The AI chip craze has led to a dire shortage in 'packaging'! Huatian Technology, burdened with RMB 12 billion in debt, is it a gambler or a strategist?

![]() 01/30 2026

01/30 2026

![]() 508

508

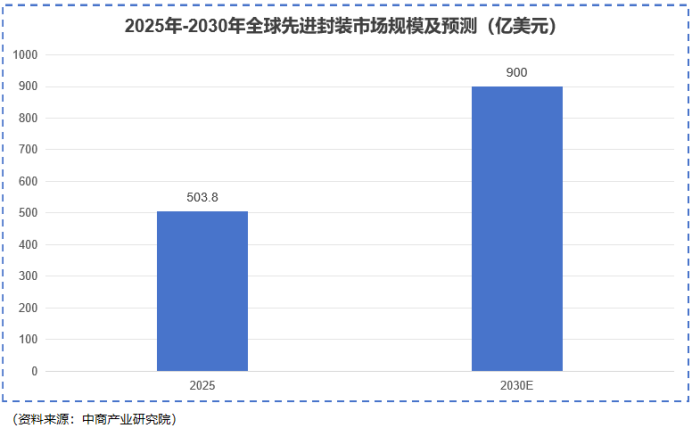

From large models to intelligent driving, demand has exploded. But you may not know that this craze has extended to a previously 'obscure' part of the industrial chain - advanced chip packaging.

TSMC's CoWoS advanced packaging capacity is in high demand from major customers such as NVIDIA and AMD, with a capacity gap as high as 20%-30%. Money alone cannot secure orders. This directly leads to one result: whoever can master advanced packaging will hold the key to the AI chip market.

At this critical juncture, let's turn our attention back to one of the top three domestic packaging and testing companies - Huatian Technology. This company has been frequently discussed due to its 'RMB 12 billion in debt' and has even been questioned by some voices regarding the 'health of its operations'.

While peers like Changdian Technology sit comfortably at the top and Tongfu Microelectronics rides high with AMD, Huatian Technology always seems a bit 'silent'. But is this silence a sign of true weakness, or is it a high-stakes gamble that requires time to verify?

Under the AI trend, packaging shifts from 'logistics' to 'vanguard'.

In the past, within the chip 'design-manufacturing-packaging and testing' chain, packaging and testing were often seen as the 'logistics department' with relatively low technical content and a labor-intensive nature.

However, as Moore's Law approaches its physical limits, it is becoming increasingly difficult and expensive to enhance performance solely through chip process shrinkage.

Thus, the industry has found a new path: integrating multiple small chips (Chiplets) like building with LEGOs through advanced packaging technology to achieve a leap in performance. This is why technologies like TSMC's CoWoS and Intel's EMIB have become so popular. Without advanced packaging, today's high-performance AI chips would not exist.

This trend has transformed global packaging and testing factories, especially those with advanced packaging capabilities, from 'logistics' into 'vanguards' determining the outcome of battles overnight. Demand has surged, and capacity is extremely scarce. This is the biggest backdrop for understanding all of Huatian Technology's moves. All its investments are aimed at boarding this inevitably crowded but potentially highly rewarding train.

Huatian Technology's foundation: A low-profile domestic 'third'.

Before analyzing the RMB 12 billion loan, let's first understand who Huatian Technology is and what its assets are.

Huatian Technology, also known as 'Tianshui Huatian' in the industry, exudes a sense of steadfastness from the northwest. Starting in Tianshui, Gansu Province, it went public in 2007 and is now the sixth largest globally and the third largest in China in semiconductor packaging and testing.

