Lenovo: Not Buying into the AI PC Hype

![]() 01/30 2026

01/30 2026

![]() 519

519

Are Dell and Microsoft's AI PCs, Which Are Hard to Sell, Becoming Lenovo's Hot Sellers?

Author | Wang Haoran

Editor | Gu Nian

The AI PC craze that swept through last year began to lose steam at this year's CES.

At Dell's CES 2026 booth, a notable detail caught many eyes: this seasoned tech giant, which had once been a vocal advocate for AI PC marketing, barely mentioned AI this year.

During on-site media interactions, Dell was described as having delivered its "least AI-centric CES briefing in five years," with the focus shifting back to product line updates, design, reliability, and commercial demands. AI was reduced to a mere functional layer rather than a key selling point.

Dell executives also stated directly in interviews that regular consumers don't base their purchasing decisions on AI features and that overhyping them can easily create a gap between expectations and reality.

Similar level-headed (calm/rational) assessments have emerged from other mainstream notebook makers. Executives from ASUS and HP have also admitted that the current real demand for AI PCs is still in the single digits, acting more as a forward-looking (forward-looking) technological feature than a market-validated necessity.

This is why, despite new products from manufacturers still incorporating NPUs and AI capabilities, the emphasis in promotions has clearly shifted towards performance, price, and use cases. Compared to previous years, CES 2026 marked a notable shift in the notebook industry: AI features are everywhere but no longer the market focus for most PC makers.

While competitors are actively toning down the AI PC hype and adjusting their pace, Lenovo is going all in: continuously rolling out more aggressive AI PC product lines while shifting its strategic focus upward, explicitly proposing a move towards a "hybrid AI platform." It aims to elevate AI from a single hardware feature to a system capability spanning local, private cloud, and public cloud environments.

The divergence isn't just about being bold versus cautious but reflects differing views on the industry's future: while most manufacturers choose to wait for AI demand to mature naturally, Lenovo is making sustained early bets to capture more market share in the AI era.

However, the value created by the AI wave is overwhelmingly flowing to the upstream of the supply chain. NVIDIA, TSMC, and memory giants have secured the lion's share of profits centered around HBM and advanced packaging, while downstream PC, smartphone, and automotive manufacturers—along with all other smart hardware makers—are collectively stuck in a "rising costs and shrinking profits" dilemma.

Leading manufacturers like Lenovo are barely staying afloat through scale advantages and inventory strategies but struggle to change their passive roles in this "zero-sum game." Lenovo's "disbelief in the hype" thus appears more like a calculated risk: it tightly seizes the current policy window to solidify market share while betting on the future by attempting to define platforms and ecosystems to gain more influence in a supply chain dominated by upstream players.

Yet, in a transformation driven by upstream computing power, cost cycles, and platform upgrades, can these "shovel sellers" truly claim a share of the AI dividends in a game dominated by chip giants?

01 The AI Divide Among the Top Four PC Makers

In September 2023, Intel CEO Pat Gelsinger first systematically proposed the "AI PC" concept, attempting to open a new growth narrative for the PC industry.

Just one month later, Lenovo took the lead in implementation during the early industry stage: showcasing an AI PC prototype at Tech World capable of running large models locally with an emphasis on data privacy and co-publishing the first industry white paper with IDC, quickly establishing its first-mover position in AI PC discussions.

Entering 2024, dubbed the "Year of AI PCs" by the industry.

Upstream chip manufacturers (AMD, Qualcomm) successively (one after another) launched processors integrating NPUs, while Microsoft set hardware thresholds for AI PCs in an attempt to drive standardization. Terminal manufacturers collectively entered the market but soon diverged in their approaches:

Lenovo chose a comprehensive rollout, advancing simultaneously from product lines to ecosystems; HP explicitly targeted the commercial market; Dell emphasized its consistent positioning as a "full-stack solution provider"; ASUS and Apple also participated in their respective ways.

However, as AI PCs gradually gained traction, bubbles began to surface and became notably apparent at this year's CES.

The most obvious change came from Dell.

