Auto Companies Launch 'Seven-Year Low-Interest Rate' Offers: Genuine Perks or Hidden Pitfalls?

![]() 01/21 2026

01/21 2026

![]() 356

356

Lead-in

Introduction

"In an era of fierce competition, exercising caution is paramount when committing to a long-term financial obligation for a current product."

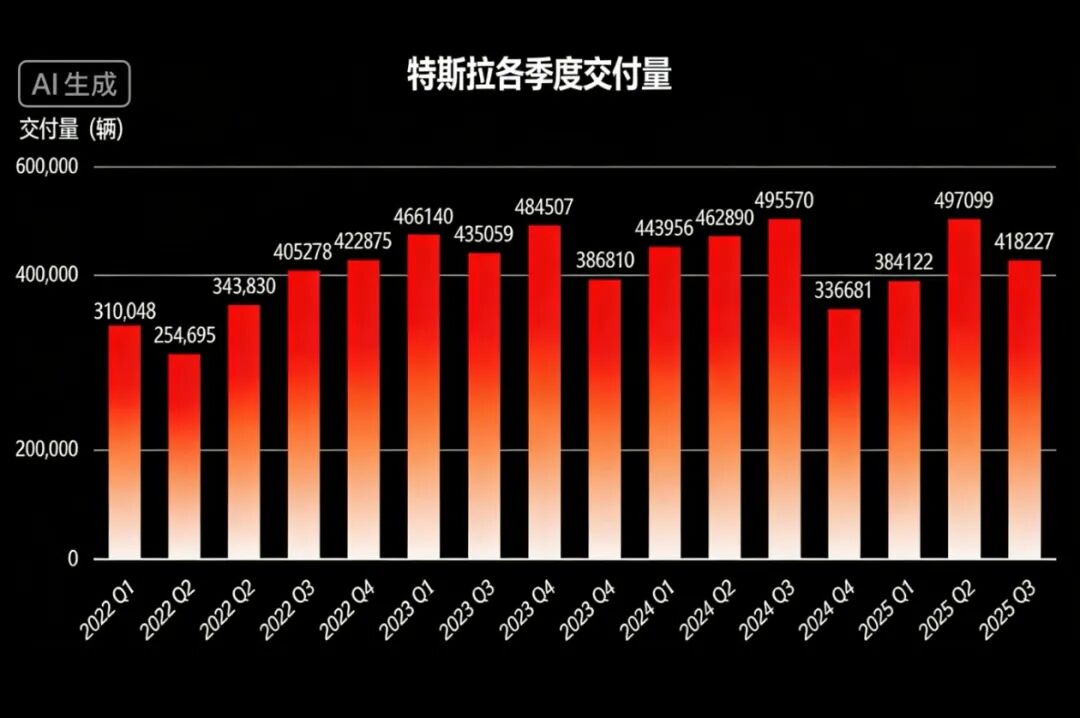

In 2025, Tesla's performance in the automotive manufacturing sector was nothing short of disappointing.

Its global delivery figures for the four quarters stood at 336,000 units, 384,000 units, 497,000 units, and 418,000 units, respectively. After a sluggish start in the first quarter, there was a modest rebound in the second quarter, peaking in the third quarter before suffering an unexpected sharp decline in the fourth quarter.

Ultimately, this U.S.-based new energy vehicle manufacturer concluded the past 365 days with a somewhat lackluster figure of 1.636 million units. Compared to the 1.789 million units delivered in 2024, this represents a year-on-year decline exceeding 8%. It falls even further short of the 1.808 million units achieved in 2023.

Two consecutive years of 'negative growth' have sounded a clear alarm for this U.S. new energy vehicle manufacturer.

Now, in 2026, Tesla's urgent priority is to swiftly boost orders, particularly in pivotal markets like China.

In 2025, according to statistics from the China Passenger Car Association, Tesla's retail sales in China reached 625,000 units, marking a year-on-year decline of 4.78%. Wholesale sales, inclusive of exports, stood at 851,000 units, reflecting a year-on-year decrease of 7.08%.

The overall scenario is far from optimistic.

However, there is a silver lining: Tesla has largely preserved its pricing structure without resorting to widespread official price reductions, opting instead to leverage financial policies to continually stimulate and attract potential customers.

In 2026, Tesla capitalized on the opportunity to double down, introducing a 'five-year interest-free' plan for the six-seat Model Y L, while also unveiling a 'seven-year ultra-low interest' plan for the rear-wheel-drive, long-range rear-wheel-drive, long-range all-wheel-drive versions of the Model 3 and Model Y, as well as the six-seat Model Y L.

The latter, in particular, swiftly ignited heated discussions.

For instance, the current official price of the Model 3 rear-wheel-drive version is 235,500 yuan. Without any additional options, with a down payment of 79,900 yuan and a loan of 155,600 yuan, the monthly payment amounts to 1,918 yuan, spread over 84 installments, with an annualized rate of 0.5%, translating to an annualized interest rate of 0.98%. The annual principal and interest payment totals merely around 800 yuan, with the total interest over seven years amounting to just over 5,000 yuan.

