**[In-depth Analysis of Financial Report] Why Learn from BYD Instead of Huawei?**

![]() 06/07 2024

06/07 2024

![]() 812

812

Author | Meng Xiao

For more financial information | BT Finance Data Hub

Total word count: 5192, estimated reading time: 13 minutes

BYD Qin is hailed as a miracle of Chinese industry by netizens, and there's a good reason for that.

Recently, BYD has been in the limelight, with various social platforms and portal websites flooded with news about the BYD Qin L DM-i's driving range exceeding 2,100 kilometers. This news even caused a sensation overseas. In fact, BYD's officially announced fuel consumption figure is slightly conservative. According to tests conducted by Yiche.com, Pacific Auto, and several well-known auto reviewers on the BYD Qin L DM-i, the results of six test cars on routes from Xi'an to Hami, Xi'an to Changchun, and Xi'an to Shenzhen all exceeded 2,300 kilometers.

Not only did the BYD Qin L trend on Chinese networks, but the topic of "filling up a tank of gas can drive from New York to Miami" also spread widely on foreign websites, sparking a stir among American netizens, some of whom even wanted to "smuggle" a BYD Qin into the United States.

Foreign media have previously reported on Chinese automakers, but never with such intense coverage as the BYD Qin L DM-i. In particular, when American netizens saw its price tag of only $13,775, they were stunned, exclaiming that this was an innovative technology that would spell "Game over" for traditional automakers. American netizens regretted that this car could not be sold in the United States due to alleged safety concerns, otherwise it would quickly dominate the American market.

Some American netizens mocked the 100% tariff imposed on Chinese new energy vehicles by the United States, arguing that even with a 100% tariff, BYD would still be better than cars priced above $30,000 in the United States. A large number of netizens expressed support for BYD, believing that if these vehicles could be produced on a large scale, all other automakers would face significant difficulties in terms of price, functionality, and quality. For a time, the entire American network was buzzing about the BYD Qin L DM-i.

That's not all the exciting news about BYD. On June 2, BYD released its May sales report, showing that the company sold 331,817 new vehicles in May, of which 330,488 were passenger cars, representing a year-on-year increase of 38.2%. To date, BYD has sold over 1.26 million new vehicles in 2024. With the launch and popularity of the BYD Qin L DM-i, BYD's sales are expected to surge in the future. Some institutions have begun to adjust their forecasts for BYD's annual sales, expecting BYD to sell between 3.7 million and 4 million vehicles in 2024.

Driven by these multiple positive news, BYD's share price experienced a wave of gains. As of the close on June 5, BYD's share price closed at 240.79 yuan. Its opening price on the first trading day of 2024 was 199.6 yuan per share, indicating a year-to-date increase of 21%. Dongwu Securities released a research report titled "Sales Review: Impressive Sales in May, DM5.0 Implementation Strengthens Product Competitiveness," giving BYD a buy rating with a target price of 314.60 yuan, representing an expected increase of 31% based on the current share price.

1

R&D Expenses Surge

In late April, BYD released its first-quarter report for 2024, showing revenue of 124.944 billion yuan, a year-on-year increase of 3.97%; net profit of 4.569 billion yuan, a year-on-year increase of 10.62%; and non-recurring net profit increased by 5.24% to 3.752 billion yuan. From a revenue and profit perspective alone, BYD's performance in the first quarter was average, as the growth rates have significantly slowed compared to 2023.

In 2022 and 2023, BYD's total revenue was 424.1 billion yuan and 602.3 billion yuan, respectively, representing year-on-year growth rates of 96.20% and 42.04%; net profits were 16.62 billion yuan and 30.04 billion yuan, respectively, representing year-on-year growth rates of 445.86% and 80.72%; and non-recurring net profits were 15.64 billion yuan and 28.46 billion yuan, respectively, representing year-on-year growth rates of 1146.42% and 82.01%. In terms of revenue, BYD has experienced rapid growth, with revenue in 2021 only at 216.1 billion yuan and exceeding 600 billion yuan in 2023, almost tripling. However, the growth in net profit is even more rapid, with BYD's net profit in 2021 only at 3.045 billion yuan, while the net profit in 2023 reached 30.04 billion yuan, ten times that of 2021.

