AI Race Among Tech Giants: ByteDance, Alibaba, and Tencent Compete Fiercely During the Spring Festival Season

![]() 01/30 2026

01/30 2026

![]() 343

343

The 2026 Spring Festival undoubtedly stands as a 'year of group battles' for China's internet sector, with AI applications taking center stage.

To date, ByteDance (Doubao, Volcano Engine), Tencent Yuanbao, Alibaba (Qianwen, Alipay), and Baidu Wenxin have invested substantial resources and capital, using red envelopes as leverage to enter the AI-driven 'Spring Festival season.'

ByteDance previously announced Volcano Engine as the exclusive AI cloud partner for CCTV's Spring Festival Gala, with Doubao deeply integrated into the event's interactions. Tencent directly offered 1 billion yuan ($137 million) in cash red envelopes to promote its Yuanbao app, embedding it in group chats and leveraging its social strengths. Although Qianwen has not disclosed whether it will join the red envelope competition, media reports indicate it has sponsored Jiangsu TV's Spring Festival Gala, suggesting more AI-driven Spring Festival activities will follow.

In Chinese culture, the Spring Festival represents a critical 'battlefield.' In 2014, WeChat's red envelopes debuted, creating an opening for WeChat Pay and marking a milestone in China's mobile payment adoption.

Over the past decade, such strategies have evolved from simple social interactions to key battles for user acquisition and industry positioning among internet giants.

This year, AI giants like ByteDance, Alibaba, and Tencent are converging during the Spring Festival, signaling that competition for consumer entry points in AI applications has reached a fever pitch. These three companies, leveraging their strengths and resources, have made distinct strategic choices, engaging in an AI race reminiscent of the 'Three Kingdoms' era while facing unique core challenges.

Strategy never emerges in a vacuum but is deeply rooted in a company's history, culture, and core capabilities—its so-called 'corporate DNA.' Undoubtedly, their primary goal is to secure a leading position in the AI era, even dominating the race, and ultimately winning this AI endurance contest.

ByteDance Aggressively Positions Itself in AI Entry Points, But Celebrations Are Premature

ByteDance stands out as the most aggressive among the three companies. Continuing its tradition of 'achieving miracles through force,' it has adopted a 'multi-pronged' approach, simultaneously advancing in applications, hardware, and development platforms.

At the consumer level, ByteDance has deployed a dense array of AI applications. According to incomplete statistics, it has launched over a dozen AI apps covering chat, social networking, tools, and other domains, with Doubao as its flagship AI application.

Doubao's Agent capabilities are deeply integrated with ByteDance's content and entertainment ecosystem, positioning it as more entertainment-oriented. Users can generate fun images and videos, engage in voice conversations, and more.

In AI hardware, ByteDance has been equally active. In late 2025, its 'Doubao Mobile Assistant' launched on ZTE smartphones, causing industry shockwaves. Unlike traditional voice assistants, Doubao gained the ability to directly operate phone functions through deep collaboration at the operating system level.

However, achieving this requires reading and interpreting information on the graphical user interface (GUI), potentially crossing privacy and data security red lines and sparking controversy. Many smartphone manufacturers, particularly banking and payment apps, have resisted or blocked such features due to security and risk control concerns.

Beyond smartphones, ByteDance is rumored to be launching Doubao AI earphones and glasses. I call this ByteDance's 'borderless game' in the AI era, attempting to create a new interaction entry point directly driven by AI models with significant room for error tolerance.

At the platform level, ByteDance's AI Agent tool 'Coze' recently announced a 2.0 brand upgrade, integrating capabilities like Agent Skill and Agent Coding. Through Coze, developers and ordinary users can create Agents for various vertical scenarios, which can be seamlessly integrated into ByteDance platforms like Douyin and Feishu.

This 'application + hardware + platform' strategy continues ByteDance's 'rapid and aggressive' approach from the mobile internet era. Rising on algorithms, from Today's Headlines' personalized news recommendations to Douyin's immersive short video feeds, ByteDance's phenomenal successes stemmed from its ultimate use of recommendation algorithms and precise capture of user interests.

Over time, this has become a path dependency—or DNA—that fuels ByteDance's deep-seated anxiety: when users can directly and clearly express needs through Agents using natural language, its successful 'guess + recommend' information flow model may be disrupted.

The core of ByteDance's AI strategy is 'seizing new entry points,' attempting to cover all hardware and software products with entry potential. Thus, ByteDance must act swiftly, leveraging its product matrix and rapid iteration capabilities to bet on every potential super entry point.

Currently, while Doubao has gained significant consumer traction, celebrations are premature. As competition intensifies, questions remain about how long its first-mover advantage will last and how to establish a sustainable new business model.

