Rijiu Optoelectronics Anticipates Net Profit to Hit 1.2 Billion Yuan in 2025, Secures 800 Million Yuan for Capacity Augmentation

![]() 01/28 2026

01/28 2026

![]() 331

331

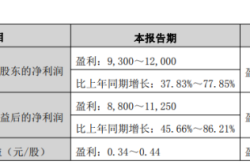

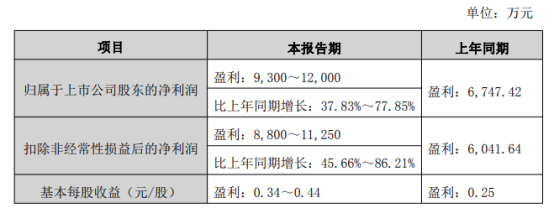

On January 27, Rijiu Optoelectronics unveiled its 2025 annual performance forecast, predicting that the net profit attributable to shareholders for the year 2025 will fall within the range of 930 million yuan to 1.2 billion yuan. This projection marks a substantial year-on-year surge of 37.83% to 77.85%. After deducting non-recurring items, the net profit attributable to shareholders is expected to be between 880 million yuan and 1.13 billion yuan, representing a notable year-on-year increase of 45.66% to 86.21%.

Explaining the factors behind this performance shift, Rijiu Optoelectronics attributed it to the synergistic effects of main business expansion, equity incentive costs, and tax adjustments.

During the reporting period, the company's light-adjusting conductive film business emerged as a key growth driver, with comprehensive downstream adaptations accomplished for the full spectrum of PDLC, SPD, EC, and LC technical routes. The focus on core automotive application scenarios spurred steady growth in business revenue.

Concurrently, the sales volume of 2A/3A optical film products, utilized in automotive displays and consumer electronics, also witnessed an uptick owing to enhanced market acceptance, further fueling revenue growth.

However, during the reporting period, the company recognized share-based payment expenses amounting to approximately 360 million yuan due to the implementation of an employee stock ownership plan, which partially counterbalanced the profit growth. Additionally, based on assessments of its subsidiaries' future profitability, the company recognized deferred tax assets linked to unrecovered losses at the end of the period, consequently reducing income tax expenses by roughly 130 million yuan.

Reviewing recent performance, Rijiu Optoelectronics has exhibited a pronounced trend of 'bottoming out and then steadily ascending.' After weathering short-term industry fluctuations in 2023, the company staged a robust rebound in 2024 by swiftly optimizing its product mix and honing in on core sectors. Annual revenue soared to 583 million yuan, marking a year-on-year increase of 21.97%. The net profit attributable to shareholders turned positive at 674.7 million yuan, and net cash flow from operating activities reached 136 million yuan, laying a solid foundation for future growth. The performance upswing was primarily propelled by the sustained growth of the light-adjusting conductive film business as the core growth engine, coupled with the steady expansion of optical film sales in the automotive display and consumer electronics sectors.

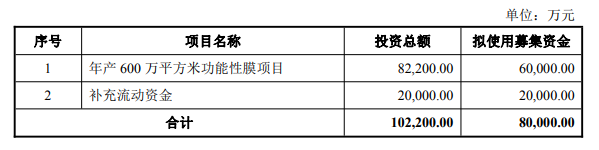

Given the sustained positive performance trajectory, the company has also embarked on a forward-looking strategic布局 (translated as "layout" here, but in a more native English context, we might say "strategic initiative"). In addition to the growth trend indicated in the recently released 2025 annual performance forecast, Rijiu Optoelectronics announced on January 9 its plan to issue shares to specific investors to raise no more than 800 million yuan. Out of this, 600 million yuan will be earmarked for the 'Annual Production of 6 Million Square Meters of Functional Film Project,' with a focus on expanding the production capacity of light-adjusting conductive films and anti-reflective films.

This strategic initiative not only aligns closely with current growth drivers but also underscores the company's resolve to solidify its position in the functional film sector and drive sustained performance growth, potentially unlocking new avenues for medium- to long-term expansion.

From rebounding off the bottom to steadily climbing and then expanding capacity based on growth momentum, Rijiu Optoelectronics has gradually forged a positive cycle of development encompassing products, capacity, and financial performance. This case vividly illustrates that the sustained growth of optical companies hinges on a foundation of platform-based technologies and capacity expansion as a driving force. It is imperative not only to closely align with mainstream sectors such as automotive, AI, and consumer electronics but also to deeply integrate into a collaborative and innovative industrial ecosystem.