Musk Halts Production of Two Flagship Models, Revenue Hits First Major Setback, Tesla Goes All-in on Robotics and AI

![]() 01/30 2026

01/30 2026

![]() 365

365

Reconstructing the 'Growth Logic'

Author: Wang Lei

Editor: Qin Zhangyong

When it comes to the ability to weave compelling narratives and tell stories, Tesla stands unparalleled.

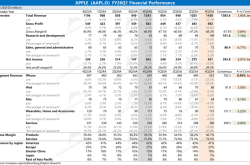

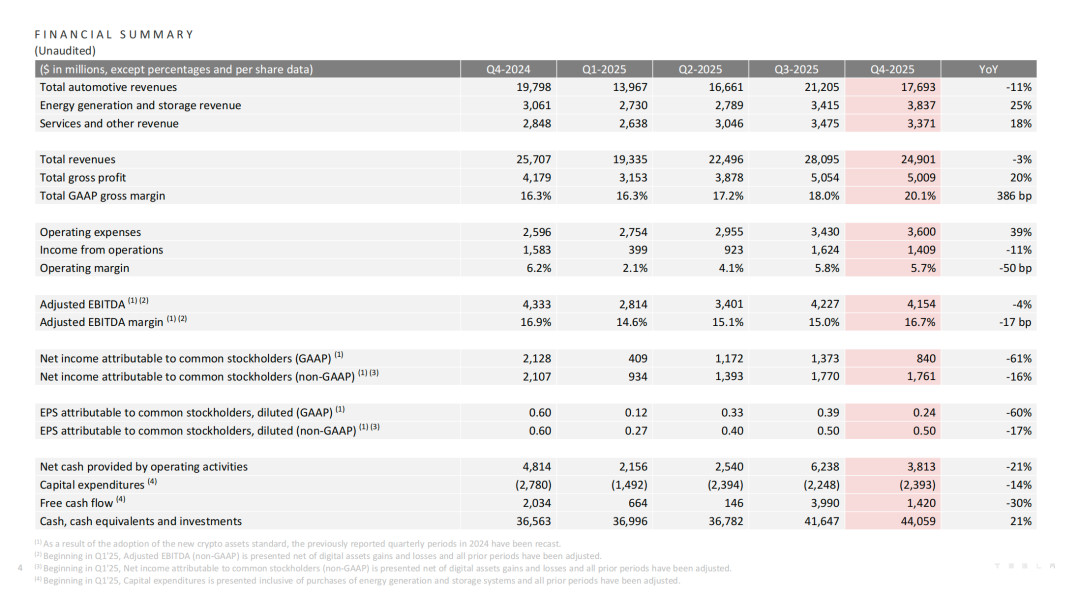

Early this morning, Tesla released its Q4 2025 financial report, revealing dismal data: revenue of $24.901 billion, down 3% year-on-year; GAAP net profit of only $840 million, a staggering 61% plunge year-on-year.

Zooming out to the full year, the situation remains grim, with total revenue of $94.827 billion, down 3% year-on-year—Tesla's first-ever annual revenue decline; full-year net profit of just $3.794 billion, nearly halved compared to 2024, down 46% year-on-year.

However, the market reacted in stark contrast, with Tesla's stock price surging 3% post-market after the financial report was released.

In fact, ahead of Tesla's financial report, Shay Boloor, Chief Market Strategist at overseas tech research firm Futurum, had predicted that the report might look 'ugly,' but the stock price might not be affected.

In his view, Tesla is no longer just a car company; investors are focused on autonomous vehicles and AI-trained robots. Musk's revelations about Tesla's Robotaxi business could be more important than the financial report itself.

Tesla's ability to narrate a long-term AI vision can bridge the gap in short-term performance, while progress in Robotaxi, Optimus, and xAI offers limitless imagination for valuation growth.

What exactly is the capital betting on in this paradox of 'falling performance, rising stock price'?

01

Farewell to Model S/X

Unsurprisingly, Tesla's Q4 earnings call, like previous ones, focused on narrating its AI endeavors.

During the call, Musk dedicated significant time to discussing the progress of Optimus humanoid robots, autonomous driving, Robotaxi, and XAI, while selectively downplaying and even contracting its core automotive business.

