AI on the Edge: Progressing from Execution to Cognition

![]() 01/21 2026

01/21 2026

![]() 557

557

At the 2025 World Artificial Intelligence Conference, an AI-powered mobile phone demonstrated the ability to perform local analysis and processing of a lengthy legal document in a remarkably short timeframe, consuming power equivalent to that used during a rapid phone charging session.

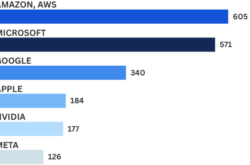

The surge in AI chips deployed on edge devices signifies a paradigm shift, with AI technology transitioning from the distant cloud to our pockets, desktops, and daily lives. While Chinese companies are rapidly closing the gap with international tech giants in the global market, their overall scale remains just one-fourteenth that of their U.S. counterparts. A profound transformation is quietly unfolding, encompassing technological routes, market positioning, and ecosystem development.

01

Redefining the 'Cognitive Architecture' of Chips

AI chips on edge devices represent more than a mere transfer of computational power; they signify a technological revolution spanning from the foundational architecture to application models. In just a few years, this transformation has evolved from a niche concept to a driving force behind large-scale applications.

In July 2025, at the World Artificial Intelligence Conference, OPPO unveiled a groundbreaking achievement: a peak word output speed of 200 tokens per second and support for 128K ultra-long texts. This means a single device can locally process content equivalent to approximately 300 pages of a book, revolutionizing the way professional documents are handled.

Behind this milestone lies the industry's redefinition of system-level AI. Powerful chips alone are insufficient; a comprehensive, bottom-up R&D layout must be established for the seamless collaboration of 'AI chips,' 'AI endpoints,' and 'AI clouds.' Compared to traditional cloud-based AI, edge AI offers multiple advantages: data remains local, safeguarding user privacy; processing latency is significantly reduced; and overall operational costs are lowered.

In the competitive landscape between edge and cloud-based AI chips, domestic manufacturers have not opted for a single technological path to overcome technological and ecological barriers. Instead, leveraging their unique resources and technological expertise, they have embarked on distinct paths of differentiated competition.

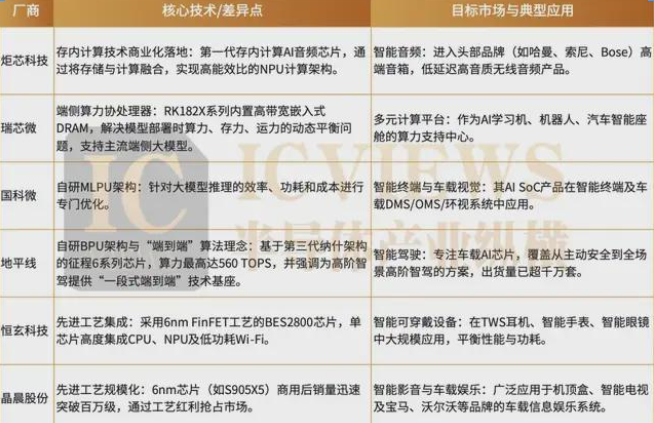

In the intelligent audio sector, Actions Technology has carved out a unique technological niche, with its commercially implemented memory-computing integration technology drawing significant attention. Through its first-generation memory-computing integrated AI audio chip, Actions Technology has seamlessly fused storage and computing, creating a high-efficiency NPU architecture. This innovation has enabled the company to penetrate the high-end speaker supply chains of leading brands such as Harman, Sony, and Bose, specifically catering to wireless audio products with stringent low-latency and sound quality requirements.

Rockchip has positioned itself as a 'computing power multiplier.' Its RK182X series coprocessors effectively address the dynamic balance challenges of computing power, storage capacity, and data transfer capacity when deploying AI models on edge devices by incorporating high-bandwidth embedded DRAM. This enables support for mainstream large edge models, making it an ideal computing power support center for various AI learning devices, robots, and even automotive intelligent cockpits.

In response to the growing demand for large edge model inference, Goke Microelectronics has independently developed the MLPU architecture, optimized for inference efficiency, power consumption, and cost. This architecture has been integrated into its AI SoC products, playing a crucial role in visual processing scenarios such as driver monitoring systems (DMS), occupant monitoring systems (OMS), and surround-view systems in intelligent terminals and vehicles.

In the highly technical field of intelligent driving, Horizon Robotics has established a strong foothold with its self-developed BPU (Brain Processing Unit) architecture. Its latest Journey 6 series chips, based on the third-generation Nash architecture, offer a maximum computing power of up to 560 TOPS. Leveraging this foundation, Horizon Robotics is committed to providing automakers with 'end-to-end' high-level intelligent driving solutions. Currently, the total shipments of Horizon Robotics chips have exceeded ten million units, securing a stable market position.

In the power-sensitive market for intelligent wearable devices, Bestechnic pursues advanced process integration. Its BES2800 chip, fabricated using a 6nm FinFET process, integrates a CPU, NPU, and low-power Wi-Fi on a single chip. This has successfully achieved an optimal balance between performance and power consumption in products such as TWS earphones and smartwatches, leading to widespread adoption.

