LoTu Technology: 2025 Comprehensive Data Insights on the Global and Chinese Smart Glasses and XR Markets, along with a 2026 Forecast

![]() 01/30 2026

01/30 2026

![]() 556

556

This article spans approximately 3,900 words and can be read in around 18 minutes. It's advisable to follow, bookmark, or opt for chapter-based reading.

In 2025, the global XR and smart glasses market witnessed a significant transformation, with the industry's main focus shifting from immersive experiences to everyday, lightly immersive yet frequently used applications.

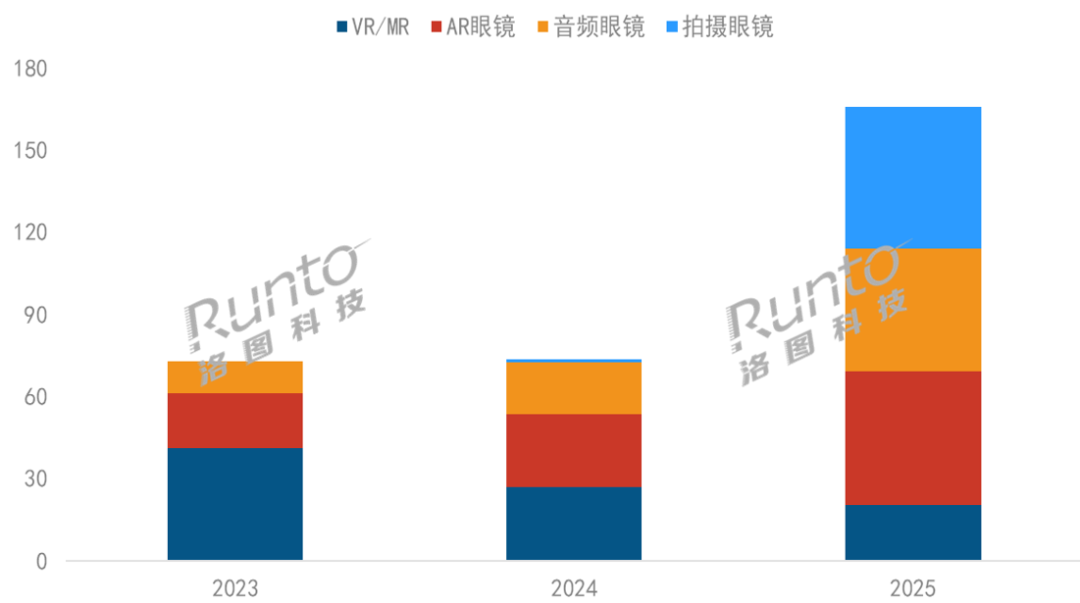

On one hand, VR/MR devices continued to grapple with limitations in hardware design, usage scenarios, and content offerings, leading to a consistent decline in global and Chinese market shipments since 2023. On the other hand, lightweight wearables such as all-in-one AR glasses and audio/camera glasses emerged as promising growth areas.

Based on product form and functionality, LoTu Technology (RUNTO) classifies XR into VR (Virtual Reality), MR (Mixed Reality), and AR (Augmented Reality). Smart glasses are further divided into AR glasses (with display and audio capabilities), audio glasses (audio-only, without display), and camera glasses (with camera, without display). Notably, AR overlaps as a subcategory in both XR devices and smart glasses.

Classification Diagram of XR Devices and Smart Glasses

Source: Compiled by LoTu Technology (RUNTO)

I. Global Market:

Combined XR and smart glasses shipments neared 12 million units; smart glasses saw a 156% surge.

According to LoTu Technology (RUNTO) data, global XR device shipments reached 6.08 million units in 2025, marking a 16.8% year-on-year decline.

VR/MR device shipments totaled 5.02 million units, down 23.1% year-on-year. Persistent issues like bulky hardware, high prices, and a lack of compelling applications limited VR/MR to niche scenarios rather than everyday use. Moreover, hardware manufacturers' cautious approach to new product launches further exacerbated the market contraction. Notably, neither Meta nor Apple released updated products in 2025.