To make way for the mass production of Optimus humanoid robots, Musk announced that Model S and X production will gradually decrease next quarter and will largely cease by the following quarter.

'I'm a bit sad, but it's time to retire the Model S/X project honorably, as we're truly moving toward a future based on autonomous driving,' Musk said.

This also means that the two flagship models that once pioneered Tesla's expansion have come to an end.

Optimus Faces Greatest Competition from China

Without dwelling on sentiment, Musk set the tone for 2026, stating explicitly that it will be a year of massive investment, with capital expenditures expected to exceed $20 billion (approximately RMB 139 billion).

Specifically, most funds will be injected into six key areas: lithium refineries, LFP battery factories, Cybercab scale-up, Semi production, a new Megafactory, and mass production of Optimus.

Among these, mass-producing Optimus, the core narrative of Tesla's latest mission 'to create amazing abundance,' was one of the longest-discussed topics during the call.

Musk revealed that the third-generation Optimus will officially debut in a few months, defined as the 'first model designed for mass production.'

How capable will this generation be? According to Musk, it can learn by observing human behavior. Demonstrate a task, describe it verbally, or even show it a video, and it can execute the task.

Currently, Tesla is establishing its first production line to prepare for mass production, aiming to start by the end of 2026, with a long-term goal of producing 1 million units annually.

However, Musk also tempered market expectations, admitting that initial production of Cybercab and Optimus will be 'extremely slow' before gradually accelerating. So slow that Musk expects no substantial increase in Optimus production before the end of this year.

Consequently, Optimus's production line will replace the Model S and X lines at the Fremont factory. Musk also noted, 'If you're interested in buying a Model S or X, now is the time to order. Even after production halts, we'll continue to support these vehicles as long as users keep them,' he said.

Notably, near the end of the call, when addressing investor questions about competition in humanoid robots, Musk expressed high praise for Chinese companies.

He believes Tesla's greatest competitor in the humanoid robot sector will undoubtedly come from China. 'I've always felt that many underestimate China. China is a competitor on another level. It excels in mass manufacturing and is quite strong in AI, with some impressive open-source AI models,' Musk said, even stating that apart from China, he sees no other significant competitors.

Only Autonomous Vehicles in the Future

Besides the third-gen Optimus robot, there's also Robotaxi, which Musk views as the ultimate form of FSD commercialization.

Tesla's Robotaxi now offers driverless paid rides in a limited area of Austin and plans to expand services to multiple U.S. cities in the first half of 2026, including Dallas and Houston in Texas, Phoenix in Arizona, Miami, Orlando, and Tampa in Florida, and Las Vegas in Nevada.

The ideal goal is to cover about a quarter or even half of the U.S. with fully autonomous vehicles by the end of the year, pending regulatory approval.

The long-discussed 'Vehicle Sharing Program for Owners' will also materialize, offering an Airbnb-like flexible join/exit mechanism where income from renting their cars to the fleet exceeds their lease payments to Tesla. In Musk's view, this equates to 'owning a Tesla for free and making money on the side.'

Musk also confirmed that the dual-seat Cybercab designed for Robotaxi will begin mass production in April 2026, emphasizing that it will have no steering wheel or pedals, with plans to expand the fleet to 1,000 units by year-end.

Similarly, mass production ramp-up will follow an S-curve, starting slow, then growing exponentially, entering a linear growth phase, and finally reaching saturation. Musk expects CyberCab production to far exceed the combined output of all other Tesla models over time.

More importantly, Tesla disclosed its FSD subscriber count for the first time in this report, with nearly 1.1 million paid customers globally. Nearly 70% opted for a one-time purchase. Based on total vehicle deliveries of 8.9 million, the FSD penetration rate is approximately 12%.

However, Musk did not disclose any details about the new FSD version or upcoming capabilities during the call. He explicitly stated that larger models than CyberCab, also designed for full autonomy, will be introduced, and 'only autonomous vehicles will be produced in the future.'

This includes the future Cybertruck, which Musk believes will be highly useful for local cargo transport within cities or over a few hundred miles.

