iPhone Steals the Show, Gemini Lends a Hand: Has Apple Truly Entered the AI Era?

![]() 01/30 2026

01/30 2026

![]() 328

328

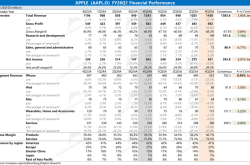

Apple (AAPL.O) released its Q1 2026 financial results (for the period ending December 2025) after the US market closed on the morning of January 31, 2026, Beijing time. Key highlights are as follows:

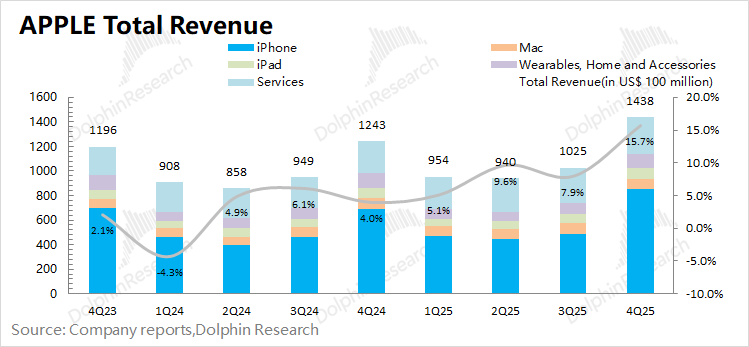

1. Overall Performance: Apple achieved revenue of $143.8 billion this quarter, up 15.7% YoY, surpassing market expectations ($138.3 billion). The revenue growth was primarily driven by the iPhone and software services businesses.

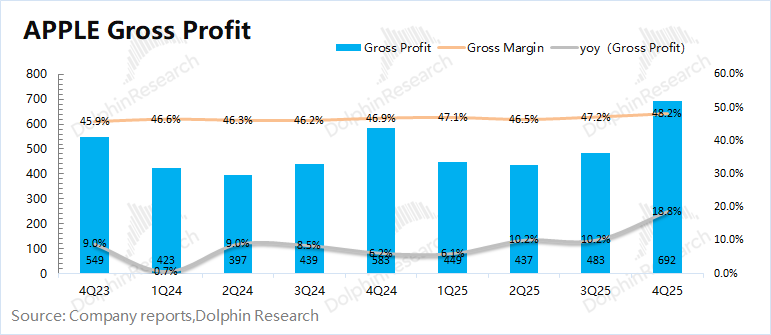

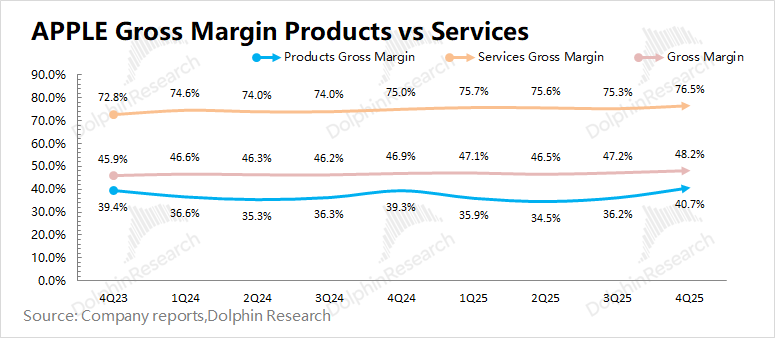

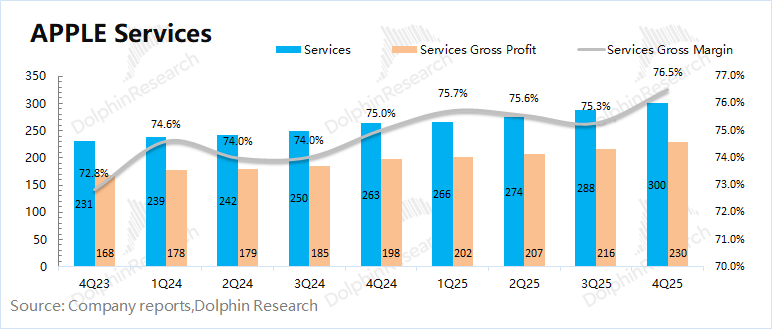

Apple's gross margin stood at 48.2%, up 1.3 percentage points YoY, outperforming market expectations (47.5%). The gross margin for software services rose YoY to 76.5%, while the hardware gross margin increased to 40.7%. The margin improvement was mainly influenced by the reduction of tariffs in China and the depreciation of the US dollar.

