Sluggish Performance Growth, Transsion Holdings Sets Sights on Africa's 'Electric Mopeds'

![]() 12/11 2025

12/11 2025

![]() 493

493

In the future, not only will Transsion Holdings' mobile phones be available in Africa, but its computers, kitchen appliances, and even electric vehicles will also make their way into local markets.

Recently, the company has launched a bid for the Hong Kong Stock Exchange's main board, planning to use the raised funds to intensify the construction of its intelligent business ecosystem and further solidify its position in the African market.

Faced with sluggish performance growth and increasing competition in its stronghold African market, Transsion Holdings can no longer sit idle. To this end, the company is building a business ecosystem centered around mobile phone products, introducing wearable devices, kitchen appliances, and ramping up its presence in the electric vehicle mobility sector, targeting the new energy mobility market in Africa and emerging markets.

Compared to the domestic market's advantages in power supply, promoting electric vehicle businesses in these emerging markets is not easy, involving the implementation of charging and battery-swapping facilities, which may take longer.

However, this is the necessary path for Transsion Holdings to transform from a single mobile phone manufacturer into a global technology enterprise.

Sluggish Performance Growth

In its sprint for the Hong Kong Stock Exchange's main board, Transsion Holdings (688036.SH) has maintained the high efficiency typical of manufacturing enterprises. On December 3rd, the day before disclosing an announcement on the A-share market, it had already submitted its H-share listing materials to the Stock Exchange of Hong Kong.

This race against time is conveying another reality to the outside world: the company is experiencing its most challenging period since its A-share listing, with a more pronounced slowdown in performance growth.

In the first three quarters of 2025, the company achieved revenue of 49.543 billion yuan and net profit attributable to shareholders of 2.148 billion yuan, representing year-on-year decreases of 3.33% and 44.97%, respectively.

If calculated from the second quarter of last year, the company's net profit attributable to shareholders has shown negative growth for six consecutive quarters. Affected by rising costs and intensified market competition, the company's profitability has continued to decline. The gross profit margin in the third quarter of 2025 dropped to 19.47%, the lowest since its listing.

The mobile phone business is Transsion Holdings' most important source of revenue, consistently accounting for over 90% of its total revenue. From 2022 to 2024, the mobile phone business achieved revenues of 42.518 billion yuan, 57.34 billion yuan, and 63.197 billion yuan, respectively. This year, however, this core business suddenly took a downturn, with revenue in the first half of the year reaching 26.093 billion yuan, a year-on-year decrease of 18.41%.

Africa and emerging Asia-Pacific markets are the two major markets for the company's mobile phone business. In the first half of this year, they achieved revenues of 9.651 billion yuan and 10.41 billion yuan, respectively, representing year-on-year decreases of 4.45% and 19.56%. Additionally, markets such as the Middle East, Latin America, Central Europe, and Eastern Europe all experienced varying degrees of decline.

Transsion Holdings entered Africa in 2006 and has been deeply rooted there ever since. From 2017 to around 2020, revenue from this market once accounted for half of the company's total revenue. However, as domestic mobile phone companies have successively ventured into Africa, Transsion Holdings' local advantage is being eroded.

From 2022 to 2024, the company's mobile phone sales in the African market were 96 million units, 106 million units, and 104 million units, respectively. In the first half of this year, sales suddenly dropped by 19.23% year-on-year to 42 million units.

Overall, the scale of the company's distributors has shrunk, with 2,981 at the end of the first half of this year, a decrease of 281 from the end of last year.

Low-End Encirclement

The success of Transsion Holdings primarily stems from its early entry into overseas markets and its localization in Africa, coupled with the active support from the domestic mobile phone industry chain. One of its well-known achievements is solving the challenge of photographing dark-skinned individuals with mobile phones, which served as a significant advantage.

In the African market, the company's first brand, TECNO, targeted mid-to-high-end consumers, addressing issues such as dual SIM card support and extended battery life. Upon its launch, it quickly became a bestseller in the local market.

Subsequently, the company capitalized on its success and introduced Infinix, a fashionable brand aimed at young consumers, as well as the itel brand, which emphasized cost-effectiveness and reliability for mass-market consumers, forming a matrix of three major brands.

