Signals of Industry Transformation: Li Auto's Firm Commitment to AI Strategy

![]() 01/29 2026

01/29 2026

![]() 373

373

By Yang Xuejian

Source: Jiedian Finance

AI, L4, Embodied Intelligence, Humanoid Robots... Li Auto's Next-Stage Goals Have Emerged.

Recently, 'Yijian Auto' reported that at 10:30 AM on January 26, 2026, Li Auto abruptly convened an online company-wide meeting. During the nearly two-hour session, Li Auto's founder, chairman, and CEO, Li Xiang, barely mentioned the automotive business, instead focusing entirely on the AI sector and unveiling a series of significant strategic plans: 2026 as the final window to become a leading AI enterprise, L4 autonomous driving by 2028 at the latest, striving to join the ranks of global companies simultaneously developing foundational models, chips, operating systems, and embodied intelligence, and explicitly announcing the entry into the humanoid robot sector.

Furthermore, 'Yijian Auto' noted that Li Auto will initiate a large-scale reorganization of its R&D system, dividing it into three core sectors based on functionality: foundational model team, software ontology team, and hardware ontology team.

'Jiedian Finance' has observed two critical aspects of these adjustments. First, Li Auto will concentrate on foundational model R&D, a technology regarded as the 'infrastructure' of AI, capable of providing core algorithm support for various scenarios such as autonomous driving and robotics. Second, the existing automotive business and planned entity products like humanoid robots will be unified under the hardware ontology team, paving the way for future integration of intelligent hardware.

Li Xiang predicts that in the future, no more than three companies worldwide will simultaneously master the core technologies of foundational models, chips, operating systems, and embodied intelligence. Li Auto must seize this historic opportunity.

'Jiedian Finance' believes that Li Auto has sent a strong signal: a comprehensive commitment and transition to the AI era. This choice reflects the broader trend of the global automotive industry's collective shift towards AI. Tesla CEO Elon Musk has repeatedly stated that Tesla is not merely an automotive company but a technology company centered around real-world artificial intelligence. Tesla's layout of FSD, humanoid robot Optimus, and self-developed AI chips aligns closely with Li Auto's strategic direction, confirming that AI transformation for automakers has shifted from an optional path to a necessary one.

Firm Commitment to AI Strategy, Seizing the 2026 Window of Opportunity

In fact, Li Auto has been consistently investing in the AI sector. Many may recall that in late 2024, after being 'absent' from social media for nearly nine months, Li Xiang reappeared and asserted that 'AI represents the entirety of Li Auto's future.' From that moment, Li Auto's ambition to become a leading AI-driven electric vehicle company was no longer a secret.

Li Xiang discussing artificial intelligence in December 2024

The recently revealed plans from Li Xiang's internal meeting indicate no deviation from the established strategy.

However, Li Xiang's AI blueprint has sparked mixed reactions within Li Auto. Numerous posts on the internal social platform reveal that many employees, particularly those in non-R&D departments like manufacturing and sales, expressed confusion and skepticism, stating, 'I don't understand' and 'I'm unclear about the meeting's significance.' 'The most urgent issue now is addressing declining sales and business review, not a distant AI strategy.'

This internal cognitive divide reflects Li Auto's complex current situation and underscores the common challenge for all AI-transitioning companies: balancing short-term performance pressure with long-term technological layout .

Indeed, in early 2026, global signals pointing towards AI development have become increasingly evident. The 2026 CES held in Las Vegas in early January and the 2026 Davos Forum in late January in Davos, Switzerland, both placed AI at the absolute core of discussions. Especially in the automotive and intelligent mobility sectors, AI penetration has become a key indicator of corporate competitiveness.

Moreover, at the 2026 CES, Physical AI emerged as a central keyword, with automobiles being the most direct application scenario for this technology. Global automakers exhibited a 'no AI, no participation' stance, indicating that the deep integration of AI and automobiles has transitioned from concept to large-scale implementation.