[Based on Sino-US negotiations: Starting from November 10, the existing 20% tariff on fentanyl was replaced by a new 10% rate.]

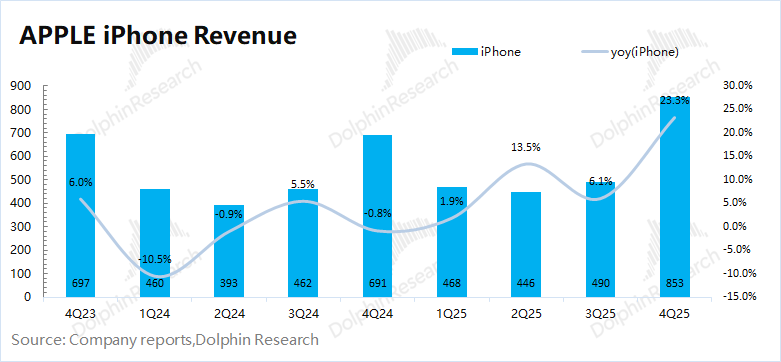

2. iPhone: The iPhone business generated $85.3 billion in revenue this quarter, up 23.3% YoY, significantly exceeding market expectations ($78.2 billion). The growth in the mobile phone business was influenced by the new iPhone 17 series and the depreciation of the US dollar. For this quarter, Haitunjun estimates that the overall shipment volume of iPhones increased by 5.7% YoY, with the average selling price rising by 16.7% YoY.

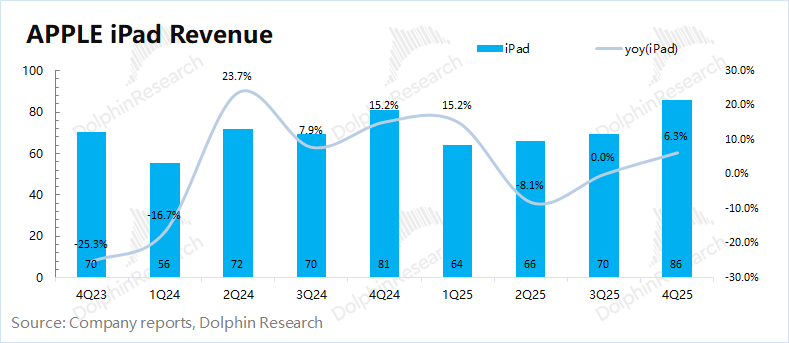

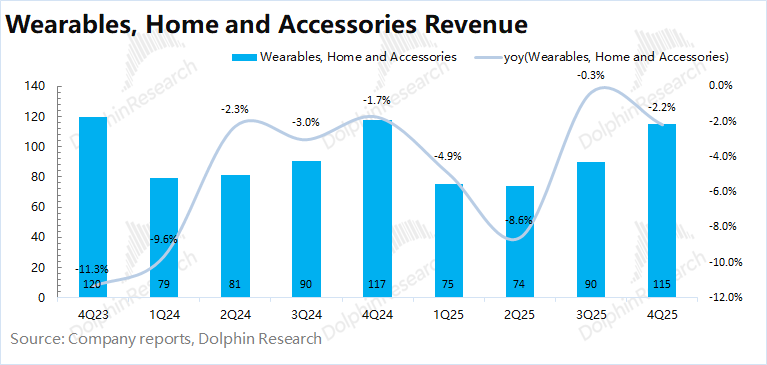

3. Other Hardware Besides iPhone: The iPad business achieved a 6.3% YoY growth this quarter, primarily driven by the M5 Pro and A16 models. However, the Mac and other hardware businesses experienced declines. The Mac was affected by the high base from strong sales of the M4 model last year, while overall demand for other hardware remained relatively weak.

4. Software Services: The company's software services revenue reached $30 billion this quarter, meeting market expectations ($30 billion). With a high gross margin of 76.5%, the software business contributed 21% of the revenue but generated 33% of the gross profit.

