Can the real-time bus APP "Che Lai Le" smoothly sail towards the Hong Kong Stock Exchange?

![]() 06/13 2024

06/13 2024

![]() 769

769

Recently, MetaLight Inc., the parent company of the real-time bus information online platform "Che Lai Le," submitted a prospectus to the Hong Kong Stock Exchange, planning to list on the Main Board. The exclusive sponsor is CICC.

When it comes to "Che Lai Le," many people may not be unfamiliar with it. As one of the most widely used real-time bus information prediction platforms in China, it has a relatively active user base. According to BurnMark Consulting, in terms of revenue in 2023, Che Lai Le ranks third among China's bus industry timing data service providers; in terms of city coverage, Che Lai Le has the widest coverage in China.

If the listing is successful, MetaLight Inc. may become the first stock of "intelligent timing data" in Hong Kong stocks. Is the field of predicting real-time traffic information still worth watching? What are the highlights of MetaLight Inc.'s financial data? Here is a brief analysis of MetaLight Inc.'s prospectus.

01

Relying on a single product to generate revenue, new products have not yet taken shape

The "Che Lai Le" platform is MetaLight Inc.'s most important product, providing real-time bus schedules, accurately predicting vehicle arrival times, and reflecting traffic congestion levels, greatly improving commuters' travel efficiency and experience. Its data sources mainly include GPS data authorized by transportation agencies, user query records and search history, as well as data summaries of buses and users, to provide commuters with the latest information about bus locations and estimated arrival times.

From the perspective of revenue structure, Che Lai Le's users are mainly on the C-end, and advertising revenue constitutes the company's largest source of income. Advertisers place ads on the Che Lai Le platform and pay for every thousand views or impressions their ads receive. The prospectus shows that from 2021 to 2023, MetaLight Inc.'s revenue from mobile advertising services was 156 million, 115 million, and 168 million yuan, accounting for approximately 95.6%, 85.2%, and 96.2% of revenue.

Advertising revenue depends on the exposure and conversion rate on the Che Lai Le platform. In 2022, affected by the pandemic, public transportation in many towns was suspended for a long time, and the active users of the Che Lai Le platform decreased accordingly, affecting advertising revenue. However, with the normalization of transportation in 2023, its advertising revenue rebounded rapidly, but compared with 2021, the growth was not significant, and the company's core business growth rate did not seem to show promising potential.

In addition to advertising, MetaLight Inc. also provides data technology services, including data-related services, data analysis services, and consulting services based on the company's data and knowledge in the public transportation field. However, this part of the revenue accounts for a small and unstable portion, and it is also difficult to expect. The reasons for the significant increase in revenue in 2022 were mainly due to the income received from providing one-time data technology services to a related party.

From a product perspective, the essence of MetaLight Inc.'s products is the combination of technology and practical problems, following a product roadmap of "time + X." "Time" represents the time series of event occurrence, and "X" represents key model indicators such as location, price, and operating status. The product roadmap of the bus field product "Che Lai Le" is "time + location".

Perhaps seeing the growth bottleneck of a single product, since the second half of 2022, the company has leveraged its technological capabilities in new fields and launched two new product lines in the renewable energy and industrial internet fields, namely "time + price" and "time + equipment status," expanding its product portfolio.

If the company's new products can replicate the success of "Che Lai Le," the renewable energy and industrial internet fields are expected to become new growth poles for MetaLight Inc., driving the company's performance to achieve high growth. However, according to the prospectus, the current revenue generated by these two product lines is not significant. It will be difficult for new businesses to grow into new growth engines in the short term, and the company still needs to continue relying on its existing business.

02

Increasing expenses affect profitability, and asset impairments exacerbate profit fluctuations

In terms of profitability, MetaLight Inc. recorded net profits of 33.465 million, -20.037 million, and -20.328 million yuan from 2021 to 2023. The large losses in 2022 and 2023 were mainly due to fair value losses of financial liabilities recorded during the period, amounting to 29.455 million yuan and 55.545 million yuan, respectively. This part of the financial liabilities refers to losses arising from changes in the value of preferred shares issued by the company to investors, which are unrelated to the daily business process and do not represent the company's continuous operating performance.

Under the Non-IFRS accounting standards, excluding the impact of changes in the fair value of financial liabilities, MetaLight Inc.'s adjusted net profits from 2021 to 2023 were 44.196 million, 9.814 million, and 46.495 million yuan, with year-on-year growth rates of -78% and 374%. The adjusted net profit margin was 27.0%, 7.2%, and 26.6%, respectively, indicating significant fluctuations in net profit.

As a data intelligence service company, MetaLight Inc.'s gross profit margin is relatively high and stable, ranging from 75.1% to 73.0% and 76.3% from 2021 to 2023. In terms of expenses, the company's sales expenses remain relatively stable, accounting for around 20% of revenue; research and development expenses have increased slightly from 17% in 2021 to 19% in 2023; and administrative expenses have increased significantly, accounting for 10% to 19% of revenue.

