AI Red Envelope Battle: BAT is "Distributing Money", while SenseTime is "Calculating Money"?

![]() 02/06 2026

02/06 2026

![]() 326

326

The heat in the AI-to-Consumer (AI to C) battlefield rises again during the Year of the Horse Spring Festival.

On February 2, Alibaba's QianWen announced a "Spring Festival Hospitality Plan" with a 3 billion yuan investment. The AI red envelope battle during the Spring Festival saw BAT all joining in.

While AI applications from tech giants are in full swing, other second- and third-tier AI large model players are inevitably left out in the cold.

Seeing neighbors generously distributing red envelopes, SenseTime's AI Agent application, "Kapi Accounting," quietly announced that its core functions would be permanently free. "Kapi Accounting" is a consumer-facing (To C) application launched by SenseTime based on its "SenseNova" large model, marking an important attempt in SenseTime's AI to C business.

In the AI To C application market, the more intense the red envelope battle among top players, the more awkward user growth becomes for second- and third-tier players.

AI large model players outside of BAT face a harsh reality: as Alibaba and Tencent make significant investments in AI to C applications, the living space (Note: " living space " is translated as "room for survival" to maintain the context) for AI applications in second-tier niche scenarios may be further compressed.

For example, with overwhelming advantages in user stickiness, updates to intelligent agents like Doubao and QianWen could potentially cut off the livelihoods of these vertical-scenario AI applications, making it difficult to continue the AI to C narrative.

So, how should AI players like SenseTime capitalize on this wave of structural AI dividends? After the entry of tech giants, how meaningful is it to continue investing in the AI to C track (Note: " track " is translated as "track" to fit the context)?

These questions warrant deep consideration.

Tech Giants Throw a Party: Have SenseTime and Others Reaped the AI Dividends?

Generative AI represents a structural opportunity—this is a consensus. However, besides ByteDance, Tencent, and Alibaba, few AI companies from the previous era have truly seized this structural opportunity.

Apart from Baidu, the AI stars of the previous era were the "Four AI Dragons," among which only SenseTime remains a significant player.

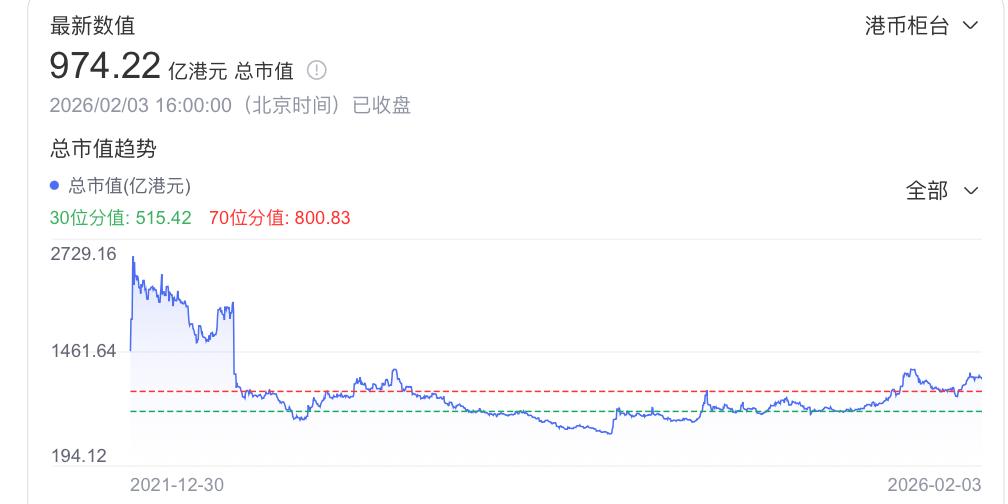

From a market perspective, the response to SenseTime's recent AI transformation has been lukewarm.

From 2024 to the present, SenseTime's market capitalization has generally trended upward but has not undergone a qualitative transformation. Its current market value is still far below half of its historical peak.

Now, let's look at Baidu during the same period. At its peak in early October 2024, Baidu's market value was approximately HK$300 billion; now, it is close to HK$400 billion.

Why compare with Baidu?

Although SenseTime and Baidu differ in scale and core businesses, they share similarities: both were AI stars of the previous era, facing challenges in their old growth models and urgently needing to transition to the AI era.

Judging by changes in their market values, the market still favors Baidu more and seems to have some reservations about SenseTime.

I believe this difference manifests in two aspects:

The stability of the "ballast stone" business is crucial.

Baidu saw a recovery in its core business in the fourth quarter of 2025, with institutional forecasts predicting a 7% quarterly growth in Baidu's core revenue to 26.5 billion yuan. In contrast, while SenseTime's losses have narrowed, its profitability outlook remains unclear, and its old growth pillars are also shrinking.

