From Robotic Arms to 'Digital Brains': The Survival Conundrum of Logistics Robots

![]() 01/30 2026

01/30 2026

![]() 481

481

China's logistics robots are undergoing a significant transformation.

In a conventional warehouse setting, engineers might spend weeks programming the layout of nearly a thousand workstations along a conveyor belt—a process that is both complex and inflexible. Meanwhile, manual sorting—which involves scanning, locating, and moving goods—typically takes 15 minutes per order.

Today, at Shanghai's Yangshan Port automated terminal, 155 autonomous guided vehicles (AGVs) navigate seamlessly, precisely transporting containers. Modern logistics centers that leverage software-defined automation and digital twins achieve 100% accuracy in deliveries. In warehouses equipped with intelligent systems, order processing time has been reduced from 15 minutes to just 5 minutes, while AI vision systems have cut scanning time per pallet from 199 seconds to a mere 53 seconds.

The driving force behind this leap in efficiency is a profound shift in the logistics system—from mechanization to software-defined, intelligent decision-making. This marks an industrial evolution where digital "brains" command physical execution.

01 Embodied Intelligence Reconfigures Logistics Chains

The exponential growth of global e-commerce parcels is the primary catalyst for China's domestic logistics "silent revolution."

Pitney Bowes projects that global parcel volume will continue to rise, reaching 256 billion items by 2027, with a compound annual growth rate (CAGR) of 8.5% from 2024 to 2027. This immense scale represents the "foremost" pressure on global logistics systems.

Amid escalating pressure, many are turning to logistics robots.

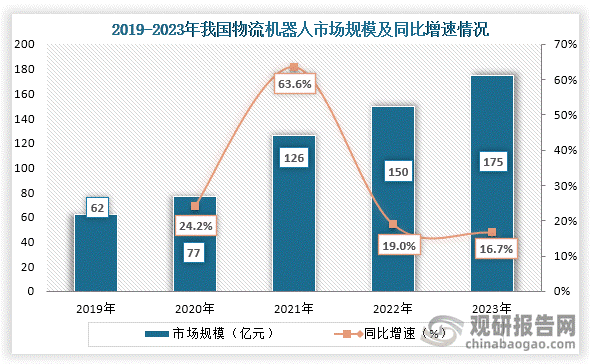

From 2019 to 2023, China's logistics robot market size expanded continuously, reaching approximately 17.5 billion yuan in 2023—a 16.7% year-on-year increase.

In warehousing and sorting applications involving AGV/AMR and "goods-to-person" robots, sorting efficiency can improve by roughly 300%. Following large-scale adoption, per-unit logistics costs for apparel can drop by 50%. Clearly, logistics robots represent the "optimal choice" for addressing current industry challenges.

However, traditional logistics robots—exemplified by AGVs—are largely confined to executing simple commands, with limited collaborative scheduling capabilities. They rely on preset physical paths, such as magnetic strips or QR codes, necessitating re-installation of guidance infrastructure if paths change—hardly "intelligent."

Fortunately, breakthroughs in artificial intelligence, multi-sensor fusion, and swarm intelligence are offering turning points for the industry.

The most pivotal development is the emergence of embodied intelligence, which equips robots with "hand-eye coordination," enabling them to tackle non-standardized scenarios like stretching and unloading.

Faced with diverse parcels and irregularly shaped goods, traditional automation often falls short. The logistics robot industry is addressing this by integrating "perception-decision-execution" capabilities into robots.

At the perception layer, high-precision 3D vision cameras and LiDAR are deeply fused, achieving sub-millimeter recognition and pose estimation for various goods, including transparent objects. For instance, JD Logistics' "Yilang" embodied intelligent robotic arm, equipped with an advanced multi-view depth vision sensing system, can analyze dimensions and shapes of massive non-standardized parcels in real time, generate grasping plans, and complete stacking with millimeter precision.

The cognition and decision-making layer relies on multi-modal large models for scene understanding and task planning. For example, JD Logistics' "Super Brain Large Model 2.0" reduces solution time for models with tens of millions of variables to under two hours, dynamically scheduling global resources and boosting human-robot collaboration efficiency by over 20%.

At the execution layer, dexterous hands and intelligent motion control algorithms ensure precise and flexible operations, with robots dynamically avoiding obstacles and making millimeter-level adjustments based on online-generated grasping plans.

