Why Has the Former 'Luxury Car Profit King' Suddenly Hit a Slump?

![]() 01/21 2026

01/21 2026

![]() 430

430

Behind Porsche's plunge in performance lies the strategic disarray of the 'luxury car profit king' amid the electrification trend, a widespread slowdown in the Chinese market, and the enduring impact of global structural shifts.

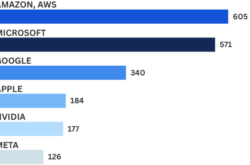

According to the UK's Financial Times, by 2025, Porsche had sold a cumulative total of 279,400 new vehicles, marking a 10.06% year-on-year decline. Correspondingly, the financial report for the first three quarters of 2025, released earlier, paints a picture of a 'historic collapse': operating revenue reached approximately €26.86 billion, down 6% year-on-year; sales profit plummeted from €4.035 billion in the same period the previous year to just €40 million, a staggering 99% drop; in the third quarter alone, the company reported an operating loss of €966 million, a stark contrast to its profitable state in the same period of 2024. From its 2023 profit peak of €7.3 billion, this performance avalanche unfolded in just two short years.

Why has the former 'luxury car profit king' suddenly lost its steam?

Three Sets of Data Reveal the 'Chill of Winter'

As the former 'global largest single market' for eight consecutive years, the collapse in the Chinese market emerged as a key factor in Porsche's sharp profit decline. In this once-dominant global market, Porsche sold only 41,900 vehicles in China in 2025, a 26% year-on-year decrease and a 60% drop from its 2021 peak.

Dealer data from first-tier cities like Beijing and Shanghai reveals that the Macan, once subject to a €100,000 markup for immediate delivery, now offers substantial discounts, with prices for entry-level models dropping significantly; the all-electric Taycan is undergoing substantial promotional clearance, with some dealers offering financial subsidy policies. The collapse of the pricing system has directly undermined channel confidence, leading to profitability pressures for dealers across multiple regions.

The collapse in the Chinese market is no accident; its root cause lies in Porsche's product matrix being mired in a 'disconnect between old and new growth drivers.' Among its fuel-powered vehicle (internal combustion engine vehicle) lineup, the Cayenne, once a profit pillar, has experienced sustained sales declines, while the classic 911 model has shown sluggish growth. The proportion of hybrid models dropped from 28% in 2023 to 19%. New energy models have also failed to fill the void, with all-electric Taycan deliveries declining year-on-year. Although the globally debuted all-electric Macan in 2024 opened for reservation (pre-orders), the market response fell short of expectations.

While product transformation lags, the cost pressures from strategic reversals continue to erode profits. In September 2025, Porsche announced the termination of its in-house battery production plan, delayed the launch of all-electric models, and extended the lifecycle of internal combustion engine vehicles. This series of strategic U-turns incurred €1.8 billion in provisions, primarily for one-time costs such as electric vehicle platform adjustments, product line restructuring, and battery project termination. Annual expenditures of this nature are expected to reach €3.1 billion. Among them, the Cellforce battery project, launched in 2021, was forced to halt due to 'lack of economies of scale,' becoming a classic example of the cost of strategic indecision.

Compounded by external market shocks, cost pressures have worsened: additional costs from U.S. tariff policies reached €300 million in the first three quarters, with an expected annual total of €700 million. Moreover, 'tariff costs cannot be passed on to customers, rendering the U.S. market nearly unprofitable.' To cut costs, Porsche has initiated layoffs, involving optimizations of both permanent and temporary positions.

Triple Crisis Exposes Root Causes of Lost Momentum

Tracing Porsche's electrification journey, it becomes evident that the brand has consistently oscillated between 'conservatism and aggression.' In 2021, CEO Oliver Blume oversaw the establishment of the Cellforce Battery Company, proclaiming Porsche's ambition to be at the 'forefront of battery technology' and setting a goal of '80% all-electric sales by 2030.' However, by 2024, the strategic tone shifted to 'flexibly responding to market changes,' with widespread delays of 1-2 years for all-electric model launches.

