Apple’s iPad Market Share Tumbles by 14%: Is the iPad on Its Way Out?

![]() 12/09 2025

12/09 2025

![]() 456

456

When the topic of tablets arises, Apple’s iPad is undoubtedly the first device that springs to mind for most people. As the trailblazer in the tablet arena, Apple has long held sway over the tablet market. However, recent news has surfaced indicating that Apple’s market share in China has taken a significant hit, dropping by 14%. Is the iPad truly becoming a relic of the past?

I. Apple’s iPad Market Share Takes a 14% Dive

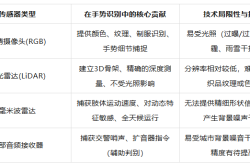

According to Jiemian News, international market research firm Omdia recently unveiled data on the Chinese mainland tablet market for the third quarter of 2025. The tablet market maintained its robust momentum this quarter, with shipments surging by 9% year-on-year to reach 8.8 million units. Nevertheless, the market landscape among leading brands witnessed substantial shifts.

In the third quarter, Apple’s iPad shipments plummeted by 14% year-on-year, totaling 2 million units. Consequently, its market share dwindled from 29% in the same period the previous year to 23%. Conversely, Lenovo emerged as the frontrunner in single-quarter growth, boasting a 71% year-on-year increase. It matched Xiaomi’s shipments at 900,000 units, propelling its market share from 6% to 10%.

In terms of shipments alone, this quarter’s market displayed a stark divergence, with domestic brands taking the lead and Apple experiencing a decline. Huawei maintained its top spot, shipping 2.7 million units and commanding a 31% market share, a 21% year-on-year increase. This widened its lead over Apple by 8 percentage points. Xiaomi and Lenovo each shipped 900,000 units, while Honor shipped 600,000 units. Collectively, domestic manufacturers accounted for 77% of the market share, up 5 percentage points from the same period the previous year.

In truth, the decline of Apple’s iPad was not without precedent. The company’s financial reports revealed that iPad revenue in the third fiscal quarter of 2025 was $6.58 billion, down 8% year-on-year and falling short of market expectations. In the fourth fiscal quarter, iPad revenue was $6.952 billion, showing a mere 0.03% year-on-year increase, essentially flat compared to the same period the previous year. Apple attributed this to the high revenue base established by the release of new iPad Air and iPad Pro models in the same period the previous year.

II. Has the iPad Truly Become a Relic?

The recent news of Apple’s iPad market share plummeting by 14% has sparked widespread concern and speculation. Many are now asking: Is the iPad no longer relevant? How should we interpret this development?

Firstly, the decline of the iPad is not a sudden occurrence but rather a long-term trend. Looking back, the iPad’s market share has been on a downward trajectory for some time. When the first-generation iPad was introduced in 2010, it successfully carved out a new niche in mobile computing, positioned uniquely between smartphones and laptops. Its large touchscreen, lightweight design, and long battery life quickly made it a favorite in the consumer electronics market, even being touted as the mainstream terminal for future office work and learning.

However, as time elapsed, Apple’s pace of innovation in the iPad lineup slowed considerably. Longer update cycles, conservative feature iterations, and a system ecosystem that failed to truly break free from being a “larger iPhone” gradually transformed the iPad from a “leader” to a “follower.” This structural contradiction of “advanced hardware but lagging software” significantly weakened users’ willingness to upgrade and their loyalty to the iPad. Hence, the decline in market share is not a sudden rejection by the market but a rational response from consumers to Apple’s lackluster product strategy.

Secondly, the rise of domestic tablets has also siphoned market share away from the iPad. In recent years, domestic tablets have made a strong comeback, forming a “siege” through localized innovation and precise positioning that has dismantled the iPad’s market barriers. If Apple’s complacency is an internal factor, then the rapid breakthroughs by domestic manufacturers are the key external force driving the reconfiguration of the market landscape. Domestic tablets were once labeled as “cost-effective alternatives,” but brands like Huawei, Xiaomi, Lenovo, and Honor have now transitioned from “followers” to “leaders.”