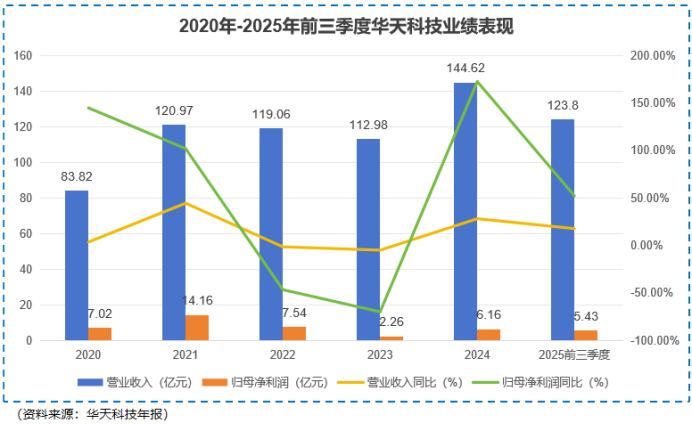

According to recent financial reports, Huatian Technology's revenue has stabilized at around RMB 12 billion to RMB 14 billion. For example, in the first three quarters of 2025, revenue hovered around the RMB 10 billion mark. This scale, compared to leader Changdian Technology (with revenue around the RMB 30 billion level) and Tongfu Microelectronics, which is tied to AMD, does show a gap. It firmly sits in the third place domestically.

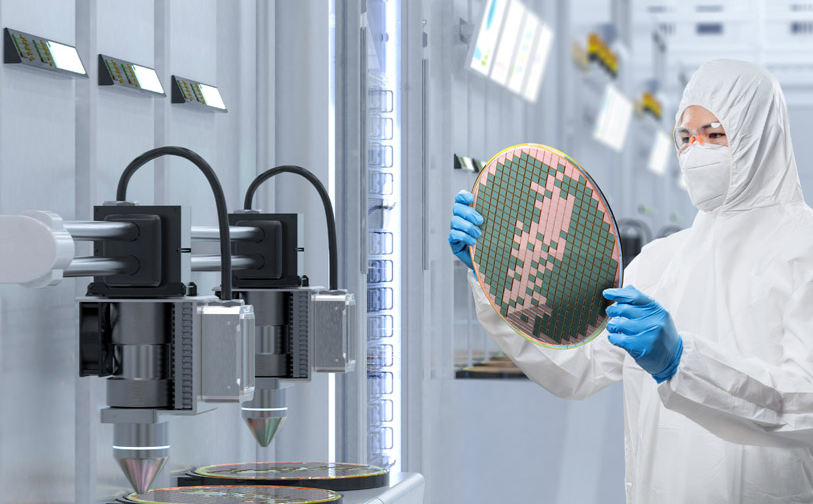

Its business spans the globe, with bases in Malaysia, Singapore, and other locations through the acquisition of Malaysia's UNISEM company. Its product line is extensive, covering traditional lead frame packaging to advanced wafer-level packaging (WLP), system-in-package (SiP), bumping, and more.

Looking at its performance from 2020 to 2025, the revenue line is flat, but the net profit curve resembles a roller coaster, with peaks and troughs. The most typical example is 2024, when net profit surged by 172% year-on-year to RMB 616 million, which initially seems impressive. However, a closer look at the financial report reveals that over RMB 763 million of this came from government subsidies and investment income. In other words, after deducting these 'extra incomes', the profitability of its main business (net profit excluding non-recurring gains and losses) is not as strong as the data suggests and may even still be in a state of slight loss or break-even.

This actually points out a core challenge for Huatian Technology: during the period of scale and technological catch-up, the profitability of its main business has not been fully released, and it requires external 'financial support' and capital assistance to support its strategic investments. This is precisely where the story of the RMB 12 billion loan begins.

In-depth analysis of the RMB 12 billion loan: A desperate move or a strategic necessity?

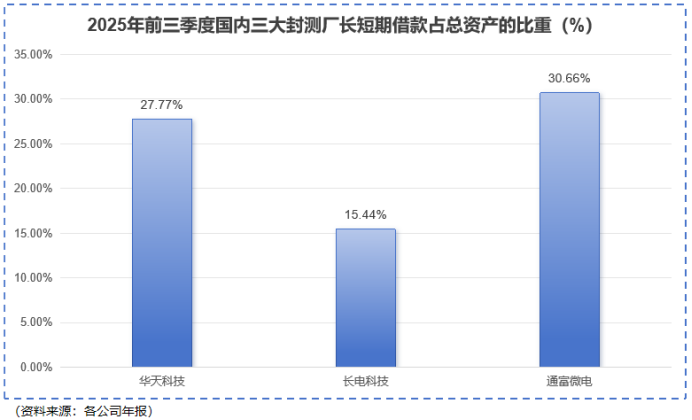

In the first three quarters of 2025, Huatian Technology's combined short-term and long-term loans reached as high as RMB 12 billion, accounting for nearly 28% of its total assets.

