Stellantis, Hard to Be the Savior of Italian Automotive Industry

![]() 09/02 2024

09/02 2024

![]() 582

582

When Stellantis is unwilling to shoulder the social responsibility of boosting the Italian automotive industry, Italy needs to make new choices to maintain its local production capacity and position as an automotive powerhouse.

In August, while the Chinese automotive industry was still debating whether weekly sales reports constituted a "convoluted" form of malicious competition, the second-quarter production data for Italy's automotive industry was only updated at the end of August... To describe it with current internet buzzwords, it could be said to have a strong sense of "relaxation."

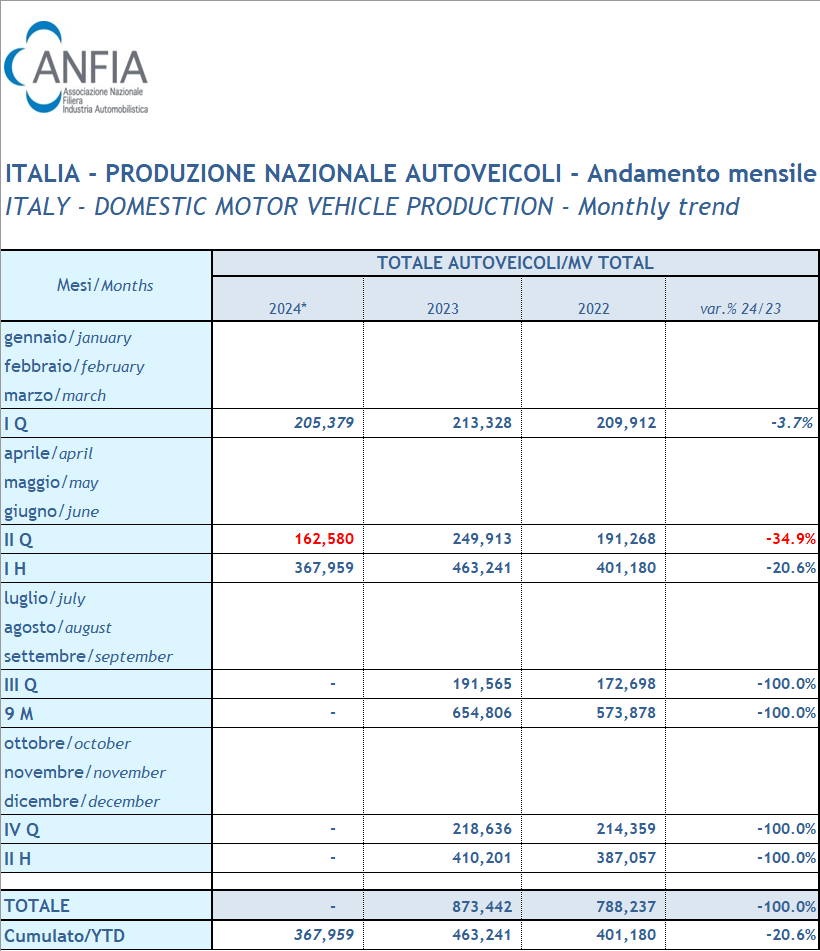

Yes, the most basic production and sales data for assessing the development of the automotive industry, the Italian National Automobile Association (ANFIA) has been suspiciously slow to release production data since updating domestic new car sales figures in June. Although this delay can be attributed to the postponement of statistical reporting—whenever August arrives, Italian civil servants and industry-related staff enter summer rotations, taking turns on vacation. However, when the "belated" data was finally updated, combined with the backdrop of the conflict between the Italian government and the Stellantis Group (for details, please click here: Italy's Dilemma: Stellantis "Controls" the Local Automotive Industry), it compelled me to lament that Italy's goal of increasing domestic automotive production this year may again prove elusive: in the second quarter, the country produced 162,000 vehicles domestically, a year-on-year decline of 34.9%.

