Spring Festival AI Campaign: Alibaba Unleashes a 3 Billion Yuan Blitz

![]() 02/04 2026

02/04 2026

![]() 350

350

Written by | Wu Kunyan

Edited by | Wu Xianzhi

The internet landscape is no stranger to leveraging short-term incentives to steer user behavior, and AI has swiftly adopted a similar tactic.

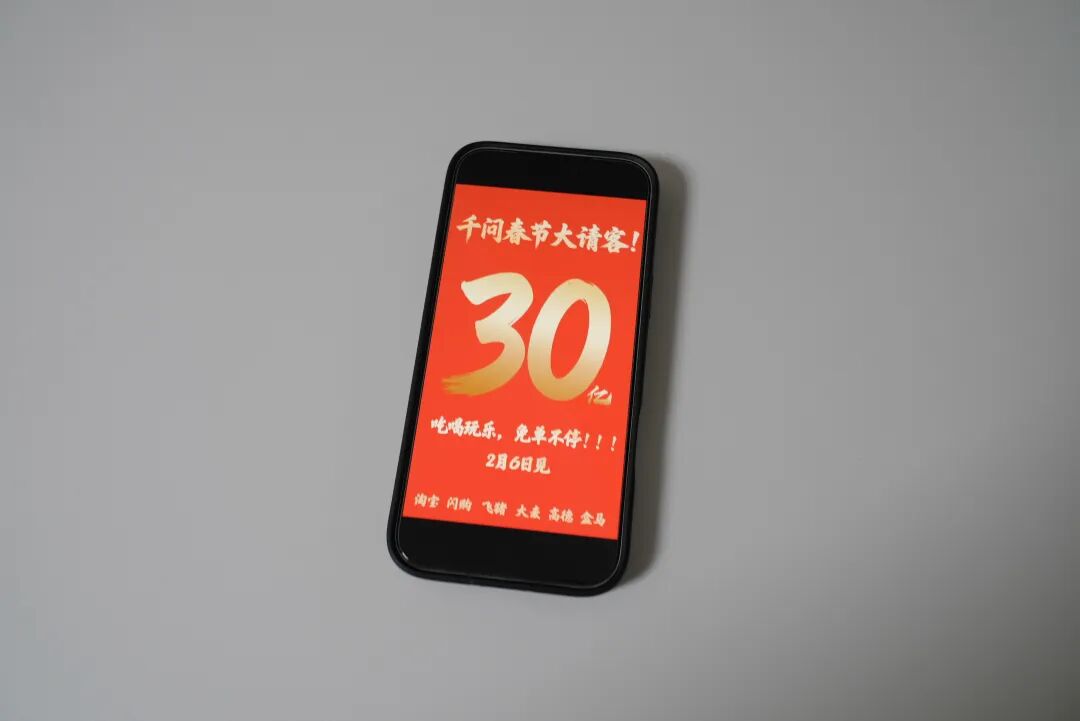

On February 2, Alibaba's Qianwen APP unveiled a staggering 3 billion yuan investment to spearhead a Spring Festival campaign, seamlessly integrating with ecosystem partners such as Taobao Flash Sales, Damai, Fliggy, and Hema. This initiative promises nationwide users complimentary orders for dining, entertainment, and leisure activities during the Spring Festival, with the campaign set to kick off on February 6.

Previously, Alibaba, ByteDance, Tencent, and Baidu emerged as frontrunners in the AI entry-point race, capitalizing on their financial prowess. As each company unveils its festive marketing strategies and saturation investment figures, four strategic ecosystem-driven visions come to the fore. Among them, Alibaba has capitalized on last year's accelerated growth in instant retail, with Taobao Flash Sales' explosive expansion providing Qianwen with a bridge from cloud-based large models to real-world shelves.

During last year's instant retail battle, Alibaba fully harnessed its "group warfare" capabilities, transforming Taobao Flash Sales into a high-traffic platform with daily order peaks surpassing 100 million and monthly active buyers exceeding 300 million.