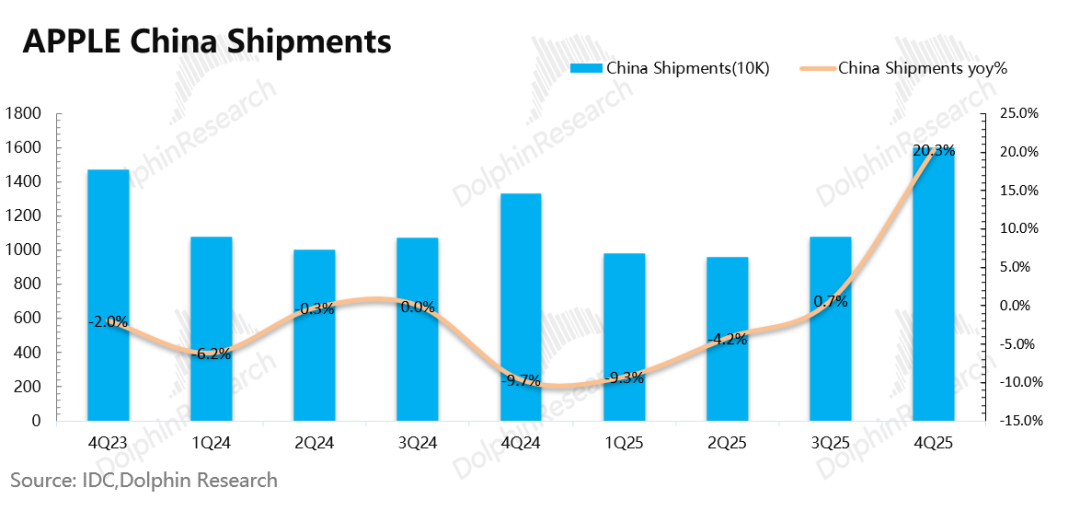

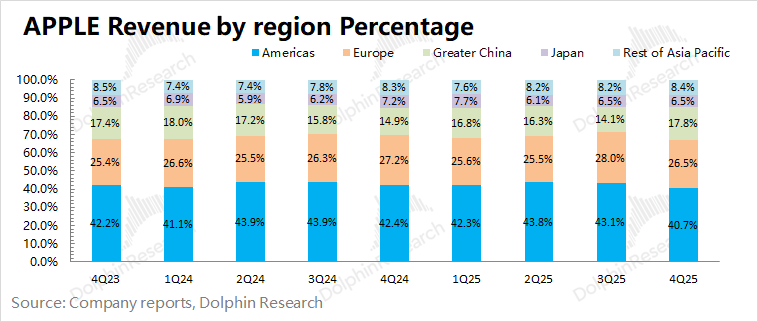

5. Regional Revenue: The Americas region remained the company's core market, accounting for over 40% of the revenue and achieving an 11.2% YoY growth this quarter. Greater China was the best-performing region this quarter. Under the 'more for the same price' policy, the iPhone 17 256G model also qualified for national subsidies, directly driving a 20% YoY increase in iPhone sales in mainland China.

Haitunjun's Overall View: Growth Accelerates, AI Remains a Market Expectation.

Apple's performance this quarter was solid overall, with both revenue and gross margin surpassing market expectations. This was primarily driven by the new iPhone 17 series and the depreciation of the US dollar.

① Revenue Growth: Mainly driven by the iPhone 17 series. Although the iPhone 17 series lacked significant innovations, the 'more for the same price' strategy proved effective. Especially the iPhone 17 256G model, which also qualified for national subsidies, led to a substantial increase in sales in mainland China.

② Gross Margin Improvement: Despite the headwind of rising storage costs, the company's hardware gross margin increased again, mainly due to the reduction of tariffs in China and the depreciation of the US dollar. In particular, the tariff in China was adjusted from 20% to 10% this quarter. (After Sino-US negotiations, the tariffs on products manufactured in China for export benefited from the reduced rate.)

Beyond this quarter's data, the company's management provided guidance for the next quarter: Revenue is expected to grow by 13-16% YoY, corresponding to $107.8-110.6 billion. The gross margin for the next quarter is projected to be 48-49%, with the iPhone remaining the primary growth driver. Although rising storage costs will have a greater impact on the gross margin next quarter, the company's guidance still suggests a steady or even rising trend.

