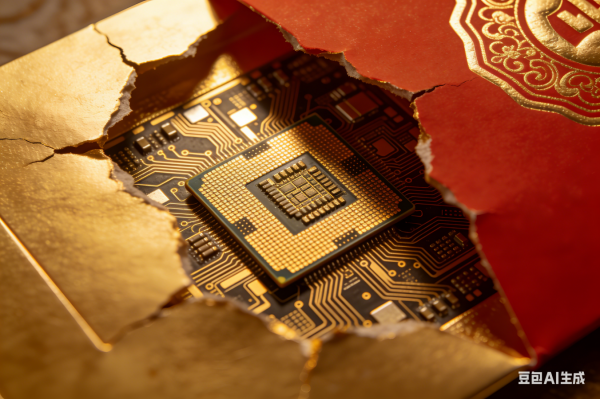

The Domestic AI Chips in Red Packets Point to the Future

![]() 02/04 2026

02/04 2026

![]() 508

508

Last Spring Festival marked the moment DeepSeek, a product of 'Deep Thinking,' went viral.

This Spring Festival is destined to be a pivotal moment in the history of AI promotion.

Following Baidu APP's investment of 500 million yuan in cash red packets and its appearance on Beijing TV's Spring Festival Gala, Tencent Yuanbao launched a 1 billion yuan red packet campaign.

On the morning of February 2nd, Qianwen APP announced an investment of 3 billion yuan to launch the 'Spring Festival Treat Plan,' offering freebies to people across the country to eat, drink, and enjoy themselves during the festival, experiencing a new lifestyle in the AI era.

This has thoroughly (completely) pushed the AI promotion offensive during the Spring Festival to its climax.

As thousands of households scramble for '10,000-yuan Pony Cards' in Tencent Yuanbao, claim 'AI Freebies' in Qianwen APP, and generate New Year greetings videos in Doubao, it also serves as a stress test for domestic AI chips.

Each red packet distributed represents an AI inference request, and every 'instant open' experience is supported by computing power.

The Spring Festival of 2026 is destined to be a historical node (milestone) for China's AI industry, marked by both surface-level user revelry and underlying breakthroughs for domestic chips.

The surface is user revelry with red packets, while the core is the breakthrough of domestic chips at the foundation.

The AI Red Packet Battle Pushes the AI War to Its Climax

1. Record-Breaking Red Packets, Tech Giants Battle During Spring Festival

This year's AI red packet battle has set new records in terms of the number of participants and the amount of funds invested, surpassing previous Spring Festival marketing efforts.

Tencent's Yuanbao APP took the lead by launching a 1 billion yuan red packet campaign during the Spring Festival, offering various forms of red packets such as 10,000-yuan Pony Cards, cash red packets, and sharing red packets.

From the results, Tencent Yuanbao APP has risen to the top of the free APP rankings in the Apple Store. In response to reports of 'Yuanbao crashing,' Tencent stated that the sudden surge in traffic caused brief instability in some services, which have now been restored.

Baidu is not to be outdone.

On the evening of January 25th, Baidu announced the launch of its Horse Year Spring Festival red packet campaign, totaling 500 million yuan, with individual red packets reaching up to 10,000 yuan. As the 'Chief AI Partner' of Beijing TV's Spring Festival Gala, Baidu distributed red packets through AI interactions, card collections, and Wenxin Assistant tasks. Unlike Tencent's 'social fission' strategy, Baidu chose a 'time for retention' approach, with a 46-day campaign period to cultivate user habits.

Alibaba's entry into the fray with Qianwen APP intensified the competition.

On February 2nd, Qianwen APP announced an investment of 3 billion yuan to launch its Spring Festival offensive, fully integrating with Alibaba's ecosystem businesses such as Taobao Flash Sales, Damai, Feizhu, and Hema, offering freebies to people across the country to eat, drink, and enjoy themselves during the festival.

The plan, set to launch on February 6th, aims to let people nationwide experience a new lifestyle in the AI era through large-scale freebie models, driving AI from chatting to practical applications.

