Robots Take Center Stage at the Spring Festival Gala: The 'Muscle Show' Masks an Industry Cooling-off Phase

![]() 01/30 2026

01/30 2026

![]() 522

522

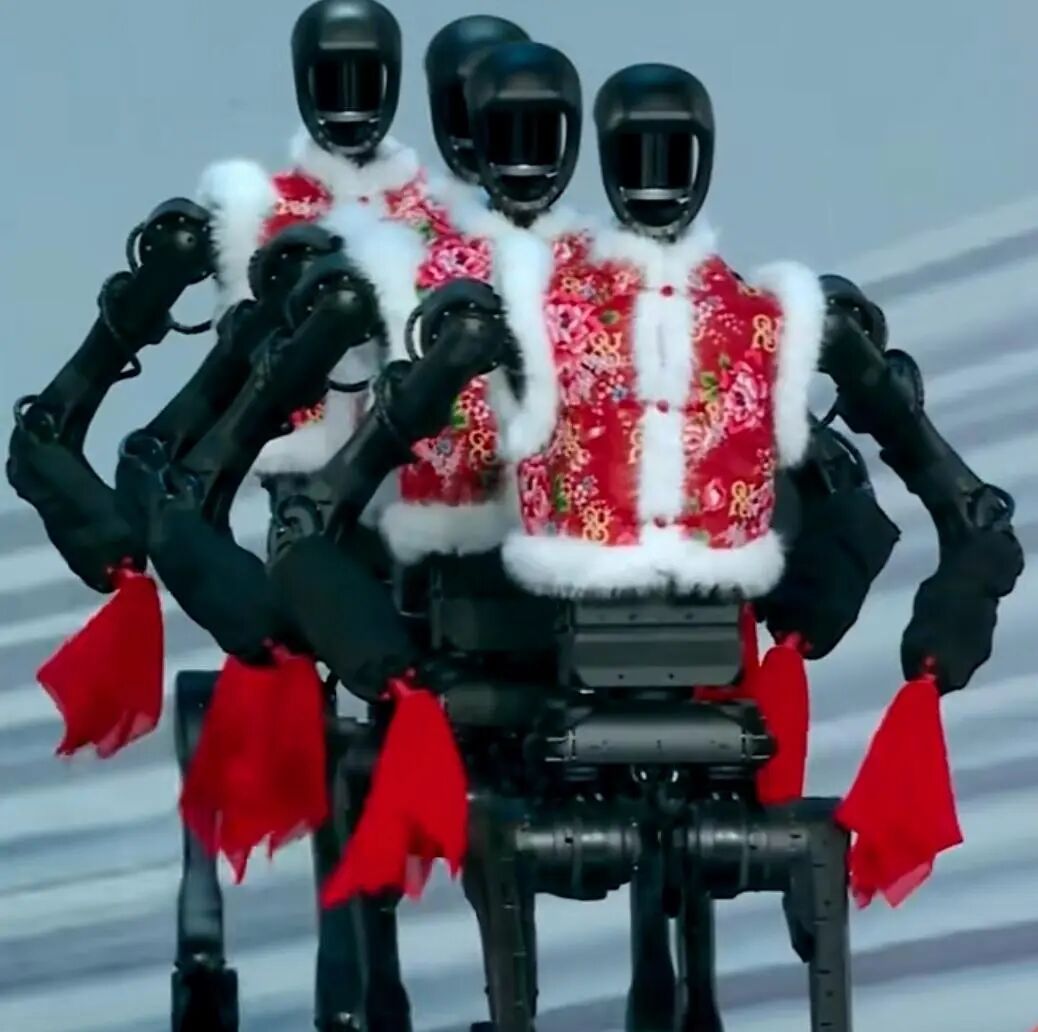

As six Chinese robotics firms stole the limelight at the Spring Festival Gala, thousands of miles away in a Texas factory, Elon Musk was rallying resources to meet his ambitious target of mass-producing "at least 1,000" Optimus humanoid robots this year. This simultaneous display of East-West rivalry for the future has never been more vividly juxtaposed in the same temporal frame.

With CCTV's partner list confirmed, the participation of six domestic firms, including Galbot and Unitree, in the Spring Festival Gala was no longer in question. While this undoubtedly served as a concentrated showcase, interpreting it merely as a triumphant declaration for the "Chinese Robot Corps" might misjudge the true state of global industrial competition. At this pivotal moment in 2026, every flashy second on stage is intricately linked to a relentless market countdown, a steep technological climb, and the immense "catfish effect" unleashed by Tesla's Optimus. What we're witnessing may not be a celebration but rather a high-pressure collective "rehearsal" before the industry's critical juncture arrives.

01

On Stage: Six Firms, Six Survival Tactics

The choices made by the six firms reflect less of an "all-around lead" and more accurately map out the differentiated survival strategies of various players during the industry's formative years.