Beyond Apple's financial results, the market is also focusing on the following aspects:

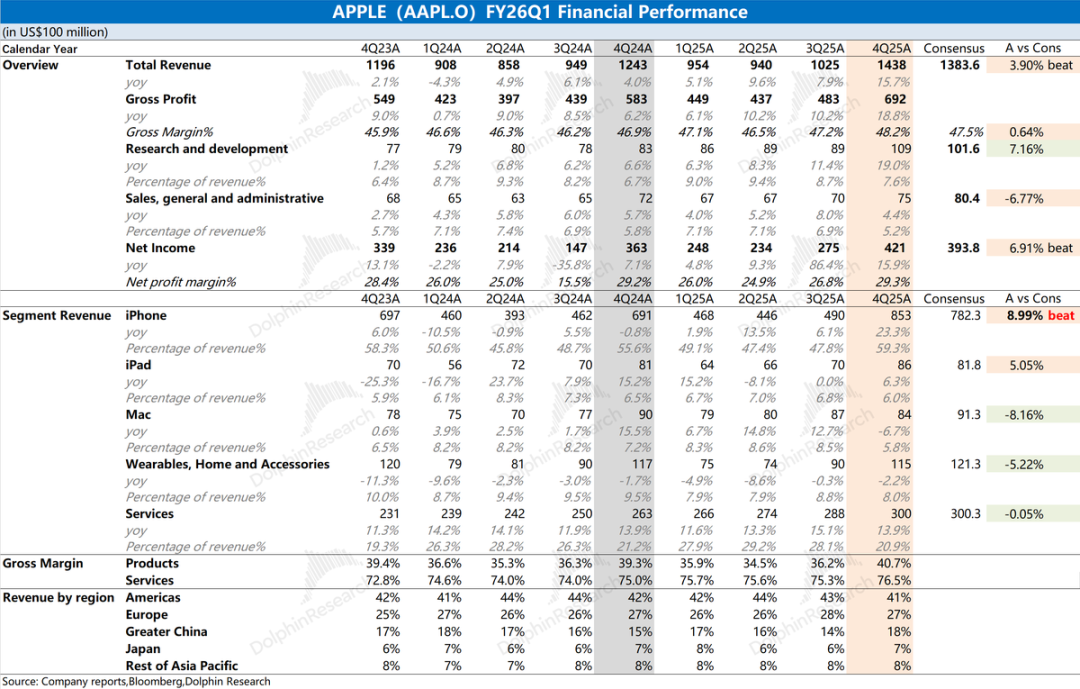

a) Apple's Collaboration with Google Gemini: On January 12, Apple and Google jointly announced a multi-year deep collaboration agreement. The next-generation Apple base model will be directly built on Google's Gemini model and cloud technology, which will enhance Apple's future AI capabilities, including the more personalized Siri to be launched this year.

Specifically, Google Gemini will provide Apple with trillion-parameter models and technical support, while the underlying computations will be fully reliant on on-device computing and Apple's private cloud.

Why choose Gemini? On one hand, Apple and Google already have an annual search collaboration worth over $20 billion. On the other hand, Gemini's market share has been noticeably rising, now exceeding 20%.