It was only on August 28 that ANFIA finally completed the country's second-quarter and first-half automotive production data. Source: ANFIA

In 2023, Italian Minister of Enterprises and "Made in Italy" (MIMIT) Adolfo Urso stated that to preserve the domestic automotive industry amid the challenge of transitioning to electric mobility, Italy needs to produce at least 1.3 million vehicles annually, including 1 million passenger cars and 300,000 trucks. Among them, the Italian government hopes that the Stellantis Group will assume social responsibility and restore its annual production in Italy to 1 million units by 2030. However, despite these aspirations, based on the current situation reported by ANFIA, this goal seems increasingly unattainable.

Based on the above data, the Italian Metalworkers' Union (FIM-CISL) estimates that the Stellantis Group will produce 630,000 vehicles in Italy this year, believing that with the postponement of vehicle purchase incentives in the country and weak demand for pure electric vehicles in many European countries, production at Stellantis' Mirafiori plant alone has declined by 51% year-on-year, with such a production reduction potentially impacting local employment.

The concerns of trade unions are not unfounded. Since March this year, Stellantis has been undergoing mass layoffs in the United States to address operational challenges in that market, first by cutting software and engineering departments and more recently by shutting down production lines for its RAM brand and planning to lay off 2,450 workers. FIM-CISL believes that the group's pressure to reduce labor costs will eventually be transmitted to Italy.

Moreover, there have indeed been rumors within Stellantis about continuing cost reductions. According to Stellantis' financial report, its net revenue for the first half of 2024 was €85.02 billion, a year-on-year decrease of 14%; net profit was €5.65 billion, a year-on-year decrease of 48%, significantly lower than market expectations. In response, the group's CEO and "cost-cutting master" Carlos Tavares once again attempted to deploy his proven "combination punch" from his past career: layoffs, streamlining product platforms, and divesting "burdensome" entities.

Admittedly, while labor costs account for a relatively small proportion of overall vehicle costs, layoffs are often the fastest short-term cost-cutting measure with the lowest resistance at the capital level, making them a common "opening move" for Carlos Tavares. According to incomplete statistics, since the promotion of Stellantis in 2019, the dual entities PSA (Peugeot-Citroën) and FCA (Fiat Chrysler Automobiles) of the group have cumulatively laid off more than 50,000 workers due to resource integration, with Fiat alone systematically cutting about 12,000 jobs.

However, compared to the opening move, the following two steps have a more profound impact on the group's multiple brands. To this day, for Italian brands such as Fiat (including Abarth), Alfa Romeo, Lancia, and Maserati, significant streamlining of model products has effectively reduced research and development, design, and even marketing expenses, but it has also suppressed the market share of these brands... While it is understandable to pursue a "small but exquisite" approach, as Carlos Tavares actively integrates the group's advantageous resources in Europe and globally, gradually shifting production capacity, supply chain procurement, and labor from Italy to low-cost regions and expanding related businesses, the prospects for the group's factories in Italy become increasingly uncertain. As for the future of Stellantis' 14 brands, given profit pressure, Carlos Tavares has not "named names" internally about which brands are at risk of closure or "snow hiding," but he has admitted that "the group can no longer afford to carry brands that are not profitable."

Previously, the current Italian government has clearly expressed its desire to stabilize and develop the domestic automotive industry, but the Stellantis Group has not given a clear commitment to the authorities' expectations for increased production, instead explaining amidst the gradual "friction" between the two sides that it will create a "sustainable future" for the group's Italian operations. In other words, Stellantis will arrange separate paths for its Italian brands, but whether they become "flowers" or "leaves" ultimately depends on their profitability. As for revitalizing the Italian automotive industry and providing a clear future plan for "struggling" factories, Stellantis' stance remains commercially oriented.

'Brand' or 'Playing Card'

The poor performance reflected in the first-half financial report undoubtedly increased the pressure on Carlos Tavares, but at Europe's doorstep, he remains committed to preparing for the "battle," integrating supply chain advantages, and launching low-cost electric vehicle models to address the constant challenges from outsiders in the EU market.

