Sales hit bottom, will SAIC-GM make major adjustments?

![]() 08/19 2024

08/19 2024

![]() 641

641

Recently, foreign media reported: "GM will launch a layoff and reform plan in China to reposition the world's largest automotive market."

An informed source revealed that GM is laying off employees in departments related to the Chinese market, including the core R&D department. Additionally, GM will discuss potential production capacity reductions with SAIC Motor in the coming weeks as part of its strategic adjustment for selling American brands in China.

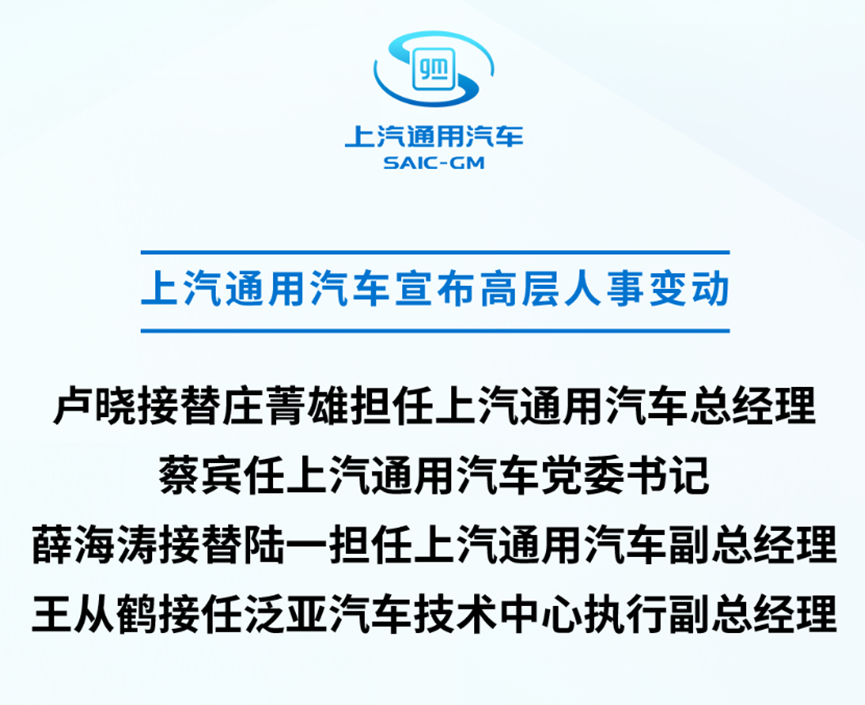

In fact, rumors of layoffs and senior management shakeups at SAIC-GM have been constant in recent years. In April, it was rumored that SAIC-GM planned to lay off 30% of its staff this year, with layoffs achieved through stricter performance standards and severance packages for low-level employees who voluntarily resign. Earlier, SAIC-GM was also rumored to be "planning to buy out the years of service of employees over 45 years old." While SAIC spokespersons denied these rumors, the frequent changes in senior management at SAIC-GM are undeniable. In its 27-year history, SAIC-GM has had seven general managers, including Hu Maoyuan, Chen Hong, Ding Lei, Ye Yongming, Wang Xiaoqiu, Wang Yongqing, and Zhuang Jingxiong, and now Lu Xiao has taken over.

Furthermore, Cai Bin, the former assistant president of SAIC Motor, has rejoined SAIC-GM as its Party Committee Secretary, while Xue Haitao, the former deputy general manager of SAIC-GM Wuling, has succeeded Lu Yi as the deputy general manager of SAIC-GM.