The only exception is the next-gen electric sports car, Roadster, which Musk said will debut in April this year, calling it 'beyond imagination.'

AI 5: A Matter of Survival

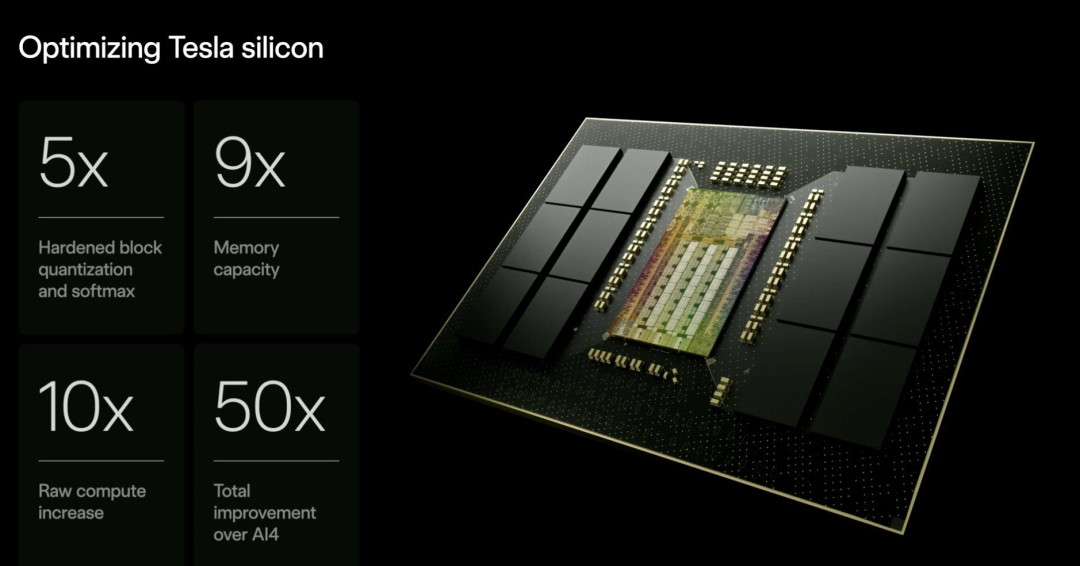

Supporting robots, FSD, and Robotaxi is AI computing power, making AI chip manufacturing crucial.

Musk stated bluntly that if AI 5 fails, Optimus will be useless. 'This isn't a cost issue; it's a survival issue for Tesla,' he said.

Thus, 'completing the AI5 chip design and ensuring it's a great chip is currently the most critical task,' he said, adding that he spends more time on chips than any other Tesla endeavor, dedicating almost entire Saturdays and most Tuesdays to it.

Tesla is building Cortex 2 at Giga Texas to boost AI training computing power; by the first half of 2026, Tesla aims to double its on-site computing capacity in Texas (measured in H100 equivalents). It also plans to mass-produce AI 5 and AI 6 autonomous driving inference chips in 2027 and 2028, respectively.

Previously, Musk mentioned that if future contract chip manufacturing remains insufficient, Tesla might build its own Terrafab, aiming for at least 100,000 wafers per month initially.

During this earnings call, Musk reiterated the plan, stating that over the next 3-4 years, Tesla's primary growth bottleneck will not be demand but the capacity of AI logic and memory chips.

To overcome this constraint, Musk announced that Tesla will build a mega chip factory (Terafab) in the U.S. dedicated to producing Tesla chips, covering logic chips, memory chips, packaging, and more. 'We need a very large factory; this will be a crucial step toward self-sufficiency,' he said.

He also stressed that existing suppliers, including TSMC, Samsung, and Micron, cannot supply the chips Tesla needs, raising concerns about geopolitical risks. Building an in-house chip factory is vital to avoid supply limitations, he emphasized.

02

Divergent Performance

In stark contrast to Musk's grand narrative during the earnings call is Tesla's actual performance.

In Q4 2025, Tesla's quarterly revenue was $24.901 billion (approximately RMB 173 billion), down 3% year-on-year from $25.707 billion, with net profit at only $840 million (approximately RMB 5.8 billion), down about 61% year-on-year.