Today, Stellantis' response strategy is not difficult to decipher. First, it pursues the maximization of portfolio benefits, relying on the market coverage and brand influence of its 14 brands to reconstruct the product ecosystem most suitable for the group's current development, even if it means reducing the "presence" of some brands. Second, it optimizes resource allocation, considering factors such as where to develop each vehicle platform on the research and development product system list, which technologies to configure, which components to procure, and where to produce in "cost depressions," all of which are constantly variable factors sought by management in search of optimal solutions. However, this strategy also poses greater risks to those relatively niche brands with low sales volumes.

Judging from the current status of several Italian brands under the group. Maserati's performance is clearly poor, with global sales declining by more than 50% in the first half of this year to just 6,500 vehicles, and full-year sales expected to be around 12,000 vehicles. Its losses also reached €82 million, continuing the trend of losses since last year.

According to Automotive News Europe, Maserati's product planning outlook is similarly bleak. Although the MC20 Folgore supercar with a three-motor powertrain will be launched next year, its high price and niche positioning make it unlikely to cause a market sensation, and other new models are unlikely to be launched before 2027.

It is worth noting that Maserati is the only brand under Stellantis to publish detailed financial results. And against the backdrop of Carlos Tavares' attempts to shed "burdens," rumors of Stellantis seeking potential buyers for this ultra-luxury brand once abounded. Although Maserati subsequently stated that "Stellantis has no intention of selling the Maserati brand or merging it with other Italian luxury brands," combined with recent comments by the group's Chief Financial Officer Natalie Knight, market changes and temporary situations may bring fluctuations, and the possibility of Maserati being acquired at some point in the future remains open. Her exact words were: "At some point in the future, we may consider where the best home for (Maserati) would be." This statement was made shortly after the group's weak first-half sales performance in 2024.

Elsewhere, some voices argue that while Alfa Romeo and Lancia have relatively healthy financial positions and better sales than Maserati, both brands rely heavily on the European market, especially Italy itself, and have limited impact on boosting the group's overall size.

In 2023, Alfa Romeo sold approximately 68,000 vehicles globally, primarily in European markets such as France and Germany. Although full sales figures for the first half of this year are not yet available, based on disclosed data from the US market, sales for the first half were approximately 4,800 vehicles, a 2% year-on-year increase. According to ACEA data, in the first half, its last gasoline-powered model, the Tonale, was registered in just 24,800 units in Europe (EU-EFTA-UK). Therefore, some analysts believe that Alfa Romeo's performance in 2024 will remain flat, estimating that its normal annual sales should remain in the range of 65,000 to 70,000 vehicles.

Alfa Romeo has won countless accolades for its powerful performance, including the first championship in F1 racing and once being the fastest four-door sedan on the Nürburgring Nordschleife, highlighting the brand's illustrious history. Within the Stellantis Group, it is positioned as a core luxury brand second only to Maserati. Today, the brand is gradually transitioning to full electrification, with plans to upgrade its lineup of Milano, Stelvio, Giulia, and other models to fully electric products by 2027, leveraging the group's STLA architecture. However, this year, Stellantis has not introduced any new Alfa Romeo-related models, and the electric SUV Milano, which has already been unveiled, remains far from mass production.

As for Lancia, once the official car of the Italian government, after brand rejuvenation, it sold approximately 24,700 vehicles in the first half of this year, a year-on-year increase of 3%, essentially flat with last year. However, in the domestic market, Lancia's market share remains below 3%, with only the Ypsilon model currently available. Nevertheless, the brand has stated that the new-generation Ypsilon electric version will enter markets such as Belgium, the Netherlands, France, and Spain, seeking expansion beyond its domestic market.

Overall, these Italian brands under Stellantis, except for the unmentioned Fiat (which sold 660,000 vehicles in the first half of 2024), mostly face the dilemma of scaling up while also dealing with product homogeneity, improving profitability while maintaining brand image, so their contribution to boosting domestic automotive production and employment in Italy is relatively limited. Even Fiat, whose steady development still relies primarily on the three pillars of "Italian design and development, global platforms, and appropriate supply chains," is moving towards global manufacturing rather than being confined to its domestic market.