Undoubtedly, Tesla's 'seven-year ultra-low interest' plan has substantially lowered the perceived threshold for car ownership, making it highly appealing to consumers with tight budgets in the early stages, seeking low monthly payments, and planning to retain the vehicle long-term. Alternatively, it caters to users who can better utilize their funds elsewhere, as the 0.98% annualized rate is significantly lower than the typical 4%-8% stipulated for market auto loans.

"With a down payment of less than 80,000 yuan, you can acquire a Model 3 and drive it for approximately seven years, with monthly payments under 2,000 yuan, akin to leasing a car. After seven years, if you no longer wish to drive it, you can sell the car, with the residual value estimated at around 50,000 yuan. Frankly, it's quite a lucrative deal, perfectly suited for someone like me, a laid-back office worker not anticipating major changes."

This is no exaggeration. As soon as Tesla launched the 'seven-year ultra-low interest' plan, a close friend of mine promptly messaged me, and I could sense his keen interest from his words.

From this specific instance, it is evident that this round of enhanced financial policies in China is yielding the desired effects.

Expanding on this, ahead of the Spring Festival, during the so-called off-season, this U.S. new energy vehicle manufacturer has clearly laid its cards on the table: to commence 2026 in China on a positive note with sincerity, while striving to maintain the pricing structure.

Interestingly, Xiaomi Auto, Tesla's biggest competitor and the one that exerted significant pressure on it in 2025, swiftly followed suit.

In a recent livestream, Lei Jun personally announced that in response to user expectations for flexible car purchases, starting from midnight on January 16, a 'seven-year ultra-low interest' plan would be officially launched for the YU7, applicable to users who place orders before February 28, 2026 (inclusive).

Under the new policy, consumers can acquire the YU7 with a minimum down payment of 49,900 yuan and monthly payments starting as low as 2,593 yuan, with a loan term extending up to seven years.

It cannot be denied that Xiaomi's 'move' clearly mirrors Tesla's strategy. During the livestream, Lei Jun candidly stated, "Many Xiaomi fans have left messages hoping we can provide similar support. We have diligently heeded your voices."

From my vantage point, such a swift response underscores the strong execution and efficiency of this rising Chinese new energy vehicle manufacturer. On the flip side, it also reflects the increasingly fierce competition in the market, indicating that Xiaomi too harbors significant anxiety about securing new orders.

Essentially, the 'seven-year ultra-low interest' plan can be fully comprehended as a disguised price war initiated by automakers through substantial concessions. It is foreseeable that an increasing number of brands will follow suit.

Indeed, this week, Li Auto, under pressure to boost sales in 2026, opted to join the fray. According to the official poster, "With a down payment starting at 32,500 yuan and monthly payments as low as 2,578 yuan, you can effortlessly drive home a new car." For the MEGA and i8, there is also an exclusive seven-year loan plan featuring interest-free payments for the first three years and monthly payments as low as 2,857 yuan.

Additionally, according to online reports, earlier, all models from Dongfeng eπ also introduced a 'seven-year low interest' plan. Against this backdrop, it reminds me of an intriguing perspective I gleaned from a discussion with a senior industry expert.

From his vantage point, in the electric vehicle era, where game rules and overall landscapes are undergoing thorough innovation (being innovated and reshaped), automakers' financial policy strategies should also exhibit greater boldness and diversity.

"'Seven-year ultra-low interest' is nothing; 'ten-year ultra-low interest with zero down payment' would be truly captivating. Automakers should even introduce genuine on-demand subscription-based long-term rental services to completely revolutionize the traditional car-buying model. This would lower the entry barrier, enhance user stickiness, and ensure profitability."

Perhaps, to some skeptics, this approach may appear radical. However, I believe that given the intense competition in the Chinese auto market, there remains significant room for innovation and flexibility in the sales process.

Of course, past experiences dictate that every advantage comes with its drawback.

Regarding the numerous new energy brands that have followed Tesla's 'seven-year ultra-low interest' plan in 2026, another analysis suggests, "Most people only perceive the reduced monthly payment pressure but overlook the uncertainties introduced by the extended time frame."

In other words, given the current rapid iteration speed of smart electric vehicles, technological advancements over seven years are bound to be revolutionary, with the widespread adoption of solid-state batteries and autonomous driving not being out of the realm of possibility.

Meanwhile, you are still repaying a loan for a 'vehicle from the past.'

A more awkward issue is depreciation. If the entire industry truly enters a phase of technological explosion, the residual value of 'older vehicles' will plummet even more rapidly. Perhaps, after just three to four years, their market value will already be below the outstanding loan balance.

This is not alarmist talk: "In an era of fierce competition, exercising caution is paramount when committing to a long-term financial obligation for a current product."

The purpose of elaborating on the above content is not to disparage the 'seven-year ultra-low interest' plan but to remind everyone that any financial promotion will have its pros and cons.

Don't get swept away by the perceived value and place a blind order, overlooking the uncertainties introduced by the extended time frame. Many things should be carefully considered in terms of consequences and costs before making a decision.

In conclusion, the adage remains: "Assess your own situation and act accordingly."

Editor-in-Chief: Du Yuxin Editor: He Zengrong

THE END