Moreover, the 'entry point' strategy is a double-edged sword. Its deep hardware and OS integration have raised industry concerns about user privacy and data security.

For instance, doubts about Doubao Mobile's security risks resurfaced recently. @DoubaoMobileAssistant quickly responded, stating that its feature calls strictly adhere to user authorization and drawing clear lines on core controversies: insisting on cloud-based processing ('no storage, no training') and full encryption of data transmissions to safeguard privacy with multiple protections.

This forces ByteDance to confront severe tests of ecological compatibility and industry trust while attempting technological leaps. Balancing rapid expansion with trust-building will be key to realizing its AI ambitions.

Alibaba Launches AI-to-Consumer Offensive, Waging an AI 'Blitzkrieg'

Alibaba's pivot has been remarkably swift. In the first half of 2025, its AI-to-consumer efforts focused on Kuake. From the second half of 2025 to the present, it has reorganized its strategy, positioning Qianwen as its new flagship and launching a 'blitzkrieg.' It first introduced Qianwen as a standalone app and quickly integrated Alibaba's core business ecosystem into the Qianwen app.

Currently, Alibaba's AI-to-consumer strategy revolves around 'Qianwen + Alibaba Cloud,' deeply integrating with e-commerce platforms like Tmall and Taobao and Alibaba's business ecosystem, including Amap and Alipay. It aims to seize AI-driven shopping and industrial service entry points, reshape the 'people-goods-scenes' dynamic, and pursue a 'full-stack technology + industrial penetration' route.

The release of Qianwen 6.0 marked a critical milestone, as Alibaba initiated the Agent era, achieving cross-system Agent capabilities within its proprietary business ecosystem—something Doubao Mobile had not accomplished.

At the model level, Tongyi Qianwen adopted an open-source strategy from its inception. Early in a technological paradigm shift, open-sourcing core technologies can significantly accelerate adoption, unite developers, and quickly build an ecosystem around one's platform.

This aligns with Alibaba's strengths—leveraging organizational advantages to gather forces for large-scale battles. Early in the new year, Alibaba Group CEO Wu Yongming wrote in his 'New Year Letter' to employees that the company had fought several impressive 'battles' that year, including the launch of the Qianwen app.

Alibaba's DNA is 'commerce' and 'infrastructure.' From 'making business easy' in B2B to C2C e-commerce with Taobao, and later Alipay, Alibaba Cloud, and Cainiao Logistics, Alibaba has spent two decades building commercial infrastructure.

This DNA shapes its AI strategy: strengthening B2B foundations while breaking through on the consumer side, fighting on two fronts. This mirrors ByteDance in reverse: one replenishes B2B with consumer success, the other supports consumer expansion with B2B strength.

In Alibaba's view, AI is not an isolated product but the underlying operating system for next-generation cloud computing, commerce, and enterprise services—all infrastructure. To this end, Alibaba is investing heavily in AI infrastructure, planning to spend over $53 billion (380 billion yuan) on cloud computing and AI within three years.

For Alibaba, models or AI apps may not directly generate profits. However, by leveraging its full-stack capabilities (chips-computing power-models-scenarios), it can build a thriving AI commercial ecosystem connecting developers, merchants, and consumers, guiding token consumption to infrastructure like Alibaba Cloud and forming a complete 'consumer-to-business' (C-B) closed loop .

Alibaba arguably possesses the most comprehensive capabilities among major AI players. However, it lacks high-exposure channels like WeChat or Douyin, relying on Network wide streaming and organic traffic driven by its large model's reputation for AI-to-consumer outreach.

Meanwhile, infrastructure development is lengthy, capital-intensive, and slow to yield returns. Alibaba must find solutions to rebuild and balance business models while embracing AI paradigms.

Tencent Advances Steadily, Driving AI-Powered Ecosystem Reconstruction

Tencent's DNA is 'social' and 'connection.' Closest to Chinese users, it understands their social habits best. From QQ to WeChat, Tencent has built China's internet 'relationship chain' foundation, using it as a centerpiece to construct a commercial ecosystem covering nearly every aspect of Chinese digital life—the most diverse collection of scenes and entry points on China's internet.

This sets Tencent apart from ByteDance and Alibaba. Its core challenge is not externally 'finding' or 'seizing' new entry points but internally addressing AI anxiety—upgrading products with AI without compromising user experience and leveraging AI to empower and reconstruct its vast, complex business ecosystem.

This demands a systemic transformation akin to 'an elephant turning,' requiring immense patience and internal coordination.

Tencent's 'Yuanbao' app has shown clear user growth momentum through rapid iterations over the past year. It has introduced numerous native AI features, while Tencent's ecosystem content—music, film, and television—is easily searchable and accessible within Yuanbao.

