Spring Festival Red Envelopes: Just a Taste! Internet Giants' AI Showdown Sets Sights on the Future

![]() 02/04 2026

02/04 2026

![]() 535

535

From AI-powered special effects and 10,000-yuan "pony cards" to complimentary dining and entertainment experiences, as well as AI-driven social gatherings... As billions of red envelopes flood China's 1.4 billion-strong population during the Spring Festival, a silent yet fierce battle for AI supremacy is unfolding.

As the Spring Festival approaches, internet giants are shifting their red envelope strategies from mobile payments and short videos to AI. Baidu's Wenxin Assistant, Tencent's Yuanbao, Alibaba's Qianwen, and ByteDance's Doubao are all aiming to popularize AI assistants through cash red envelopes, free order plans, and partnerships with Spring Festival Galas.

This familiar tactic of splashing cash on marketing is not just about acquiring traffic; it's also a nationwide stress test and a validation of their AI strategies. From the methods of distributing red envelopes to the strategic intentions behind them, a deep competition centered around AI technical prowess, ecosystem integration, and user mindset has commenced.

(Generated by Doubao AI)

The Traffic War and Capability Trial

The Spring Festival AI red envelope battle intensified in early 2026. On February 2-3, Alibaba's Qianwen announced a staggering 3 billion yuan investment to launch the "Spring Festival Feast," exclusively sponsoring four Horse Year Spring Festival Galas on Dragon TV, Zhejiang TV, Jiangsu TV, and Henan TV—marking the largest spend to date.

In this battle, Tencent announced on January 25 that its Yuanbao app would launch a Spring Festival red envelope campaign on February 1, distributing 1 billion yuan in cash.

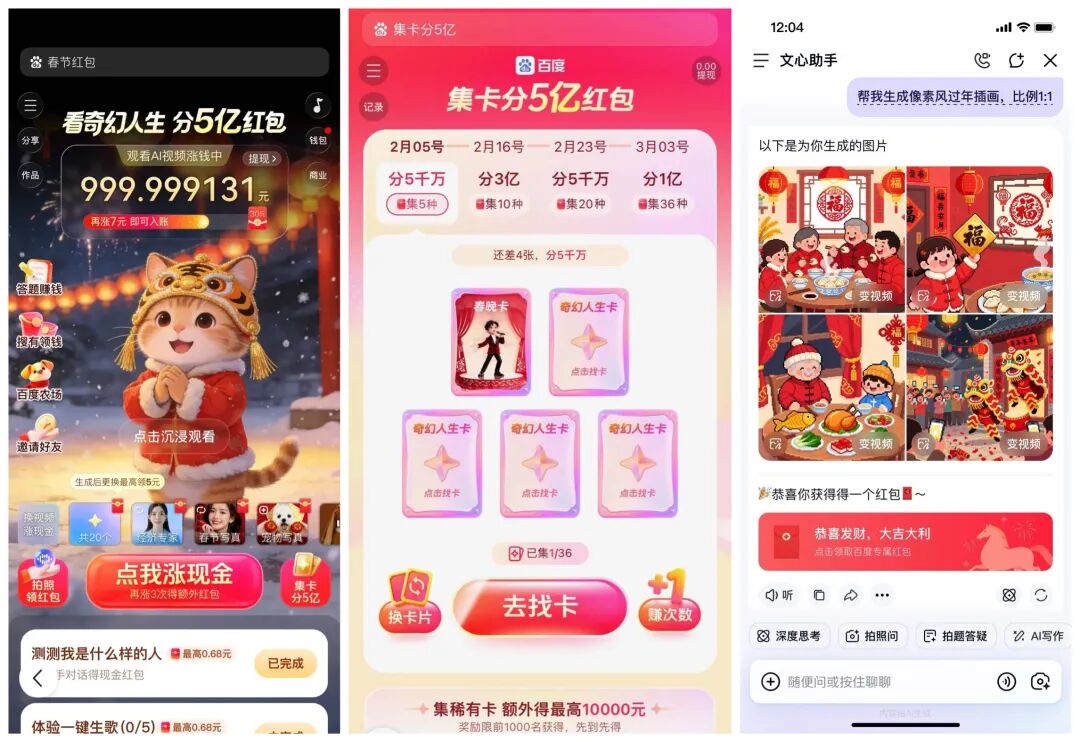

Baidu also announced a Horse Year Spring Festival red envelope event on the evening of January 25, allowing users to share 500 million yuan in cash through AI interactions and card collections within the Baidu app.

