Cutting Tariffs by 90% and Offering Subsidies for Electric Vehicles: Who Benefits from Canada's Trade Turnaround with China?

![]() 01/21 2026

01/21 2026

![]() 362

362

Lead

Introduction

Despite strategic maneuvers and uncertainties, the globalization of the automotive industry must press on. True competitiveness lies not in barriers but in the ability to innovate continuously in an open environment.

Recently, China's automobile exports have frequently delivered positive news.

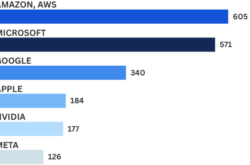

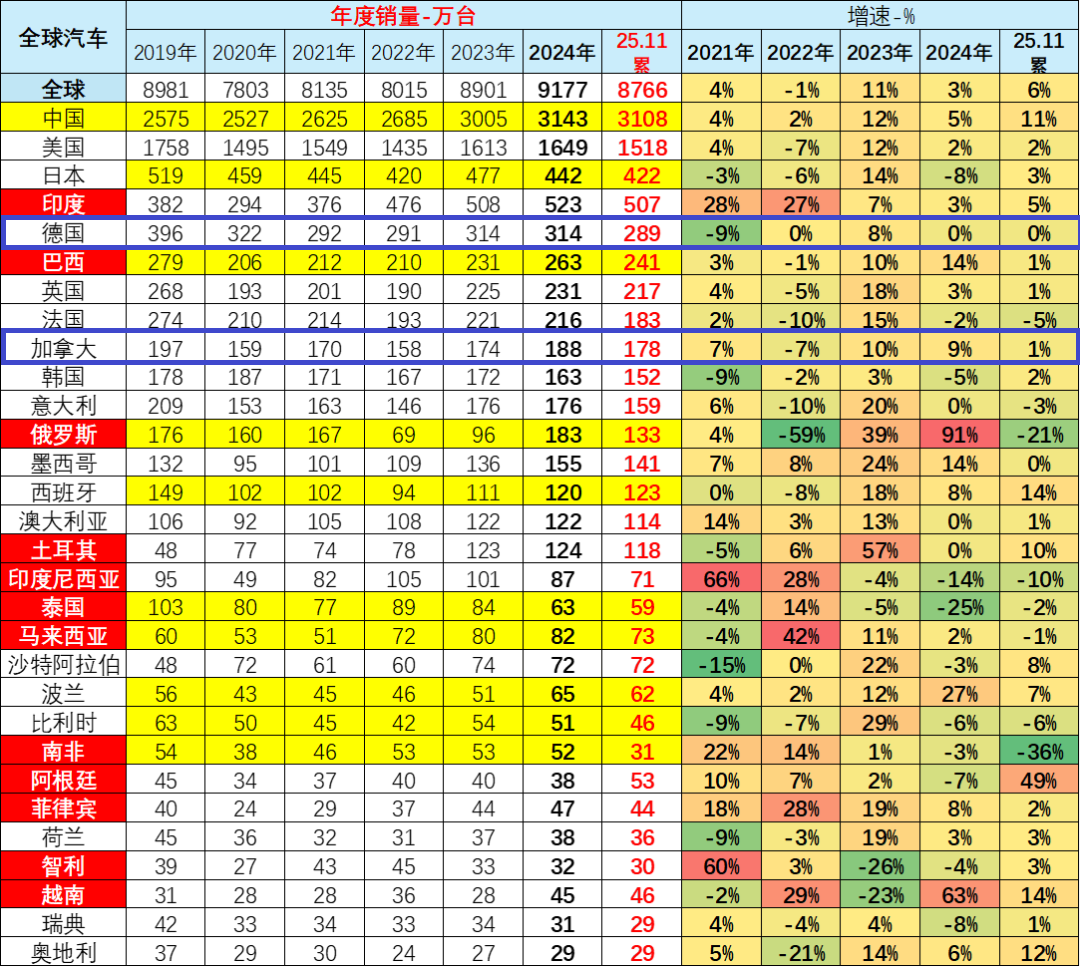

Data from the China Association of Automobile Manufacturers (CAAM) shows that in 2025, China exported 7.098 million vehicles, up 21.1% year-on-year. Meanwhile, customs data, which includes complete vehicles and complete knock-down kits, puts the figure even higher at 8.32 million units, a 30% increase, with an export value of $142.4 billion.

On one hand, there are rapidly growing numbers, while on the other, a series of favorable policies are emerging in overseas markets.