It is worth mentioning that BYD's R&D expenses have continued to rise. In the first quarter, BYD's R&D expenses reached 10.61 billion yuan, an increase of 70.1% from the same period last year's 6.238 billion yuan, which is consistent with BYD's consistent increase in R&D expenses in recent years. In the past five years, BYD's R&D expenses were 5.629 billion yuan, 7.465 billion yuan, 7.992 billion yuan, 18.65 billion yuan, and 39.57 billion yuan, respectively, representing year-on-year growth rates of 12.83%, 32.61%, 7.05%, 133.44%, and 112.13%, especially with exceptionally rapid growth in R&D expenses in the past two years.

In the first quarter of 2024, BYD's R&D expenses reached 10.61 billion yuan. Based on this calculation, the annual R&D expenses will set a new record. Currently, BYD's R&D expenses account for 8.49% of its total revenue, further increasing from the 6.6% in 2023. In the first quarter of 2023, the R&D expense ratio was 5.2%, representing a year-on-year increase of 3.29 percentage points. For BYD, which has quarterly revenue exceeding 10 billion yuan, this is indeed a significant investment, perhaps the key to BYD's ability to achieve significant breakthroughs in the field of new energy vehicles.

If you don't have an intuitive impression of this R&D data, you can compare it to the R&D expenses of the new carmakers NIO, Xpeng, and Li Auto during the same period. NIO's R&D expenses in 2023 were 13.43 billion yuan, Li Auto's were 10.59 billion yuan, and Xpeng's were 5.277 billion yuan. The total R&D expenses of these three companies in 2023 were 29.297 billion yuan, while BYD's R&D expenses during the same period were 39.57 billion yuan, exceeding the sum of the three by 10.3 billion yuan. In the first quarter of 2024, Li Auto's R&D expenses were 3.049 billion yuan, and Xpeng's were 1.35 billion yuan. NIO has not released its first-quarter report, but based on the first-quarter R&D expenses of 2023, which were 3.076 billion yuan, it is difficult for NIO's first-quarter R&D expenses in 2024 to exceed 5 billion yuan. This also shows that BYD's R&D investment far exceeds that of the three new carmakers NIO, Xpeng, and Li Auto.

Even more shocking to investors is that BYD's R&D investment in the first quarter once again exceeded Tesla's $1.175 billion for the same period, and Tesla's R&D ratio of 5.4% lags far behind BYD's 8.49%. In 2023, Tesla's R&D expenses were $3.969 billion, also less than BYD's 39.57 billion yuan. That year, Tesla's R&D ratio was only 4.1%, also lower than BYD's 5.2%.

According to BT Finance statistics, BYD has invested a total of 87.933 billion yuan in R&D expenses from 2016 to 2023, plus 10.61 billion yuan in the first quarter of 2024, BYD's cumulative R&D investment since the financial report began showing R&D expenses has reached 98.543 billion yuan, and this year's cumulative R&D expenses will easily exceed 100 billion yuan. Currently, there are few domestic enterprises that can rival BYD.

2

Leading by Scrutinizing Details

On May 28, when BYD launched the new Qin L and Dolphin 06 models, it also released the "Fifth-generation DM Technology." The thermal efficiency of the core engine of this fifth-generation DM technology has reached the industry's highest level of 46.06% for mass production, with a global lowest fuel consumption of 2.9L per 100 kilometers and a global longest combined range of 2,100 kilometers, ushering in the era of fuel consumption 2 and redefining new benchmarks for plug-in hybrid technology.

As BYD officially announced, the key data of the core engine of the fifth-generation DM technology is leading in the industry, with fuel consumption only one-third that of traditional gasoline vehicles and a combined range three times that of traditional gasoline vehicles. This means higher energy conversion efficiency and lower energy consumption, which means you can travel further with less money.