Expanding to the full year, the situation worsens, with total revenue of $94.827 billion, also down 3% year-on-year—Tesla's first-ever annual revenue decline. Full-year net profit also shrank significantly to $3.794 billion, nearly halved from 2024, down 46% year-on-year, hitting a five-year low.

The root cause of the profit plunge lies in the significant slowdown of Tesla's former cash cow—its core automotive business.

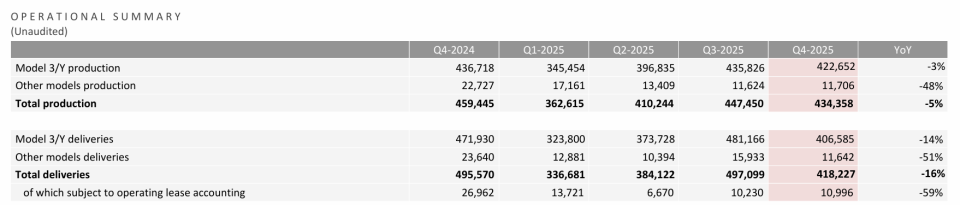

In Q4 2025, Tesla delivered 418,000 vehicles globally, down 16% year-on-year. For the full year, cumulative deliveries were 1.636 million, down 8.6% year-on-year. This marks Tesla's first-ever annual delivery decline, with BYD seizing the global electric vehicle sales crown.

Besides the sales-driving Model 3 and Model Y, other models failed to drive growth. In Q4, the 'other models' category, including Cybertruck, Model S, and Model X, totaled about 12,000 deliveries, down 51% year-on-year.

Given their limited sales and high production complexity, this may explain why Musk halted Model S and Model X production amid current automotive business pressures.

Further quantifying revenue, in Q4, automotive revenue was $17.693 billion, down 11% year-on-year; full-year automotive revenue was $69.526 billion, down 10% year-on-year. While automotive still contributes over 70% of revenue, its share of total revenue has declined from a high of 88% in 2021 to about 73%.

Regarding the profit plunge, Tesla attributed it to decreased vehicle deliveries and reduced regulatory credit income. Additionally, rising operational expenses from AI and other R&D projects, along with increased tariffs, further eroded profits. Financial reports show Tesla's operating expenses at $12.74 billion in 2025, up 23% year-on-year.

However, Tesla's annual financial report was not entirely without highlights.

The gross profit margin, one of Tesla's core financial indicators, performed significantly better than market expectations. In the fourth quarter, Tesla's gross profit margin increased by 3.8 percentage points year-on-year to 20.1%, far exceeding market expectations of 17.1%, and returned to above 20% for the first time in eleven quarters, marking the highest point in two years.

Even after deducting revenue from carbon credits, the automotive gross profit margin increased by 4.3 percentage points year-on-year to 17.9%.

Moreover, Tesla's energy generation and storage business segment outperformed the automotive business particularly impressively. In the fourth quarter of 2025, Tesla's energy business revenue surged to $3.837 billion, a year-on-year increase of 25%. Energy storage deployment also reached a record 14.2 gigawatt-hours, a year-on-year increase of approximately 29%.

Even more astonishing was the full-year performance, with revenue reaching $12.771 billion, a staggering 27% year-on-year increase, making it the company's fastest-growing segment. Its profitability was equally robust, with quarterly gross profit surpassing $1.1 billion for the first time in history and achieving a record profit for the fifth consecutive quarter.

Additionally, Tesla's service and other business revenue reached $12.530 billion, a year-on-year increase of 19%. It can be said that, except for the underperformance of the core automotive business, the other segments all had highlights.

As of the end of the fourth quarter of 2025, Tesla's total cash, cash equivalents, and investments reached $44.1 billion (approximately RMB 306.3 billion), an increase of $2.4 billion from the previous quarter, providing ample resources for the expansion described in Musk's 'grand narrative.'

In fact, judging from the financial report and Musk's statements, it is not difficult to see that 2026 will be a critical year for verifying whether Tesla can become an 'AI super empire.'

In this context, perhaps this is why capital selectively overlooks the weakness of traditional businesses and turns its attention to the future narrative described by Musk, which consists of AI, robotics, and fully autonomous driving.