ByteDance's Volcano Engine became the exclusive AI cloud partner for CCTV's 2026 Spring Festival Gala, with its AI assistant Doubao launching interactive features. The "Collect Auspicious Horses" activity on Douyin (TikTok's Chinese version) offers 300 million yuan in prizes.

Baidu: Leveraging Massive Search Users

Baidu was the first among the tech giants to launch its Spring Festival AI red envelope campaign. Centered on the Baidu app and Wenxin Assistant, it offers a 500 million yuan red envelope event running from January 26 to March 12, covering the entire Spring Festival period and Lantern Festival—the longest duration to date.

Baidu's campaign features three play modes: watching videos for cash, collecting rare cards (with the top 1,000 collectors winning 10,000 yuan each), and guessing passwords via Wenxin Assistant. Users enter the "Fantastic Life" theme hub by searching "Spring Festival Red Envelope" in the Baidu app, experiencing nearly 200 AI effects and earning rewards through plot branches (storyline choices). AI interactions yield "Life Cards" for a four-round prize pool. Baidu Search's official Xiaohongshu account @BaiduSearch will release clues for "Guess the Password from Horse Images," triggering hidden red envelopes via Wenxin Assistant.

As of February 1, nearly 50 million people used AI features to grab red envelopes in Baidu's campaign. The app's popularity forced emergency server expansion (scaling) on launch day. Baidu also appeared as the "Chief AI Partner" at the 2026 Beijing Radio and TV Spring Festival Gala, amplifying its reach.

Baidu's strengths lie in: 1) A strong traffic base (Baidu app MAU exceeds 700 million; Wenxin Assistant MAU tops 200 million); 2) Deep AI integration (linking red envelopes to core functions like image search and AIGC video creation); 3) Long campaign duration and diverse play modes (card collection, interactive stories, password guessing) to sustain user engagement.

Tencent: Mounting a Defensive Counterattack via Social Advantage

Tencent's Yuanbao launched the "1 Billion Yuan Split on Yuanbao" campaign on February 1, running until February 17. Focused on social sharing and AI interactions, users get five daily lottery draws, with 40+ extra chances via AI dialogues, generating text/image blessings, and sharing links. Prizes include cash red envelopes, 100 limited-edition "10,000-yuan Pony Cards," surprise rewards (QQ Music/Meituan coupons), and red envelope multipliers. As of February 3 at 11 AM, 37 "10,000-yuan Pony Cards" had been claimed.

Notably, Yuanbao's new AI social feature "Yuanbao Party" launched public testing on February 1, allowing users to earn red envelopes through group chats. The app topped Apple's Free App Chart 14 hours after launch, causing temporary server fluctuations due to surging traffic.

Tencent's key advantage is its social ecosystem. WeChat's 1.4 billion MAU enables viral red envelope sharing ("both sender and receiver get lottery chances"), potentially driving exponential user growth. Direct WeChat Pay withdrawals lower participation barriers, while "Yuanbao Party" merges AI with social scenarios to address industry retention challenges. The 10,000-yuan prize generates buzz, fueling social media discussions.

Alibaba: Launching a Full-Scale Offensive via Ecosystem Synergy

On February 2, Alibaba's Qianwen announced a 3 billion yuan "Spring Festival Feast" campaign launching on February 6. Focused on "free orders + cash red envelopes," it integrates Alibaba's ecosystem businesses like Taobao, Freshippo, Fliggy, Damai, and Gaode, covering dining, shopping, and entertainment.

According to China Business News, Qianwen will also distribute large cash red envelopes, though details remain undisclosed. Industry insiders suggest it may follow its "Problem-Solving AI" approach. The Qianwen app's AI movie ticket booking feature is in beta testing and will roll out soon.

Additionally, Qianwen exclusively sponsored four Horse Year Spring Festival Galas and participated as an "AI actor," creating innovative programs via AI video generation, image recognition, and Q&A, with exclusive password red envelopes during the shows.

Alibaba's strengths include ecosystem synergy and differentiated models. On January 15, the Qianwen app integrated Alibaba's ecosystem services (e.g., food delivery, shopping, flight bookings). The 3 billion yuan investment creates scale effects, while Qianwen's open-source ecosystem (top global downloads) provides a solid technical foundation.

