Tesla's Intelligent Driving: The Sickle Finally Falls

![]() 01/30 2026

01/30 2026

![]() 570

570

Introduction

Introduction

This 'combo punch' works well in North America, but may not be as effective in China.

Entering 2026, Tesla has been constantly making moves.

Take the Chinese market as an example, through promotional policies such as seven-year ultra-low interest rates and limited-time insurance subsidies, Tesla is attempting to attract terminal consumers who are still on the fence and achieve a 'successful start'. Meanwhile, with the 'affordable' Model 3 making a surprise launch in multiple Asian countries this week, there has finally been progress on the long-stalled product innovation front.

Looking towards another crucial battleground—the North American market—Tesla's focus on 'innovation' is more concentrated on FSD. The confidence supporting this comes from the fact that in the past 2025, this intelligent driving system has fully demonstrated a transformation from 'futures' to 'spot goods', achieving an experience upgrade from 'usable' to 'user-friendly'.

At the recently concluded CES show, many friends of mine who went to the United States to personally experience the latest version of FSD gave it tremendous praise. From Musk's perspective, he is also very confident, stating, 'We are in the process of transitioning from a former autonomous driving company to a future autonomous driving company.'

In short, given various signals, FSD is striding into its harvest period. Perhaps, precisely based on this opportunity, Tesla feels that the time for reaping the rewards has come.

Seizing the moment, the sickle falls continuously.

01 'Only Monthly Subscriptions Allowed in the Future, Free AP Canceled'

In North America, Tesla has undoubtedly delivered a 'combo punch' for FSD.

At the beginning of this section, let's turn our attention back to January 14th local time, when Musk posted a brief tweet on a social platform, officially announcing that starting from February 14th, FSD will completely abandon the buyout system and will only be available through monthly subscriptions in the future.

The news quickly sparked widespread discussion.

As of now, the monthly subscription price for FSD is $99. The one-time buyout price is $8,000, which translates to being able to cover 81 consecutive months (nearly 7 years).

In my opinion, the aforementioned adjustment is undoubtedly 'more beneficial than harmful'.

After all, the buyout system is more like a 'one-time deal', with income arriving all at once and no lasting momentum; the subscription system can be seen as a perpetual motion machine for cash flow, breaking down user consumption into a steady stream of stable income. This predictable revenue model is exactly what the capital market loves.

Secondly, it is also beneficial for most car owners. Monthly payments are more flexible and have a relatively lower threshold. Of course, for users who want to hold onto their vehicles for a long time, the buyout system is undoubtedly more cost-effective.

Furthermore, it is important to note that in Musk's trillion-dollar compensation package in 2025, there was a requirement for Tesla to accumulate 10 million active FSD subscribers. The modification of the rules may also be related to this mandatory standard.

Finally, from the business logic that Tesla is gradually revealing, the company is transitioning from a primary car-selling business to a technology company that relies on selling services for substantial profits. It is only reasonable to first target its flagship FSD for this transformation.

What came as a surprise, however, was its second move.

A few days ago, according to relevant news, Tesla has already taken the lead in disabling Autopilot in the United States and Canada. In the future, users in these two regions will only be able to choose to subscribe to FSD when purchasing a vehicle.

According to the official website configurator, the previously default free adaptive cruise control + lane centering assistance provided by Autopilot has been adjusted. After the adjustment, the lane centering assistance has been completely moved into the FSD subscription package.

In other words, it directly implies: 'In the future, without spending money on FSD, it will be equivalent to driving manually.'

To obtain a good intelligent driving experience, an additional cost must be paid. Even Musk stated on social media that 'as FSD functionality improves, the monthly service fee of $99 will also continue to rise.'

Of course, there has also been recent news that is favorable to users. US insurance company Lemonade announced that it will offer a 50% premium discount for car owners who activate FSD, with data showing that this system can enhance safety.

Taking 2025 as an example, Tesla vehicles with FSD enabled had an average of one accident every 6.69 million miles driven; in contrast, Tesla vehicles driven by humans had an average accident frequency of once every 963,000 miles.

From the perspective of usage cost, the premium discount to some extent offsets the subscription cost for intelligent driving, helping to form a positive cycle among users and enhance their trust in FSD.

In any case, after delivering this 'combo punch', one can argue that the highly assertive Tesla is using resolute actions to 'force' North American consumers to quickly adapt to the new game rules it has set.

As the sickle falls, Musk's ambition is fully exposed. Without exaggeration or bias, this sector will also be the core 'trump card' for this US technology company in facing future fierce competition.

