New Dual-Threshold Rules for New Energy Vehicle Purchase Tax: A Market Survival Battle Under the Dual Challenges of Range and Energy Consumption

![]() 10/13 2025

10/13 2025

![]() 566

566

In October 2025, the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Taxation Administration jointly unveiled new regulations regarding the purchase tax exemption for new energy vehicles from 2026 to 2027. These regulations aim to steer the rapidly expanding new energy vehicle sector by introducing enhanced technical benchmarks.

This policy shift does not equate to a 'total abolition of exemptions.' By raising the pure electric range requirement for plug-in hybrid (including extended-range) passenger vehicles from the original 43 kilometers to 100 kilometers, a more-than-doubling increase, the move not only directly impacts consumers' vehicle purchasing costs but also propels automakers to a pivotal moment for technological advancements and product lineup refinements. The market viability for low-range plug-in hybrid models is rapidly diminishing.

▍Product Matrix Adaptation Under Pressure

At the corporate level, certain automakers confront short-term challenges in model realignment. Take BYD as an illustration; some entry-level models aimed at the lower-tier market boast pure electric ranges clustered around 50-80 kilometers, just shy of the new benchmark. For instance, the entry-level Qin PLUS DM-i employs a small-capacity battery pack to deliver roughly 55 kilometers of pure electric range, a setup that will lose its purchase tax exemption status post-2026. Given the statutory tax rate of 10%, consumers will face an additional 12,000 yuan in vehicle purchase expenses for an entry-level plug-in hybrid model priced at 120,000 yuan.

The repercussions of the new regulations extend beyond individual firms, triggering a structural overhaul across the entire plug-in hybrid market. Presently, plug-in hybrid models with pure electric ranges below 100 kilometers are predominantly found in the entry-level market, priced at 100,000 yuan or less. The pure electric modes of certain models merely cater to short-distance commuting needs, with actual usage heavily reliant on fuel-powered operation. This not only falls short of achieving meaningful emission reductions but also strays from the core objectives of new energy policies. The implementation of the new regulations will directly expedite the phase-out of such models.

For small and medium-sized automakers, the withdrawal of low-range plug-in hybrid models could spell an existential threat. Unlike industry leaders such as BYD, these companies lack substantial technological reserves and economies of scale. Upgrading pure electric ranges to 100 kilometers necessitates significant investments in battery system enhancements, chassis redesigns, and energy consumption optimizations, while their product premium capabilities struggle to offset the added costs. Even for firms capable of executing technological upgrades, the phase-out of low-range models will set off a chain reaction.

From the consumer's standpoint, models that fall short of the new standards will be removed from the 'Tax Exemption Catalog,' potentially narrowing the array of available choices. However, in the long run, this will steer the market towards higher-quality, long-range products. Cui Dongshu, Secretary-General of the China Passenger Car Association, noted that stringent standards will incentivize companies to introduce higher-performing models, meeting consumer demand for extended range and low energy consumption, and fostering a win-win scenario for industrial and consumption upgrades. He also believes that this policy adjustment will spur consumers to concentrate their purchases before the year's end. Coupled with factors such as the 'Silver September, Golden October' peak season and year-end sales drives by automakers, it will contribute to a slight positive growth in the fourth quarter.