At CES 2026, Dell nearly abandoned the previous year's high-profile embrace of AI PCs, instead re-emphasizing traditional product lines like XPS. Executives explicitly stated in interviews that they would no longer promote new PCs as "AI-core selling point" products.

Dell announced at CES 2026 that AI features currently fail to address more practical user problems. Kevin Twelliger noted that from a consumer perspective, users don't make purchases based on artificial intelligence, and current AI features may do more harm than good, confusing users rather than helping them.

An industry veteran with decades of experience in notebook reviews believes Dell's shift is good news for the industry. Over the past year, he reviewed over a dozen "AI notebooks" but found that most features remain at the experiential level, with nearly none providing genuine assistance in daily work.

This pivot is not an isolated case.

An ASUS executive stated bluntly in a Forbes interview that while he forecasts AI PCs may account for about half of PC shipments by 2027, products currently equipped with NPUs and recognized by users as AI PCs still represent a single-digit market share.

HP's CEO also offered a similar assessment in public interviews: AI does constitute part of the new PC cycle, but its actual contribution to sales remains limited at around 10%.

In just one year, as three major mainstream manufacturers successively downplayed their AI transitions and hesitated in their shifts, Lenovo chose to continue doubling down.

Also at CES 2026, Lenovo unveiled its most complete AI PC product lineup ever at Tech World, all equipped with an Agent Core and on-device AI computing power, enabling dual modes of "local intelligence + cloud collaboration" to meet diverse use cases.

Beyond the landmark implementation of its hybrid AI strategy, AI PCs as core terminal carriers saw a comprehensive outbreak (outbreak/boom), covering business, consumer, gaming, and other full scenarios, paired with cross-device collaborative ecosystems and cutting-edge concept products.

02 Better Than AI: National Subsidies

The reason for doubling down is simple: while AI PCs have not yet been fully embraced by consumers, they still deliver tangible growth dividends.

Canalys data shows that in Q1 2025, PC shipments (excluding tablets) in mainland China reached 8.9 million units, a 12% YoY increase. AI PCs accounted for 36% of these shipments, surging 150% YoY and reaching a record market share.

Benefiting from the overall rise in AI PC shipments, Lenovo saw significant growth in market share and revenue over the past few quarters.

Lenovo's personal computer business hit a historic single-quarter high in Q2 2025, maintaining its global market share leadership at 25.6%. AI PC penetration rose to 33% of total shipments, while consolidating its leadership in global Windows AI PCs with a 31.1% market share.

However, this round of dividends may stem less from superior AI experiences and more from the structural dividend of "buying new over old" amplified by national subsidies.

On one hand, from a global market perspective, Canalys analysts noted that Q2 national subsidies remained a critical factor for manufacturer success, with AI PC shipments in mainland China accounting for 28% of the overall PC market. Meanwhile, the firm projects that AI PC shipments in Greater China will account for 34% of global PC volumes in 2025.

In contrast, China's PC market faced overall pressure in H1 2024. IDC data showed a 6.9% YoY decline in PC sales in September 2024, while Canalys pointed out that global PC shipments grew 3% YoY in Q2 2024—a figure that would have exceeded 5% excluding mainland China, indicating slower growth in the Chinese market compared to the global average.

Entering 2025, the National Development and Reform Commission and Ministry of Finance announced subsidy policies for consumer goods trade-ins, explicitly listing computers as eligible categories. National subsidies in China drove greater AI PC growth.

On the other hand, subsidies directly brought AI PC pricing into the range of traditional PCs. Within the same budget, new products labeled as AI were naturally more likely to be chosen. Even if users were uncertain about actually needing these features, the consumer psychology of "having it is better than not" proved particularly pronounced for durable goods like PCs.

However, as national subsidies weakened in the latter half of 2025, their stimulative effect diminished.

