Breaking the 50% Export Share Deadlock! 2025 Pickup Trucks: Great Wall Defends Its Position, Changan and BYD Rewrite the Rules

![]() 01/21 2026

01/21 2026

![]() 491

491

Author / Qin Yue

Produced by / Zhuojian Auto

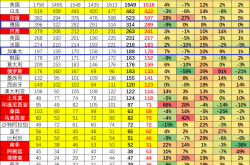

In 2025, the Chinese pickup truck market will witness a historic turning point—annual sales will surpass passenger cars for the first time. Dual data from the China Passenger Car Association (589,000 units) and the China Association of Automobile Manufacturers (609,000 units) confirms the rise of this commercial vehicle segment.

A more profound transformation lies in the dramatic differentiation of the competitive landscape: Great Wall Pickup maintains its "superpower" status with over 30% market share, Changan achieves leapfrog growth through technological exports, BYD disrupts the market as a new energy dark horse, while traditional players like Zhengzhou Nissan struggle amid transformation.

This multi-dimensional competition, centered around technology routes, globalization strategies, and user needs, is reshaping the competitive rules of China's pickup truck industry.

Loosening of the "Superpower" Dominance: Great Wall's Defense and Challengers' Offensives

Great Wall Pickup's "championship myth" continues. In 2025, its global sales exceed 180,000 units, securing the top spot in the Chinese market for the 28th consecutive year, with a domestic retail share approaching 50%. Its dominance is particularly strong in the core markets of Southwest and Northwest China.

Supporting this hegemony is its comprehensive product matrix covering utility, passenger, and off-road models—the Jingangpao solidifies the mid-range market, the Great Wall Cannon series maintains over 10,000 monthly sales for 62 consecutive months, and the Shanhaipao Hi4-T pioneers the new energy off-road pickup segment, establishing a dual-track defense system of "fuel + new energy."

However, the offensive from challengers has taken shape. Changan Pickup enters the top three with an annual sales volume of 56,644 units and an 8.9% year-on-year increase, with December exports surging 121% year-on-year as a key breakthrough point.

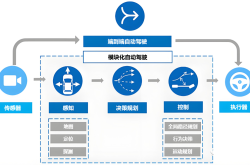

Its core weapon is the world's first super extended-range pickup, the Changan Hunter K50, equipped with a Blue Whale 2.0T extended-range engine + dual motors. With 470N·m torque and a 0-100km/h acceleration of 7.9 seconds, it not only outperforms joint venture models like the Ford Ranger but also delivers a dimensional reduction attack on the Great Wall Cannon hybrid in terms of pricing—starting at 182,900 yuan, 46,000 yuan lower than the Great Wall Cannon hybrid, while standardly equipped with L2-level autonomous driving and 22kW external discharge functionality.

This combination of "technology + cost-effectiveness" has secured Changan's position as the sales champion in the hybrid pickup segment.

BYD's emergence is even more disruptive. As a new entrant to the pickup market, its 2025 sales reach 39,000 units, soaring 232.3% year-on-year, with nearly 40,000 units exported in its first year—a "dark horse miracle."

Unlike Great Wall's full-spectrum layout and Changan's focus on extended-range technology, BYD leverages its Blade Battery and DM-i technology to focus on pure electric and plug-in hybrid routes, precisely targeting the overseas new energy commercial vehicle blue ocean.

Data shows that BYD's new energy pickup overseas sales reached 3,416 units in October 2025, far surpassing Changan Hunter's 553 units, becoming a new force in the export market.

Technology Route Showdown: Survival Spaces for Extended-Range, Pure Electric, and Fuel

The 73,000 units of new energy pickups sold in 2025, with a 243% year-on-year increase, makes technology route selection a matter of survival for enterprises.

The divergence between Great Wall and Changan is particularly typical: Great Wall bets on "hybrid + pure electric" dual technologies, with the Shanhaipao Hi4-T adopting a P2 hybrid architecture and focusing on off-road performance; while Changan firmly focuses on extended-range technology, with the Hunter K50 offering a 1,031km combined range and 30kW external discharge, precisely catering to commercial scenarios such as power grid repairs and wind power maintenance, addressing the range anxiety of pure electric pickups.

Their market performances validate the rationality of their route selections. Great Wall's new energy pickups sell over 30,000 units annually, occupying the high-end market with differentiated positioning in off-road scenarios; Changan's new energy models grow 33.2% year-on-year, with the Hunter K50 securing the top spot in hybrid pickup sales, its extended-range technology gaining market recognition for its practicality in commercial scenarios.

In contrast, BYD's pure electric pickups leverage the safety advantages of its Blade Battery to rapidly gain traction in overseas markets, forming a new energy tripartite pattern (translated as "landscape") of "Great Wall for off-road, Changan for commercial use, and BYD for overseas markets."