However, Yuanbao's distinctiveness lies in its integration with Tencent's product ecosystem. It functions as a Yuanbao contact in WeChat, a Yuanbao avatar in Tencent Meeting, and a Yuanbao plugin in QQ Browser. Yuanbao also appears in comment sections across Tencent products, where users can chat and interact by simply mentioning @Yuanbao.

These efforts aim to make Yuanbao an atomic AI capability—a foundational module integrated into more Tencent products. As Yuanbao's capabilities evolve, the AI capabilities and user experience across the Tencent ecosystem will improve.

From standalone tool products to content platforms and then to core social products, Tencent's offerings are quietly undergoing layered AI transformations. Tool products like Sogou Input Method and QQ Browser have received comprehensive AI upgrades.

Content services like Tencent News and Tencent Video have integrated AI capabilities 'silently' based on their unique user scenarios.

Communication and social products like WeChat and QQ, being closest to users and massive in scale, face greater AI transformation challenges. Tencent continues to explore these areas.

Currently, the industry consensus is that AI applications are shifting from chatbots to Agent competitions. An Agent's usability depends partly on the availability of high-quality tools and products within its ecosystem. Tencent's steady AI advancement across its products lays the groundwork for its Agent ecosystem.

Late last year, Tencent reorganized its large model operations, hiring former OpenAI researcher Yao Shunyu as Chief AI Scientist in the 'CEO/President Office,' overseeing both the Large Language Model Department and the newly established AI Infra Department.

Regarding his post-Tencent work direction, Yao Shunyu mentioned, 'Tencent has strong To C DNA and considers how to provide AI value to more users while implementing AI across rich scenarios.'

At Tencent's 2025 employee conference, Pony Ma emphasized that Tencent's AI core lies in product long-term competitiveness and user experience. Regarding the highly anticipated AI integration in the WeChat ecosystem, Ma clarified that an AI 'all-in-one' package may not be universally popular. WeChat will persist with decentralization, planning its smart ecosystem to balance user needs and privacy security.

Recently, companies like Google and OpenAI predicted AI trends for 2026, agreeing that 'Agents will become absolutely central, with multi-agent systems expected to demonstrate truly visible industrial impact.' Agents will undoubtedly be a key battleground for Tencent in the AI arena.

With its product ecosystem foundation, high-quality Chinese corpora from its content ecosystem, and contextual language from social scenarios, coupled with increased talent density, Tencent's advantages will further emerge in the Agent era.

Conversely, Tencent needs to strengthen its large model capabilities and the coupling between models and products. Hiring Yao Shunyu and organizational changes reflect Tencent's determination.

Ma recently noted that the Hunyuan large model team and Yuanbao product team have engaged in cross-functional, embedded, and collaborative design. This organizational approach ensures that foundational model capabilities align closely with upper-layer product demands, preventing technological and market disconnection.

Tencent's goal is not creating blockbusters but achieving system-wide AI transformation through AI architecture and system design—'system-level intelligence.' This poses greater challenges to Tencent's execution and strategic resolve. Currently, Tencent maintains its rhythm, appearing unhurried but rapidly penetrating businesses.

As a Goldman Sachs report stated, Tencent's strategy is 'restraint' and 'ecosystem penetration.' This approach demands immense internal coordination and profound organizational change—extremely difficult but, once achieved, will construct deeper moats.