Similarly, Amlogic has driven its development through advanced process nodes. Its 6nm process chips (such as the S905X5) have rapidly surpassed sales of one million units after commercialization. Leveraging the performance and cost advantages brought by the process, Amlogic has quickly captured markets for intelligent set-top boxes, smart TVs, and in-vehicle infotainment systems for brands like BMW and Volvo.

02

Agile Survival Strategies of Industry Leaders

The market for AI chips on edge devices has formed a multi-dimensional competitive landscape, with international giants still holding sway. However, Chinese companies are achieving rapid growth through breakthroughs in niche markets. From a scale perspective, in the first half of 2025, the revenue of the top five U.S. tech giants reached 244.45 billion yuan, while the combined revenue of 18 Chinese companies was only 19.33 billion yuan, with the former being 12.65 times larger than the latter. This scale gap reflects the advantages of international giants in decades of technological accumulation and global channel布局 (layout), as well as highlighting the scale limitations of Chinese enterprises in the early stages of market penetration. The profitability gap is even more pronounced. In the first half of 2025, Chinese companies collectively reported a net loss of 3.941 billion yuan, while the top five U.S. tech giants reported a combined net profit of 66.116 billion yuan. This difference not only stems from the pricing power gap brought by core technology patents but is also closely related to the development stage of Chinese enterprises, which are currently characterized by high R&D investment and high supply chain integration costs. Most domestic manufacturers are still in the 'investment phase,' requiring continuous capital injection to break through process bottlenecks and ecological barriers, while international giants have entered a mature profit-harvesting phase.

However, if we shift our focus from mere scale comparison to growth potential, the performance of leading Chinese enterprises demonstrates strong momentum for breakthroughs. Taking domestic leading application-specific integrated circuit (ASIC) design companies as an example, they showed clear differentiation in the first half of 2025. Among them, Rockchip stood out with remarkable performance growth, achieving revenue of 1.732 billion yuan in the first half of 2025, a year-on-year increase of 45.23%; its net profit attributable to shareholders reached 450 million yuan, a substantial year-on-year increase of 190.42%. Its net profit in the first three quarters reached 780 million yuan, continuing to maintain a high year-on-year growth rate of 116% to 127%. Behind this explosive growth lies its precise positioning in niche markets with rigid demands, such as intelligent in-vehicle aftermarket, AI cameras, and industrial control. Its products meet the cost-efficiency needs of terminal manufacturers in terms of low power consumption and high compatibility, while forming stable order flows by partnering with multiple leading domestic IoT device manufacturers.

Amlogic, on the other hand, has maintained steady growth. In the first three quarters, the company's main business revenue reached 5.071 billion yuan, a year-on-year increase of 9.29%; its net profit attributable to shareholders was 698 million yuan, a year-on-year increase of 17.51%; and its core net profit was 630 million yuan, a year-on-year increase of 13.71%. As a benchmark enterprise in the smart home chip field, its growth drivers come from both an increase in market share in overseas set-top box markets and the demand for AI functionality upgrades in domestic smart TVs and edge computing gateways. By leveraging mature supply chain management and economies of scale to reduce costs, Amlogic has achieved a balance between growth and profitability. Allwinner Technology achieved a total revenue of 2.161 billion yuan in the first three quarters, with a net profit of 278 million yuan, showing relatively moderate growth. This difference may be related to the company's full product portfolio—its focus on mid-to-low-end consumer electronics chips faces fiercer competition, and some products still rely on traditional processes, lagging slightly behind peers focused on high-end scenarios in terms of AI functionality iteration speed. This reflects the differentiation logic in the edge-side AI chip market that 'Track selection determines growth slope.'

This trend of rapid growth is not unique to these companies but is also evident among other manufacturers focusing on edge-side AI. For example, Actions Technology is expected to achieve revenue of 721 million yuan in the first three quarters of 2025, a year-on-year increase of 54.50%; its net profit attributable to shareholders was 151 million yuan, a staggering year-on-year increase of 112.94%. As a specialized enterprise focusing on intelligent audio and wearable device chips, its growth core lies in capturing the wave of AI functionality popularization in terminal products such as TWS earphones and AI glasses. By developing a low-power NPU architecture, it has addressed core demands for local voice wake-up and noise reduction in small devices, while offering more cost-effective product pricing, successfully replacing some international brand chips and entering the supply chains of terminal manufacturers like Xiaomi and Transsion. Notably, the growth of Chinese enterprises is not solely reliant on the domestic market; some leading manufacturers have already embarked on overseas expansion. The overseas revenue of Rockchip and Amlogic both exceed 40%, enabling them to avoid direct confrontation with international giants in the high-end market by participating in the global supply chain competition for mid-to-low-end IoT devices. This 'encircling the cities from the countryside' strategy has become an important supplement to their growth.