Building on this momentum, Alibaba has further consolidated its ecosystem's consumption businesses. Through Qianwen's unified interface, it aims to dismantle and reorganize the consumption decision-making and fulfillment capabilities scattered across various apps. Following the MCP transformation, Qianwen will assume these responsibilities, expediting the transition of large models from dialogue to action.

Moreover, the 3 billion yuan investment significantly outpaces the commitments made by other major players in the Spring Festival race.

From a user education standpoint, Alibaba's ambitions extend beyond fostering AI usage habits. The 3 billion yuan in complimentary orders aims to entice users to explore the new "AI-driven services" pathway during the Spring Festival, a period when they are least inclined to switch services.

Qianwen as the 'Central Service Hub'

The movie The Matrix envisions a futuristic scenario where humans interface with computers, with the system rendering a "world model" in real-time within the human mind. In Alibaba's AI-driven consumption ecosystem, a unified "interface" is essential, and Qianwen logically assumes this role. Flash Sales has laid a solid foundation in supply and traffic coordination. On January 15, the Qianwen App introduced Qianwen Task Assistant 1.0, fully integrating it with services across Alibaba's ecosystem, including Taobao e-commerce, Taobao Flash Sales, and Alipay, setting the stage for its current initiatives.

For Alibaba, Qianwen's public debut carries at least two layers of significance. At the business level, it provides an organizational framework for Alibaba's vast consumption ecosystem in the AI era. On another level, it signals Alibaba's vision of a centralized AI evolution path for the "super app" model.

Alibaba's strength in consumption lies in its business depth and supply richness. However, the frontends of different consumption businesses operate independently, with distinct apps catering to varied needs and traffic logics. Users switching apps based on whims led to repeated churn and re-engagement. Qianwen endeavors to reorganize these scattered frontends into a unified entry point.

Drawing an imperfect analogy, Alibaba's consumption ecosystem was previously a parallel structure among different apps, with each branch operating independently. Qianwen transforms this into a series structure, where traffic flows sequentially through a central switch. In Alibaba's design, after Qianwen identifies user intent and breaks down tasks, it allocates traffic and instructions to the corresponding fulfillment branches.

When the interface takes center stage, its primary task is to attract users, with the AI assistant addressing various needs from real-world Spring Festival scenarios.

Viewed through this lens, Alibaba's 3 billion yuan in complimentary orders assumes the significance of a pledge. The Spring Festival represents the peak of annual travel and offline consumption, making red packet subsidies not just about user acquisition but also about driving real behavior, akin to WeChat's "Pearl Harbor attack" during the mobile payment wars. At that juncture, Qianwen will evolve from a showcase of model capabilities into Alibaba's "central service hub" for consumption.

At the Qianwen Assistant launch event, Wu Jia stated that the ideal AI should possess proactive communication abilities akin to humans, understanding user needs, offering solutions, and collaborating with users to make consumption decisions. Qianwen's ultimate form as a "central service hub" points toward "proactive agency" based on ecosystem supply capabilities.

This AI product form resembles the "travel agency agent" concept proposed by Booking CEO Glenn Fogel. In the traditional Western OTA (Online Travel Agency) industrial chain, travel agency agents were tasked with understanding family preferences and budgets, proposing itineraries, and finalizing plans with clients. Alibaba envisions AI playing a similar role, leveraging technology to replicate this experience and extend it to more consumption industries.

Through Qianwen's reorganization of Alibaba's businesses, we can discern Alibaba's vision for AI's ultimate form.

In the mobile internet era, super apps derived their strength from consolidating high-frequency services into a single container. In the AI era, Alibaba takes this centralization further—not only housing services but also decision-making.

Group-Level Wind Tunnel Testing

Shifting focus to the industry, the excitement surrounding this year's Spring Festival is understandable. AI is undergoing a paradigm shift from speech to action, coinciding with a national holiday marked by peak traffic and consumption.