Conversely, AR glasses shipments reached 1.06 million units, up 35.9% year-on-year. Advances in display technology and optical solutions drove upgrades towards higher image quality and lighter form factors, while prices declined. Deep integration with AI large models further enhanced usability. In stark contrast to the stagnant VR/MR market, the AR glasses segment saw a flurry of new product launches, with Meta, Google, and others introducing their first AR offerings, and VITURE, Thunderbird Innovation, and XREAL also updating their products.

In 2025, global smart glasses (including AR glasses) shipments soared to 6.81 million units, up 156% year-on-year. The key driver was Meta's collaboration with Ray-Ban on camera-equipped smart glasses. Ray-Ban Meta's lightweight, stylish design, coupled with AI capabilities, brought smart glasses back into daily life scenarios. Since its October 2023 launch, cumulative shipments exceeded 3 million units, enabling camera glasses to match the VR/MR device market scale by 2025.

In 2025, Meta introduced three smart glasses models, including its first AR glasses with a built-in display, the second-generation Ray-Ban Meta, and a sports-focused variant. Due to stronger-than-expected smart glasses sales, Meta significantly increased orders with upstream supplier Qualcomm, securing over 12 million AR1 series chips.

II. China Market:

Smart glasses sales surged by 211%; camera glasses grew from zero to 500,000 units.

Similar to the global market, China exhibited pronounced structural differentiation. According to LoTu Technology (RUNTO)'s latest "China XR Device Retail Market Monthly Tracking Report," consumer-grade XR device (including VR/MR and AR) retail volumes across all channels in China reached 692,000 units in 2025, up 29.1% year-on-year.

VR/MR device sales declined 24.5% year-on-year, falling from 269,000 units in 2024 to 203,000 units. Leading brand PICO refrained from launching any new consumer-grade products, instead focusing on cost reduction, efficiency improvement, and scenario deployment. This included integrating NVIDIA GeForce NOW cloud gaming and launching a multi-million-dollar offline large-space project, "Space Odyssey," in collaboration with Intel.

The AR glasses market expanded from 267,000 units in 2024 to 489,000 units in 2025, an 83.2% increase. BB cinema glasses saw ongoing cost reductions and expanded usage scenarios, while waveguide glasses benefited from the popularity of AI glasses, attracting new brand entries and driving sales growth.