This figure is even higher than that of leader Changdian Technology. Where has all the money gone? How big are the risks?

As the name suggests, these are loans obtained from banks based solely on the company's creditworthiness without using property or equipment as collateral. This indicates that banks recognize Huatian Technology's market credit, which is a positive sign. However, it is also a double-edged sword. Once the company encounters operational issues and cash flow tightens, failing to repay the loans will cause its credit rating to plummet, potentially triggering a chain reaction of banks calling in loans, which could even be fatal.

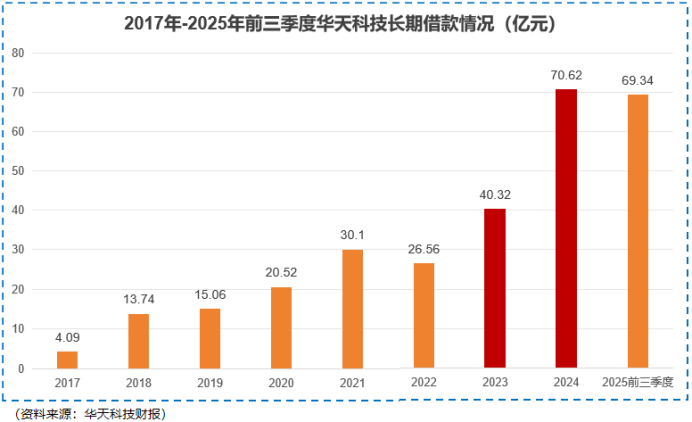

Long-term loans (approximately RMB 6.9 billion) - These are the major portion, with long maturities and relatively stable interest rates, clearly used for long-term capital expenditures.

If a company's short-term loans account for more than 5% of its total assets, caution is warranted. Huatian Technology's ratio often hovers around 10%, which is indeed on the high side. The market is concerned about whether it might engage in 'short-term debt for long-term investments', leading to a liquidity crisis?

As of the end of the third quarter of 2025, the company had RMB 5.862 billion in monetary funds on hand, which can fully cover its RMB 4.996 billion in short-term loans. In other words, the company does not face an immediate urgency of being unable to repay loans in the short term. This is the confidence behind its willingness to maintain high levels of short-term loans.

Where has the money been spent? Interpretation of strategic intentions.

Huatian Technology is not spending money recklessly. Its loan surge began in 2018, corresponding to two major strategic moves:

1. Mergers and acquisitions to acquire technological 'tickets': In 2018, Huatian Technology spent nearly RMB 3 billion to acquire Malaysia's UNISEM. This deal was extremely crucial, enabling Huatian Technology to acquire advanced packaging technologies and production capabilities such as bumping, SiP, and FC all at once, achieving a 'painless' leap from traditional packaging to advanced packaging. Without this acquisition, it might not even have the qualification to participate in the AI packaging competition today.

2. Crazy expansion of production to seize production capacity (Rampant capacity expansion to seize market share): This is the main destination for current loans (especially long-term loans). From 2024 to 2025, Huatian Technology has announced a cumulative investment of RMB 15 billion in building multiple advanced packaging and testing projects in Nanjing and other locations (such as Pangu Semiconductor, Nanjing Phase II, etc.). Meanwhile, it also initiated the acquisition of Huayi Microelectronics, a domestic leader in power device packaging and testing, in 2025, with the intention of expanding into new market segments.

Seeing the huge opportunities brought by AI and chip localization, Huatian Technology believes it must spare no expense, increase leverage, and rapidly expand its advanced packaging capacity. It is betting on industry demand in the coming years. If the bet pays off, every yuan invested now will turn into market share and profits in the future; if the bet fails or industry recovery falls short of expectations, massive idle capacity and financial interest will drag it into the abyss.

