NIO's Q1 revenue decreased by 7% year-on-year, Li Bin aims for a 20% gross profit margin

![]() 06/07 2024

06/07 2024

![]() 753

753

"NIO Energy secures another 1 billion yuan in financing and will pursue independent financing in the future."

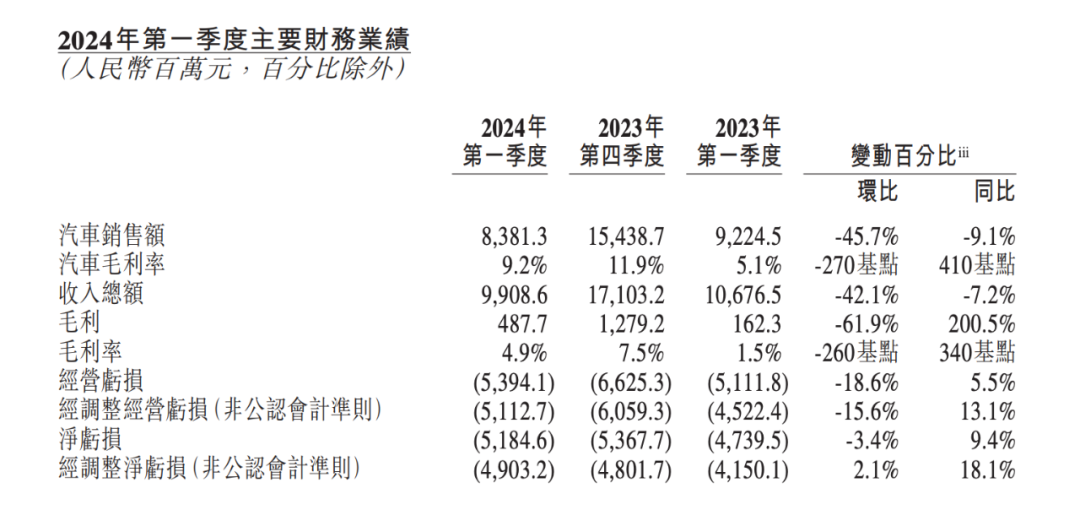

NIO (NIO.US; 9866.HK; NIO.SG) released its financial report for the first quarter of 2024. The report showed that NIO's revenue for the first quarter decreased by 7.2% year-on-year and 42.1% quarter-on-quarter, while the company's gross profit margin increased to 4.9%, and gross profit increased by 200.5% year-on-year.

In terms of revenue, NIO's total revenue for the first quarter was 9.9 billion yuan, a decrease of 7.2% compared to 10.677 billion yuan in the same period of 2023. Gross profit for the first quarter was 480 million yuan, an increase of 200.5% compared to the same period in 2023; gross profit margin for the first quarter was 4.9%, while it was 1.5% in the same period of 2023. The net loss for the first quarter was 5.18 billion yuan, an increase of 9.4% compared to the same period in 2023.

Source: NIO Auto Financial Report

Automobile sales revenue for the first quarter was 8.38 billion yuan, a decrease of 9.1% compared to the same period in 2023; the automobile gross profit margin for the first quarter was 9.2%, while it was 5.1% in the first quarter of 2023. Other sales revenue was 1.52 billion yuan, an increase of 5.2% year-on-year but a decrease of 8.2% quarter-on-quarter. Cash and cash equivalents, restricted cash, short-term investments, and long-term term deposits amounted to 45.3 billion yuan.

The number of vehicle deliveries in the first quarter reached 30,053, including 17,809 high-end intelligent electric SUVs and 12,244 high-end intelligent electric sedans, a decrease of 3.2% compared to the same period in 2023. In April of this year, the delivery volume was 15,620 vehicles, and in May, it was 20,544 vehicles. As of May 31, the cumulative delivery volume of NIO vehicles reached 515,811 vehicles. NIO estimates that the company's automobile delivery volume for the second quarter of 2024 will be between 54,000 and 56,000 vehicles, representing an increase of approximately 129.6% to 138.1% compared to the same period in 2023.