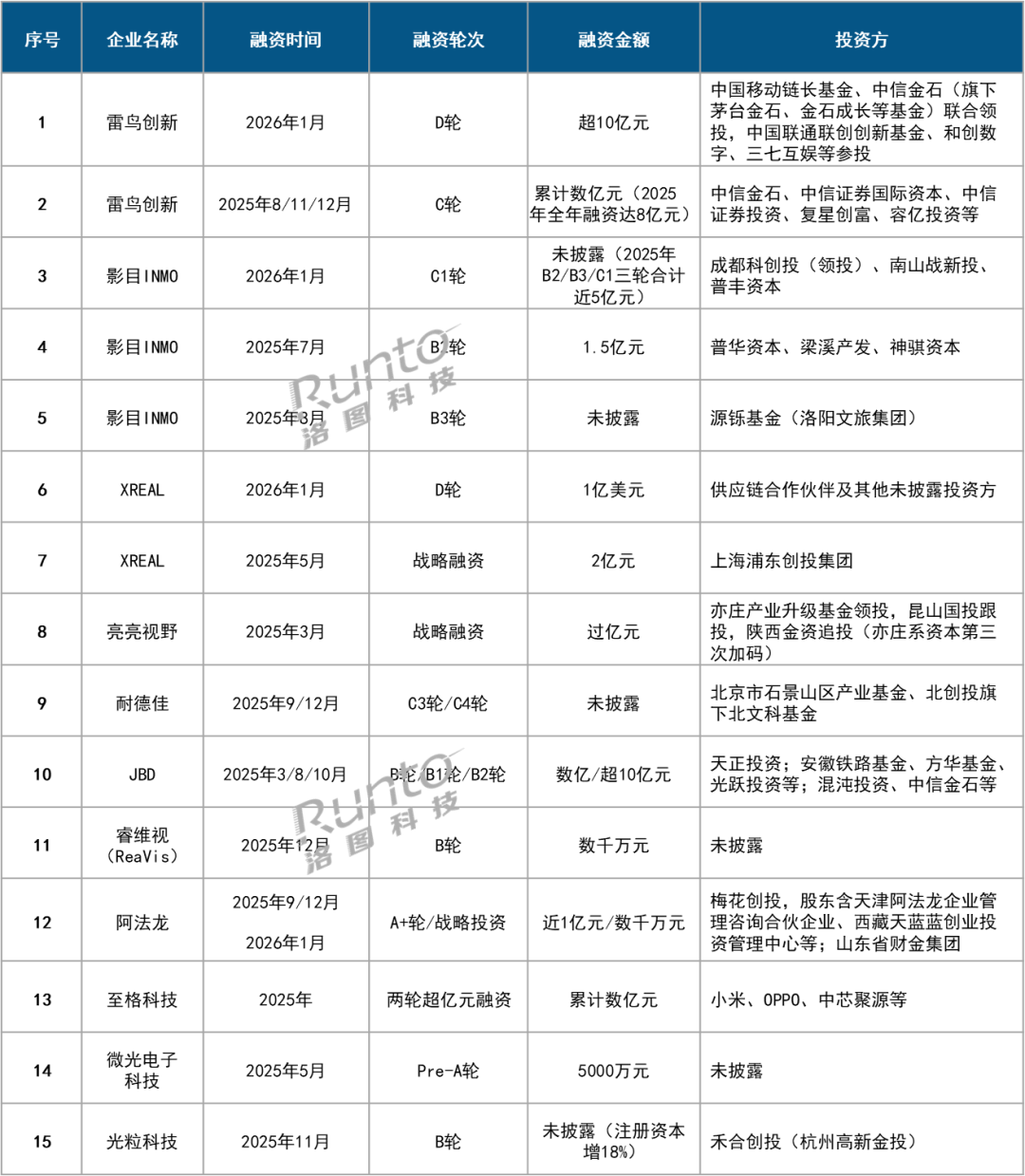

Starting in 2025, the AR sector witnessed a new wave of investment and financing (see appendix for details). Among terminal brands, Thunderbird Innovation secured cumulative funding of 800 million yuan across multiple rounds in 2025 and announced a D round exceeding 1 billion yuan in January 2026, led by China Mobile and CITIC Goldstone, with participation from China Unicom and others. XREAL received 200 million yuan in exclusive investment from Pudong Venture Capital Group in May 2025 and completed a $100 million D round in January 2026. INMO Technology completed three funding rounds (B2, B3, C1) in 2025, totaling nearly 500 million yuan.

In the upstream supply chain, Micro LED microdisplay leader JBD secured over 1 billion yuan in B2 round funding for 2.5-micron pixel pitch technology industrialization. Waveguide manufacturer Ned+ completed four funding rounds (C1 to C4) within a year, accelerating mass production of its "Liu Li" waveguide module.

Beyond strategic investments, telecom operators leveraged their nationwide offline service networks and user bases to promote schemes like "glasses with phone top-ups" and "contract bundle plans," driving the industry's transition from niche adoption to mainstream penetration.

In 2025, China's smart glasses (including AR glasses) shipments reached 1.454 million units, surging 211% year-on-year. Camera glasses stood out, with mass entry by cross-industry brands and Huaqiangbei white-label imitations propelling market scale from zero to nearly 500,000 units.