ByteDance: The Traffic King on CCTV's Gala Stage

On December 28, ByteDance announced Volcano Engine as CCTV's exclusive AI cloud partner for the Spring Festival Gala. Doubao will engage audiences via AI couplet customization, smart lantern riddles, multilingual translation, and blessing generation on New Year's Eve.

ByteDance's Douyin app also launched its "Joyful Chinese New Year" campaign, featuring activities like "Climb Peaks on Horseback," "Catch Horses for New Year," "Collect Auspicious Horses (300 million yuan prize pool)," and "Friends' Gala" from January 30 to March 3. While ByteDance hasn't disclosed total red envelope amounts, the "Collect Auspicious Horses" activity alone offers 300 million yuan.

ByteDance's advantages include top-tier IP leverage and traffic efficiency. Exclusive CCTV Gala partnership ensures national exposure, while its ecosystem (Douyin, Toutiao) provides massive traffic. By late 2025, Doubao became China's first AI product with 100 million DAU, praised for its intimate, witty dialogues (e.g., fashion advice, homework supervision), fostering high user stickiness.

Industry Trends: Spring Festival AI Red Envelopes as a C-End Battleground

Spring Festival AI red envelopes are critical for internet giants to capture C-end traffic and user stickiness. As a national-scale event with the broadest user reach and highest engagement, it serves as the best window for AI products to go mainstream. In 2015, WeChat's Gala "Shake" red envelopes added 100 million card-binding (bank card-linked) users overnight, reshaping mobile payments—a model now emulated by tech giants.

With AI lacking high-frequency, rigid demand scenarios, red envelope incentives lower user trial barriers, fostering habits of "asking AI first."

Long-Term Strategy and Ecosystem Competition

The Spring Festival AI red envelope battle is just the surface; beneath lies deep strategic layouts in AI that determine long-term competitiveness.

Baidu's AI strategy revolves around "full-stack self-research + systemic capabilities," building a "chip-cloud-model-application" ecosystem. Technologically, it launched Kunlunxin M100 and M300 chips in November 2025, addressing AI computing costs and security. In January 2026, Kunlunxin spun off to file for a HKEX IPO with a $50 billion valuation. Its Wenxin model ranked first domestically in text and second globally in math (LMArena, January 15).

In applications, Baidu formed an agent matrix (search, digital human, coding agents), while RoboTaxi led commercialization with 17 million orders across 22 cities by October 2025. Baidu Cloud supports AI business, creating a "technology-scenario-commercialization" loop.

Tencent focuses on "social + AI fusion," using its Hunyuan model as the technical base and Yuanbao as the C-end carrier, deeply integrated with WeChat. To address model shortcomings, it adopted DeepSeek and boosted GPU computing power, leveraging open-source trends to elevate Yuanbao. Tencent also hired OpenAI's ex-researcher Yao Shunyu as Chief AI Scientist and Singapore's Sea AI Lab's Pang Tianyu for reinforcement learning.

Product-wise, Tencent embedded AI in WeChat, QQ, and Tencent Meeting (e.g., summarizing public accounts, generating meeting minutes), while "Yuanbao Party" aims to create a "social space" for AI-user collaboration.

Alibaba adheres to an "AI as infrastructure" strategy. Technologically, it built "chip-cloud-model" capabilities, with its Zhenwu 810E AI chip (96G HBM2e memory, 700GB/s inter-chip bandwidth) for training, inference, and autonomous driving. Its open-source Qianwen model had 200,000+ derivatives and 1 billion+ global downloads by January 21, 2026, leading the open-source field.

Business-wise, Alibaba pursues "AI to C + AI to B" dual drives: Qianwen app integrates Taobao, Alipay, and Fliggy for C-end services, while Alibaba Cloud serves 1 million+ enterprise clients with AI capabilities. Media reports suggest Alibaba plans to invest 480 billion yuan in AI infrastructure and cloud computing over three years.

ByteDance centers its AI strategy on "Doubao as a super entrance + multimodal tech + hardware-software synergy," aiming for "AI everywhere." Technologically, it focuses on multimodal models, hiring ex-Google DeepMind VP Wu Yonghui to lead long-term R&D. Doubao's "model family" optimizes response speed and efficiency per scenario, processing 63 trillion tokens daily by late 2025 (a 200%+ surge in six months).

Product-wise, Doubao integrates with ByteDance's ecosystem (Douyin effects, CapCut scripts, Feishu summaries), launches AI phone assistants for cross-app operations, and expands globally with Dola (10 million+ DAU).