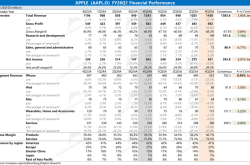

Just this week, Tesla also released its 2025 financial report, disclosing the FSD optional installation rate for the first time. As of the end of the fourth quarter, a cumulative total of 1.1 million users have purchased it, with 330,000 being subscribers. Looking solely at 2025, among the over 1.6 million new car owners, 300,000 FSD users were added, accounting for just over 18%.

Faced with such a phased result, one can only say that there is still a long way to go.

02 'Will the Combo Punch Work in China?'

One might ask, why did Tesla choose the North American market first to carry out a thorough reform of FSD's business model?

In fact, the answer is very simple.

Firstly, the comprehensive experience of the 'full-featured version' is indeed becoming increasingly outstanding; secondly, local users are already accustomed to on-demand subscriptions; thirdly, the monthly pricing of $99 is indeed not too high; fourthly, its industry status is that of an absolute oligopoly, with its product strength consistently being the best choice in the pure electric sector.

Precisely with the support of the aforementioned frameworks, the protagonist of today's article has abundant confidence. Tesla clearly knows that although there may be some pain, ultimately the vast majority of people will willingly pay.

Then, a new question arises: Will this 'combo punch' be effective in the Chinese market?

Not long ago, at the Davos Forum, Musk released major news: 'We hope to obtain supervised fully autonomous driving approval in Europe, ideally next month, and it may be around the same time in China.'

The core message I extracted directly points to: 'The full-featured version of FSD is about to enter China.'

From Tesla's perspective, this intelligent driving system will undoubtedly be a crucial 'trump card' for whether it can turn the tables in 2026. In 2025, the decline in both retail and wholesale sales has already sounded an alarm for it. In 2026, it should make every effort to reshape its competitiveness and leading advantage in this strategic location.

However, the premise is that the 'approach' must be flexible. If it forcibly continues the transformation method used in the North American market, directly banning the buyout of FSD and even canceling the free Autopilot, Chinese consumers will certainly give Tesla a resounding slap in the face.

As for the reasons, they are also clearly laid out on the table.

Firstly, regardless of how superior the local comprehensive experience is, the complexity of roads in China far exceeds that in North America, and FSD has not truly proven itself here.

Secondly, Chinese consumers have not fully developed the habit of on-demand subscriptions. Currently, the buyout price of FSD, equivalent to RMB 64,000, has already kept the vast majority of users at bay.

Assuming that after the official entry of the full-featured version into China, the monthly subscription fee will be set at around RMB 700, exceeding RMB 8,000 annually. How many car owners do you think would be willing to pay such a high cost?

Thirdly, while Tesla is unbeatable and hard to find an opponent in North America, the situation is completely opposite in China, where it is be caught in (trapped) in a bloody siege. Currently, in terms of intelligent driving, most domestic brands charge for hardware and offer software for free for life, and in terms of comprehensive experience, they are not inferior to FSD.

In such a fiercely competitive environment, the original 'combo punch' is almost completely ineffective. Not to mention canceling the free Autopilot in an attempt to force users to subscribe. If the protagonist of today's article really dares to do so, many consumers will certainly turn into the harshest judges in an instant.

I still maintain the view that 'the Chinese market no longer allows Tesla to do whatever it wants.'

Instead, it must proceed with caution and show greater sincerity to have hope of breaking out of the slump and redrawing an upward trajectory. For example, extending the free trial period for FSD; for instance, setting more reasonable subscription fees based on reality; and for another example, reducing the one-time buyout price.

Only by making efforts to lower the entry threshold and further increase adoption rates can the full potential of this system be unleashed.

'We are very much looking forward to FSD's entry into China. With the participation of this catalyst, 2026 is bound to become even more exciting.'

Last week, when participating in the latest intelligent driving experience of a leading domestic new force based on a world model, I asked their engineers for their views on Tesla's recent actions. In just over thirty words, this was the response they gave.

Although there was no direct prediction of FSD's prospects, a sense of both anticipation and tension could be felt from their words. After all, the Chinese auto market has reached a point where the competition in the first half regarding electrification has largely come to an end, while the second half regarding intelligence has just begun.

In 2026, the intelligent driving sector is destined to 'expand in width and ascend in height'.

With everyone contributing their efforts, let's wait and see what kind of performance Tesla and numerous domestic brands, including several leading suppliers, will each deliver.

Editor-in-Chief: Cui Liwen Editor: Chen Xinan

THE END