The increase in expenses affects the company's profitability. Meanwhile, in 2022, a financial asset impairment loss of 23.71 million yuan was recognized, mainly due to the inability to recover loans and receivables from two related companies, resulting in a sharp drop in the company's profit margin for that year.

In terms of cash flow, as of the end of 2023, MetaLight Inc. had cash and cash equivalents of 55.51 million yuan, but the company also had 40 million yuan of immediate loan repayments, so the current cash flow is not exactly abundant for the company.

03

User data maintains growth, but the first-mover advantage is being lost

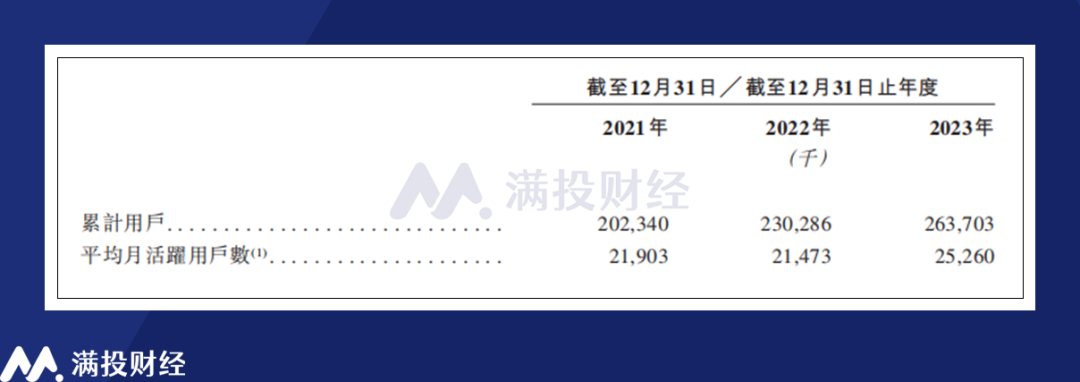

The "Che Lai Le" app was launched in 2013 and had a certain first-mover advantage in the field of real-time public transportation information prediction at that time. In 2015, the number of registered users of the Che Lai Le app exceeded 10 million, and it broke through 100 million registered users in 2018. As of December 31, 2023, the number of Che Lai Le users reached 264 million, and the average monthly active user count in 2023 was approximately 25.26 million.

In recent years, Che Lai Le has maintained growth in new registrations, and the platform has maintained a certain level of activity. Its geographical coverage has also rapidly expanded to nearly 450 cities and towns across China, making it the most widely covered real-time transportation information platform in China. As a result, MetaLight Inc. has successively completed seed round financing, Series A and A1, Series B and B1, and Series C financing, attracting investors such as Shunwei Capital, ZhenFund, Alibaba, Broadband Capital, and Hongdao Capital.

Authorized data from transportation agencies is an important part of Che Lai Le's profitable business model. However, data authorization from transportation agencies is not exclusive, so there are not a few apps similar to Che Lai Le on the market, such as Palm Bus and Bus e-Travel. Not to mention the increase in similar apps, real-time traffic information functions built into maps such as Gaode and Baidu are also competing with Che Lai Le for market share.

Che Lai Le's first-mover advantage is being lost, and choosing to go public at this time seems a bit "too late." Moreover, the "necessity" of such specialized public transportation prediction platforms for commuters is also worth considering. If Che Lai Le does not have a significant advantage over other platforms, acquiring and retaining subsequent users will become increasingly difficult. The company's main revenue comes from the exposure and conversion rate of advertisements placed on the platform, but excessive advertising comes at the expense of user experience. If the company cannot continuously acquire new users to increase advertising exposure, it may be difficult to break through the growth bottleneck.

Although Che Lai Le also added an artificial intelligence chatbot function in April 2024, allowing commuters to use voice commands to query bus routes, arrival times, and service updates without having to manually operate, enhancing user experience and further strengthening Che Lai Le's competitiveness in the market, this is clearly not enough.

With the development of the Internet of Things and 5G technology, the application prospects of timing data are broad. MetaLight Inc. has certain accumulations and technological advantages in the field of intelligent timing data analysis. Successfully expanding the scope of data analysis products to different industries and getting rid of reliance on a single business model are the keys for MetaLight Inc. to break through the bottleneck. Therefore, the company's other two product lines of "time + price" and "time + equipment status" are expected to add imagination space to MetaLight Inc.'s future.

Whether it is relying on a new product portfolio or continuously enhancing the competitiveness of "Che Lai Le," MetaLight Inc. needs a large amount of financial support. The funds raised from the company's listing will be mostly used to develop timing data base models, improve the technology stack to enhance overall technical capabilities; for sales and marketing efforts to increase market share and brand awareness; and to supplement operating funds.

Whether the new products can develop smoothly remains to be seen, but in the meantime, MetaLight Inc. will continue to face significant challenges brought about by the intensifying competition in the real-time bus prediction field.

- End -