On January 20, reports indicated that the German government plans to introduce €3 billion in subsidies to drive electric vehicle sales growth. The subsidy program is open to all manufacturers, including Chinese brands.

The new subsidy plan will run until 2029 and is expected to support the purchase of approximately 800,000 electric vehicles. Subsidy amounts range from €1,500 to €6,000, depending on the vehicle model and the buyer's income level, with a focus on middle- and low-income groups. Industry analysts believe that Germany's move will significantly benefit Chinese automobile exports to the country.

Throughout 2025, Chinese automakers sold 68,700 passenger vehicles in Germany, a 120.4% year-on-year increase. Despite facing various challenges, Chinese automakers set a new sales record in the German market. According to forecasts, Chinese automakers are expected to reach 100,000 units in Germany by 2026.

Recently, Canada also announced that it would reduce tariffs on Chinese electric vehicles from 106.1% (6.1% most-favored-nation tariff + 100% additional tariff) to 6.1%, with an initial import quota of 49,000 units in the first year, increasing to approximately 70,000 units annually by the fifth year. Additionally, over 50% of imported vehicles will be "affordable electric vehicles priced below $35,000," creating new low-cost options for Canadian consumers.

Furthermore, Canada stated its plan to develop domestic electric vehicles using Chinese technology over the next three years through joint ventures, cooperation, and investment with Chinese companies, aiming to become the first country in North America to achieve this vision.

Against the backdrop of intense domestic competition, sluggish growth, and soaring overseas exports, the potential and future of China's automotive growth undoubtedly lie in the vast overseas markets. The recent relative easing of trade barriers in Canada's 2-million-unit market and Germany's 3-million-unit market indeed brings more opportunities and possibilities for Chinese automakers to go global.

01 Canada and Germany: Not Acting Out of Goodwill

The world doesn't show kindness without reason; there are often underlying motives, especially in international trade.

Clearly, Canada's relaxation of trade barriers against Chinese automobiles is not a mere policy shift but a result of realities compelling changes at the industrial, market, and diplomatic levels.

Firstly, the gap in its domestic industry has slowed its green transition. While Canada hosts five major automakers—General Motors, Honda, Toyota, and others—its new energy vehicle (NEV) sector is nearly "half-empty." Data shows that Canada currently has no electric vehicle assembly plants with an annual capacity exceeding 50,000 units, and its self-sufficiency rate for core components is less than 8%. Critical parts like batteries and electric motors are highly reliant on imports.

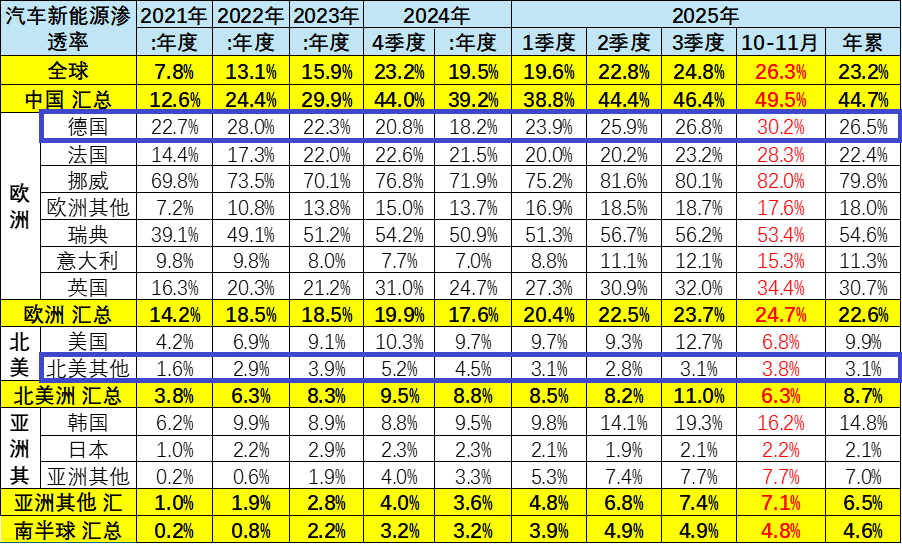

However, Canada has set targets of 20% NEV sales by 2026 (approximately 380,000 units) and a ban on fossil fuel vehicle sales by 2035. Yet, in 2025, pure electric vehicles accounted for only 6% of new car sales, while plug-in hybrids made up 4%, with market shares dominated by U.S., Japanese, and Korean automakers. A report by Ontario's Financial Accountability Office predicts that without external supply, the province will lose 3,400 automotive manufacturing jobs and 16,300 parts-related jobs by 2026, exacerbating the risk of industrial hollowing out.