Some firms have developed integrated solutions. For example, Jingsong Intelligence's autonomous loading system integrates its "Eagle Eye" global perception system, "Smart Brain" decision-making and planning system, and "Skillful Hand" precise execution system, forming an organic whole capable of autonomous dynamic planning and precise loading/unloading.

Meanwhile, "swarm intelligence" scheduling systems multiply transportation efficiency for hundreds of robots.

For instance, the logistics AI large model developed by Guizhou Zhongke Zhiyuan orchestrates three "intelligent agent" clusters—business, operations, and control—to work collaboratively, increasing a park's annual transportation capacity from 2 million to nearly 5 million tons.

This implies that the value of individual robots is limited; the true revolution lies in system-level intelligent collaboration.

Revolutionary navigation advancements have freed robots from tracks, granting them "near-human" autonomy.

For example, in Shenzhen Metro Line 2, a robot with a cartoon "outfit" delivers goods to a 7-Eleven convenience store inside the station—the world's first application test of a robot autonomously riding the subway for last-mile delivery.

Behind this is a multi-source fusion navigation system combining up to five perception methods, including LiDAR, vision, and inertial navigation, enabling stable task execution even deep in factories without GPS signals.

The collaborative force of these three technological engines—"eye-brain-hand" coordination, swarm scheduling, and control hubs—constitutes the core driving force for industrial upgrading.

02 Prosperity Masks Underlying Losses

Technological breakthroughs have made logistics robots a revolutionary engine for enhancing warehousing operational efficiency, successfully driving sustained market expansion.

By 2024, China's logistics robot market size had grown from 13.9 billion yuan in 2020 to 44 billion yuan, capturing 37.2% of the global market.

Domestically, a cohort of firms—including Geek+, Standard Robots, and Hikrobot—has emerged, capable of providing full-scene solutions encompassing core hardware, intelligent algorithms, and beyond.

However, when the spotlight turns to these tech firms' financial statements, the picture changes dramatically.

On one hand, revenue growth and overseas successes; on the other, widening losses.

