"Big Fund Phase III is Launched!"

![]() 10/23 2024

10/23 2024

![]() 607

607

Text: Poetry and Stars

ID: SingingUnderStars

If I hadn't read Lehe Micro's interim report, I would have missed this exciting news: Big Fund Phase III has been established.

Big Fund is the abbreviation for the National Integrated Circuit Industry Investment Fund. Big Fund Phases I and II have nurtured and incubated a large number of outstanding chip enterprises and created several classic cases, such as assisting JCET in acquiring STATS ChipPAC through a reverse takeover.

Unlike traditional subsidy-based assistance, Big Fund injects capital into chip companies when they need it most, usually only becoming the third largest shareholder without seeking control. After the companies grow, they cash out and exit. Often, they end up making a significant profit.

According to Lehe Micro's interim report, the third phase of the National Integrated Circuit Industry Investment Fund was established in May with a registered capital of up to RMB 344 billion, exceeding the combined total of the first two phases.

The establishment of this fund is not only substantial financial support for the semiconductor industry but also a manifestation of the national strategic intention and firm determination to develop the semiconductor industry.

With the implementation of Big Fund Phase III, China's integrated circuit industry is expected to enter a new stage of rapid development, and domestic chips are expected to make breakthroughs in more fields, laying a solid foundation for building an independently controllable and secure industrial system.

Upon reading this, I was confused and quickly checked iFind to see if Big Fund Phase III had invested in Lehe Micro. It turned out that Big Fund Phase III had not made any moves since its establishment.

01 Lehe Micro's Creative Tactics Lehe Micro's core product is PLC chips, commonly used in IoT devices. Many traditional machines can generate digital signals through PLC chips and connect to industrial computers, facilitating data exchange and remote control through IoT.

The company's largest shareholder is Lehe Science and Technology Group Co., Ltd., whose indirect major shareholder is the Tsinghua University Research Institute in Shenzhen, with the Shenzhen State-owned Assets Supervision and Administration Commission as the actual controller.

In 2002, Dr. Liu Kun returned to China and joined the Tsinghua University Research Institute in Shenzhen to found Lehe Micro.

Dr. Liu Kun received his bachelor's degree from Dalian Maritime University in 1983 and his Ph.D. in Electrical Engineering from Delft University of Technology in the Netherlands in 1992. From 1993 to 1995, he was an associate professor and professor in the Department of Electronic Engineering at Shanghai Jiao Tong University. Since 1996, he has worked on CDMA mobile communication research, wireless communication system development, and ASIC design and development for wireless and broadband communications at institutions such as Nanyang Technological University in Singapore, Singapore Technologies Electronics, and Synopsys in the United States.

According to my research, Dr. Liu Kun has participated in the formulation of several national standards for power line communication.

An interesting fact is that today's IoT technology was incubated by the former ubiquitous power IoT.

The first round of power system reform (Guo Fa [2002] No. 5 Document) began with the separation of power plants and grids, and China's power grid investment cycle kicked off in 2003.

The entire process can be divided into three stages: grid construction (2003-2008), smart grid (2009-2014), and UHV (2012-2019). During this super cycle, China's power grid investment increased from RMB 99.8 billion in 2002 to RMB 513 billion in 2018, directly driving the rapid rise of China's IoT enterprises.

After 2019, power investment slowed down, but other industries began to reap the benefits of IoT technology. Almost every industry is now pursuing the concept of the Internet of Everything.

However, despite the company's advanced technology, it has little connection with Big Fund, and its latest financial performance has been poor.