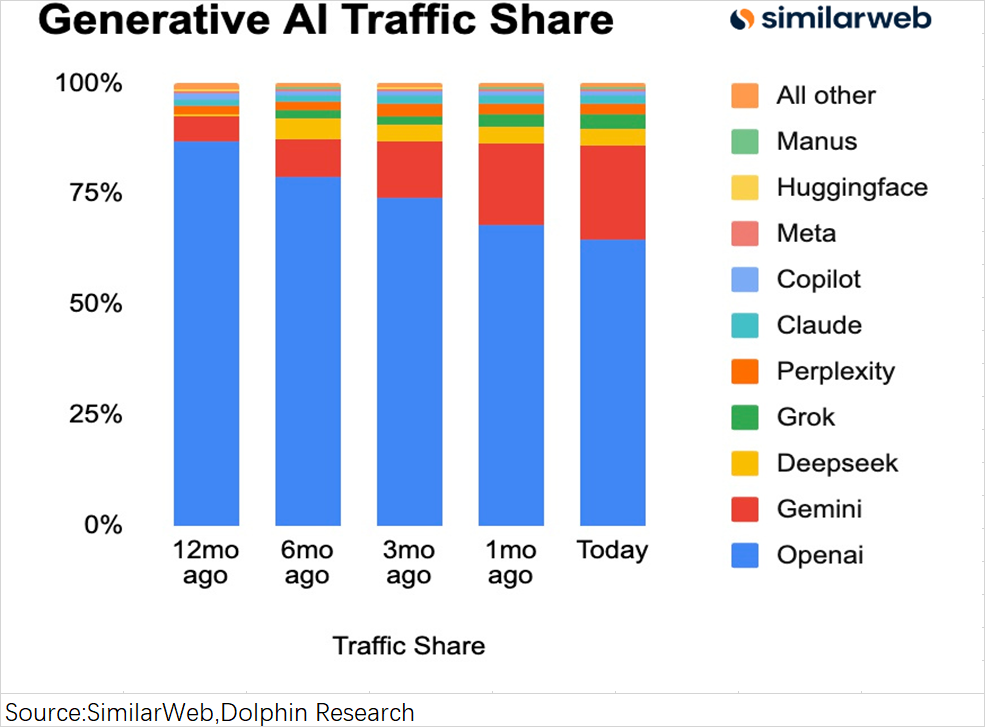

b) Performance of Apple's New Products: The iPhone remains the foundation of Apple's hardware business, with this quarter's growth primarily driven by the new products launched last fall. Although the new iPhone models did not bring significant innovations, the 'more for the same price' strategy still achieved 'noticeable results.'

The iPhone 17 series uniformly upgraded storage to start at 256G, while maintaining the price at 5,999 yuan (meeting national subsidy requirements in mainland China). This directly drove a nearly 20% increase in iPhone shipments in mainland China this quarter, far outperforming the overall mobile phone market (which saw a -0.8% YoY change).

c) Siri Upgrades: Following the collaboration with Google Gemini, the market has higher expectations for Siri upgrades.

Market expectations suggest that the new Siri, powered by Google Gemini, will make its debut on the iOS 26.4 beta version in late February to early March, with a planned official rollout between March and April. This version of Siri will run on Apple's private cloud computing servers, with a scale of approximately 1.2 trillion parameters.

Leveraging Gemini's capabilities, Siri is expected to unlock several core new features: supporting multimodal interactions (text, image, voice), equipped with a 128K token ultra-long text processing module, capable of real-time screen content analysis, and executing complex cross-application instructions.

Taking (a+b+c) together, Apple's short-term performance is still primarily influenced by its traditional businesses (especially the iPhone). However, the market is currently more focused on the company's progress in the AI field, particularly the upcoming Siri upgrade, which is considered even more crucial.

Apple's current market capitalization ($3.79 trillion) corresponds to a PE ratio of about 30 times its net profit for fiscal year 2026 (assuming revenue growth of +12%, a gross margin of 48.3%, and a tax rate of 17.5%). Given the company's historical PE range of 25X-40X, its current stock price is positioned slightly below the midpoint of the range.

For Apple, a two-pronged view is necessary: ① In the short term, Apple's recent performance rebound is primarily driven by the outstanding performance of the iPhone 17 series. The market expects the company to introduce a 2nm chip in its next-generation products, which will stimulate demand and continue to drive the company's performance upward. ② In the medium to long term, Apple already has a vast user base for its hardware. Subsequent breakthroughs in AI and Siri will provide the company with even greater growth potential.

Overall, Apple's financial results once again demonstrate the company's market influence. The 'more for the same price' strategy for the iPhone 17 series is essentially a form of 'profit-sharing upgrade' by the company. In other words, once the company 'shares profits,' its growth rate returns to double digits, with immediate effects.

Apple's current business foundation remains solid, providing strong support for the company to maintain a relatively high PE ratio even at lower growth rates. With its massive global hardware user base, AI/Siri represents a 'potential upside opportunity' for the company.

After leveraging Gemini's 'brain,' the market has even higher expectations for Siri's iterative upgrades, which are expected to open up further growth opportunities for the company.

Here is a detailed analysis:

I. Apple's Core Business Remains 'Stable!'

1.1 Revenue: In the first quarter of fiscal year 2026 (4Q25), Apple achieved revenue of $143.8 billion, up 15.7% YoY, surpassing market expectations ($138.3 billion). The revenue increase this quarter was primarily driven by growth in the iPhone, iPad, and software services businesses, while other hardware businesses such as Mac and wearables saw declines.