Furthermore, the high growth of Chinese enterprises is essentially a successful practice of 'agile survival strategies.' Unlike international giants, which focus on general-purpose high-end chips with long development cycles, domestic manufacturers excel at rapidly iterating products based on niche scenarios. For example, they optimize low-power performance for smart home scenarios and enhance stability and environmental adaptability for automotive scenarios. This 'small but beautiful' differentiated route not only reduces reliance on advanced processes (most edge-side chips adopt mature 12nm-28nm processes, avoiding the risks of high-end process bottlenecks) but also precisely meets the diverse customization needs of terminal manufacturers. Meanwhile, the collaborative upgrading of the domestic industrial chain has provided support for growth. The increased localization rate of EDA tools and the release of mature process capacity by foundries like SMIC have not only lowered chip design and production costs but also shortened the product development cycle from R&D to mass production, enabling Chinese enterprises to respond more quickly to market changes. However, there are still hidden concerns behind this growth: some companies' high growth relies on a single customer or a single track, resulting in weak risk resistance; the sustainability of R&D investment and insufficient accumulation of core patents may constrain long-term development; and the international giants' downward layout (sinking layout) in the mid-end market will intensify competitive pressure. In the future, if Chinese edge-side AI chip companies can maintain their agile response advantages while continuously strengthening technological barriers and expanding into diverse scenarios and overseas markets, they are expected to achieve a transition from 'high-speed growth' to 'high-quality growth' while narrowing the scale gap.

03

Where Will the Next Round of Competition Lead?

If the competition in the past few years has revolved around 'enabling AI to run on the edge side,' the core proposition of the next round of competition will be 'enabling AI to truly think and collaborate on the edge side.' The focus will shift from validating cutting-edge technologies to deep penetration and experience reconstruction in mainstream scenarios, while the competitive dimensions will upgrade from single computing power metrics to a comprehensive competition of system efficiency, ecological collaboration, and business models.

First and foremost, the most significant trend is the 'hardware implementation of intelligent agents.' Currently, edge-side AI mainly completes predetermined task inference, while the next generation of chips needs to become the physical carriers of autonomous intelligent agents. This means that chip architectures must natively support the complex capabilities required by intelligent agents, such as the storage and high-speed retrieval of long-term memory, logical execution of multi-step planning, and real-time invocation of external tools and APIs. This will expedite the birth of a new chip design paradigm, possibly requiring the integration of dedicated 'task planning units' or 'memory engines' beyond traditional CPUs and NPUs. In the future, the chips in your mobile phones, earphones, or glasses will no longer be passive computing power modules responding to instructions but the 'brains' of 'personal digital twins' capable of proactively understanding context, managing long-term goals, and orchestrating various applications.

Secondly, competition is set to intensify in terms of 'scenario depth.' In the fiercely competitive consumer electronics market, merely enhancing parameters is no longer enough to stand out. The real potential for differentiation lies in leveraging AI chips to completely revamp the experience in key scenarios. In the automotive sector, the focus of competition will shift from the entertainment features of intelligent cockpits to 'cockpit-driving integration' central computing platforms. A high-performance edge AI chip must be capable of simultaneously managing driver monitoring, passenger interaction, in-cabin environment control, and real-time perceptual data sharing with the autonomous driving domain. This enables comprehensive, low-latency interactions between the vehicle and its occupants. In the robotics field, as humanoid robots edge closer to commercialization, edge AI chips will play a pivotal role in determining their cost and performance. These chips must efficiently handle environmental perception, real-time obstacle avoidance, and motion planning locally, acting as the sensitive 'cerebellum' of robots. Furthermore, highly privacy-sensitive scenarios, such as personal health management, will emerge as core areas where edge AI chips prove their indispensability.

Finally, and most fundamentally, competition will center around 'ecosystems and standards.' The race for hardware performance will eventually reach its limits, while the extent of hardware-software synergy will define the upper bounds of user experience. The future victors will undoubtedly be those who can cultivate or spearhead a thriving developer ecosystem. This necessitates that chip companies offer not just hardware but also comprehensive toolchains—highly optimized compilers, extensive model libraries, and low-code development platforms—that substantially reduce the hurdles for developers to deploy and optimize AI applications on complex heterogeneous chips. Simultaneously, in the vision of the Internet of Everything, seamless AI collaboration across devices and scenarios will become the standard. Whether a company can lead or actively engage in shaping protocol standards for AI task collaboration, computing power sharing, and secure data exchange across devices will determine if it is building isolated islands or bridging continents. For Chinese manufacturers, capitalizing on China's vibrant AI application innovation landscape and collaborating with domestic operating systems and leading large models to forge a 'software-hardware integration' ecosystem is a crucial strategy for building competitive moats and gradually extending their influence.

The latter half of the edge AI chip race represents a shift from 'technological realization' to 'experience definition.' Success will no longer be solely determined by the chip with the highest benchmark score but by the platform that best comprehends scenario-specific challenges, most effectively empowers developers, and constructs the most open and efficiently collaborative ecosystem. The chips in our hands will serve as the fundamental building blocks for us to connect with and shape the intelligent world.