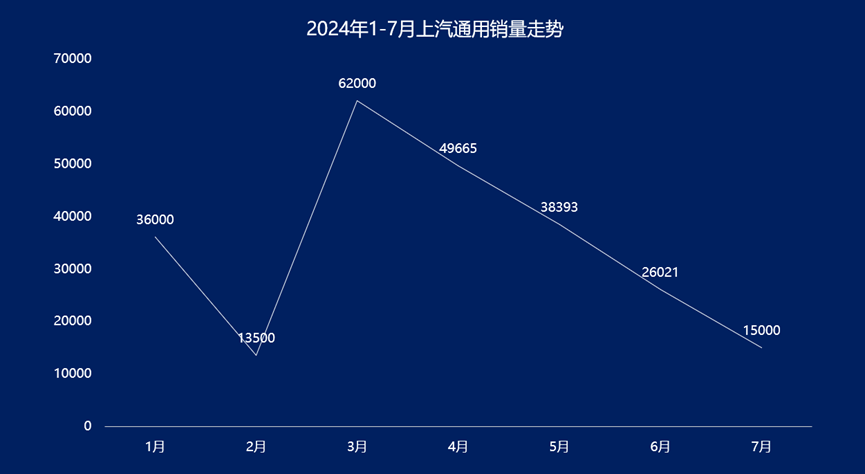

In fact, news of layoffs at SAIC-GM is nothing new, and production capacity reduction is the top priority of its strategic adjustment. In recent months, SAIC-GM has faced an even more severe market situation. In July, SAIC-GM sold only 15,000 vehicles, a year-on-year decline of 82.42%; from January to July, SAIC-GM sold a total of 240,579 vehicles, down 55.14% year-on-year, almost halving. Notably, SAIC-GM has seen the largest sales decline among SAIC Motor's subsidiaries this year.

After the news broke, GM China responded: "GM will continue to face challenges in the Chinese market, including changes in the competitive landscape, overcapacity, and aggressive pricing. Currently, GM is working closely with its joint venture partner to restructure its business for profitability and sustainable development. A series of important measures have been taken, including reducing inventory, producing on demand, protecting pricing systems, and lowering fixed costs."

Currently, against the backdrop of a fierce price war in the automotive industry, SAIC-GM has also resorted to price cuts. Among them, American car brands including Buick, Chevrolet, and Cadillac have significantly reduced their prices. The dealer reference prices for classic models like the Buick GL8 and Buick Regal are now 205,900 yuan and 114,800 yuan, respectively. The luxury model Cadillac CT4, with a guidance price of 219,700 yuan, is now priced at around 169,700 yuan, making it the "most affordable" model among second-tier luxury brands. Despite SAIC-GM following the market trend of price cuts, its sales have not improved significantly. Data shows that in July, Cadillac CT4 sold only 199 units, down 59.2% month-on-month; from January to July, cumulative sales were 1,966 units, far from ideal.

As the share of gasoline-powered vehicles declines, SAIC-GM's path to electric transformation does not seem smooth. Currently, SAIC-GM's lineup of new energy vehicles for sale is quite thin. Only seven models are available on the official website: Buick Velite 6, Buick E5, Buick E4, Cadillac LYRIQ, Cadillac LYRIQ IQ, the newly launched Buick GL8 Luzun PHEV, and Chevrolet Trailblazer Plus. However, the performance of these seven new energy models is not optimistic. In July, the best-selling Buick model, the Velite 6, sold 2,898 units, while the sales of Buick E5 were less than 1,000 units, and Buick E4 less than 100 units; the sales of Chevrolet and Cadillac's new energy vehicles were also far from ideal, hovering between two and three digits.

Industry insiders suggest that the low sales may prompt GM to consider selling the Buick brand to SAIC Motor. After all, the Buick brand has nearly ceased production in the US and European markets, with China being its largest consumer market. Moreover, due to price reductions by brands like Cadillac and Lincoln, Buick's market space has been squeezed, limiting its ability to contribute significantly to corporate profitability, given its focus on low-to-mid-range models.

Compared to Buick, GM has higher expectations for the development of SAIC-GM Wuling, as the demand for its compact electric vehicles continues to grow in China. An informed source revealed: "GM will continue to jointly produce lower-priced vehicles and electric vehicles with SAIC Motor and Wuling Automobile, some of which will also be exported from China." However, the current market performance of Wuling and Baojun is also unsatisfactory. It is reported that Baojun's sales have fallen from 1 million vehicles in 2017 to 33,000 vehicles in 2023, a decline of 971,000 vehicles over six years; Wuling's situation is slightly better, with a decline of 154,000 vehicles over three years. Whether SAIC-GM Wuling can deliver the expected results for GM remains uncertain.

In the future, SAIC-GM plans to launch 12 new energy vehicle models from 2024 to 2025, including Ultium-based pure electric models and a new generation of PHEV intelligent plug-in hybrid models. At present, it is uncertain whether the adjustments made by SAIC-GM and the introduction of new products will bring about new changes in its market performance. However, it is certain that SAIC-GM will go through a period of pain in the coming years.

(Images sourced from the internet, remove upon infringement)