The financial report also revealed that on May 31 this year, Wuhan Guangchuang Emerging Technology Phase I Venture Capital Fund Partnership (Limited Partnership) invested 1 billion yuan in cash in NIO Energy and holds a 10% equity stake.

Regarding this investment, NIO's founder, chairman, and CEO Li Bin said in a conference call that after this financing, the company still holds a 90% stake, and subsequently plans to launch an independent financing plan.

"This investment is mainly used to build the network, and overall, the profitability is very clear." He revealed that currently, more than 2,000 battery swap stations have about 30-40 orders per day, so there is no problem with long-term sustainability.

"The new brand Ledao plans to start deliveries in September this year, and there will be 100 stores by then. Each store's investment will be around 1 million to 2 million yuan, which is not a significant pressure on the company. Ledao is a mid-size SUV, and there will be subsequent product planning, but not too many products. The overall market for Ledao is approximately the family car market with a price of around 200,000 yuan, and the overall market size is around 4 million yuan. Li Bin said that the company still has a very large market space here."

NIO currently has self-developed technologies such as chips that can significantly improve gross profit margins, and battery costs are also declining. Li Bin said that the target is a scale of 30,000 vehicles and a gross profit margin of 20%, and he is very confident in achieving this target. NIO will not sacrifice profit margins for sales, and it will definitely pursue a gross profit margin of over 15%. Optimizing the gross profit margin while ensuring steady sales growth is an important task for NIO in the next stage.

Charging stations also need to be upgraded in the future. The upgrade cost is 200,000 to 300,000 yuan, and currently, there are over 1,000 third-generation stations. Starting from June, the fourth-generation charging stations will be officially deployed. The fourth-generation stations will be compatible with both Ledao and NIO brands. Li Bin said that overall, by the end of the year, there will be over 1,000 charging stations available for Ledao users.

There is a positive correlation between charging stations and sales in the region, and NIO is an example in the Yangtze River Delta region. Over 50% of NIO's users are in the Yangtze River Delta region because there are nearly 900 battery swap stations in this area.

"The company is also looking at the ROI model to see how much incremental sales a battery swap station deployment can bring." He said that the next step in battery swap deployment will be based more on promoting sales, making investment returns more targeted.

On June 4, the Ministry of Industry and Information Technology, the Ministry of Public Security, the Ministry of Housing and Urban-Rural Development, and the Ministry of Transport jointly released a list of enterprises selected for the pilot program for intelligent connected vehicles' access and road travel, and NIO was among the first batch of selected enterprises. Regarding this, Li Bin said that being selected is a recognition of NIO, and secondly, it will also take this opportunity to explore higher-level intelligent driving.

In March this year, NIO also adjusted its battery strategy, and Li Bin said that the strategic adjustment is very important. In March, it released a long-life battery strategy and adjusted the monthly battery rental price. This adjustment is crucial for users to accept the subscription model. He said that the proportion of users adopting the rental method on Sundays now exceeds 80%, and the refund rate has increased significantly.

In addition to battery discounts, Li Bin believes that the expansion of the sales network is also very important. In March and April this year, the number of qualified sales staff increased significantly and started contributing to sales orders.

From a global market perspective, currently, NIO's sales in Europe account for a relatively low proportion. In the long run, it will formulate reasonable strategies based on local tariff policies in Europe. In the Middle East market, NIO will start providing its products and services in the Middle East later this year.

Currently, NIO has 3 automotive brands. NIO targets the high-end market and family users, while Ledao is more affordable. These brands also offer battery swap services, and there is a high degree of reuse in intelligence and electric motors. The three brands can share a lot of capabilities and investments. Currently, some minor issues are that in May, order demand exceeded the company's production capacity, so the delivery volume in May was limited. Overall, the order volume is still growing, and currently, production capacity is being increased through training workers and running double shifts.

This article was originally written by the public account Caijing Tuya (ID: caijingtuya). Please contact Tuya if you wish to reprint it.