Consider two straightforward examples. Huawei has leveraged the cross-device collaboration capabilities of its HarmonyOS to position its tablets as the core nodes of a “super terminal.” Features like “one-swipe connection” for device interoperability and seamless multi-screen tasking precisely address the pain points of mobile office work and learning, enabling its market share to surpass and widen the gap with Apple. Lenovo, on the other hand, has achieved explosive growth through a strategy of “segmented scenarios + price penetration.” Its customized tablets for the education market come pre-installed with course resources and parental control systems, meeting the rigid demands of online education. Meanwhile, its mass-market models cater to light office and entertainment needs with high refresh rate screens and long battery life, all at half the price of an iPad.

The core competitiveness of these domestic tablets lies in their shift from “hardware specification comparisons” to an “ecosystem competition” of “hardware + software + services.” In contrast, the iPad’s closed ecosystem falls short in adapting to local applications, with many professional software programs remaining at the stage of smartphone port adaptations, unable to meet the localized needs of Chinese users. It is inevitable that they will be surpassed by domestic models.

Thirdly, the development of mobile smart terminals has begun to blur the lines of the iPad’s domain. Over the years, with the rapid evolution of the mobile smart market, the convergence of mobile device market boundaries has significantly diminished the iPad’s “irreplaceability.” From the perspective of the Jobs era, the core value of tablets was to bridge the gap between the small screens of smartphones and the lack of portability of computers. At that time, smartphone screens were generally around 4.5 inches, while laptops and desktop computers exceeded 13.3 inches. The vast gap between 4.5 inches and 13.3 inches became the foundation for the survival of tablets. However, over the years, this value proposition has been gradually eroded by technological advancements.

On one hand, smartphone screen sizes have continuously expanded, jumping from 5 inches to 6.7 inches or even larger today. Coupled with split-screen functionality and large-screen optimizations, they can now fulfill most lightweight entertainment and information acquisition needs, significantly encroaching on the “fragmented usage scenarios” that once belonged to tablets. On the other hand, the rise of foldable smartphones has further squeezed the living space of tablets. Their form factor of “unfolded as a tablet, folded as a smartphone” perfectly balances large-screen experience and portability, making many consumers no longer feel the need to purchase a tablet separately.

More importantly, the functional innovations of foldable smartphones are more appealing, such as hover shooting and split-screen multitasking, directly covering the core usage scenarios of tablets. Meanwhile, the iPad’s disadvantages in mobility have become increasingly apparent. This demand substitution is not an isolated case but a widespread industry trend. When users can accomplish multiple functions with a single device, their willingness to pay specifically for a tablet naturally declines. The iPad, positioned as a high-end and relatively expensive product, has become the first choice that users abandon.

Fourthly, where should tablets head in the future? In the long run, tablets cannot be confined to being just an entertainment tool. How to truly become an indispensable piece of smart hardware is a question that the entire industry must confront. Currently, the primary uses of most tablets are still centered around entertainment activities such as watching videos, playing games, and reading e-books. Their applications in office work, learning, and creation are not yet deeply or widely entrenched.

To achieve sustainable development of tablets, all stakeholders in the industry need to collaborate to steer tablets towards a more diversified and specialized direction. On one hand, tablet manufacturers need to ramp up R&D investment to enhance product performance and functionality, endowing tablets with more productivity attributes. For instance, developing more efficient office software and professional-grade creative tools to meet users’ needs in office work, learning, and creation.

On the other hand, it is imperative to strengthen cooperation with other industries to expand the application scenarios of tablets. For example, collaborating with the education industry to develop tablet products and applications tailored for teaching and learning; partnering with the healthcare industry to apply tablets in areas such as telemedicine and health management. Through these measures, the value and competitiveness of tablets can be elevated, making them truly indispensable smart hardware in people’s lives and work.

Only in this manner can tablets truly achieve their long-term development and avoid becoming mere dust-collecting “relics” at home. Where the iPad should go is also a question that is testing the management of Apple.