Pure electric is the future, while range-extended is survival

![]() 08/27 2024

08/27 2024

![]() 624

624

Introduction

Introduction

In today's Chinese automotive market, only by surviving can one have a future.

In 2024, the increasingly brutal and even abnormal Chinese automotive market has taught all automakers participating in it a lesson: "As long as the green mountains remain, one need not fear a lack of firewood."

Precisely based on this background, more and more cases of "slapping in the face" are emerging.

Among them, the most typical examples are those brands that once loudly proclaimed range extension as outdated technology and went to great lengths to educate end-users that pure electric is the future. Faced with the bloody reality and pressure, they had to bow, compromise, and accept.

After all, survival is the most important thing.

Just last week, on the same day, AVATR first held a range extension technology press conference, officially bringing its "Kunlun Range Extension" to the forefront and announcing that starting with AVATR 07, multiple related products will be introduced within the year to meet the diverse needs of users.

Subsequently, at Geely's 2024 interim results press conference, Zeekr CEO An Conghui revealed that "our large flagship SUV model will be equipped with two powertrain options, including pure electric and super electric hybrid, and is expected to be launched in the fourth quarter of 2025." The super electric hybrid he mentioned is likely to be range extension under most conditions.

In addition, there are also Aion LX Plus, IM Motors, as well as Xiaomi and XPeng with ambiguous attitudes...

Today, among automakers that solely produce pure electric vehicles, apart from NIO, which carries the heavy burden of battery swapping, and Tesla, which has a significant first-mover advantage, nearly all others seem to be on the verge of "extinction." Naturally, new questions arise: Why has range extension suddenly become popular? What are the underlying reasons?

From being universally criticized to switching sides

This section begins with a set of data.

According to the results announced by the China Passenger Car Association, retail sales of new energy passenger vehicles in July reached 878,000 units, an increase of 36.9% year-on-year and 2.8% month-on-month. In contrast, retail sales of traditional gasoline-powered vehicles were only 840,000 units, a year-on-year decrease of 26% and a month-on-month decrease of 7%.

As a result, the domestic retail penetration rate of new energy passenger vehicles in July officially surpassed the 50% mark, reaching a remarkable 51.1%, an increase of 15 percentage points from 36.1% in the same period last year.

Without exaggeration, electric vehicles surpassed gasoline vehicles in a single month for the first time in a true sense. As bystanders, we undoubtedly witnessed history again. Ironically, the strong sales of electric vehicles still rely heavily on the "gas tank."

Taking a deeper look, let's consider the wholesale sales share of new energy passenger vehicles in July as an example. The proportions of pure electric, plug-in hybrid, and range-extended vehicles were 53%, 34%, and 13%, respectively. In contrast, the corresponding figures for the same period last year were 68%, 25%, and 8%.

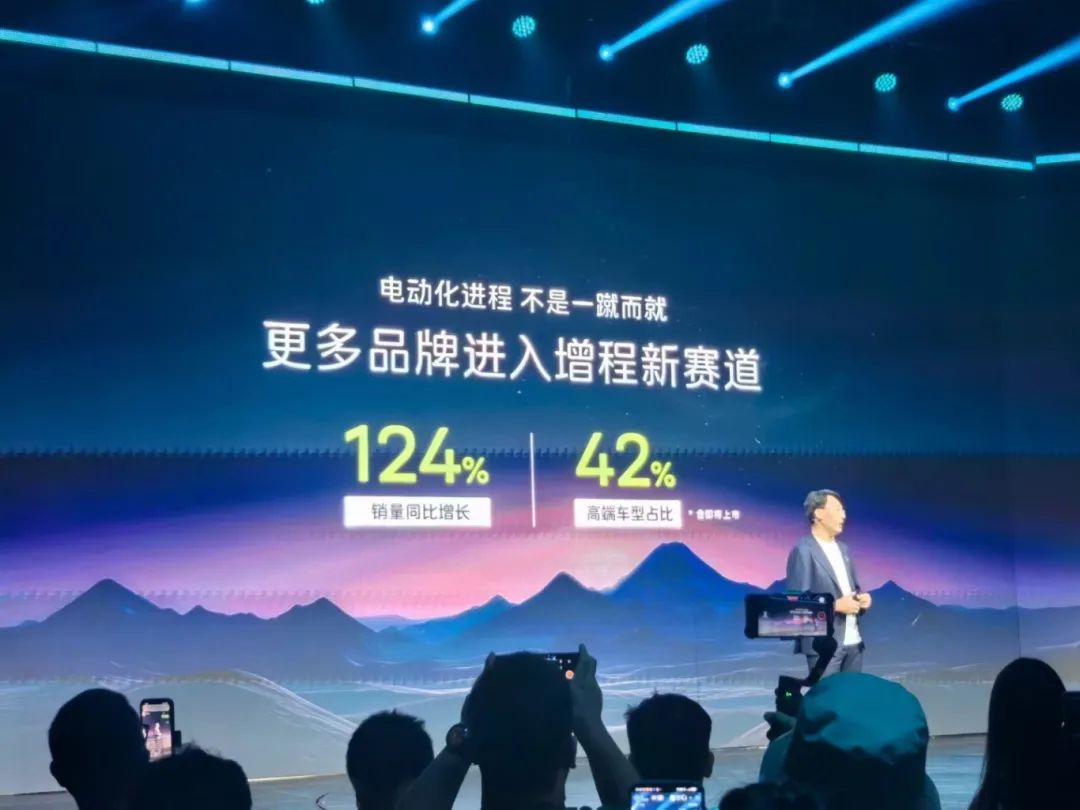

Furthermore, in terms of year-on-year growth in wholesale sales of new energy passenger vehicles in July, pure electric vehicles increased by only 0.9%, plug-in hybrids increased by 73%, while range-extended vehicles witnessed an explosive 115% increase.