Galbot embodies a "top-down" approach. With over $300 million in financing and the rare concept of an "embodied large model," it aims to cement its image as the "Chinese beacon for foundational models" in the minds of capital markets and top partners. The Spring Festival Gala serves as a costly yet essential brand-building endeavor. Unitree Technology validates the commercial value of "continuous visibility." As a "regular" making its third appearance, its core objective has shifted from "proving capability" to "solidifying stability." The founder's revelation of $1 billion in annual revenue is a notable feat in the consumer robotics market, but it's merely a stepping stone in the face of a trillion-dollar industrial opportunity. Dreame and its ecosystem (MOVA, Mofa Atom) exemplify another pragmatic approach: "nurturing the ecosystem with home appliances, buying time with scenarios." By generating cash flow from mature products like robotic vacuum cleaners, they subsidize cutting-edge explorations like humanoid robots. Their collective appearance resembles a coordinated roadshow of internal technological assets, aimed at showcasing the breadth of their full-scenario technological reserves to the market and potential B2B clients. Shouqu Technology, a newcomer, reveals the industry's extensibility: smart mobility devices seeking alignment with the "robot" concept represent a typical "sailing by borrowing wind" category upgrade strategy. Viewing these six firms as a unified "corps" is perilous. They are more akin to explorers in the same ocean, sailing different vessels, carrying different provisions, and heading toward distinct destinations. The Spring Festival Gala stage temporarily blurs these differences, unifying them under the spotlight of "Chinese technology."

02

Off Stage: Musk's 'Shadow Costs' and the Market Countdown

While the spotlight shines on Beijing, the global industry's truly taut nerves are tracking every iteration of Tesla's Optimus. Musk brings not just technological competition but a complete overhaul of perceptions regarding supply chains, costs, and market scale.

1. The 'Anchor Point' for Scale Projections Has Been Reset Before Optimus emerged, industry projections for the humanoid robot market were cautious and long-term. A Boston Consulting Group report once predicted that the global humanoid robot market would reach a scale of tens of billions of dollars by 2035. However, after Tesla's intervention with its formidable automotive industrialization capabilities, institutions like Goldman Sachs and Morgan Stanley have significantly advanced the projected timeline for market explosion. In a 2025 report, Goldman Sachs raised its global market projection for 2030 to $154 billion, explicitly stating that reducing manufacturing costs to below $20,000 is the critical threshold for humanoid robot proliferation. Tesla's goal aligns precisely with this. This sets a ruthless "shadow cost" for all players: no matter how excellent your technological path, if you cannot approach this cost and mass production scale, you may be barred from the mainstream market. 2. The Competitive Dimension Shifts from 'Laboratory' to 'Factory' The disruptive nature of Optimus lies in its inherent "must-be-producible-on-assembly-lines" gene from birth. This forces the global competition to shift from comparing laboratory papers and single-machine demonstrations to comparing supply chain management capabilities, scalable manufacturing processes, and unit-hour costs. While Chinese firms may lead in single-point technologies like algorithms and dexterous operations, they face their most severe challenge in the systems engineering capability to integrate thousands of components with extremely high consistency and at extremely low costs. The "agility" showcased at the Spring Festival Gala and the "reliability, affordability, and mass replicability" needed in factories represent two vastly different capabilities. 3. The Survival Logic Under the 'Catfish Effect' Musk's most significant impact is accelerating the industry clock and reshaping investment logic. Capital markets no longer pay solely for "interesting technologies" but scrutinize "clear commercialization paths and timelines" more harshly. This compels all firms, including the six on stage, to transition faster from "demonstrations" to "deliveries," from "project-based" to "product-defined." The Spring Festival Gala's halo can buy them some time and attention but cannot replace tangible orders and financial statements.

03

A Sobering Observation: Three Realistic Challenges After the Celebration

After the festivities, the Chinese robotics industry must confront three core questions: Challenge 1: Ecosystem Prosperity or Repetitive Involution? The simultaneous appearance of six firms may seem like ecosystem prosperity at first glance. However, a closer examination reveals: how many have achieved autonomy and breakthroughs in core "bottleneck" components like reducers, servo systems, and force-control sensors? If a large number of firms still rely on similar off-the-shelf core component stacking solutions, then this prosperity is more about application-layer "horizontal involution" than "vertical deepening" of industrial foundations. Challenge 2: Who Holds the Power to Define Scenarios? Currently, most domestic robots are still adapting to predefined scenarios (e.g., exhibitions, companionship, specific industrial processes). In contrast, Tesla's Optimus has been "defining scenarios" from day one, aiming to create a universal, human-labor-replacing productivity unit. The battle for scenario definition rights is the ultimate battle for industrial discourse. Which of the firms on stage are genuinely pioneering uncharted application deserts? Challenge 3: Beyond the National Stage, Where Is the Global Market? The Spring Festival Gala is an unparalleled domestic branding platform, but robotics is an inherently globalized industry. Can Chinese firms' products gain equal recognition in German factories, Japanese hospitals, and American warehouses? When stripped of the "national narrative" veneer and faced with the technological, cost, and reliability demands of the world's most discerning clients, that will be the true coming-of-age test.

04

Conclusion: Between the Cracks of 'Showcase' and 'Combat'

Therefore, the value of the 2026 Spring Festival Gala's robot segment lies not in declaring "we have arrived" but in prompting us to reflect on "where we currently stand." It is a precious stress test and a nationwide cognitive primer but far from the final act.

This East-West competition is essentially a race between two paths: one is a top-down, goal-oriented industrial scale path (Tesla), and the other is a bottom-up, multi-pronged application innovation and ecosystem construction path (current Chinese players). These paths are not entirely opposed and may eventually converge. However, before that happens, the Chinese industry must undergo a crucial mindset shift: from pursuing "sensational" moments under the spotlight to committing to "unheralded" stable operations on production lines and in complex scenarios. The stage lights will eventually fade, but the factory lights never go out. When Chinese robots step down from the Spring Festival Gala stage and enter workshops, warehouses, and homes, competing on cost and reliability with that "shadow" from Texas, only then can we truly claim that "the future" has arrived.