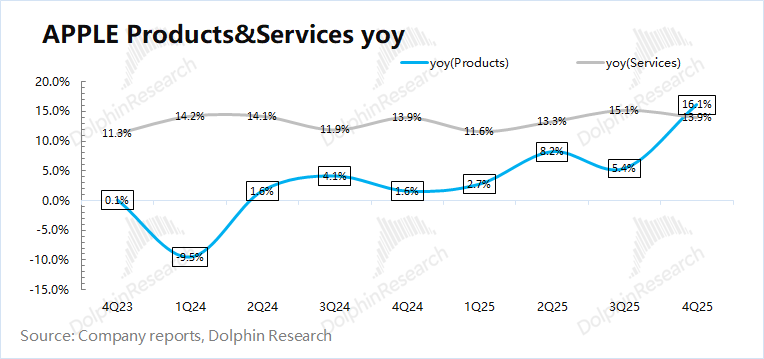

From a hardware and software perspective:

① Apple's hardware business grew by 16.1% this quarter. The acceleration in hardware business growth was mainly driven by the iPhone and iPad businesses, with the iPhone business growing by 23%. The Mac and wearables businesses saw declines this quarter.

② Apple's software business grew by 13.9% this quarter, maintaining double-digit growth. The resolution of the Google lawsuit earlier released risks for the company's software business. The recent collaboration with Google Gemini has brought more market expectations.

From a regional perspective, revenue saw varying degrees of growth YoY. The Americas, Europe, and Greater China are the company's three primary revenue sources. Specifically, the Americas region accounted for over 40% of the revenue, with an 11.2% growth this quarter. The Europe region maintained a 12.7% growth rate this quarter. Greater China was the best-performing region this quarter, with a growth rate reaching 38%. Under the 'more for the same price' policy, the iPhone 17 256G model also qualified for national subsidies, directly driving a 20% YoY increase in iPhone sales in mainland China.

1.2 Gross Margin: In the first quarter of fiscal year 2026 (4Q25), Apple's gross margin stood at 48.2%, up 1.3 percentage points YoY, outperforming market consensus expectations (47.5%). The gross margin improvement was mainly driven by the gross margins of both the hardware and software businesses.

Breaking down the gross margins of hardware and software:

Apple's software gross margin remained relatively high at 76.5% this quarter. The most significant change this quarter was the increase in the hardware gross margin to 40.7%, primarily influenced by tariff changes and the depreciation of the US dollar.

Based on Sino-US negotiations: Starting from November 10, the existing 20% tariff on fentanyl was replaced by a new 10% rate.

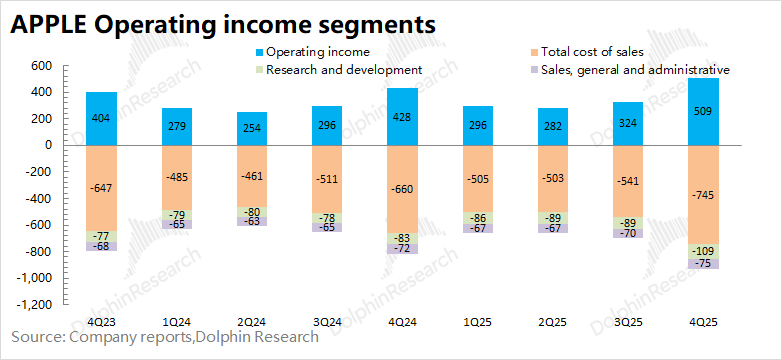

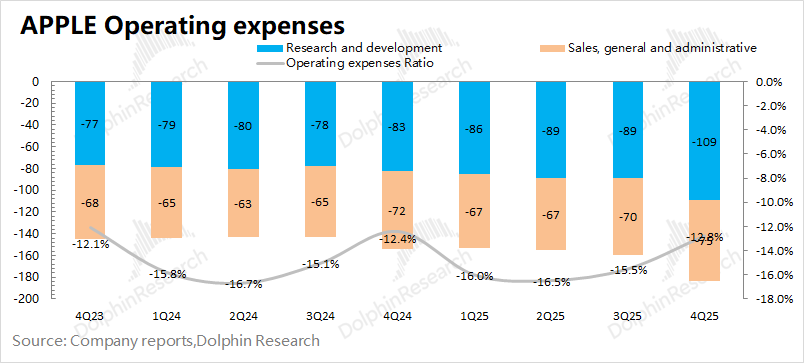

1.3 Operating Profit: In the first quarter of fiscal year 2026 (4Q25), Apple's operating profit reached $50.9 billion, up 18.7% YoY. The growth in operating profit this quarter was driven by both revenue growth and gross margin improvement.