After imposing a 100% tariff in October 2024, Canada's electric vehicle market plunged into a "high-price, limited-choice" dilemma. In 2025, the average price of new electric vehicles in Canada reached CAD 63,000 (approximately RMB 310,000), compared to a pre-tariff entry price of just CAD 26,000 (approximately RMB 138,000) for Chinese electric vehicles. This directly caused a 40% year-on-year drop in new zero-emission vehicle registrations in Canada during the third quarter of 2025, with pure electric vehicle sales halving.

More critically, Canada's automotive industry has long been dependent on the United States, with 95% of its automobile exports relying on the U.S. market. However, Trump's tariff threats dealt a fatal blow to Canada's automotive sector.

In April 2025, the Trump administration imposed a 25% tariff on Canadian-made automobiles and parts, leading General Motors to close a factory in Oshawa, reduce production capacity at its Ingersoll plant, and Stellantis to cancel Jeep production plans near Toronto, putting 750 workers at risk of unemployment.

Analysts pointed out that U.S. tariff threats have prompted Honda and General Motors to consider relocating factories, potentially causing Canada to lose over CAD 30 billion in automobile exports annually.

Coupled with Trump's recent moves in Venezuela, plans to "acquire land" in Greenland, and even superimposing the U.S. flag onto Canadian territory, these actions have heightened Canada's concerns. Under multiple pressures, Canada's automotive industry faces a choice: either continue relying on the U.S. and endure ongoing policy shocks or proactively break free and seek new cooperation anchors in the global market.

Turning to cooperation with China can essentially be seen as a passive countermeasure against U.S. trade protectionism.

Isn't Germany's situation similar? While widely interpreted as "extending goodwill to China," a deeper look reveals that it largely stems from Germany's inevitable choices under multiple pressures of industrial dilemmas, climate goals, and geopolitical maneuvers.

On one hand, there is the market predicament. After Germany terminated electric vehicle subsidies at the end of 2023, the market immediately slumped: pure electric vehicle registrations plummeted by 27% in 2024. The core reason for the growing fatigue was the lack of subsidies, making electric vehicles too expensive.

Data shows that middle- and low-income households account for 50% of new car buyers in Germany, yet domestic automakers' electric models are mostly priced above €30,000. The Volkswagen ID.3 starts at €35,000, while the Mercedes EQA exceeds €40,000, far out of reach for middle- and low-income groups.

"What we need are electric vehicles affordable for ordinary families, not luxury products serving only high-income groups," stated the president of the German Association of International Motor Vehicle Importers, highlighting the core demand behind policy openness. Chinese automakers' cost advantages enable subsidized model prices to drop to €20,000, directly activating the mass market—a key to Germany achieving its goal of "1 million electric vehicle registrations by 2026."

Volkswagen Group's closure of its Dresden plant at the end of 2025—the first shutdown of a domestic assembly plant in its 88-year history—exposed the contradiction of high costs and low production capacity. While BMW and Mercedes are accelerating electrification, their software capabilities and battery technology still lag behind Chinese automakers.

Analysis by the German Economic Institute shows that due to declining market share in China, U.S. tariff impacts, and sluggish electrification progress, German automakers' profits continue to fall, potentially cutting up to 90,000 jobs by 2030.

The industrial dilemma and transformation pain have made Germany realize the need for a catalyst to drive automotive innovation—a role potentially filled by Chinese automakers.

Germany's Environment Minister stated, "There is no evidence that Chinese automakers will flood in; we choose to face competition rather than impose restrictions." The German Association of the Automotive Industry predicts that subsidies will drive a 17% increase in electric vehicle registrations by 2026, with Chinese brands' participation making this goal more achievable.

Of course, a core factor is geopolitical maneuvering. Germany's greenlighting of electric vehicle subsidies for China can also be seen as exchanging policy sincerity for cooperation, providing a buffer against Sino-European electric vehicle trade frictions. After all, Germany's automotive operations in China have also been affected in recent years, urgently requiring new cooperation models and communication strategies.

02 Who Will Be the First to Reap the Benefits?

Policies in the two markets yield different benefits for China.