On the other hand, saturation investments at the group level have aligned different businesses toward a common goal. They must collectively serve AI-to-Consumer (AI2C) breakthroughs while vying for user decision-making power. In the mobile internet era, entry points were valuable for distributing links and traffic. In the AI era, entry points distribute services—the reorganized results of AI and their influence on user decisions and actions.

If past Spring Festival marketing focused on "reach first, then storytelling and experience," this year's AI competition resembles a platform race. It pits platform ecosystems against core capabilities in consumption, social interaction, search, and content, with fiercer and more pragmatic competition. Even as companies vie for user attention with subsidies, events, and saturation advertising, the real challenge lies in fulfilling genuine needs afterward.

From a certain perspective, this gives Alibaba an edge in this entry-point competition. It boasts sufficient business touchpoints to make Qianwen's entry narrative more inherently tied to "action."

On the other hand, high-frequency Spring Festival needs like food delivery, in-store dining, ticketing, and travel bookings are essentially comprehensive tests of price, timeliness, and certainty. AI's effectiveness in handling these tasks is constrained by both technological and business depth.

Technologically, Qianwen acts as a central hub, encapsulating consumption-related capabilities into callable tools. It completes intent recognition, tool selection, and subsequent orchestration during user dialogues. This represents a cross-tool chain spanning different business formats. Users are indifferent to the computations and mappings behind the central hub; the delivered results directly impact user experience, determining Qianwen's marketing effectiveness in this Spring Festival battle.

When faced with ambiguous needs, AI may hesitate between invoking different business tools. A typical example is users purchasing New Year goods in advance, requiring further clarification to determine whether to use instant retail or far-field e-commerce for same-day or next-day delivery.

Similar scenarios arise in ticketing, travel bookings, and in-store group-buying. Qianwen must engage in multi-round dialogues to discern user intent and map it to different tools. If users feel like they're "helping AI fill parameters," AI will hardly be seen as a convenient entry point.

Accompanying increased consumption is after-sales support. Even if the ordering process is smooth, issues must be resolved. In traditional machine learning algorithms, after-sales tasks like cancellations and refunds are already challenging. Qianwen, emphasizing actionable capabilities, may face significant hurdles in this area.

From this perspective, Qianwen's Spring Festival offensive is not just about actively participating in entry-point competition but also serves as a group-wide "wind tunnel test." It utilizes the most intense dining, entertainment, and leisure scenarios to simultaneously expose the strengths and limitations of action-oriented AI. Whether Qianwen can retain this pathway after the festival will determine if Alibaba's AI2C is merely a marketing stunt or a genuine super entry point.

Stepping Out of the Walled Garden

In an interview, Amazon CEO Andy Jassy, when asked about OpenAI's impact on its advertising business, stated that people shopping on Amazon largely commence their journey there. This is partly attributable to Amazon's vast product selection, competitive prices, and fast delivery speeds.

Agent technologies making leapfrog advancements have begun to tentatively venture into physical-world execution capabilities. Regardless of whether users can place their trust in AI, the core metrics they truly care about remain the familiar factors of price, timeliness, and service quality.

Admittedly, Jassy's remark carries a hint of "let them eat cake" privilege. As a retail giant rooted in the industry for decades, Amazon's access to user search and purchase history naturally gives it a stronger foundation for personalized understanding and capabilities compared to third-party AI. While this advantage is downplayed, we cannot deny that if large models fail to meet user demands for "variety, speed, quality, and affordability" in their organizational results, such AI recommendations lack commercial viability.

Based on this, revisiting Alibaba's centralized design, AI dissolves the app walls within its ecosystem, attempting to sell convenience to users. These presentations are grounded in Alibaba's actual consumption business conditions—the "convenience" it promises ultimately returns to a traditional commercial proposition: supply organization efficiency.

This 3 billion yuan entry-point experiment essentially seeks a balance point. It must leverage its vast supply base to empower AI with "actionable" capabilities while finding a symbiotic path between user trust and ecosystem closure.

Only then, having been honed by ecosystem consumption businesses, might AI have a chance to step out of the walled garden and into the broader market-driven landscape.