China Consumer-Grade XR and Smart Glasses Market Sales (2023-2025)

Source: LoTu Technology (RUNTO), Unit: 10,000 units

II (1) China AR Glasses Market:

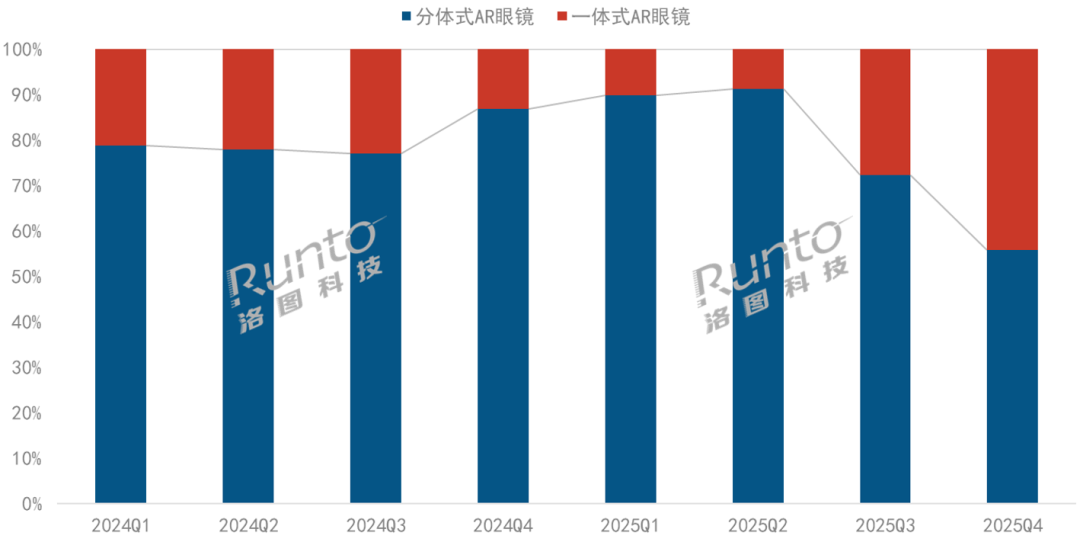

Tethered/all-in-one sales ratio shifted from 8:2 to 7:3.

AR glasses are categorized into tethered models (primarily for cinema, gaming, etc., with Birdbath solutions) and all-in-one models (emphasizing real-time information with waveguide solutions). According to LoTu Technology (RUNTO) online data, the sales ratio between tethered and all-in-one AR glasses in China's online market shifted from 82:18 in 2024 to 73:27.

The tethered AR glasses market is dominated by Thunderbird Innovation and XREAL, which together account for over 70% of the online market share. Their products predominantly feature Micro OLED screens + Birdbath optical solutions. In 2025, suppliers like Sony and Visionox achieved breakthroughs in screen brightness and power consumption.

In 2025, the all-in-one AR glasses market saw intensive entry by new brands such as Kuake, Rokid, Xuanjing, and Lenovo, which launched "AI+AR" products, altering the competitive landscape.

All-in-one products predominantly use Micro LED screens + waveguide solutions. Monochrome green Micro LED schemes remain mainstream due to their low costs and power consumption, while full-color Micro LED schemes are gradually being adopted in mid-to-high-end consumer products. Waveguide solution suppliers like Ned+ and Lingxi Weiguang improved mass production yields; among these, diffractive waveguides became the most widely adopted solution due to their wide field of view, slim form factor, and cost advantages.

China AR Glasses Online Market Product Type Sales Structure (2024-2025)

Source: LoTu Technology (RUNTO) Online Data, Unit: %

II (2) China Audio/Camera Glasses Market:

Audio glasses leveraged ecosystem penetration; camera glasses saw brand influx and explosive growth.

The growth of audio glasses is attributed to form factor innovation and functional integration. On one hand, integrating earphone functionality into glasses while maintaining diverse aesthetic designs makes them stylish, all-day-wearable audio devices. On the other hand, affordable pricing below 1,000 yuan lowered consumption barriers, with this price segment accounting for over 50% of online market sales in 2025. Additionally, brands like Huawei and Xiaomi incorporated them into their "phone + wearables" ecosystems, further accelerating mainstream adoption.