Production and Employment Dilemmas

Therefore, looking back at the quarterly production questions raised at the beginning of this article, it is difficult not to associate them with the "passive" dilemmas faced by the Italian automotive industry: the government does not see the actual implementation of Stellantis Group's commitments to Italian production capacity in the short term, and the future development of several Italian brands is also uncertain. Therefore, relying solely on Stellantis' actions to boost domestic production is clearly insufficient.

Of course, before seeking new external assistance, Italy needs to stabilize the confidence of the local industrial grassroots first. In response to the slowdown in investment by the Stellantis Group in Italy and the potential reduction in production there, on August 8, MIMIT, led by Urso, convened a national automotive industry roundtable with regional trade unions and Stellantis.

During the meeting, the attitudes of all parties were intriguing. First, the representatives of the regional trade unions stated that the rift between the Italian government and the Stellantis Group was widening and that no practical solutions had emerged from previous "frictions" to address the employment issues of automotive workers. The representatives said that, given the current situation, as Stellantis shifts production to Poland, Serbia, and Albania, where labor costs are lower, Italian factories may face the risk of at least 12,000 job cuts, and Italian parts suppliers will also face additional large-scale layoffs. The aforementioned President of FIM-CISL, Ferdinando Uliano, stated that parts suppliers would lose an additional 12,000 to 13,000 jobs.

Giuseppe Manca, the Italian HR Director of the Stellantis Group, responded that the group had reiterated its willingness to cooperate with the Italian government and had developed detailed plans for each Italian factory through 2030. Stellantis promised to update its industrial plans in the context of new market conditions and policy changes and strive to increase production to 1 million vehicles by confirming Italy's central position in the group's global strategy.

However, this statement is not new. At the inception of the group, Carlos Tavares did indeed state that each brand under the group would have 10 years to clarify its position and carry out related self-adjustments. "The CEOs of each brand must have a clear idea of the brand promise, customers, objectives, and brand communication." In reality, however, doubts remain about whether Carlos Tavares' promise to maintain the integrity of the brand list in a volatile market will be fulfilled.

As for the Italian government, which took the initiative to convene the meeting, despite its concerns, it clearly did not want to make any statements that might provoke conflict with Stellantis. Urso stated that "there is absolutely no conflict between the two sides" and that they were willing to find a common path of cooperation with Stellantis. Clearly, Italy may have temporarily lowered the tone of its early demands, and the current priority has shifted to ensuring that these Italian brands do not "dry up due to lack of water."

Nevertheless, the meeting still revealed some positive initiatives. The Italian government emphasized enhancing the overall production level of the domestic automotive industry through cooperation with regional labor unions and the external automotive supply chain. Urso pointed out that the government would reshape incentives for the automotive industry, providing $750 million in funding support starting in 2025, with annual increases to $1 billion from 2026 to 2030. These funds will prioritize supporting the local parts supply chain and employment, encouraging the scrapping of old and highly polluting vehicles. Furthermore, the government is studying a mandatory mechanism to encourage the use of locally produced components in vehicles assembled in Italy or Europe, ensuring the sustainability of local parts production. The meeting also mentioned the necessity of introducing new automakers. Urso revealed that a technical delegation from MIMIT would soon visit China for relevant negotiations with Chinese automakers.

Stellantis is not interested, so who will take on the goal?

From the Italian perspective, when Stellantis is clearly unwilling to shoulder the social responsibility of reviving the domestic automotive industry, attracting Chinese automakers actively expanding into international markets to invest has become crucial for the sustainable development of Italy's industry.

Earlier in July this year, Urso visited China. During his two-day stay in Beijing, he stated that China is an indispensable market and key partner for Italian enterprises. Cooperation between Italy and China in areas such as green technology, electric vehicles, and buses is becoming increasingly important, presenting an opportunity to usher in a new phase in the strategic partnership between the two countries. He also emphasized that this transition signifies a shift from a commercial to an industrial partnership. During the visit, Urso met with representatives from automakers including Chery, JAC Motor, and Dongfeng Motor.