It is clear at a glance which ones are struggling to expand and which ones have the potential to stand out. Returning to the question of why range extension has suddenly become popular, the answer is not difficult to understand.

Whether one accepts it or not, range extension inherently has various "strengths" compared to plug-in hybrids, such as a simpler overall structure, lower overall costs, and easier research and development. As for the so-called "weakness" of higher fuel consumption under high-speed conditions with low battery, even if it exists, it is often not a particularly fatal "pain point."

This reminds me of a controversial view previously expressed by Li Xiang, CEO of LIXIANG ONE, that "Chinese auto brands that are still insisting on multi-gear PHEV technology will switch to range-extended technology routes within the next one or two years. This prediction can be verified by 2025."

At the time, this prediction seemed somewhat radical, but it is now rapidly coming true.

For all OEMs, the current Chinese automotive market is all about the fast eating the slow. As the product launch cycle continues to shorten, even down to months instead of years, embracing range extension seems to be an inevitable trend that cannot be refused, and it is also a lever for them to engage in intense "price wars."

"Although we are still developing here, the public charging resources cannot compare to those in Shanghai. The cold winter is so long, and most trips are long-distance self-drives of over a thousand kilometers. The energy replenishment conditions at highway service areas are also not good. Anyway, after comprehensive consideration, range extension is more suitable for me. I usually drive it as a pure electric vehicle in the city because I have a private charging pile at home, and when I go on the highway, I drive it like a pure gasoline vehicle."

This is not a fabrication; the above response genuinely came from a friend in Lanzhou, who explained to me why he ultimately decided to buy a WENJIE M7 this year.

Behind these words lies the reflection that due to China's vast geography, vehicle usage needs are complex and diverse. Although the general direction of new energy transformation is irreversible, the role of the fuel tank cannot be replaced for a long time to come.

This situation undoubtedly provides a huge space for range extension to shine.

In many northern cities, especially in lower-tier cities, compared to the hesitation of potential customers when purchasing pure electric vehicles, the entire process of purchasing range-extended vehicles goes much more smoothly.

In short, from being universally criticized to switching sides, both automakers and users have proven through their actions what it means to say, "It doesn't matter if it's outdated, as long as it suits our needs."

Of course, it is important to be vigilant that implementing range extension does not necessarily mean "saving the day."

For leaders like LIXIANG ONE and WENJIE, this technology route serves more as an icing on the cake, and the fundamental reason for their explosive sales is still due to the outstanding quality and precise positioning of their products, as well as the brand's aura.

What kind of range extension do we need?

In a few days, we will welcome another Chengdu Auto Show.

At this special juncture, many new cars have chosen to launch early. For example, the Nezha S Shooting Brake version last weekend and the WENJIE M7 Pro yesterday. Their commonality is that they have more or less bet on range extension.

Then, another question worthy of discussion comes to the forefront, which is also the subtitle of this section: "What kind of range extension do we need next?"

In fact, in recent times, I had the opportunity to test drive several currently recognized range-extended star models in-depth consecutively. While the overall experience can receive a high score, flaws and regrets are also clearly evident.

First, the pure electric driving range is relatively short.

Perhaps due to being accustomed to pure electric vehicles with actual driving ranges of up to 500 kilometers, suddenly switching to range-extended vehicles with maximum actual pure electric driving ranges of only around 200 kilometers can cause unexplained anxiety.

Taking myself as an example, due to the lack of a private charging pile, my daily commuting distance is approximately 50 kilometers. Excluding the initial and final parts of the commute, I need to recharge every 2-3 days.

In response, some readers may criticize, "It's a range-extended vehicle, so why don't you just use gasoline?" In rebuttal, I want to say, "You don't understand these users at all. Everyone has a heart that yearns for pure electric vehicles."

Second, the charging speed is slow.

Perhaps due to being accustomed to pure electric vehicles using 800V electrical architectures that can achieve charging powers of up to 200 kW or even 500 kW on corresponding high-power charging stations, suddenly switching to range-extended vehicles with slower charging speeds can cause significant discomfort.

Taking current mainstream products equipped with batteries of over 40 kWh as an example, they can barely reach 2C, and a full charge often takes around an hour. Considering the high charging frequency of range-extended vehicles, there is indeed much room for improvement in the charging experience.

Third, there is significant vibration and noise.

Perhaps due to being accustomed to the quietness and smoothness of pure electric vehicles, range-extended vehicles can undoubtedly match the driving experience of the former when operating in pure electric mode. However, once the battery runs low, the range extender has to forcibly intervene, and the resulting vibration and noise cannot be ignored.

Especially during highway cruising, when the accelerator pedal is deeply pressed, the sensory impact of the "roar" and the relative lack of power feel like a "small horse pulling a big cart."

Precisely because of these three flaws, I am increasingly convinced that in next year's Chinese automotive market, a sufficiently powerful range-extended vehicle should have an actual pure electric driving range of around 300 kilometers, with charging speeds reaching at least the so-called 3C or even 4C standard. As for suppressing vibration and noise, efforts should be made to make the driving experience as close to that of pure electric vehicles as possible. Additionally, the vehicle's power reserve should be sufficient even at low battery levels, without any sudden drops.

There is no doubt that this sector will eventually see automakers compete for the "technological high ground." It is time to tear off the inherent label of being "outdated."

Next year, it is entirely foreseeable that as many corresponding new products gradually arrive, the voice and market share of range extension in the Chinese automotive market will continue to surge. By then, the protagonists of today's article will undoubtedly stand tall.

In short, the saying still holds true: "Pure electric is the future, while range-extended is survival."