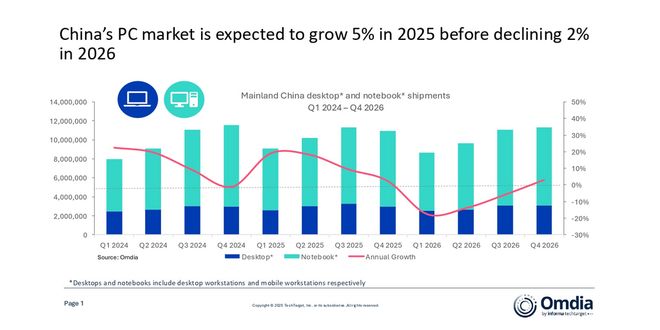

In Q3 2025, China's PC market grew only 2% YoY, while global PC shipments increased by around 8-9% according to IDC and other agencies. Omdia noted in its latest report that both the coverage and actual stimulative effect of Chinese subsidies have significantly weakened, projecting a 2% decline in overall PC shipments in China for 2026.

Additionally, statistical criteria contribute to the rise in AI PC shipments.

Current mainstream market agencies define AI PCs not by superior user-level AI experiences but by whether hardware integrates processors or NPUs with AI acceleration capabilities. This means many conventional product lines, such as Lenovo's ThinkPad and Xiaoxin series, can be classified as AI PCs.

03 Hardware Manufacturers Struggle to Claim AI Dividends

For Lenovo, current shipment figures may represent more of a continuation of old-cycle dividends. As this wave recedes, what will sustain future growth? The answer may lie in Lenovo's CES 2026 exhibits.

On one hand, Lenovo's Qira assistant operates on a hybrid AI architecture. Latency- and privacy-sensitive inference tasks execute locally via NPUs, while more complex reasoning and third-party service integrations occur in the cloud. This model is rapidly becoming the default architecture for AI PC ecosystems.

Unsurprisingly, Q1 2026 will reveal Qira's interconnected ecosystem across Lenovo devices.

On the other hand, as Lenovo's premium offering, the Aura Edition series PC—co-developed with Intel—emphasizes software-driven system-level intelligence rather than traditional hardware-centric positioning. Features include automatic scenario adaptation, one-touch media file transfer across devices, and AI-assisted fault diagnosis and support.

The releases of Qira and the Aura Edition series clearly indicate that Lenovo is no longer content to be merely an AI PC hardware supplier. It is attempting to transform into a leader of hybrid AI platforms, using AI PCs as a breakthrough point to comprehensively control the AI experience layer across PCs, smartphones, tablets, wearables, and other multi-terminal ecosystems.

While consumer-side experience improvements may be inevitable, as AI PCs debate user experiences, the explosive demand for AI computing power is driving upstream-downstream capacity reallocation and impacting the entire hardware market.

IDC's latest warning paints a bleak picture: its pessimistic forecast projects global PC shipments could decline by up to 9% in 2026; even under optimistic projections, the market will shrink by about 5%. Since H2 2024, mainstream PC memory and storage costs have cumulatively surged by 40-70%, affecting all traditional PC hardware manufacturers.

More critically, the true winners of AI dividends are not consumer-facing hardware brands but upstream computing power and chip giants.

AI infrastructure players like NVIDIA, TSMC, and memory manufacturers have captured the largest AI dividends, while traditional hardware makers across PCs, smartphones, and automotive sectors face a collective dilemma of "high costs and low margins."

In late November of last year, Lenovo Group Chairman Yang Yuanqing stated in media interviews that when combining businesses like smartphones, computers, and AI servers, Lenovo may rank among the industry's largest buyers of components. With closer supplier relationships in the supply chain—particularly long-term partnerships with key components—Lenovo can better manage current supply shortages and price hikes.

According to Bloomberg, Lenovo's component reserves, including memory and other critical hardware, stand at 150% of usual inventory levels. However, locking in supplies through long-term agreements primarily serves as a self-preservation strategy during crises and does not alter the downstream manufacturing sector's passive position in AI dividend distribution.

Moreover, cost pressures may further delay AI PC adoption.

Particularly since the industry has set clear hardware standards for AI PCs: built-in NPUs, computing power exceeding 40 TOPS, and 16GB+ memory (with many high-end designs targeting 32GB or higher). The issue lies in the fact that memory components are currently the scarcest and most expensive.

Under cost pressures, manufacturers may struggle to launch high-configuration models at affordable prices, but raising prices could suppress AI PC penetration rates.