Although as a listed company, the actual decisions of Huatian Technology are made collectively, let's imagine for a moment what beliefs the company's founder and core management team, represented by Chairman Xiao Shengli, might hold when facing external question (doubts) about high levels of debt (accounting for 3%).

'From Tianshui to where we are today, we deeply understand that in the globally competitive semiconductor industry, there is no retreat; we can only move forward. In the past, we survived by being steady and reliable; today, facing a once-in-a-century industrial transformation and the wave of domestic substitution, we must be more bold.'

'This RMB 12 billion is not a burden; it is 'ammunition'. We have used it to purchase tickets for entering the advanced packaging arena and are building capacity for the future. Semiconductors are a cyclical industry; we invest during the lows and reap during the highs. The market is now concerned about our debt ratio, but we are clearer about what we hold - proven packaging technologies, demand orders from global customers, and the firm support of the country for an autonomous and controllable industrial chain.'

'We firmly believe that every cautious yet bold investment made today is building a moat for the future for Huatian Technology and also for China's packaging and testing industry. We have sufficient cash to cover our short-term loans, and our long-term loans correspond to growth opportunities in the next five years. We are confident in managing this leverage and taking Huatian to new heights.'

This imagined confidence stems from judgments about industrial trends and a determination to fight to the end.

Yan Xi believes that the semiconductor industry of Huatian Technology is extremely capital-intensive, with a single advanced factory often requiring billions of yuan in investment.

At a critical juncture of industrial upswing and domestic substitution, if companies dare not invest due to fear of debt, the result will be falling behind step by step and being completely left out. Huatian Technology's choice to increase leverage for capacity expansion is driven by the nature of the industry and is an expression of strategic initiative. Its correctness does not depend on the debt figure itself but on whether the expanded capacity is advanced and can be timely released during periods of high demand.

The biggest risk point for Huatian Technology lies in the time lag between its 'profitability of the main business' and its 'huge capital expenditures'. Currently, its profitability is not strong, relying on subsidies and investment income to dress up its profits, yet it is carrying a huge amount of interest to bet on a future.

The arrival and timing of this 'future' are uncertain. If the demand growth for AI chips falls short of expectations or the technological yield and customer certification progress of its newly built capacity lag behind competitors (such as Changdian and Tongfu Microelectronics), then massive fixed asset depreciation and financial expenses will erode all profits, plunging it into the quagmire of 'increasing revenue without increasing profits' or even losses. At that time, high debt will transform from a 'lever' into a 'noose'.

The global semiconductor cycle and the progress of China's chip localization. It is betting on an upward cycle and that after the rise of domestic chip design companies (such as HiSilicon and Horizon Robotics), they will leave a large number of packaging and testing orders to domestic manufacturers. From this perspective, its high-debt expansion is also a bet on the overall success of China's semiconductor industry. The support of the National Integrated Circuit Industry Fund (the Big Fund) and relevant policy tilt (favors) are important 'safety cushions' for this high-stakes gamble.

In the short term, there is always pressure to repay debts, the profit-generating ability of the main business needs to be strengthened, and there is a risk that strategic bets may not pay off. However, its strategic intentions are clear, it has seized key transformation points in the industry, and its current cash flow can still cover risks, giving it the capital to take a chance.

It does not sit as comfortably as Changdian Technology at the top, nor does it have a super customer like Tongfu Microelectronics to protect it. Huatian Technology is taking a more difficult and riskier third path: through high leverage, it is forcefully advancing in technology and capacity, attempting to make a comeback during the next industry peak.

In the semiconductor industry, which is destined to be spectacular, Huatian Technology has already placed a heavy bet. The game has reached mid-point, and the outcome is still uncertain. Let's wait and see.

Note: (Disclaimer: The content and data in the article are for reference only and do not constitute investment advice. Investors operate at their own risk.)

- End - I hope to resonate with you!