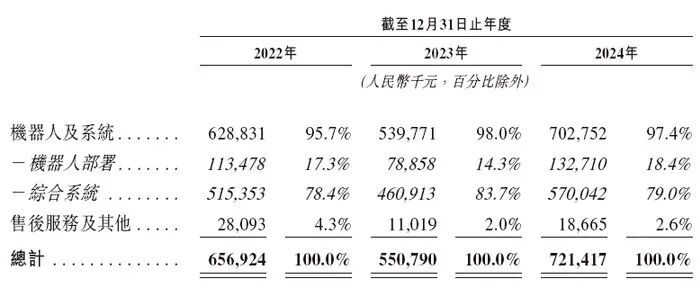

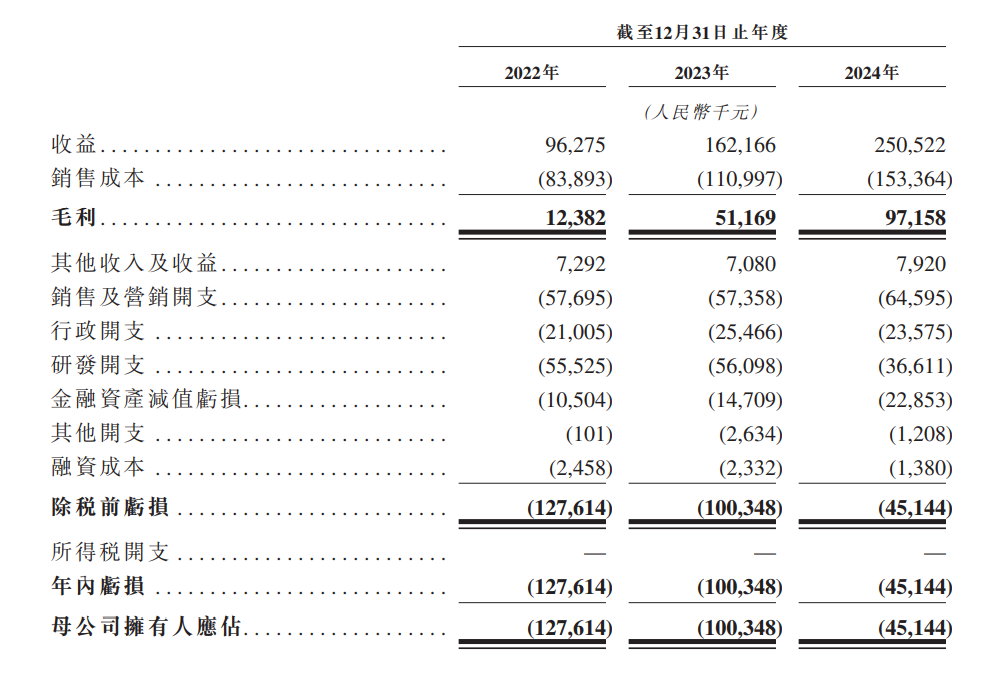

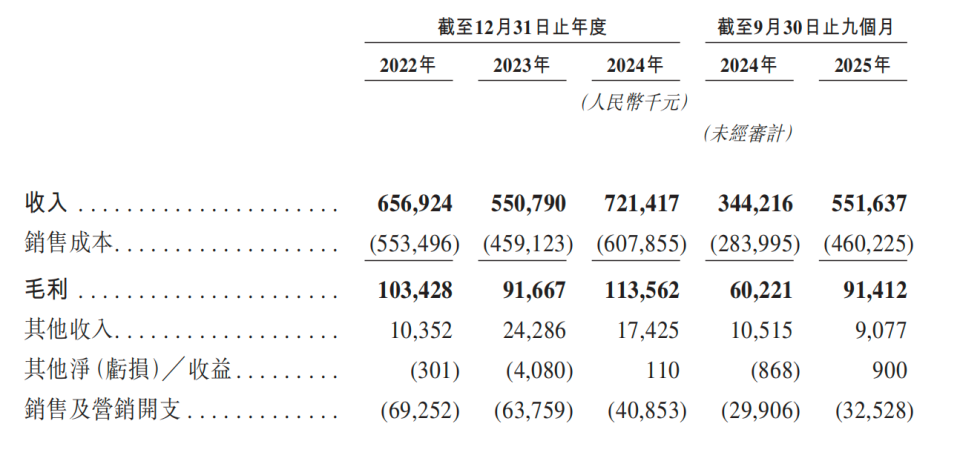

For example, KALER achieved 721 million yuan in revenue in 2024, ranking among the top five domestically, yet recorded a net loss of 178 million yuan, with a gross margin of just 15.7%.

Standard Robots saw its revenue CAGR exceed 61% from 2022 to 2024, with overseas revenue growing at a 150% CAGR during the same period. Yet, cumulative losses over the same timeframe exceeded 273 million yuan, including a 163 million yuan loss in the first three quarters of 2025.

Moreover, shareholder exits have sparked market concerns about the sector's future.

Standard Robots' prospectus reveals that from March to May 2025, seven institutions, including Casicapital and Source Code Capital, along with core management, intensively transferred existing shares, with some transfer prices discounted by up to 72% from Series D financing valuations.

A massive question mark looms over the industry: as capital patience wanes, why do these firms dedicated to liberating human labor find themselves trapped in a "grow more, lose more" cycle?

First, losses stem from high R&D investment and upfront market expansion costs—key challenges faced by all robotics firms.

To maintain leadership in core technologies like algorithms, perception, and robot swarm scheduling, firms must engage in a "technology race."

For example, Geek+ continuously upgrades its RMS scheduling system to solidify its global scheduling advantage, developing AI algorithm-driven intelligent scheduling and omnidirectional path planning. Lanjiang Intelligence leads national key R&D projects like "Dynamic Scheduling and Optimization of Autonomous Mobile Robot Swarm Systems."

While this competition drives product performance leaps, it forces firms to sustain staggering R&D expenditures.

For instance, Standard Robots' R&D expenses accounted for 18.5%, 21.2%, and 19.8% of revenue from 2022 to 2024—significantly above industry averages. Geek+'s R&D expense ratio reached 30.1% in 2022. Lanjiang Intelligence's 2024 financials show R&D expenses surging over 47% year-on-year, with substantial salary increases for researchers—a deliberate investment to "enhance competitiveness."

Though vital for long-term survival, these cash outflows severely erode already thin profits.

Furthermore, fierce market competition has driven up sales expenses and triggered brutal price wars, continuously suppressing industry-wide gross margins.

To secure clients and establish benchmarks, firms often resort to extreme measures. Lanjiang Intelligence admits in its financials that to enter new sectors like photovoltaics, it adopted "competitive pricing strategies" for flagship projects, even accepting orders with a -5.99% gross margin.

