advancing its physical AI business. XPENG's "two-legged" strategy appears more prudent than Tesla's somewhat extreme all-in approach and may enable it to seize market opportunities more effectively in the short term.

After all, consumer demand for smart vehicles remains robust today, while curiosity about humanoid robots and autonomous driving continues to grow. XPENG's "I want it all" approach can effectively cater to both trends simultaneously.

Often, seemingly conservative strategies can evolve into aggressive advantages.

From a technological standpoint, both XPENG and Tesla have chosen a full-stack self-research path, unwilling to rely on others for the core "brains" of their vehicles or the "souls" of their robots.

The strength of their underlying technologies will directly determine how far they can progress in the future. While Tesla holds first-mover advantages and strong brand appeal, XPENG's deep understanding of Chinese market demands, faster response times, and flexibility in adapting intelligent driving to local conditions and product definitions are key factors that cannot be overlooked.

Additionally, while Li Auto is currently focused on the automotive sector, particularly on reclaiming its position in the extended-range market, its aggressive push into products like smart glasses suggests that its entry into the physical AI arena is only a matter of time. When that happens, Tesla may face not just a single rival but a collective challenge from a cohort of Chinese automakers led by XPENG.

In Conclusion

Tesla's 2025 financial report feels like a farewell to an era. Halting production of the Model S and Model X and betting on robots and physical AI undoubtedly signals a charge into a new era.

It's clear that this will be a tough battle.

The coming days may not be easy. Tesla's automotive sales could continue to decline, revenue pressures will persist, and while Optimus robots may represent a future trend, achieving widespread adoption and commercial value akin to automobiles will take considerable time. This requires not just foresight but also the courage to endure immediate hardships.

However, reviewing Tesla's history, has it not always progressed amid skepticism? From being dismissed as unrealistic for electric vehicles to being criticized as overly aggressive for autonomous driving, this company seems inherently accustomed to walking a path less favored by others.

Now that electric vehicles have become mainstream, Tesla, as a leader, will naturally turn its gaze toward new battlegrounds that will shape the next decade. Physical AI and humanoid robots are the directions it has chosen this time.

The investment is substantial, and the risks are high. Yet, if Tesla can weather this toughest period, the rewards may include years or even decades of leadership and commercial returns in an entirely new field.

(Cover image source: Tesla Official)

Tesla, XPENG, Li Auto, Robots, AI

Source: Leikeji

Images in this article are sourced from the 123RF licensed image library.