Sales Keep Climbing: Who Claims Fuel Vehicles Are Obsolete?

![]() 10/14 2025

10/14 2025

![]() 600

600

Lead

Introduction

In a seemingly disadvantaged position, the resilient fuel vehicle is quietly mounting a comeback.

The unstoppable ascent of new energy vehicles and the decline of fuel vehicles have become an almost universal consensus within and outside the automotive industry, with ongoing debates about whether the penetration rate of new energy has reached a pivotal turning point. Fuel vehicles appear to have been marginalized.

However, in this less-favored corner, the tenacious fuel vehicle is quietly staging a resurgence. Data from the China Automotive Data Research Institute reveals that in June, retail sales of fuel vehicles reached 973,000 units, marking a 6.2% year-on-year increase and putting an end to the previous trend of consecutive monthly declines. In July, fuel vehicle sales surged even further, with domestic sales climbing to 981,000 units, an 8.4% year-on-year rise. By August, this upward trend solidified, with domestic sales of fuel vehicles surpassing the one-million mark, reaching 1.074 million units—a 9.5% month-on-month increase and a 12.9% year-on-year rise.

While fuel vehicles have stabilized, new energy vehicles, despite breakthroughs in penetration rate, are showing signs of underlying pressure in their growth trajectory. Especially with the implementation of purchase tax policies next year and the recent tightening of related regulations, these developments have not only directly influenced some consumers' purchasing decisions but have also, to a certain extent, depleted next year's market sales potential.

From the perspective of market trend sustainability, the recent sales recovery of fuel vehicles is by no means a temporary fluke. With the squeezing out of price bubbles, the resolution of intelligence shortcomings, and the tightening of preferential policies for electric vehicles, fuel vehicles have regained some breathing room.

01 Fuel Vehicle Sales Recover for Multiple Consecutive Months

Examining passenger vehicle data from the China Passenger Car Association, retail sales of fuel-powered passenger vehicles continued to climb in September.

In August, retail sales of narrowly defined passenger vehicles in China reached 2.018 million units, of which 1.115 million were new energy narrowly defined passenger vehicles. This implies that retail sales of fuel-powered narrowly defined passenger vehicles were 903,000 units. The latest data from the China Passenger Car Association shows that in September, retail sales in the national passenger vehicle market reached 2.241 million units, of which 1.296 million were new energy passenger vehicles. This suggests that retail sales of fuel-powered narrowly defined passenger vehicles were 945,000 units, surpassing the previous forecast of 900,000 units.

The recovery of the fuel vehicle market is closely tied to the resolution of intelligence shortcomings and price concessions at the terminal level.

Intelligent experience has become one of the core decision-making factors for consumers when purchasing vehicles. As early as the J.D. Power 2023 NVIS study, it was shown that the impact of price on potential consumers continues to diminish, while the weight of automotive intelligent experience has risen to 14%, becoming the third largest decision-making factor after vehicle quality (18%) and vehicle performance (16%), on par with vehicle design (14%) and far exceeding the influence of brand (13%) and price (13%).

However, constrained by traditional configuration logic, fuel vehicles in the past have always struggled in the intelligent realm: assisted driving could only achieve basic high-speed cruise control and was ineffective in complex road conditions; intelligent cockpits were even more of a 'shortcoming,' with in-vehicle systems lagging, voice interactions providing irrelevant responses, and even basic navigation updates being untimely, frequently disappointing users.

Nevertheless, with hardware adaptation and software upgrades, 'equal intelligence for fuel and electric vehicles' is gradually becoming a reality.

Take the newly launched all-new Sagitar L as an example. In terms of hardware, the new car is equipped with 7 cameras, 5 millimeter-wave radars, and 12 ultrasonic radars. Inside, it features a 15-inch 2K floating central control screen, a 10.25-inch full LCD instrument, and a W-HUD head-up display system. On the software side, the new car is equipped with the IQ.Pilot enhanced driving assistance system, covering 95% of urban road conditions and 100% of highway scenarios, enabling features such as highway pilot assistance, precise ramp entry and exit, smooth obstacle avoidance, and traffic light start-stop.

While addressing intelligence shortcomings, fuel vehicles are also making bold moves in terms of size and pricing.