This oscillation has led to severe waste of R&D resources and persistently low utilization rates of electrification production capacity. Repeated shifts in technical routes have further caused missed opportunities. While Chinese new-energy players have achieved widespread adoption of 800V high-voltage platforms, with models like the Xiaomi SU7 Ultra supporting high-power ultra-fast charging, Porsche's all-electric vehicles still rely on 400V platforms, resulting in significant charging efficiency gaps.

The gap in intelligence is even more pronounced: Porsche's infotainment system lacks localized functionality, and its autonomous driving supports only L2+ level capabilities. In contrast, Chinese new-energy players have achieved full coverage of urban NOA (Navigate on Autopilot), with chip computing power and functional iteration speeds far exceeding their peers. Amid strategic hesitation, Porsche's market position is being steadily eroded by Chinese new-energy players. For example, high-end models like the Li Auto L9 and Seres M9 are precisely diverting traditional luxury SUV users through scenario-based innovations, with configuration upgrade speeds far outpacing Porsche—which only introduced rear-seat entertainment screens in the 2025 facelifted Panamera.

Even more damaging is the erosion of brand premium due to 'technological democratization.' Porsche's internal research shows that in 2025, over one-fourth of potential buyers abandoned purchase plans after test-driving new-energy models from Chinese competitors, with 'insufficient cost-effectiveness' cited as the primary reason.

Additionally, the 'sweet yet troublesome' situation in the North American market has exacerbated profit pressures. Although sales growth has made it the largest single market, the U.S. tariff on EU automobiles rose from 2.5% to 15%, expected to cause €700 million in direct losses for Porsche in 2025. Attempts to pass on costs through price hikes triggered market backlash, worsening order volumes and inventory cycles.

Meanwhile, currency fluctuations have added further strain. In 2025, volatile exchange rates between the euro and major currencies significantly reduced revenue from overseas markets when converted. Financial reports indicate that exchange losses accounted for 18% of the decline in operating profit, becoming the second-largest profit eroder after restructuring costs.

Can Porsche Replicate Its Past Miracles?

Faced with a performance avalanche, Porsche's remedial measures are beginning to take shape. At the product level, the brand is accelerating the launch of all-electric models, attempting to regain market share through technological iteration while deepening group synergies to reduce R&D costs via platform sharing. On the cost control front, in addition to layoffs, marketing expenses will be slashed, and inefficient dealer outlets will be closed. Regional market strategies have also undergone significant adjustments.

For the Chinese market, Porsche plans to optimize product configurations to better suit local needs; in North America, it aims to improve charging experiences by collaborating on charging network construction. The brand has set targets to 'restore operating profit margins to 8%-10% and increase the share of electrified models to 45%.' However, challenges remain severe. Industry forecasts suggest that the luxury electric vehicle market will continue to grow rapidly in 2026, but Porsche's current electrified model share stands at just 36%. Failure to accelerate transformation could lead to further market share contraction.

More critically, reshaping brand value—when 'performance' is no longer scarce—poses the core challenge for surviving the winter. Industry analysts point out that Porsche's self-rescue efforts face three key tests: first, whether it can rapidly address intelligence shortcomings; second, how to balance its premium brand positioning with market competition; and third, whether it can persuade dealers to continue investing in transformation. Without resolving these three issues, even short-term performance recoveries are unlikely to reverse long-term decline.

Of course, Porsche's predicament is not unique but rather a microcosm of the 'transformation pains' collectively experienced by traditional luxury brands. Since 2025, multiple European luxury automakers have faced profit declines, with electrification delays eroding traditional brands' profit margins. For all players relying on brand premiums from the internal combustion engine era, Porsche's 2025 crisis sends a clear signal: there is no middle ground in the electrification and intelligence transformation—either actively adapt or face elimination.

Image: Sourced from the internet

Article: Auto Review

Layout: Auto Review