Traditional fuel routes still have survival space, but competition has intensified. JAC Motors sells over 60,000 pickups in 2025, albeit with a 4% year-on-year decline, but its export volume exceeds 50,500 units, highlighting its advantage in the fuel pickup export market; SAIC Maxus follows closely with 56,000 units sold and a 14% year-on-year increase, rapidly expanding in Southeast Asian and Middle Eastern markets through SAIC Group's export system.

Notably, these companies are accelerating the passengerization upgrades of their fuel models, incorporating intelligent cockpits and safety configurations to counter the impact of new energy models.

Globalization Game: From Product Exports to Technology Exports

The 2025 pickup export volume of 300,000 units and the first-time exceeding 50% export share make globalization the core battlefield for enterprise competition. Great Wall Pickup maintains its lead with cumulative exports exceeding 63,000 units, but Changan, SAIC Maxus, and JAC exhibit even more rapid growth, forming an "one strong, multiple strong" export landscape.

Great Wall's globalization strategy emphasizes "localized production + brand deep cultivation," establishing production bases in Thailand, Brazil, and other markets, and leveraging the passenger-oriented image of the Great Wall Cannon to break the stereotype of pickups as "utility vehicles."

In contrast, Changan has taken a differentiated path—collaborating with Stellantis Group to develop global pickups, achieving a leap from "product exports" to "technology exports." This technology export model not only drives export sales but also enhances the global voice of Chinese pickups.

Data shows that Changan Pickup's exports exceed 50,000 units in 2025, forming an export second tier alongside SAIC Maxus and JAC, with exports accounting for over 90% of their respective total sales.

Direct confrontations between international and Chinese brands have commenced. The Ford F-150 Raptor dominates the high-end market with its professional off-road configurations, while the Zhengzhou Nissan Fengtan plug-in hybrid version, with 800N·m torque and 131km pure electric range, represents the fusion of Chinese and foreign technologies.

However, Chinese brands are rapidly seizing the mid-range market with cost-effectiveness advantages. The comprehensive range and configurations of the Changan Hunter K50 far surpass those of the Ford Ranger at the same price point, while BYD's pure electric pickup overseas pricing is only half that of the Tesla Cybertruck, highlighting its competitiveness.

Transformation Dilemmas of Traditional Automakers: The Case of Zhengzhou Nissan

While leading companies forge ahead, some traditional players are mired in transformation difficulties. Zhengzhou Nissan, once the "invisible champion" of the fuel pickup era, with its Ruichi series known for durability, saw 49,000 units sold in 2025 and a 34.6% year-on-year increase, but behind these figures lies a severe lag in new energy transformation.

Its R&D expenditure accounts for less than 1.5%, far below the industry average of 3.5%. Its first electric pickup, the Ruichi 6 EV, only launched in 2023 and covers only the pure electric route, lacking extended-range or plug-in hybrid products. In 2025, its new energy model sales reached only 513 units, with a penetration rate of less than 5%.

Zhengzhou Nissan's dilemma stems from multiple shortcomings in technology, strategy, and supply chains. Its core technologies rely on external procurement, with insufficient synergy in three-electric systems (battery, motor, electronic control) with Nissan's global technologies, while its ownership structure prevents it from receiving full resource support from Dongfeng Motor Group.

In contrast, Great Wall has built a complete industrial chain covering batteries, motors, and electronic controls, with its self-developed Hi4-T hybrid architecture forming a technological barrier; Changan relies on Blue Whale Power and Huawei's ecosystem to achieve autonomous control of core technologies. This gap in technological autonomy is becoming a dividing line between traditional automakers and emerging forces.

2026 Outlook: The Ultimate Showdown Between Digitalization and Globalization

The market transformations in 2025 foreshadow the competition focus in 2026. Changan Pickup will prioritize "digital pickups," deepening collaboration with Huawei's ecosystem to enhance intelligent interaction experiences; Great Wall plans to accelerate the iteration of new energy products and expand its overseas production base layout; BYD will launch domestic versions of new energy pickups to address shortcomings in the domestic market.

Industry differentiation will further intensify: leading companies will expand their advantages through technological iteration and globalization strategies, while small and medium-sized enterprises with insufficient R&D investment and ambiguous strategies may be eliminated. New energy penetration will continue to rise, with extended-range, plug-in hybrid, and pure electric routes forming differentiated competition, while passengerization, intelligence, and multi-scenario adaptability become core directions for product upgrades.

The 2025 pickup truck market represents not only Great Wall's defensive battle but also Changan and BYD's breakthrough battles, as well as China's pickup truck industry's transformation from scale growth to high-quality development. This competition centered around technology, globalization, and user needs will ultimately propel Chinese pickups to occupy a more important position in the global market.

END