First, in Canada, the short-term benefits of the 49,000-unit quota are almost securely locked in by Tesla, driven by its established channel and production capacity advantages.

As early as 2023, Tesla exported 44,000 Model 3/Y units from its Shanghai plant to Canada, accounting for over 80% of China's total NEV exports to Canada that year (41,700 units).

Currently, Tesla operates 39 stores across major Canadian cities, with a mature Supercharger network and after-sales service system. In contrast, most Chinese independent brands have yet to enter the Canadian market, requiring substantial investment in time and costs to build channels from scratch.

Reuters predicts that Tesla will restore Model 3/Y exports from its Shanghai plant to Canada to 40,000 units by 2026, accounting for over 80% of the 49,000-unit quota, making it the biggest short-term winner.

Additionally, Lotus Cars, now owned by Geely Holding, has explicitly stated that its all-electric supercar, the SUVEletre, completed rigorous North American market certification in 2024, becoming the only Chinese-made electric vehicle to successfully enter the North American market above the $80,000 price range. The significant tariff policy benefits are expected to slash the Eletre's planned Canadian selling price by about 50%, driving exponential growth in Lotus's wholesale volumes in Canada.

For Chinese independent brands, the opportunity in Canada lies not in short-term quota competition but in localized production and supply chain exports three years later. BYD, Geely, Chery, and Stellantis are poised to become long-term players with their respective advantages.

BYD is likely to lead the way, having supplied electric buses to Canadian transportation agencies for years. These vehicles have proven reliable in harsh climates like Toronto and Vancouver. In July 2024, BYD submitted documents to the Canadian government inquiring about entering the passenger vehicle market. With this policy shift aligning with BYD's ambitious 2026 overseas goals, it may accelerate preparations to enter the Canadian market.

Geely could leverage synergies with Volvo and Lotus Cars to gain faster entry into the Canadian market. Any automaker entering Canada must comply with stringent safety and compliance standards, including crash tests, lighting requirements, and bilingual labeling. Charge compatibility, cold-weather performance, and software localization are also critical. Geely already holds a regulatory and compliance advantage over competitors.

Chery, another major exporter, may capitalize on the economic SUV segment, which accounts for over 50% of Canada's SUV market, with models like the Toyota RAV4 and Honda CR-V dominating sales. Having gained ample experience in Russia, Brazil, and other regions, Chery is well-positioned to navigate diverse climates and market conditions.

Leapmotor, a rising new energy vehicle (NEV) manufacturer with growing sales and influence, could also enter Canada through Stellantis' network.

Turning back to Germany, the electric vehicle subsidy policy's beneficiaries depend on current Chinese automakers' performance there. According to data from the first 11 months of this year, none of the top ten brands by sales volume are Chinese. However, BYD, MG, and Leapmotor lead Chinese brand sales in Germany.

MG, the earliest Chinese brand to enter Europe, sold 26,000 units in Germany in 2025, capturing a 1% market share. BYD sold 23,000 units, a 700% year-on-year increase, with the Seal and Yuan PLUS models contributing over 80% of sales. Leapmotor achieved an astonishing 3,989.9% growth, selling 7,280 units and rising to a 0.3% share, with the T03 and C11 models winning consumers through high cost-effectiveness.

Benefiting from upgrades to the Polestar 2 and 4, Polestar sold 5,007 units in Germany in 2025, a 57.4% increase. XPENG Motors sold 2,991 units, a 661.1% increase, with the G9 and P7 series gaining traction in the premium electric SUV market. These brands are also poised for growth under the subsidy policy.

Data also shows that Chinese-made electric vehicles' market penetration in Germany surpassed 11% in the third quarter of 2025, with this figure expected to rise further after subsidy openness.

In fact, Germany's subsidy policy implicitly encourages local investment. Chinese automakers setting up plants in Germany can enjoy additional tax credits (up to 5%), providing opportunities for BYD, Chery, and others to expand European production capacity.

In summary, whether in Canada or Germany, opening subsidies to Chinese electric vehicles represents a choice where "pragmatism triumphs over protectionism." It proves that in the global wave of automotive electrification, there are no permanent "local protections"—only eternal "value competitions."

While uncertainties remain for China's automotive exports, the true significance of these two trade breakthroughs lies not in immediate vehicle sales but in tearing open trade protection barriers. It demonstrates that in the global automotive industry's transformation, technological and cost advantages will ultimately break through geopolitical barriers.

Editor-in-Chief: Du Yuxin Editor: He Zengrong

THE END