Overall, each company has distinct AI strengths and challenges:

Baidu excels in systemic capabilities and tech accumulation, forming a closed AI ecosystem. However, its search business faces erosion, and AI results reduce ad revenue.

Tencent leverages its social moat and user base (1.4 billion WeChat MAU), with diverse products for AI integration. Yet, its model capabilities lag, requiring time to catch up with self-developed Hunyuan.

Alibaba benefits from commercial integration and open-source ecosystems, with "e-commerce + local services + cloud" providing rich AI scenarios. However, internal complexity may slow AI rollouts, and it lacks a super traffic entrance (entry point).

ByteDance's AI strengths lie in traffic conversion efficiency and product innovation speed. The vast user bases of Douyin and Jinri Toutiao provide Doubao with a natural traffic pool, while its rapidly iterative product capabilities enable it to quickly respond to market demands. ByteDance's weaknesses include relatively weak ecological integration capabilities and intense competition from Alibaba and Baidu in the B-end market.

Spring Festival red envelopes mark the beginning, not the end, of AI popularization. Over the next few years, competition in the AI field will intensify, with the focus shifting from user scale to depth of usage. The decisive factor will be the ability to create rigid demands.

Based on the current development status, let's make an immature prediction. In the short term, competition for traffic will remain the core battleground, and the effectiveness of Spring Festival red envelope campaigns may directly influence the market landscape. The focus of competition during this phase will center on user acquisition, feature iteration, and scenario enrichment, with incentives like red envelopes, social viral spread, and ecological collaboration continuing to play a significant role.

In the medium term, competition will shift from traffic acquisition to a deep contest of "model capabilities + scenario integration." At the technical level, large model capabilities will gradually converge, with open-source models reducing the technological gap. The differentiated advantages of self-developed models will become crucial. In terms of scenarios, Tencent's "social + AI," Alibaba's "lifestyle services + AI," ByteDance's "content + AI," and Baidu's "search + AI" may form distinct differentiation paths, with users potentially developing fixed preferences based on usage scenarios. During this phase, retention rates will replace download volumes as the core metric, and AI products must identify truly high-frequency, rigid-demand scenarios to achieve sustainable development.

In the long term, ecological integration and technological barriers will determine the final landscape. Enterprises with a positive cycle of "model-data-scenario" will prevail, while smaller players will gradually exit due to insufficient computing power, data, and scenarios. Additionally, global competition will become a significant battleground, with regulatory policies and localization capabilities playing a pivotal role.

It is important to highlight that the essence of industry competition will, in the end, pivot back to user value. Presently, the AI sector grapples with challenges such as "ambiguous positioning for consumer-end products" and "a scarcity of high-frequency, essential-use scenarios." Marketing strategies centered around Spring Festival red envelopes may boost short-term traffic but fall short in addressing long-term user retention. Moving forward, AI products that genuinely tackle user challenges and deliver unparalleled value will be the ones that prevail in the competitive landscape. Concurrently, regulatory frameworks concerning technology ethics and data security are expected to mature, with adherence to these regulations becoming a critical factor for business survival.

Conclusion

The initial fervor surrounding red envelope promotions is bound to wane. Once users exit the final red envelope screen, the AI application icons that remain on their mobile devices will signify the true 'victories' of this contest.

The substantial investments made by Baidu, Tencent, Alibaba, and ByteDance are not merely short-sighted tactics aimed at capturing traffic; they are also focused implementations and showcases of their respective AI strategies. From the varied strategies employed in red envelope campaigns to the underlying technological infrastructure, ecosystem configurations, and strategic directions, the rivalry among these four industry leaders has thoroughly encompassed the entire spectrum of "technology-traffic-scenarios-commercialization."

The buzz around Spring Festival AI red envelopes can be likened to surface waves, beneath which lies a significant shift in the Chinese internet sector's comprehensive evolution towards the artificial intelligence age. Baidu's methodical approach, Tencent's subtle yet powerful social ecosystem network, Alibaba's all-encompassing commercial scenario integration, and ByteDance's swift advancements propelled by traffic all signify distinct strategies on the AI chessboard. This enduring competition to shape the future landscape is devoid of mere imitators, featuring only resolute explorers. (Source: Official WeChat Accounts of the Four Companies)

Risk Warning: The information presented in this article is derived from publicly accessible sources and should not be construed as investment advice.