First, revenue from its visual AI business has declined.

Data shows that in the first half of last year, revenue from this business fell by 14.8% year-on-year.

Second, revenue from "X Innovation Businesses" (including intelligent driving, smart healthcare, home robots, and smart retail) was 107 million yuan in the first half, down about 39.6% year-on-year. The decline in revenue from "Jueying" (intelligent driving) was the main reason.

The pace of decline in "ballast stone" businesses like AI vision may still be too fast. In other words, the urgency for SenseTime's AI large model transformation and commercialization has increased.

So, has the past transformation been effective?

Yes, but not enough.

In the first half of last year, SenseTime's generative AI business revenue reached 1.816 billion yuan, up 72.7% year-on-year. During the same period, its adjusted net loss also halved.

On the surface, the transformation seems to have yielded positive results. Moreover, with the continuous commercialization of the "SenseNova" large model, generative AI revenue accounted for 77% of SenseTime's total in the first half of last year.

Although the data looks better, the fundamental contradiction remains unresolved.

This contradiction is that the scale of profitable business is insufficient, generative models require continuous investment, and the company may still face a structural phase of financial bleeding in the future.

This leads to the second point.

Strategic transformation into generative AI takes time, and large model businesses must always survive in the cracks between tech giants. Moreover, they have reached a stage of resource-driven growth, making it difficult to "increase revenue and reduce costs."

What should be done?

As SenseTime's Chairman and CEO, Xu Li's solution is twofold: address funding issues through share placements and adjust the strategy to further focus on generative AI while restructuring business lines.

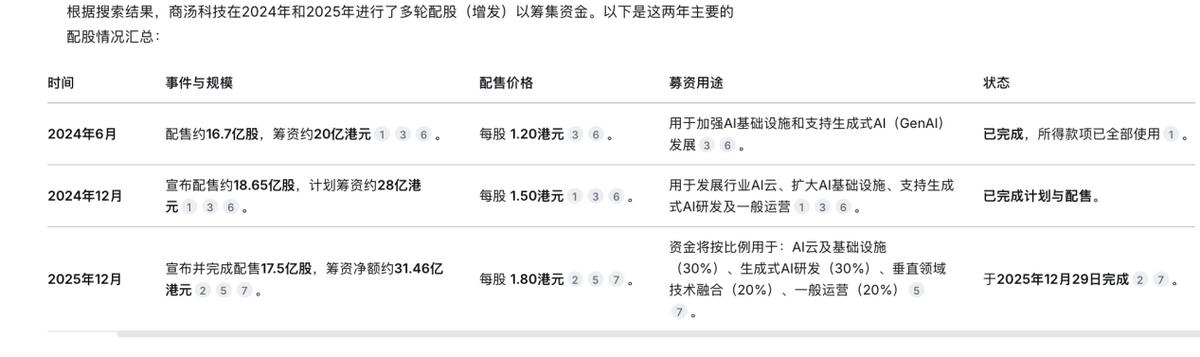

According to DeepSeek, SenseTime conducted three share placements from 2024 to 2025, raising a total of over HK$7.9 billion.

By the end of June last year, SenseTime held 13.2 billion yuan in cash and equivalents, plus the 3.14 billion yuan raised by the end of December last year. Even if no money is spent in the second half, the total cash reserves would amount to approximately 16 billion yuan by year-end.

The question then arises: how long can this level of cash reserves sustain high-intensity AI investments?

Currently, Alibaba has publicly committed to investing 300 billion yuan, while Tencent and ByteDance also appear determined to continue investing, unwilling to cede market share. The competition in AI to C is set to enter an even more intense phase. If industry competition intensifies further, the squeezing effect from tech giants will become more pronounced, and second-tier players will need additional funds for AI R&D.

So, with its current funding level, can SenseTime join the first tier in the generative AI field?

Ultimately, this question must be answered by Xu Li, the Chairman and CEO.

Advancing the "1+X" Strategy: SenseTime and Xu Li Have "No Choice"

On the AI path, Xu Li has long planned a backup strategy for SenseTime.

Starting from the end of 2024, Xu Li began implementing a "1+X" organizational structure, establishing a transformation direction toward generative AI. The so-called "1+X" refers to "1" as the core business, including AI cloud, foundational models, AI applications, and CV general-purpose visual models; "X" refers to a matrix of ecosystem enterprises formed through restructuring and spin-offs.

From an external perspective, the "1+X" strategy is essentially a "spin-off strategy."

Spinning off businesses offers two major advantages:

First, it provides organizational flexibility for subsequent independent listings or financing of businesses; second, it offers more imagination space for the capital market.

Referencing Baidu's spin-off of Kunlun Chip business and Alibaba's spin-off of Cainiao, the underlying logic of business spin-offs is the same.