The price war is even more direct in last-mile autonomous delivery vehicles. For example, Neolix's core X3 model cost has plummeted from over 200,000 yuan initially to below 70,000 yuan—a voluntary "bleeding" competition.

Meanwhile, market expansion keeps sales expenses elevated. Lanjiang Intelligence's 2024 sales expenses saw employee salaries jump 51.7% year-on-year, while advertising costs (mainly exhibition fees) soared 140% to support overseas expansion. Standard Robots' sales expense ratios were 59.9%, 35.4%, and 25.8% from 2022 to 2024—though declining, they remain high.

On one side, massive investments driven by technological vision and market expansion; on the other, a business reality lacking stable "self-sufficiency." This reflects collective anxiety over the industry's failure to balance scalability and profitability.

03 From Selling Machines to Buying the Future

To break free from "growth without profit" anxiety, the logistics robotics industry must pivot from broad technology races to pursuing core technologies and differentiated capabilities for specific scenarios.

For example, the heavy-duty embodied robot jointly released by Dematic and Lumix Robotics targets pain points in heavy material handling.

With a dual-arm collaborative load capacity of 50kg, it integrates high-precision force control and 3D LiDAR + depth vision guidance, adapting flexibly to complex logistics warehousing environments and offering Dematic diversified revenue streams from core components to solutions.

Second, firms should anchor their business in "solutions" models to deepen customer ties and boost profits.

Increasingly, companies recognize that selling hardware alone traps them in low-margin quagmires; future value lies in providing software-hardware integrated solutions that enhance overall efficiency.

For instance, the rigid AGV handling sector is already a red ocean, with domestic brands capturing 70% market share. Homogenized competition has slashed AGV robot average prices by over 50%.

In contrast, the global AMR solutions market offers significantly larger profit margins. CIConsulting projects its market size will reach 162.1 billion yuan by 2029, with a CAGR exceeding 33% from 2024 to 2029. Warehousing automation penetration is expected to surpass 20% by 2029.

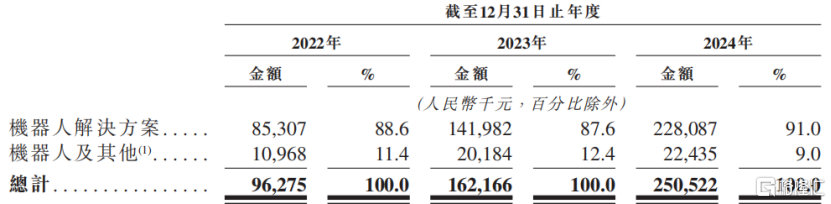

Against this backdrop, some firms have already transformed. For example, solution revenue accounted for 91% of Standard Robots' 2024 total.

Geek+'s solution gross margins also significantly outperform hardware. In 2024, its warehousing fulfillment AMR solutions had gross margins of 39.2%, while overseas AMR solutions reached 46.5%, with customer repurchase rates nearing 75%.

This model binds clients more deeply to business processes through software, algorithms, and system integration, not only raising average selling prices and gross margins but also fostering stronger customer relationships.

Finally, as industry technology accumulation and market expansion enter critical phases, many robotics firms are rushing to list, using capital to buy time for reaching profitability inflection points.

KALER, making its second attempt at a Hong Kong IPO, is a prime example.

Though the company's revenue surged 60.3% year-on-year in the first nine months of 2025, net losses still reached 134 million yuan, with persistently negative operating cash flow. More daunting is its high debt—net liabilities hit 1.196 billion yuan by September 2025, while cash on hand fell below 100 million yuan.

This means that raising funds through IPOs for R&D and expansion is no longer about financing growth, but about "blood transfusion" to sustain survival and securing a crucial window of respite for the company to turn losses into profits.

From technological breakthroughs and financial dilemmas to model exploration, it is foreseeable that China's logistics robotics industry is undergoing a profound transformation. Companies that secure orders and demonstrate profitability through core technologies will have vastly different fates from those "story enterprises" that operate solely by "bleeding" resources.

Ultimately, the true worth of China's logistics robotics industry does not hinge on the sheer quantity of operational robots it produces. Rather, it resides in the industry's ability to revolutionize the intelligent benchmarks of global supply chains, achieving this with an efficiency that is unparalleled in history.

* The image is sourced from the internet. Should there be any infringement, please contact us for its removal.