ByteDance, on the other hand, chose a different route by partnering with CCTV's Spring Festival Gala.

Its subsidiary, Volcano Engine, became the exclusive AI cloud partner for the 2026 Spring Festival Gala, and its intelligent assistant, Doubao, will also launch various interactive features.

Currently, Doubao APP ranks second in the free APP rankings in the Apple Store, just behind Tencent Yuanbao.

2. From 'Traffic Acquisition' to 'Scene Domination'

In this light, AI promotion during the Spring Festival is no longer just a festive marketing campaign but a battle for AI users.

Looking back at 2015, WeChat Pay successfully bound hundreds of millions of users to its ecosystem by distributing hundreds of millions of cash red packets through 'shake' on CCTV's Spring Festival Gala, rewriting China's mobile payment landscape.

At Tencent's annual meeting on the afternoon of January 26th, Tencent's Chairman Ma Huateng mentioned the upcoming 1 billion yuan cash distribution campaign for the AI application Yuanbao during the Spring Festival, expressing hope to recreate the success of WeChat's red packets and establish AI product dominance.

2026 marks a critical transition for AI applications from 'usable' to 'user-friendly,' and user retention data after the Spring Festival will determine the differentiation between the first and second tiers.

Hu Yanping, a distinguished professor at Shanghai University of Finance and Economics, pointed out, 'The ultimate determinant of this land grab is no longer just the amount of traffic but the core capabilities of the product itself.' Spring Festival red packets are just the 'igniter,' and the quality of product iterations and user retention rates in the three months after the festival will truly determine the rankings of the four tech giants in the AI era.

3. Chip Self-Sufficiency Inside Red Packets

Amidst the flurry of red packets at the application layer, we must also note that the underlying computing power war has intensified.

Take Tencent Yuanbao as an example. On the first day of its 1 billion yuan cash red packet campaign, the system's instantaneous concurrency exceeded 100 million. This means that millions of user intent recognitions, red packet amount calculations, account balance updates, and intelligent dialogue responses must be completed per second.

Supporting these high-concurrency scenarios are no longer NVIDIA's GPUs but clusters of 10,000 domestic AI chips.

Baidu's Wenxin Assistant's Spring Festival special effects generation runs on Kunlunxin's third-generation 10,000-card cluster; Alibaba's Qianwen's 'AI Freebie' decisions rely on Pingtouge's Hanguang 800 inference acceleration; Tencent Yuanbao's social AI responses are supported by a hybrid architecture of its self-developed Zixiao chip and Intel CPUs; ByteDance's Doubao's Spring Festival Gala interactions are deployed on inference instances of Volcano Engine's self-developed Yunque chip.

Tech giants feed their self-developed chips with their AI applications, and the self-developed chips, in turn, support application experience optimization, forming a flywheel effect.

The Breakthrough of Domestic AI Chips

1. Dramatic Changes in China's AI Chip Market Landscape

Once, NVIDIA dominated the AI chip field, holding 95% of China's high-end computing power market share with technical advantages and generating nearly $50 billion in annual revenue from the Chinese market.

This all changed in 2022.

To curb China's technology, the U.S. government imposed strict chip export controls, directly cutting off NVIDIA's supply of high-end chips to China. In 2023, the U.S. export ban rendered NVIDIA's A800 and H800 chips, designed specifically for the Chinese market, non-compliant.

In April 2025, the U.S. further tightened controls, forcing NVIDIA to halt sales of its custom H20 chip for the Chinese market, resulting in about $4.5 billion in inventory losses and $8 billion in potential revenue losses for the company.

NVIDIA CEO Jensen Huang publicly stated in October 2025 that due to export controls, NVIDIA's market share in China's high-end training chip market plummeted from 95% to 0%, and the company '100% left the Chinese market.'

NVIDIA, currently holding a 39% market share in the first place, is expected to see its share shrink significantly to just 8%.

This market upheaval not only reflects the rapid rise of domestic AI chips but also foreshadows a profound refactor (reconfiguration) of the global AI computing power landscape.

