Apple falls out of the top five! PC market upheaval: AI PC becomes the hope of the entire market

![]() 09/29 2024

09/29 2024

![]() 566

566

AI PC and national subsidies drive a new round of growth.

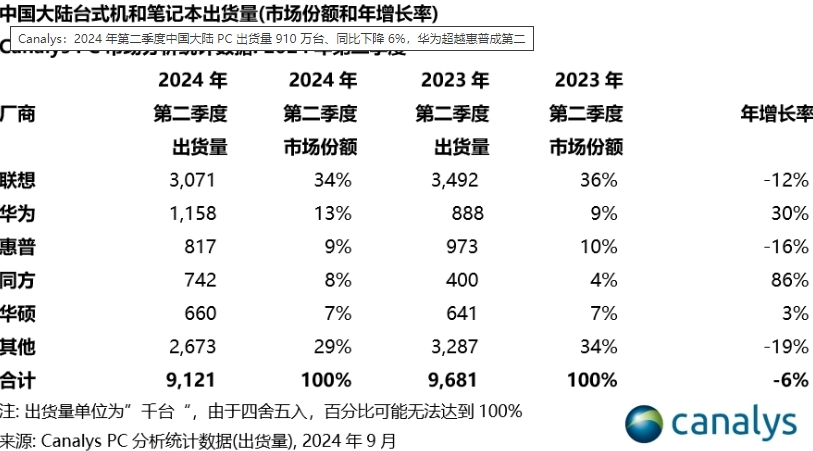

Recently, Canalys released a report on PC shipments in mainland China for the second quarter of 2024. The PC shipments in the report include desktops, laptops, workstations, and tablets, but tablets are calculated as a separate category.

Slowdown in PC decline, Apple falls out of top five

The data shows that PC shipments in mainland China during the quarter reached 9.1 million units, a year-on-year decrease of 6%. Although the overall PC market is still declining, the decline has significantly slowed compared to the first quarter of 2024. In comparison, PC shipments in mainland China in the first quarter of 2024 were only 7.94 million, with a year-on-year decrease of 12%.

Source: Canalys

Notably, Tongfang jumped to fourth place in the PC shipment rankings with a growth rate of 86%, shipping 742,000 units in the second quarter, capturing an 8% market share, slightly surpassing ASUS. Tongfang's impressive performance has somewhat mitigated the downward trend in the market and suggests that some purchasing power remains untapped in the market.

After Tongfang entered the top five, Apple, which ranked fifth in the first quarter, was squeezed out of the top five rankings, becoming part of the "others" category. This is the second time Apple has fallen out of the top five in digital product rankings after the smartphone rankings in the second quarter of 2024, with only tablet shipments remaining in the top five.

In addition to Tongfang, Huawei also performed impressively in the second quarter, with a year-on-year increase of 30% and shipments reaching 1.158 million units, although there is still a significant gap compared to Lenovo, which ranked first.

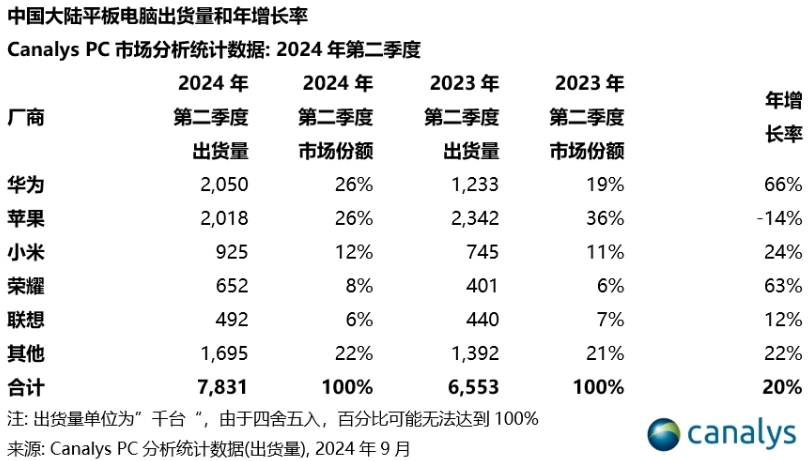

Turning to the tablet category, tablet shipments in the second quarter reached 7.8 million units, a year-on-year surge of 20%. Huawei continued to surpass Apple as the top-shipping brand with 2.05 million units, slightly exceeding Apple's 2.01 million units, although the lead narrowed compared to the first quarter. However, Huawei's tablet shipments still grew by a staggering 66% year-on-year, contributing significantly to the surge in tablet shipments.

Source: Canalys

Apart from Huawei, Honor also performed impressively, ranking fourth with 652,000 shipments, a year-on-year increase of 63%, second only to Huawei. Xiaomi maintained its third position with 925,000 shipments, almost unchanged from the first quarter. Overall, in the second quarter of 2024, all tablet brands except Apple experienced significant growth, with Apple's shipments declining 14% year-on-year.

The surge in tablet shipments is primarily attributed to a flurry of new tablet launches in the first half of the year, coupled with frequent price cuts and promotions, which spurred demand for replacements. However, as the overall rankings remained relatively unchanged, the subsequent analysis will focus on PC data.

Tongfang's turnaround as a dark horse, with Mechrevo playing a pivotal role

In Canalys' report, the most notable aspect is Tongfang's entry into the top five and the displacement of Apple. For those unfamiliar with the PC market, they may be wondering which brand Tongfang is and why they rarely see its computers in the market.

