Apple's AI-driven Device Replacement Cycle

![]() 06/27 2024

06/27 2024

![]() 523

523

Amidst the surge in NVIDIA's stock price after its stock split, companies supplying NVIDIA, such as TSMC in the contract manufacturing segment, Supermicro and Dell in the server segment, as well as three companies capable of supplying HBM - Hynix, Samsung, and Micron, along with ARM on the architectural side, have also hit record highs.

After various technology giants in the U.S. stock market increased their capital expenditures, these companies have essentially raked in significant profits, at least not having to worry about orders in the short term. The arms race on the hardware side continues to accelerate. However, the development on the application side has not been as rapid as on the hardware side. Apart from the successful commercialization of ChatGPT, the profitability of most AI applications is still relatively weak, and there has not yet emerged an application entry point that can provide a large number of users. The market recently expects that Apple, which has invested in AI the latest, will excel in the application side.

I. Apple ALL IN AI, Gambling on the Large Device Replacement Cycle

Two weeks ago, Apple launched the AI-related Apple Intelligence initiative, referring to the implantation of AI large models in iPhones starting with the iPhone 16 series. Part of the technology originates from Apple's own research and development, namely the original SIRI, while the other part requires collaboration with partners.

After announcing the AI initiative, it immediately attracted large model applications such as ChatGPT, Google's Claude, Meta's Llama, and Perplexity to apply for cooperation with Apple. Apple's stock price surged by over 10% within two days, setting a new record high.

The main reason for the surge is Apple's accelerated execution of its AI plan, which is widely recognized by the market for Apple's ability to produce quality products. Coupled with the surge in technology stocks, the AI plan has become a catalyst.

Another point is that although Apple is the latest technology giant to fully invest in AI, Apple has the highest APRU user base in the mobile phone industry. User groups with strong paying ability are precisely what large model companies need the most. Therefore, there is considerable room for imagination regarding Apple's paid AI applications. According to predictions, if Apple's AI features at the launch event are implemented on new models, it is expected to drive a 5-10% sales increase for the iPhone.

The combination of these two factors leads foreign investors to believe that after embedding AI large models, Apple can drive more consumers' demand for device replacements and help mobile phone manufacturers increase pricing and profits. For example, the price of Samsung's S24 Ultra with AI large models has increased from $1,199 for the previous generation to $1,299, and more AI features requiring subscriptions can be introduced in the future.

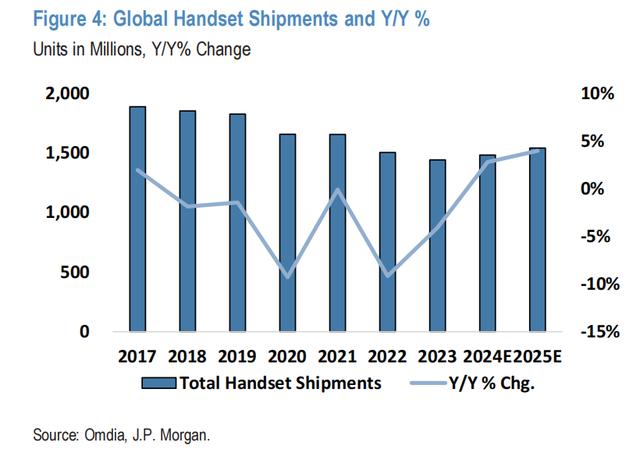

JPMorgan believes that after three consecutive years of declining global smartphone shipments, this year marks a turning point for global shipments to return to growth. After Apple embeds large models, global shipments are expected to grow by another 5% next year.

Among them, JPMorgan predicts that the share of AI phones in the smartphone market will increase from 13% this year to 28% next year. It is estimated that Apple will account for more than 50% of the global AI smartphone market this year, but as AI phones become more widely popularized, Apple's market share in AI phones will decline.

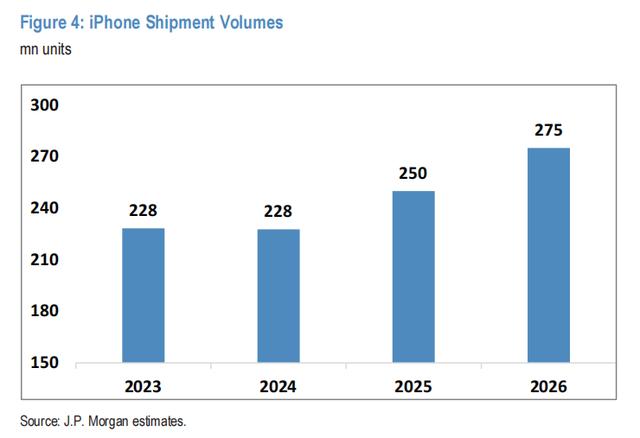

JPMorgan predicts that Apple's shipments in 2025/2026 will reach 250 million/275 million units, compared to 228 million units in 2023/2024. The reason for JPMorgan's upward revision is that AI phones will drive sales in the largest markets, China and North America.