The growth of camera glasses stems from rising demand for Vlog creation and outdoor sports recording. Glasses-based recording offers a more natural, convenient, and immersive first-person perspective, aligning with users' lightweight recording needs.

In 2025, China's online market saw over 100 camera glasses brands, with early entrants like Thunderbird Innovation and Xiaomi dominating. Newcomers such as Li Auto, Kuake, and Starry Meizu quickly gained traction in Q4 2025, while white-label products captured nearly 10% of the market, resulting in a "leading brands, emerging contenders, and white-label fillers" landscape.

Entering 2026, products from ByteDance (Doubao), Samsung, XGIMI, Vidda, and Huawei are set to launch.

In reality, technical bottlenecks like optical design, weight balancing, and thermal management for prolonged use posed challenges for mass production in 2025. However, this sets the stage for robust growth in 2026. Privacy compliance may emerge as a critical variable for camera glasses.

III. Market Forecast:

Global smart glasses to grow 71% in 2026; China's smart glasses to surge 120%, surpassing 3.2 million units.

LoTu Technology (RUNTO) forecasts global XR device shipments to reach 7.05 million units in 2026, up 16.0% year-on-year. Smart glasses shipments are projected at 11.65 million units, up 71.1% year-on-year.

In China, with smart glasses included in the 2026 national subsidy program (see "Breaking: Smart Glasses Added as Sole New Category to 2026 National Subsidy Program"), LoTu Technology (RUNTO) projects China's XR device (VR/MR/AR) sales to reach 1.1 million units in 2026, up 58.8% year-on-year, primarily driven by AR devices. Smart glasses (audio glasses/camera glasses/AR glasses) overall market sales are expected to exceed 3.2 million units, up 120% year-on-year.

In the VR/MR market, despite cooling consumer demand, B2B and vertical sectors retain significant potential, with rigid needs for immersive experiences in industrial manufacturing, medical training, architectural design, and virtual exhibitions.

In the AR market, as domestic supply chain players like Goertek and Appotronics ramp up production, costs for high-transmittance, high-brightness waveguide solutions will decline further. This will enable "AI+AR" glasses with basic display functions to be priced below 2,000 yuan or even 1,500 yuan, triggering a surge in first-time buyers.

In the smart glasses market, lightweight designs and extended battery life remain core breakthroughs. Weights are expected to drop below 40 grams, with all-day battery life, significantly enhancing user experience.

Next, deepening vertical scenario penetration will become a new strategic focus for enterprises. Products unveiled at CES 2026 demonstrated breakthroughs in both industry-specific and consumer-grade niche scenarios. Industry applications focus on harsh environments and precision displays, while consumer scenarios expand from audiovisual entertainment and information display to gaming, sports, health, office, and learning.

Furthermore, deep AI integration will redefine smart glasses' value. Current AI functions primarily include voice assistants, real-time translation, and object recognition. As multimodal large models' reasoning capabilities shift from cloud to edge AI, smart glasses will gain stronger real-time processing power, evolving from passive receivers to proactive environmental sensors capable of predicting user needs. They could also deeply interconnect with smart cars and smart homes, becoming the first interface for human-machine interaction.

Additionally, ecosystem maturity will determine XR devices and smart glasses' adoption. Compared to smartphones' millions of apps, smart glasses' app ecosystem remains weak, with limited high-quality exclusive apps, insufficient scenario coverage, and poor cross-device compatibility. As platforms like Android XR continue to evolve, smart glasses will gradually integrate with services from Google, Alibaba, and others, addressing app ecosystem shortcomings.

LoTu Technology (RUNTO) will soon release its "2025 Market Summary Report and 2026 Outlook" for smart wristbands (watches/bands). Stay tuned.

Appendix: Incomplete Statistical Table of Financing Events in China's Smart Glasses Industry

(2025-January 2026)