According to the Italian Embassy, on August 6, Ambassador Jia Guide met with Urso. Both sides highly praised the successful official visit of Italian Prime Minister Giorgia Meloni to China and exchanged views on implementing the outcomes of the visit, further strengthening bilateral exchanges, and pragmatic cooperation in the industrial sector. On the same day, Reuters reported that the Italian government was in talks with Dongfeng Motor Group to establish a factory in Italy. Sources revealed that the government might participate in Dongfeng's investment through a minority stake, aiming to establish a manufacturing hub covering all of Europe. This potential deal has been viewed by some foreign media as one of the significant achievements of Prime Minister Meloni's visit to China at the end of July.

Subsequently, Italian newspaper "Il Sole 24 Ore" reported more details of the negotiations, including the requirement that the new factory must adopt rigorous IT security and data protection measures. The Italian government explicitly requires that consumer data be collected and managed within the country and comply with European privacy and security regulations. Additionally, Italy demands that Dongfeng locally source at least 45% of the components for each vehicle produced. This condition not only benefits local industrial development but also qualifies Dongfeng for hundreds of millions of euros in public financial subsidies.

Although Dongfeng stated on August 14 that it was only in preliminary contact with the Italian government, had not yet engaged in substantive factory construction negotiations, and had not discussed topics such as cybersecurity, data protection, and localization of components, Dongfeng's European strategy indicates plans to enter the German, Italian, Spanish, and Swiss markets. Electric vehicle models from its Hoval and MAXUS brands will start accepting orders in select European markets in the fourth quarter of this year.

Based on the above reports, it appears that factory construction negotiations are indeed progressing but face pressing disagreements. Localization of the supply chain production corresponds to the mandatory mechanism being studied by MIMIT. Regarding data security issues, they may align with the European Parliament's 2023 Data Act legislation's requirements for managing cross-border data flows, rather than being unilaterally set thresholds by Italy. This suggests that the Italian government views the entry of Chinese manufacturers as an opportunity to revive its automotive sector, contingent on respecting the EU's high security standards. As Stefano Aversa, President of AlixPartners Europe, Middle East, and Africa, emphasized, "As long as local suppliers play a crucial role in component supply and ensuring Western safety standards, Chinese manufacturers entering Italy could revitalize the country's stagnant market."

Simultaneously, the Italian government is exploring more "options" to attract foreign automakers. It is rumored that due to Stellantis's potential adverse impact on Italian brands, capacity, employment, and tax revenue, the Italian government is considering legal means to "take over" the rights to use Stellantis' dormant brands.

According to relevant statements, for the bankrupt Italian brands Innocenti and Autobianchi still held by Stellantis, MIMIT has separately registered new graphical trademarks with the Italian Patent and Trademark Office. This is based on a draft law submitted to the Audit Court in December last year, stating that Italian brands not used for at least five years can be provided to companies "investing in Italy or transferring manufacturing activities to the country" once under government control. The Italian government may believe that "reviving" local brands, coupled with models suited to the local market, will help investment automakers quickly bridge the gap with Italian consumers.

Apart from negotiations with Dongfeng, Italian supply chain discussions have also emerged involving Chinese-Italian cooperation. For instance, Italian company EuroGroup Laminations (EGLA), which produces stators and rotors, has signed a preliminary strategic partnership agreement with Wahin Rubber Industry Group. Both parties are planning to establish a joint venture controlled by EGLA to further drive market growth and jointly enhance penetration in the electric vehicle component sector.

Note: This article was originally published in the September 2024 issue of "Auto Industry Observer" magazine under the title "Stellantis Struggles to Be Italy's Automotive Savior." Stay tuned for more.

Image: From the Internet

Article: Auto Industry Observer

Typesetting: Auto Industry Observer