Simultaneously, the EPS for fiscal years 2025/2026 has been increased to $8.1 and $9.69, respectively. The market's previous expectations for EPS were $7.26 and $7.64, and JPMorgan has raised its target price for Apple to $245, corresponding to approximately 29 times PE based on next year's earnings forecast.

Foreign investors believe that Apple's decline in the Chinese market in 2023-2024 is mainly due to the re-emergence of Huawei's self-developed chips. However, starting next year, the share of the global smartphone market will depend on each company's progress in high-end AI phones. Foreign investors believe that based on Apple's advantages on the application side, Huawei's share will decline next year, Samsung's share will remain flat, and Apple's market share will return to growth.

It is worth mentioning that Apple's ability to produce quality products is undoubted, but whether the applications can be successfully implemented may lead to some disputes with regulators, which may affect the stock price in stages, similar to whether FSD can be successfully launched.

Assuming that the AI large model provided by Apple in the Chinese market is different from the overseas version, and Huawei may also launch its own AI large model phone, sales performance in the Chinese market may not be as optimistic. As it has been rumored that Apple's Chinese version may cooperate with Baidu or other domestic large model vendors, if this is true, Apple's competitiveness in the Chinese market with large models will be affected.

In addition, Apple stated that due to regulatory issues, it cannot launch AI features in the European market for the time being. And at the launch event, Apple mentioned that new Siri features integrated with AI will not appear until next year, and these features will initially only be available in American English, excluding users in other regions.

Apart from regulatory issues, it is a consensus in the industry that global smartphone shipments have exited the cycle inflection point and are returning to slow growth. In this round of device replacement cycles driven by new technologies, which manufacturer provides a better application experience is crucial.

II. Temporarily Abandoning Vision Pro for AI

Under the logic of the device replacement cycle, Apple's stock price has hit a record high. However, from a valuation perspective, the forward PE ratio is 30 times. During the previous round of device replacement cycles driven by sanctions against Huawei, the forward PE ratio peaked at around 33 times.

Due to the issues mentioned above, such as the regulation of AI implementation and fierce competition, the certainty of Apple's future growth is not as high as that of other technology stocks. This has led to significant differences in the market's views on the price range of $210-220 after Apple's stock price hit a new high. Of course, Apple's share repurchase amount significantly leads other technology stocks, providing a considerable safety cushion.

There are also views in the market that are not optimistic about AI driving Apple's device replacement cycle. Taking ChatGPT for macOS as an example, it is a collaboration between Apple and OpenAI, but it has not actually helped increase Mac shipments.

The key lies in whether the AI services launched after the collaboration can have unique competitive advantages.

For example, large model vendors collaborating with Apple must have exclusive cooperation with Apple. Otherwise, if they only collaborate through accessing large models, other phone manufacturers can also emulate them. However, it seems difficult to require OpenAI to only collaborate with Apple. A more likely collaboration model is that Apple designs the applications, while the actual reasoning relies on the large models and computing power of the partners.

It is worth noting that while Apple launched its AI plan, it also adjusted the product strategy for the Vision Pro headset.

Currently, the Vision Pro has been on sale for nearly half a year. Although the initial review experience was quite impressive, for more users, the Vision Pro remains a very expensive product. When it was first released, it cost approximately 50,000-60,000 yuan in China, and recently, the domestic version is about to be released with a pricing of approximately 25,000-30,000 yuan.

Even though the Vision Pro offers a good spatial experience, it faces the same issues as the current AI development, namely the lack of a killer application on the application side. Coupled with the originally high pricing, even if the price is significantly reduced in the future, it will still be difficult to attract more consumers.

Due to poor user adoption, this year's shipments of Vision Pro have decreased from the original 700,000-800,000 units to 400,000-450,000 units.

Moreover, Apple plans to launch a headset with a lower price tag, expected to be named Apple Vision. The future selling price is expected to drop from $2,500 to $1,500-2,000. There may be the cancellation of the EyeSight display, removing the function of displaying the user's eyes from an external source, and possibly using lower-spec chips to reduce the visual effects of combining the headset with reality.

After popularizing the low-cost version to users, Apple plans to continue developing the high-end Vision Pro, with the new generation expected to arrive in 2026. However, if the low-cost version sacrifices user experience, even if the lowest price comes to $1,500, it will still be about three times more expensive than Meta's headset.

III. Conclusion

Therefore, even if the headset hardware experience is good, without a matching ecosystem on the application side, it will ultimately be futile under high pricing.

As technology giants maintain significant investments in AI, Apple's future investment in AI will undoubtedly be substantial. However, Apple has already abandoned its long-standing car manufacturing plan this year, and the recently launched Vision Pro has disappointed the market. Can Apple continue to support AR/VR devices that are unlikely to achieve returns in the short term while increasing investment in AI?

Based on these concerns, the market currently believes that the current 30 times PE valuation is reasonable. As for whether it can reach the most expensive 33 times PE in recent years, it depends on how quickly large models are integrated into mobile phones, as other phone manufacturers are also doing the same thing.