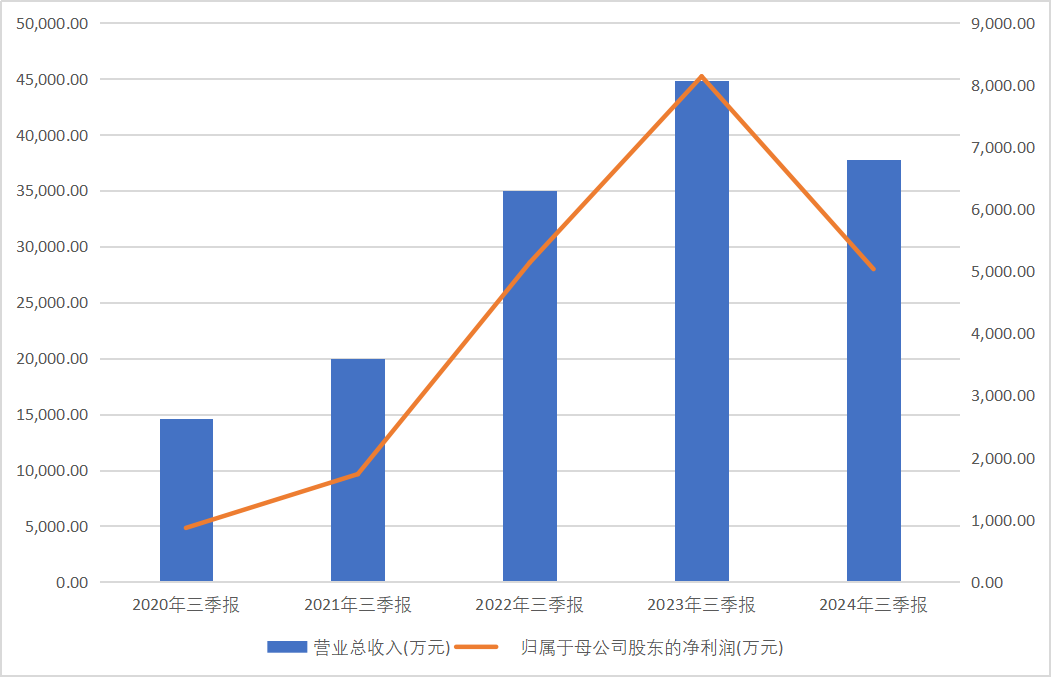

Lehe Micro's third-quarter report for 2024 showed that its revenue for the first three quarters was RMB 378 million, down 15.68% year-on-year; net profit attributable to shareholders was RMB 50.35 million, down 38.12% year-on-year; and non-GAAP net profit was RMB 44.40 million, down 38.89% year-on-year.

Data Source: iFind

The main reasons for the decline in both revenue and net profit are product-related issues.

From the perspective of product applicability, over 90% of the company's products are supplied to the power system. When the company released its interim report, revenue and net profit were still growing, but in the third quarter, affected by the bidding procurement and shipment progress of the State Grid, the company's revenue was significantly reduced, dragging down performance.

02 A New Round of the Power Cycle After the ubiquitous power IoT, State Grid and China Southern Power Grid have introduced a new concept: digital and intelligent power grid.

In early 2024, State Grid announced plans to strengthen the construction of a digital and intelligent power grid to promote a green and low-carbon energy transition. It plans to build demonstration projects in scenarios such as digital distribution networks, new energy storage regulation and control, and vehicle-grid interaction. The expected investment exceeds RMB 500 billion, and in July, it further announced that annual investment would exceed RMB 600 billion, with new investments primarily used for UHV project construction and grid digitization and intelligent upgrades.

China Southern Power Grid's 14th Five-Year Plan proposes achieving full coverage of digital platforms by 2025, popularizing smart meters and low-voltage centralized reading systems, with an automatic meter reading rate exceeding 99% and distribution automation coverage exceeding 90%. It is expected to invest RMB 670 billion during the 14th Five-Year Plan period, with RMB 320 billion allocated to distribution networks to strengthen smart grid construction. In February 2024, China Southern Power Grid proposed seven aspects to advance the construction of a new power system, aiming to build a clean, low-carbon, secure, abundant, economically efficient, supply-demand coordinated, and flexible intelligent power system.

The new concept implies significant investments, which will benefit a large number of IoT technology enterprises.

03 The Second Curve

I have analyzed many listed companies engaged in smart grid-related businesses, and they share a common characteristic: a single business line and relatively weak risk resistance.

When the power industry investment is low, these companies are often left helpless.

Currently, Lehe Micro also seems to be in a similar situation.

However, the company has prepared a diversification strategy in advance.

In June 2024, the company launched a cost-effective PLC SOC chip and communication module specifically designed for smart lighting. This product incorporates a built-in Risc-V 32-bit MCU, tailored for smart lighting applications such as DC magnetic track lights. Since its debut at the Guangzhou International Lighting Exhibition and China International Building Decoration and Materials Expo, the chip has received widespread attention and inquiries from many lighting enterprises, significantly enhancing Lehe Micro's competitiveness in PLC technology and smart lighting products.

In 2023, the company launched a high-speed PLC chip for the smart photovoltaic field, which achieved large-scale mass production and sales in the first half of 2024. This not only consolidated Lehe Micro's leading position in the smart photovoltaic renewable energy market but also further expanded our influence.

In 2023, the company also introduced a highly integrated, low-cost, high-speed dual-mode chip for the smart grid market. By 2024, this chip had been fully promoted and sold, which is expected to significantly enhance the company's competitiveness in the smart grid market.

Among them, the risc-v chip is completely independent and has great potential for future development.

-END-

Disclaimer: This article is based on the publicly disclosed information (including but not limited to interim announcements, periodic reports, and official interaction platforms) of listed companies. Poetry and Stars strives for fairness in the content and opinions presented in this article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Poetry and Stars assumes no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is original to Poetry and Stars and may not be reproduced without authorization.