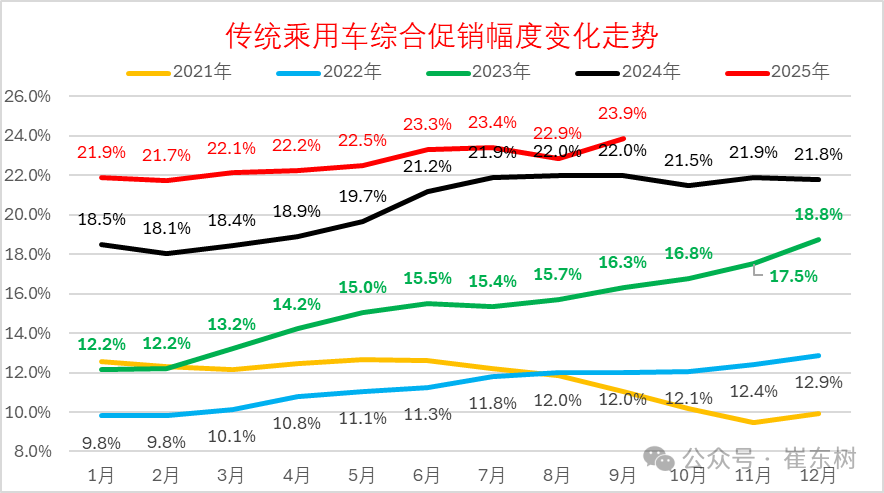

Data shows that in September, promotions for traditional fuel vehicles remained stable at 23.9%, an increase of 1 percentage point from the previous month and 1.9 percentage points from the same period last year. Previously, the fixed-price whole vehicle promotions launched by joint venture brands yielded significant results. Fuel vehicle models such as the Regal, Sylphy, Teana, and Corolla saw significant sales increases under highly favorable fixed-price policies.

Beyond fixed pricing, cross-level competition is also a powerful means for fuel vehicles to boost sales. Again, taking the Sagitar L as an example, after its recent launch, not only has its length increased to 4,812mm, giving it an advantage in the A+ segment, but its pricing has also reached an all-time low. When the Sagitar first landed in China in 2006, it was priced between 140,000 and 210,000 yuan. After upgrades, the starting price of the Sagitar L has dropped to 110,000 yuan, with the top-end model priced below 130,000 yuan.

02 New Energy Holds the Advantage, but Fuel Vehicles Have a 'Trick Up Their Sleeve'

Despite showing a stable recovery trend, fuel vehicles are still outpaced by new energy vehicles, which have seen even greater growth and a steady climb in their penetration rate.

In September, retail sales of new energy passenger vehicles reached 1.296 million units, up 15.5% year-on-year, a growth rate far exceeding that of fuel vehicles. This helped the retail penetration rate of new energy passenger vehicles climb to 57.8% in September, up 5 percentage points from the same period last year and 2.6 percentage points from August.

In the short term, the policy of halving the purchase tax starting in 2026 will greatly stimulate consumers to complete their purchases within the year.

During store visits, a Xiaomi salesperson mentioned that the purchase tax has a significant impact on customers' decisions: 'Many people give up halfway when they hear the car has a one-year wait, and then when they hear about the purchase tax, 90% give up. Unless they really like it.'

The salesperson further explained that just as consumers prefer to have shipping costs included in the price of clothes rather than paying for shipping separately, they are willing to accept a higher base price for a car but not an additional purchase tax.

Additionally, with the combination of trade-in subsidies and year-end sales pushes by automakers, there is still significant room for growth in new energy penetration. And after the purchase tax policy is implemented in 2026, fuel vehicles may also have the opportunity to regain more initiative.

Against the backdrop of the rapid advancement of new energy vehicles, every sales recovery of fuel vehicles is easily labeled as a short-term rebound, sparking controversy. However, from the continuous growth from June to September, the substantial resolution of intelligence shortcomings, to the precise competition in pricing and size, fuel vehicles are proving with a series of actions that their vitality does not rely on policy buffers or market accidents but stems from their realignment with user needs.

Of course, we must still be aware that the 57.8% penetration rate and 15.5% year-on-year growth of new energy vehicles still underscore the overall direction of industry transformation. Short-term stimuli from purchase tax policies and continuous cost reductions through technological iterations will continue to inject momentum into the new energy market. The possibility of fuel vehicles regaining market dominance is minimal.

However, this does not mean that fuel vehicles will exit the stage. In vast lower-tier markets, there are still a large number of users who are less sensitive to charging facilities and usage costs than to the convenience of immediate refueling and maintenance. In certain specific scenarios, the range stability and low-temperature adaptability of fuel vehicles still hold irreplaceable advantages.

For fuel vehicles, this recovery is more like a strategic adjustment. By upgrading intelligence to shed the label of backwardness, by competing on cost-effectiveness to solidify their base, and by optimizing technology to reduce energy consumption and emissions, they can find their own long-term survival space amidst the growth of new energy.

Editor-in-Chief: Yang Jing Editor: He Zengrong