2. Domestic AI Chips Seize Strategic Window

NVIDIA's retreat has opened up a vast market space for domestic AI chips.

According to Bernstein Research, by 2026, China's AI chip market landscape will undergo earth-shaking changes: Huawei is expected to dominate with a 50% market share, while U.S. chip company AMD is projected to take second place with a 12% share. Cambricon and Hygon are expected to rank third and fourth with 9% and 8% shares, respectively.

The report further predicts that by 2028, China's domestic AI chip production will exceed domestic demand, with a supply-demand ratio expected to reach 104%. In 2026, this ratio will be 39%, and the compound annual growth rate (CAGR) of domestic AI chip sales is expected to reach 74% over the next three years, with sales potentially growing by 93% by 2028. The localization substitution of inference chips is accelerating.

3. The Rise of Domestic AI Chips

According to multi-source research by Caijing Magazine, at least nine Chinese AI chip companies have shipped or ordered over 10,000 cards.

Huawei's Ascend and Baidu's Kunlunxin are among the largest-scale domestic AI chips in terms of shipments. Backed by large tech companies, they have stable customers. International market research firm IDC data shows that in the first half of 2025, Huawei's Ascend held the largest market share among domestic AI chips.

Not only are established chips continuing to thrive, but AI chip startups are also Not willing to be left behind (not willing to be left behind), going public collectively.

From the second half of 2025 to early 2026, AI chip startups such as Muxi (Maxio), Moore Threads, Iluvatar CoreX, and Enflame Technology successively released prospectuses, ushering in a wave of listings for domestic GPUs.

Among them, Moore Threads set the record for the fastest IPO approval on the STAR Market in 88 days. The remaining unlisted domestic AI chips are still some distance from the top, but they are equally powerful. It is understood that companies like Xi Wang (Xiwang) and Tsingmicro have also shipped or ordered over 10,000 cards, indicating that this round of industrial trial and error is entering the 'scaled delivery verification' stage.

4. The Gap Remains, but the Path is Clear

Although domestic AI chips are in a period of rapid development, with some inference performances surpassing NVIDIA's H20, there is still a huge gap in peak performance compared to NVIDIA.

Therefore, 'squeezing every token out of each chip' has become an industry consensus.

Xu Bing, CEO of Xiwang, stated at a product launch on January 28th that the inference cost per million tokens in the Chinese market had dropped to 1 yuan in 2025. Xiwang's goal is to reduce this to the 1-cent level using dedicated inference chips and system architectures.

The strategy of 'compensating for single-chip performance with system architecture' is precisely China's differentiated competitive choice against NVIDIA.

IDC data shows that in China's generative AI IaaS (infrastructure) market in 2025, training accounted for 49.6% and inference for 50.4%. IDC predicts that by 2029, training will drop to 23.3% and inference will rise to 76.8%.

This prediction highlights China's rapid autonomization process in AI semiconductor technology.

If this comes to pass, Huawei's Ascend AI chips and China's domestic AI semiconductor technology will occupy a more important position in the global market.

Conclusion:

After the Spring Festival, when users have spent the cash in their red packets and used up their freebie coupons, some AI applications may face an uninstallation wave after the subsidies subside.

However, products with less lag, faster responses, and stable generation will cultivate user habits and further accelerate the universal adoption of AI.

From Huawei's Ascend dominating half the market to Baidu's Kunlunxin and Alibaba's Pingtouge with their 10,000-card clusters, from Cambricon's performance explosion to the collective listings of Maxio, Moore Threads, Iluvatar CoreX, and Enflame Technology.

This is not just a simple 'substitution' but the beginning of 'surpassing' for domestic AI chips.

The red packets will be spent, but the breakthrough of AI chips has just begun.

Cited Articles:

EEWorld 'Domestic AI Chips, Showing Off Their Muscles'

Caijing AI 'At Least Nine Chinese AI Chip Companies Have Shipped Over 10,000 Cards'

IDC '2025 China Generative AI Infrastructure Market Report'

Bernstein Research 'China AI Chip Market Forecast (2026-2028)'