Apple's operating expense ratio stood at 12.8% this quarter, up 0.4 percentage points YoY. The company's selling and administrative expenses remained stable, while R&D investment increased over the past two quarters.

Considering the current capital expenditure situation, the company's capital expenditure reached $2.4 billion this quarter, down 19% YoY. While other major companies are increasing their AI investments, Apple's capital expenditure remains relatively low. The company's investment in AI and other innovative businesses is partially included in R&D expenses, with R&D expenses maintaining double-digit growth recently.

II. iPhone: Significant Effect of 'Increased Quantity Without Price Increase'

In the first quarter of fiscal year 2026 (i.e., 4Q25), the iPhone business generated $85.3 billion in revenue, up 23% year-on-year, outperforming market expectations ($78.2 billion). The growth of the company's iPhone business in this quarter was mainly driven by the new iPhone 17 series and the depreciation of the US dollar.

Dolphin Research analyzed the main sources of iPhone business growth this quarter from the perspectives of volume and price:

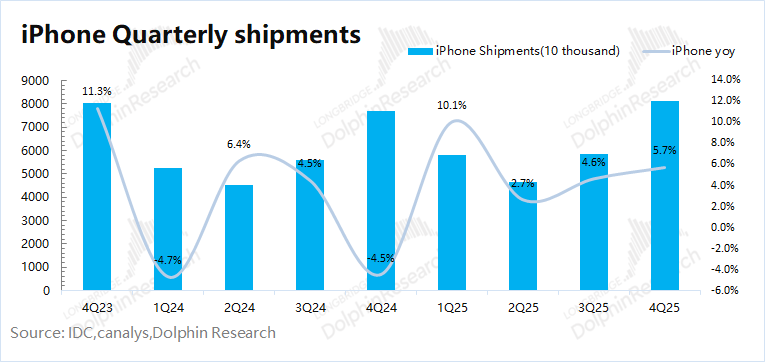

1) iPhone Shipments: According to IDC data, the global smartphone market grew by 1.4% year-on-year in the fourth quarter of 2025. Apple's global shipments increased by approximately 5.7% year-on-year this quarter, outperforming the overall market.

The company's shipment growth this quarter was mainly driven by the new iPhone 17 series and the Chinese mainland market. With the iPhone 17 256G model eligible for national subsidies, iPhone sales in the Chinese mainland grew by 20% year-on-year this quarter (while the overall Chinese market declined by 0.8% year-on-year), making it the best-performing market.

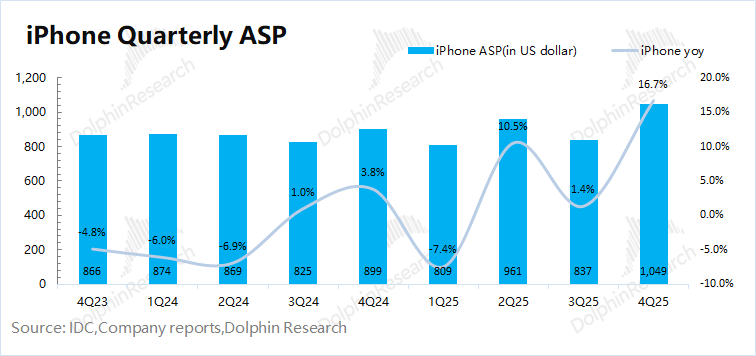

2) Average Selling Price (ASP) of iPhones: Based on iPhone business revenue and shipment volume, the ASP of iPhones this quarter was approximately $1,049, up 16.7% year-on-year. Affected by the new iPhone 17 models and the depreciation of the US dollar, revenue and product prices in regions outside the US benefited from favorable exchange rates (when converting foreign currencies into US dollars for accounting purposes).