Even if you search on platforms like JD.com, you might only find the PC brand "Tsinghua Tongfang," with dismal sales figures, as all product page ratings are below 5,000, far below the average sales of third-tier brands. So where do Tongfang's sales come from?

Firstly, Tsinghua Tongfang does belong to the same Tongfang mentioned in the rankings, but it is only one of its sub-brands. Tongfang is also one of the largest PC ODM manufacturers in China, with well-known brands like Mechrevo, Mechanic Master, Thunderobot, Hot-Blood, and Hasee using Tongfang's PC molds for some or all of their products.

Source: Tsinghua Tongfang

However, Tongfang's most directly controlled sub-brands are Tsinghua Tongfang, Tongfang Computer, and Mechrevo. Based on other market information, Tongfang's surge in shipments is primarily attributed to increased government procurement and Mechrevo's sales growth.

In the consumer PC market, Mechrevo has become one of the most watched brands in recent years, with its cost-effective market strategy and gradually improving product lines and quality driving significant growth in both reputation and sales.

In recent months, Mechrevo has successively launched several popular products, becoming one of the most recommended brands in the price range below 5,000 yuan. Moreover, as Tongfang's high-end molds begin mass production, Mechrevo is accelerating its market share capture in the 5,000-8,000 yuan range.

If you follow laptop recommendations on platforms like Bilibili and Baidu Post Bar, you'll find Mechrevo frequently recommended, with a presence in all but the high-end market above 10,000 yuan. Interestingly, Mechrevo has a clear understanding of its positioning and rarely ventures into the high-end market above 10,000 yuan, allowing it to focus more on the broader mid-to-low-end market.

Why is Mechrevo popular among consumers? The answer is simple: its high cost-effectiveness. While most brands' Core i5 Ultra series laptops still cost over 5,000 yuan, Mechrevo's Wujie 14 Pro has already reduced its price to below 4,000 yuan. It also boasts impressive hardware, including a 2.8K 120Hz high-resolution display with a maximum brightness of 400 nits and a standard 1TB SSD storage.

Source: JD.com

When comparing products of similar prices, you'll find that other brands with the same processor are generally more expensive by hundreds of yuan and inferior in terms of display, mold, and power supply. Products with similar hardware configurations to the Mechrevo Wujie 14 Pro generally cost over 5,000 yuan, with a price difference of nearly 30% that can easily outweigh brand reputation gaps.

Under the influence of Mechrevo, the average price of lightweight laptops in the market has been declining in the past six months, with Lenovo, ASUS, Acer, HP, and other manufacturers launching many cost-effective mid-to-low-end products. The PC market is entering a new round of price wars.

AI PCs and national subsidies: Is the PC market taking off?

Judging from the PC shipment data for the first and second quarters of 2024, the PC market in mainland China is showing an overall trend of recovery, with the year-on-year decline in the second quarter significantly reduced. In the third quarter, Lenovo, Huawei, ASUS, HP, and other manufacturers have successively launched new AI PCs, with a large number of Snapdragon-powered PCs attracting market attention (for those interested, you can check out my previous review of the Snapdragon-powered YOGA Air 14s).

Apart from the mass rollout of Snapdragon-powered PCs, Intel's Core i5 200v series laptops will also be launched in October, with many reviews already available. Test results show that while there is no significant performance improvement, the laptops deliver impressive battery life, comparable to the renowned MacBook in this regard, raising questions about Intel's "magical" creations.

Source: Intel

As inventories of older processors gradually deplete, it is foreseeable that Core i5 Ultra, Snapdragon X, and AMD AI series will become the primary platforms for lightweight laptops, with AI services and long battery life becoming standard features.

For those who frequently travel and work on the go, the experience provided by the new generation of lightweight laptops will be superior to most previous laptops. In terms of battery life alone, the new generation can easily achieve over 10 hours of use while maintaining a certain level of performance, significantly enhancing the overall experience.

Moreover, AI applications for PCs are also rapidly iterating. Lenovo recently unveiled its new AI PC at IFA, highlighting several intriguing features. For instance, the PC can automatically adjust its mode based on the user's usage scenario for an optimal experience and learn the user's habits to adjust the PC system, creating a notable difference in experience compared to traditional PCs.

Source: Leitech

In addition to the upcoming wave of upgrades driven by AI PCs, the nationwide PC trade-in subsidy program, which began on September 1, has also injected new vitality into the PC industry. With a maximum subsidy of 20%, a laptop originally priced at 10,000 yuan can now be purchased for only 8,000 yuan (note that the subsidy can be enjoyed even without trading in an old device; for more details, see my guide on trade-in subsidies).

Even in the Leitech editorial department, many editors have taken advantage of this opportunity to upgrade their old computers to new ones. The tangible benefits have significantly stimulated consumption. Furthermore, trade-in subsidies in regions such as Beijing, Shanghai, Guangdong, and Sichuan have been expanded nationwide, removing restrictions on delivery addresses and offering hope to provinces that have not yet launched similar programs.

Driven by both AI PCs and national subsidies, PC shipments in mainland China are expected to surge in the third quarter. To capitalize on this upgrade trend, various brands are likely to launch more competitive products in the coming months. If you're planning to buy a new computer but are still hesitant, it might be worth waiting a bit longer.

Source: Leitech