Transsion Holdings enjoyed a market feast in Africa, thousands of miles away. In 2015, its shipments in the African market exceeded 50 million units, and in 2017, it surpassed Samsung to claim the throne of Africa's mobile phone king. According to Frost & Sullivan, based on mobile phone sales in 2024, the company ranked first in Africa with a 61.5% market share.

However, its shortcomings have long been apparent. For years, Transsion Holdings has primarily focused on low-end mobile phones in the African market, with a high sensitivity to costs. As leading domestic mobile phone companies such as Honor and Xiaomi have successively entered the African market, competition has further intensified. Coupled with the surge in memory chip prices, production costs have risen further, making it difficult for low-end mobile phones to transfer cost pressures through price increases, thus squeezing profit margins.

Transsion Holdings finds itself in a dilemma: lowering prices to maintain market position will inevitably affect profitability, while ramping up efforts in the mid-to-high-end market will make it difficult to compete with other rivals.

Perhaps in response to intensified market competition and rising chip prices, the company has adjusted its product prices in recent years. The average selling price (ASP) of smartphones decreased from 551.4 yuan in 2022 to 543.8 yuan in 2024, with a slight increase to 547.5 yuan in the first half of this year. During the same period, the ASP of feature phones dropped from 65.5 yuan to 55.7 yuan and then to 50.1 yuan.

Meanwhile, the gross profit margin of the mobile phone business has been on a downward trend amid fluctuations, standing at 19.1%, 22.9%, 20.2%, and 18.5%, respectively.

Setting Sights on Electric Vehicles

Nowadays, Transsion Holdings is attempting to transition from a single mobile phone business to a mobile phone-based intelligent ecosystem.

Beyond mobile phone products, the company has established two major business segments: mobile internet services and Internet of Things (IoT) products, similar to Xiaomi's business model.

However, compared to Xiaomi, which currently boasts a robust AloT ecosystem, Transsion Holdings is still in its infancy, with these two business segments contributing very limited revenue.

In the first half of 2025, the company achieved revenue of 29.283 billion yuan, with mobile internet services contributing 417 million yuan and IoT products and others contributing 2.568 billion yuan, accounting for 1.4% and 8.8% of its total revenue, respectively.

Mobile internet services primarily involve providing application downloads, games, and other services through its self-developed mobile phone operating system. The company's biggest highlight lies in its IoT products business.

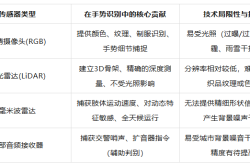

The IoT business segment mainly revolves around hardware and software: hardware devices include laptops, tablets, wireless earphones, smartwatches, home appliances, energy storage products, and light electric mobility devices; supporting software includes technical support for network connectivity and intelligent control, jointly constructing an IoT ecosystem covering home, mobility, and work scenarios.

According to the prospectus, the company has developed kitchen appliances suitable for efficiently cooking traditional African dishes based on market preferences in Africa. Additionally, it has prioritized the expansion of light electric mobility devices, having launched two series of products: Revoo for individual users and TankVolt for passenger and freight transportation needs.

Revoo primarily meets market demands for commuting and food delivery; TankVolt mainly consists of electric two-wheelers and three-wheelers equipped with charging and battery-swapping facilities, having expanded its business to African countries such as Kenya and Tanzania.

Motorcycles are traditional means of transportation and livelihood tools in Africa and other emerging markets. Under the trend of new energy transformation, light electric mobility vehicles are widely favored due to their economic and environmental advantages. According to the prospectus, the market size for light electric mobility vehicles in emerging markets has grown from 7.3 billion US dollars in 2020 to 12.3 billion US dollars in 2024, with a compound annual growth rate of 13.9%, and is expected to reach 25.4 billion US dollars by 2029.

Such market prospects have attracted many companies to enter the field. Among them, Zeno, an electric mobility company founded by a former Tesla executive, has already entered the African market.

Compared to the domestic market with abundant power supply, the disadvantage of power supply in Africa is bound to affect the promotion of Transsion Holdings' electric vehicle business. Additionally, the need to invest in the layout of charging, battery-swapping, and battery leasing systems poses significant challenges during business expansion.

The intended use of funds from the company's planned Hong Kong Stock Exchange listing reveals its strategic direction, including strengthening investment in mobile internet services and IoT products, researching and developing AI technology and accelerating product iteration, as well as investing in market promotion and brand building.