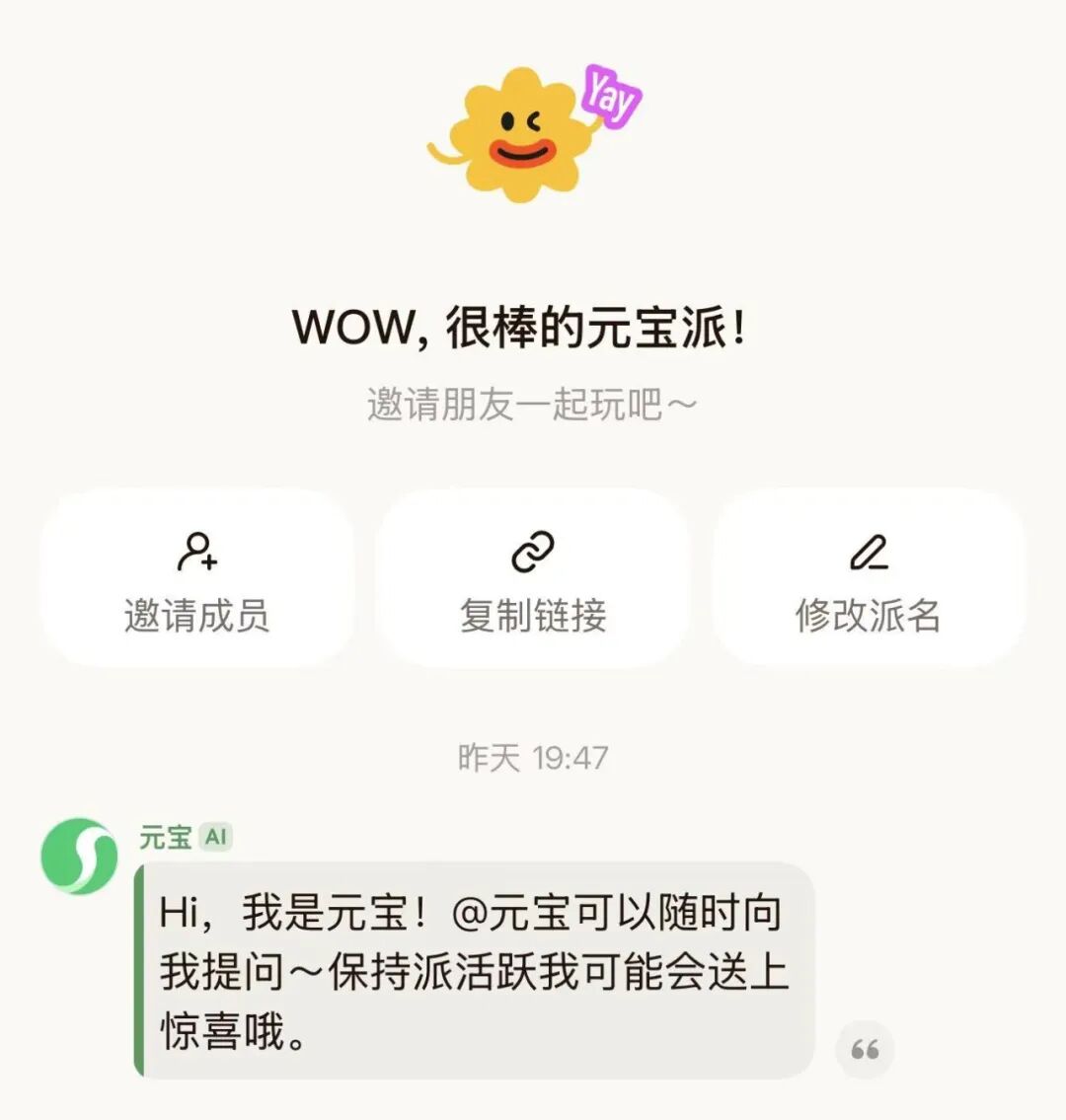

Next, Tencent will likely continue leveraging its strengths. For instance, Yuanbao App recently began beta testing 'Yuanbao Pai,' allowing users to create or join existing 'Pai' groups where AI participates in chats, mood regulation, and task execution—seen as a key 'AI + social' experiment.

Note: Yuanbao Pai in beta testing

Note: Yuanbao Pai in beta testing

Given Yuanbao's 1 billion yuan red envelope campaign and social features, 2026 may see more overt actions from Tencent.

AI Race Among Tech Giants: Determination Visible, But Patience Required

Overall, the differences in AI strategies among ByteDance, Alibaba, and Tencent are essentially determined by their respective core business models, resource endowments, and commercial ecosystems.

Specifically, ByteDance leverages its C-end traffic to achieve rapid breakthroughs through a closed loop of 'traffic-content-commerce'; Alibaba builds a 'technology-commerce' barrier through full-stack technology, capitalizing on its e-commerce and cloud ecosystems; Tencent adopts a steady and solid penetration strategy based on the strong stickiness of its social ecosystem, vigorously promotes the AI integration of its products, and continues to exert effort in its areas of expertise.

The year 2026 promises to be an exciting one for AI development in China. In the coming period, the AI narrative in China will continue to be dominated by companies such as ByteDance, Alibaba, and Tencent. Meanwhile, a host of large model companies like DeepSeek, Kimi, and Zhipu, as well as internet giants such as Baidu, JD.com, and Meituan, will carve out niche segments in their respective areas of strength, leading to a diverse and competitive industry landscape.

However, it is important to recognize that AI is not a race that can be won solely through first-mover advantage; rather, it requires a comprehensive contest involving technological accumulation, scene understanding, ecological integration, and a global perspective. All the major players have entered the fray, but none dare to guarantee a total victory through a single breakthrough.

The ultimate winner may not be the one with the loudest voice today, but the one that can best navigate through cycles and continuously evolve. Just like in the middle game of chess: the moves are not yet finalized, and the outcome remains undecided. Only those with patience and composure will smile in the end.