In fact, major automakers are constantly introducing new energy products and pushing the driving range of new energy vehicles to new heights. Nowadays, driving range has become the main reference data for the performance of a new energy vehicle. After market verification, plug-in hybrid vehicles are more in line with market demand. At the end of 2023, the Honda Accord e:PHEV and Honda CR-V e:PHEV claimed to have achieved driving ranges of 2,132.7 kilometers and 1,936.1 kilometers, respectively, under full charge conditions, but these figures are only laboratory data and have not been verified by consumers. In March 2024, Geely Automobile announced that its Leishen electric hybrid platform will launch a new generation of electric hybrid systems, with a maximum range of over 2,000 kilometers when fully charged and fueled. In May, the Chery Fengyun T9, as the first SUV model to undergo actual testing, also achieved a good result of 1,800 kilometers under full charge and fuel conditions. The Dongfeng Aeolus L7, which is the first model to feature the马赫 electric hybrid technology, achieved an actual driving range of 2,054 kilometers in testing. For a while, a driving range of 2,000 kilometers became the "standard" indicator for plug-in hybrids.

Auto media person Zhang Zhiyong said that the DM-i technology of the BYD Qin L and Dolphin 06 cannot be considered an innovative breakthrough. It is evident that the sensation caused by BYD is far greater than that of Honda, Dongfeng, Chery, and Geely. "The most commendable aspect of BYD is that, despite its high R&D expenses, it is still scrutinizing technical details. The fifth-generation DM technology does not have any black technology compared to the previous generation, but it has perfected every detail and corrected many issues in the previous generation's technology. Each of BYD's technologies may not be the most advanced globally, but the combination of multiple technologies is globally leading. It seems like there has been tremendous progress in technology, but it is actually the result of scrutinizing details, and the technology has achieved the ultimate level, ultimately creating a miracle in the history of Chinese industry."

Zhang Zhiyong believes that BYD's related technologies, which seem to be feasible for every automaker, are actually difficult to replicate because everyone overlooks the details. "BYD dares to engage in price wars because of its complete industrial chain, which can gradually reduce costs and upgrade production lines. Scrutinizing every technology is much more profound than the so-called craftsmanship spirit of Japanese companies, which is worth learning by many enterprises. In contrast, Huawei's excessive R&D investment makes it difficult for other enterprises to replicate."

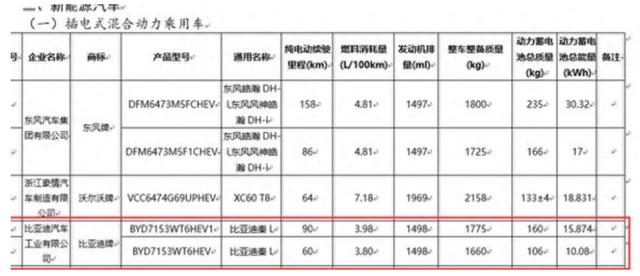

BYD's meticulous scrutiny of details has allowed the Qin L and Dolphin 06 DM-i to achieve a low fuel consumption of only 2.9L/100km (NEDC conditions), making them the undisputed global leaders in low fuel consumption. Even if the WLTC fuel consumption announced by the Ministry of Industry and Information Technology is used, the result of 3.8L is still quite astonishing (so far, an auto review team has measured a result of 1.9L/100km on the highway).

To demonstrate the strength of this data, let's compare it with Japanese cars known for their energy efficiency and fuel economy. The hybrid Corolla, with a smaller body and lighter weight, has a WLTC fuel consumption of 4.07L. The hybrid Camry, also a B-class car, has a WLTC fuel consumption of 4.5L. The hybrid Accord, which is also a plug-in hybrid, has a WLTC fuel consumption of 4.88L. Except for the Corolla, which is not in the same class as the Qin L and has a combined fuel consumption close to that of the Qin L, the combined fuel consumption of the Camry and Accord is significantly higher than that of the Qin L. The Qin L maintains a significant advantage of at least 20% energy savings over both.

An engineer responsible for technology at BYD said, "The fifth-generation DM is more of an improvement and upgrade in all aspects based on the fourth generation and has not changed the original architecture. We believe that the current DM-i architecture is the most reasonable." He also said that BYD had tried Toyota THS or two-speed and three-speed DHT technical routes in the past, but complex transmissions are a product of the internal combustion engine era. DM-i is an electric-based hybrid system, and the direction is to simplify. Electric motors have high rotational speeds and can maintain an efficient working range from 0 to tens of thousands of revolutions, so the motor itself can act as a continuously variable transmission.

Automobile professionals have pointed out that the evolution of BYD's DM-i from the fourth generation to the fifth generation is the result of scrutinizing details and achieving impressive data. This significant improvement in data has also led to globally astonishing leading