It can be said that within the next 3-5 years, companies lacking AI capabilities will be eliminated by the market. According to the latest data, Tesla's Robotaxi, with its first batch of 30 safety driver-free test vehicles in Austin, has accumulated 120,000 miles of driving in complex conditions. Its FSD system has passed 278 stringent EU tests, validating the commercial feasibility of AI technology in the automotive sector. Recent discussions about FSD's entry into the Chinese market have also intensified. Although the official launch timeline remains uncertain, it is sufficient to motivate domestic automotive technology companies to redouble their R&D efforts.

For traditional automakers, the transition to electrification has already been arduous. In the realm of intelligence, they are gradually abandoning self-developed paths and turning to technology companies. For instance, BMW has partnered with Amazon to integrate the next-generation Alexa voice assistant, powered by artificial intelligence, into the driving experience. Mercedes-Benz has formed a deep alliance with NVIDIA, with the 2025 Mercedes-Benz CLA set to feature NVIDIA's Alpamayo autonomous driving platform, providing enhanced L2 end-to-end driving assistance.

From 'Jiedian Finance's perspective, Li Auto's AI strategic choice deeply resonates with global industry trends. For Li Auto, further investing in AI and participating in the embodied intelligence and humanoid robot sectors is not far-fetched but a logical path to expand the boundaries of its Physical AI business.

Refocusing on Automotive Business, The New L9 Must Not Fail

For Li Auto, 2026 is undoubtedly a critical year.

Li Xiang has designated this year as 'the final year to become an AI leader,' reflecting both a sense of urgency towards industry trends and the necessity of strategic transformation. Against the backdrop of global automakers intensifying their AI efforts, the fleeting nature of the window of opportunity leaves Li Auto with little time to hesitate between 'maintenance' and 'innovation.' To achieve this goal, it must balance short-term performance with long-term layout , paving the way for its AI strategy through comprehensive adjustments.

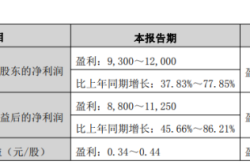

Risks and opportunities always coexist. The confusion among some Li Auto employees stems from the current performance pressure: in 2025, Li Auto's annual deliveries declined by approximately 19% year-on-year, failing to meet the set sales target. Meanwhile, the new energy vehicle industry is witnessing intensifying price and product wars.

However, Li Auto's clarity lies in not separating its AI strategy from its automotive business. After a period of growth from 2022 to 2024 and a temporary setback in 2025, Li Auto has gained a clearer understanding of its automotive business logic.

On August 28, 2025, during Li Auto's interim results meeting, Li Xiang already set the tone, stating that in terms of product configuration strategy, Li Auto would reduce the number of SKUs (Stock Keeping Units) and return to the approach of the Li ONE and L9 era—focusing on each model and maximizing a single configuration to provide users with the strongest product strength and cost-effectiveness.

According to 36Kr Automotive, Li Auto's overall strategic direction for 2026 is to 'regain leadership in extended-range products,' aiming for 40% growth and an annual sales target of 550,000 units. Among these, the 2026 L9 will be a top priority.

According to 36Kr Automotive, the body size, chassis, and extended-range battery pack of the 2026 L9 will undergo upgrades. Li Auto's self-developed intelligent driving chip, M100, will also debut in the L9. Regarding pure electric products, it is reported that Li Auto will launch only one new model in 2026.

In terms of channels, Li Auto emphasizes dynamic optimization, such as closing 100 inefficient commercial stores, to ensure a focus on high-value models for its automotive business in 2026.

'Jiedian Finance' believes that these adjustments reflect Li Auto's more precise resource allocation. Mid-to-high-end models like the L9 not only offer higher profit margins per unit, providing sustained financial support for AI R&D, but also serve as excellent carriers for AI technology implementation.

Despite previous executive departures, Li Auto swiftly adjusted its organizational structure, on the one hand, recruiting autonomous driving experts and robotics R&D specialists from other technology companies to address shortcomings, and on the other hand, breaking down departmental barriers to achieve efficient collaboration, ensuring a seamless connection between AI R&D and product implementation.

In Conclusion

Overall, Li Auto's series of adjustments are not isolated moves but form a complete logical closed loop centered around AI transformation. The 2026 window of opportunity tests Li Auto's strategic resolve and resource integration capabilities. For this new energy vehicle company undergoing transformational pains, embracing AI is both a breakthrough out of the red ocean and an inevitable choice to face future competition.