III. Other Hardware Products Besides iPhone: iPad Rebounds, While Other Hardware Declines

3.1 Mac Business

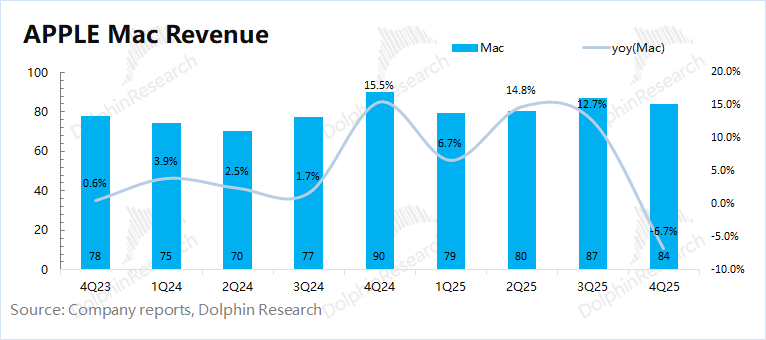

In the first quarter of fiscal year 2026 (i.e., 4Q25), the Mac business generated $8.4 billion in revenue, down 6.7% year-on-year, falling short of market expectations ($9.1 billion), primarily due to the high base effect from the strong sales of the M4 models last year.

According to IDC's report, global PC market shipments grew by 11% year-on-year this quarter, while Apple's PC shipments increased by 4.4% year-on-year. The company's performance lagged behind the overall market. Combining company and industry data, Dolphin Research estimates that the ASP of Macs this quarter was $1,181, down 10% year-on-year.

3.2 iPad Business

In the first quarter of fiscal year 2026 (i.e., 4Q25), the iPad business generated $8.6 billion in revenue, up 6.3% year-on-year, slightly exceeding market consensus expectations ($8.2 billion), mainly driven by the growth of the M5 Pro and A16 models.

3.3 Wearables and Other Hardware

In the first quarter of fiscal year 2026 (i.e., 4Q25), revenue from wearables and other hardware businesses was $11.5 billion, down 2.2% year-on-year, falling short of market expectations ($12.1 billion), remaining sluggish this quarter.

Although the company attributed this quarter's performance to supply chain disruptions affecting AirPods Pro 3, AirPods are just one part of this business segment. The continued decline indicates weak downstream demand.

IV. Software Services: Steady Growth, New AI Expectations

In the first quarter of fiscal year 2026 (i.e., 4Q25), software services generated $30 billion in revenue, up 13% year-on-year, meeting market consensus expectations ($30 billion). Even with external links allowed in the US App Store, Apple's software services revenue maintained double-digit growth, reflecting the strength of its software ecosystem.

The gross margin for software services continued to improve, reaching 76.5% this quarter, staying above 75% for five consecutive quarters. With its high gross margin, the software business accounted for 21% of the company's revenue this quarter but generated 33% of its gross profit.

Apple's strategic layout in the AI field continues to prioritize 'privacy first and full ecosystem integration,' mainly including: ① Launching Apple Intelligence, introducing dozens of features such as visual intelligence and real-time translation, supporting 15 languages, with most iPhone users actively using them; ② Building hardware performance barriers relying on Apple Silicon chips (such as M5) to create a globally leading AI hardware platform; ③ Reaching a strategic cooperation with Google, focusing on jointly developing the next-generation Apple Foundation model for more personalized AI functions to be introduced in 2026.

The resolution of the previous Google lawsuit released risks for Apple's software business. Recently, the company has also procured 'Gemini' services, further deepening its cooperation with Google in software.

Google Gemini will provide Apple with trillion-parameter models and technical support, while underlying computations will be fully completed through on-device computing and Apple's private cloud, injecting more anticipation into the iterative upgrade of Siri. If the next-generation Siri performs well, it will bring more growth prospects to the company's software business.

- END -

// Reprint Authorization

This article is an original piece from Dolphin Research. Authorization is required for reprinting.

// Disclaimer and General Disclosure

This report is for general comprehensive data purposes only, intended for users of Dolphin Research and its affiliated institutions for general reading and data reference. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial status, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report assumes their own risks. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from using the data contained in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions mentioned in this report shall not, under any jurisdiction, be regarded or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall they constitute recommendations, inquiries, or endorsements of relevant securities or related financial instruments. The information, tools, and materials in this report are not intended for or proposed to be distributed to jurisdictions where distribution, publication, provision, or use of such information, tools, and materials contradicts applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliated companies are required to comply with any registration or licensing regulations.

This report merely reflects the personal views, insights, and analytical methods of the relevant authors and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) make, copy, reproduce, duplicate, forward, or distribute in any form of copies or replicas in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all related rights.