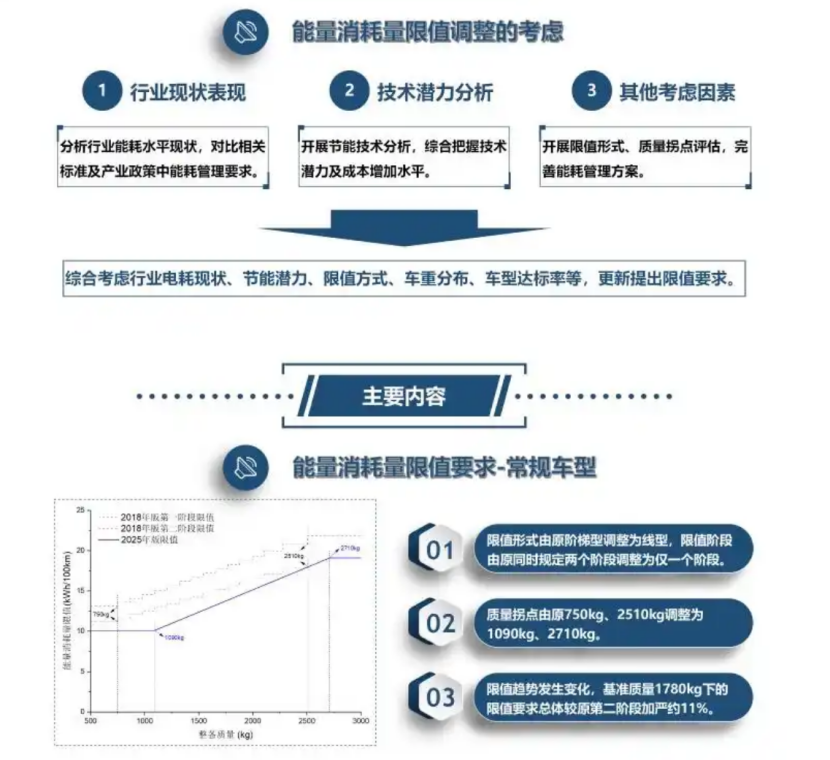

The crux of technological upgrades for pure electric models lies in energy consumption management. The new regulations stipulate that the energy consumption per 100 kilometers for pure electric passenger vehicles must adhere to the corresponding standards outlined in 'Energy Consumption Limits for Electric Vehicles Part 1: Passenger Vehicles' (GB 36980.1—2025), with models exceeding a maximum design total mass of 3500kg required to comply with the limits for the 3500kg class. This adjustment compels automakers to ramp up investments in areas such as battery management system (BMS) optimization, lightweight vehicle design, and drag coefficient reduction.

The new regulations intertwine pure electric range with energy consumption performance, battery performance, and other metrics, demanding that pure electric models further curtail energy consumption. Meanwhile, plug-in hybrid models must not only 'be capable of utilizing electricity' but also 'do so efficiently'—under charge-sustaining mode, passenger vehicles with a curb weight below 2510kg must achieve fuel consumption below 70% of the corresponding limit, while under charge-depleting mode, electricity consumption must remain below 140% of the corresponding limit. These multi-faceted technical requirements will also compel companies to transition from singular range enhancements to comprehensive technological optimizations, accelerating the iterative upgrading of hybrid technologies.

▍Consumer Short-Term Dilemmas and Long-Term Gains

The impact of policy adjustments on consumers is characterized by 'short-term pain coexisting with long-term benefits.' In terms of vehicle purchase costs, a 'price scissors gap' (price differential) between old and new models will emerge in the short term: the end of 2025 will serve as the 'last-chance window' for low-range models. Some new energy vehicle startups, grappling with production capacity issues that delay deliveries until the following year, have also rolled out policies to subsidize purchase taxes. The implementation of the new regulations will act as a pivotal catalyst for the new energy vehicle industry's transition from 'policy-driven' to 'technology-driven.'

According to rough estimates by Cheshi Ruijian, while new models launched after 2026 will face cost pressures due to technological upgrades—with battery cost increases for plug-in hybrid models potentially leading to price hikes of 3,000-8,000 yuan, and R&D investments for energy consumption optimization in pure electric models possibly driving up pricing—the actual purchase costs may still prove more advantageous after factoring in purchase tax exemptions. Based on calculations, for a 150,000 yuan long-range plug-in hybrid vehicle, after a 15,000 yuan purchase tax exemption, the actual expenditure will be roughly on par with a 120,000 yuan model without exemptions.

Industry insiders note that consumer decision-making for plug-in hybrid models will also undergo a shift, with 'range' evolving from a 'bonus feature' to a 'basic threshold.' The 120-200 kilometer range interval is emerging as the mainstream choice, while energy consumption performance, battery warranty, and intelligent configurations will become focal points for differentiated competition. Surveys by the China Passenger Car Association reveal that in the first half of 2025, 62% of potential consumers listed 'pure electric range exceeding 100 kilometers' as a must-have option, up 35 percentage points from the previous year. For users in lower-tier markets with limited charging infrastructure, the 'multi-day charging interval' characteristic of long-range plug-in hybrid models better aligns with their usage scenarios. Meanwhile, mid-to-high-end users are more inclined to opt for models that combine range with intelligent configurations, with the market exhibiting traits of 'simultaneous advancement in demand stratification and product upgrading.'

The new regulations for purchase tax exemption on new energy vehicles, slated to take effect in 2026, represent both a 'litmus test' of technological prowess and a 'consolidation phase' for market positioning for leading companies. Despite short-term pressures from costs and iterations, they will further cement their leading advantages through product structure upgrades in the long run. Additionally, Cui Dongshu believes that the elevated standards will not only serve as a major guide for global automotive brands competing in the Chinese market but also offer forward-looking insights for the future technological development trajectory of new energy vehicles worldwide.

For a substantial number of low-range plug-in hybrid models and high-energy-consumption pure electric models, this policy adjustment marks the formal commencement of a 'countdown to obsolescence.' The market share of low-end plug-in hybrids and inefficient pure electric models will undergo reallocation, with small and medium-sized automakers lacking technological reserves potentially exiting the market during the shakeout.

Layout|Yang Shuo Image Sources: Official Website of the Ministry of Industry and Information Technology, BYD, Qianku Network