In other words, Xu Li's "1+X" strategy can, in a sense, be seen as a "financing strategy."

However, in reality, this idea may not necessarily succeed.

Why did Alibaba halt business spin-offs and refocus on AI and big consumption as its strategic mainline? I believe one reason is that Alibaba realized that this round of AI market enthusiasm is essentially about AI to C and AI chips.

Why has Baidu's stock price surged?

Simply put, it's because of Kunlun Chips. Baidu's valuation recovery owes much to the spin-off of Kunlun.

But the essence of the chip boom lies in the logic of AI computing power investment superposition (Note: " superposition " is translated as "combined with" to convey the meaning) domestic substitution. Although the import of H200 chips has been approved, the core narrative of computing power autonomy remains unchanged. Therefore, Alibaba has also begun preparing for the listing of T-Head, aiming to build a landscape of chips + AI infrastructure + big consumption.

For SenseTime, as a demander of computing power, greater AI computing power demand means larger investments in infrastructure construction. The story of AI chips doesn't work for SenseTime.

If the chip story doesn't work, what about AI to C?

Why is AI to C hot?

I believe it's not just about AI technology but because Yuanbao, QianWen, and Doubao's core imagination is the next "super entrance." While tech giants tell AI stories on the surface, they are still driven by the mobile internet's commercial core narrative.

Look, short videos have reshaped traffic entrances, giving rise to Douyin's trillion-GMV e-commerce and new growth in local life services. Will this story repeat in the era of AI large models? Today, in the field of AI large models, it's ultimately ByteDance, Tencent, and Alibaba that are fiercely competing.

For SenseTime and others, transitioning to AI To C may ultimately lead to a "dilemma":

Focusing solely on AI infrastructure lacks imagination, while transitioning to AI To C means "encroaching on the turf of tech giants."

Even if SenseTime's "1+X" strategy succeeds, the market may not truly buy into the narrative logic of "spin-off financing."

Because this narrative logic is too costly.

In this Spring Festival AI red envelope battle, QianWen casually invested 3 billion yuan. SenseTime's 2025 interim revenue was only 2.358 billion yuan.

With a single move from the QianWen business group, half of SenseTime's annual revenue is invested. How can this game continue? Continuing to burn money on To C businesses—how meaningful is that?

Moreover, ultimately, AI large model applications are not just about the scale of funding but also about the return on investment.

Recently, the market's reaction to QianWen's announcement to join the red envelope battle has been intriguing. After announcing the "Spring Festival Hospitality Plan," Alibaba's stock price retreated slightly over the past two days.

The market is not worried that Alibaba won't win but that winning won't be cost-effective.

Imagine if the AI large model battle turns into another "food delivery subsidy" war, the outcome would likely leave no winners. By the same token, if we replace Alibaba with SenseTime, would the market's reaction be different? Probably not.

For SenseTime, the current situation is, to some extent, a "historical legacy" issue.

From 2020 to the present, SenseTime's Net profit attributable to shareholders (Note: " Net profit attributable to shareholders " is translated as "net profit attributable to shareholders" to maintain financial accuracy) has been in the red. Of course, after years of effort, SenseTime's net profit losses have significantly narrowed, and these achievements cannot be denied. However, for many years, SenseTime has been a "financing" innovation enterprise driven by external forces.

According to Tianyancha APP, based on incomplete statistics, including its IPO, SenseTime has undergone at least nine rounds of financing.

There's nothing wrong with relying on external financing for business development. When Dr. Tang Xiaoo founded the company, he started from scratch. Without external financing, there would be no SenseTime with a market value of hundreds of billions today.

However, in the long run, relying on external forces is not the optimal solution.

Going forward, for SenseTime to raise funds, it must demonstrate profitability on its financials. But to achieve profitability, it must reduce budgets and increase revenue while cutting costs. However, today, the era of AI's great transformation is far from over, and investments in large models are essential. Tech giants are still doubling down, and SenseTime is far from reaching profitability.

Bread or future?

This question seems to have been answered by Xu Li.

In the era of Tang Xiaoo, SenseTime focused on AI vision and achieved its historical breakthrough with an IPO, but the company's profitability issue remained unresolved. In Xu Li's era, there are more opportunities and challenges, but the long-standing issue of losses is even more severe.

It's not that SenseTime chooses the era; the era has chosen SenseTime, and at this juncture, SenseTime and Xu Li have no choice.

What innovative path will SenseTime, under Xu Li's leadership, take next? How will the structural dividends brought by AI materialize under SenseTime's "1+X" strategy?

It's worth continuing to watch.

Disclaimer: This article is based on legally disclosed company information and publicly available data, offering commentary. However, the author does not guarantee the completeness or timeliness of this information. Additionally, the stock market carries risks, and caution is advised when entering. This article does not constitute investment advice, and investment decisions must be made independently.