Challenges in the 2026 Auto Market Emerge Right from the First Month

![]() 01/30 2026

01/30 2026

![]() 438

438

Introduction | Lead

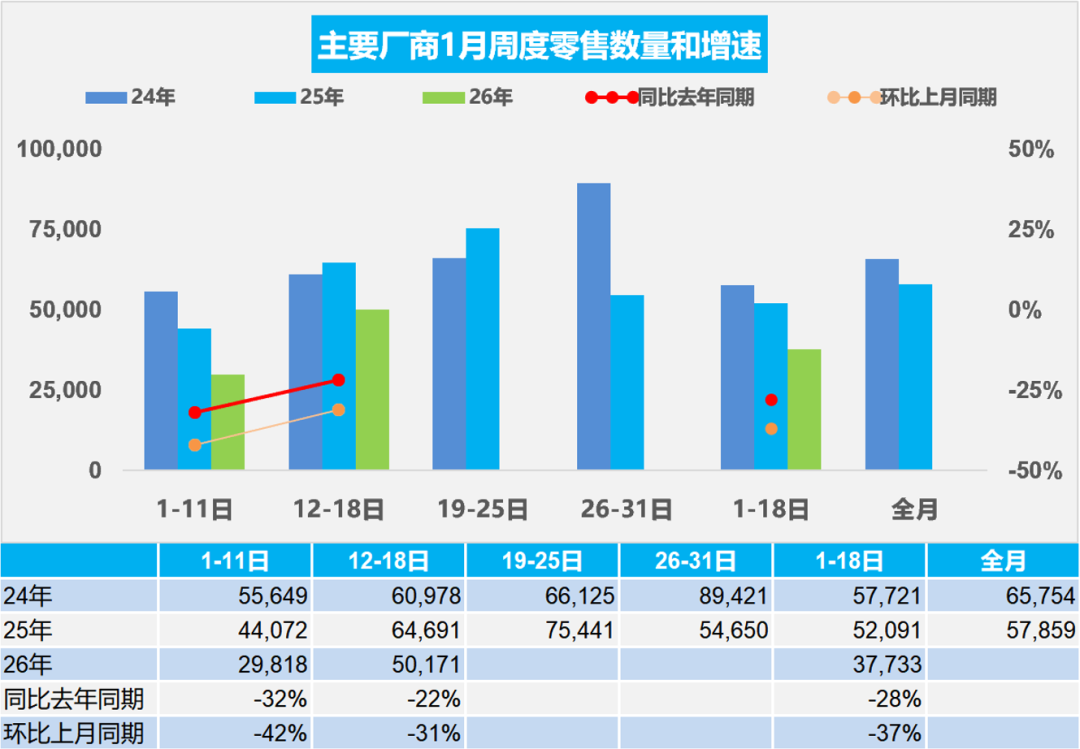

The consensus within the industry is that the Chinese automotive sector is poised to enter a challenging phase of 'sluggish growth' in 2026. This forecast is already evident in some of the January data. The auto market was sluggish in the first half of January, with retail sales figures for passenger vehicles indicating a substantial 28% year-on-year decrease from January 1st to 18th, and a 37% drop compared to the previous month, marking the most significant market downturn in recent years.

This article is produced by Heyan Yueche Studio

Written by Cai Yan

Edited by He Zi

2,317 characters in total

4-minute read

In January 2026, there was a general decline in customer footfall at automotive showrooms, and the auto market's sluggish start has become an undeniable reality. With the adjustment of the new energy vehicle purchase tax exemption from full exemption to a 50% reduction starting in 2026, consumer purchasing costs rose, prompting consumers to delay their purchases. Wu Songquan, a senior chief expert at the China Automotive Technology and Research Center, predicts a significant slowdown in the overall growth rate of the domestic auto market in 2026.

△China's Auto Market Faces a Chilly Start in January

The Auto Market Faces a Chilly Start in January

From January 1st to 18th, 2026, China's auto market experienced a colder spell than in previous years. According to data from the China Passenger Car Association, nationwide retail sales of passenger vehicles amounted to only 679,000 units, showing a significant 28% year-on-year decrease and an even larger 37% month-on-month drop. The wholesale market also witnessed a 35% year-on-year decline, with the supply chain end feeling the chill as well. Although full-month forecast data indicates that total retail sales of narrowly defined passenger vehicles in January may reach 1.8 million units, with a 20.4% month-on-month decrease and basically flat year-on-year performance, this does not alter the fact of the market's sluggish start.

January saw markedly different trends in the fuel vehicle and new energy vehicle markets. The contraction trend in the fuel vehicle market is irreversible, characterized by a pattern of 'stable inventory and weak new additions.' Traditional joint venture brands like FAW-Volkswagen, SAIC Volkswagen, and SAIC General Motors still exhibit some resilience by relying on classic fuel vehicles and undergoing intelligent transformation. Although new energy vehicles also experienced a decline, their resilience was notably stronger than that of fuel vehicles. Data reveals that from January 1st to 18th, 2026, retail sales of new energy passenger vehicles were 312,000 units, showing a 16% year-on-year decrease.

△Traditional Joint Venture Brands Rely on Classic Fuel Vehicles to Weather the Decline

In this market differentiation, the fortunes of different automakers vary. Although BYD has not yet disclosed its total sales plan for 2026, it has clearly accelerated its overseas market expansion, targeting 1.3 million units in overseas sales for 2026, and remains resolute despite the market downturn. Tesla commenced the new year with a financial strategy, attempting to boost consumption by extending auto loan terms to seven years. Chery Fengyun, Great Wall, Geely, Changan Qiyuan, and others have made breakthroughs in specific price segments with their plug-in hybrid technologies. Joint venture brands display an imbalanced pattern of 'stable fuel vehicles and weak new energy vehicles,' with new energy vehicle model sales falling far below the industry average. The luxury brand market has also started to loosen its grip, with new energy vehicle models like NIO, BYD Han, and Xiaomi SU7 successfully penetrating the forefront of the C-class vehicle segment, breaking the established pattern of the luxury market.

Why Did the Chilly Spell Arrive So Quickly?

The chilly spell in the auto market in January 2026 was not triggered by a single factor but rather by a confluence of multiple variables such as policy, market, and seasonality. The most pivotal shockwave stemmed from the adjustment of the new energy vehicle purchase tax policy. Starting from January 1st, 2026, the previously fully exempt policy was altered to a 50% reduction. This policy change implies that consumers purchasing a pure electric vehicle priced around 200,000 yuan will now have to pay an additional purchase tax of approximately 8,850 yuan. For consumers, this represents a significant extra expense. The policy change has fostered a strong sentiment among consumers to delay their purchases, with many frequently asking, 'Will the policy change again?' and 'Is it a loss to buy now?'

Seasonal factors have also intensified the market chill. The 2026 Spring Festival falls relatively late, with the pre-holiday car purchasing peak concentrated from late January to February, while the same period last year had already entered a hot sales cycle. This misalignment effect of the Spring Festival has further exacerbated the year-on-year decline in data. Persistent low temperatures in northern regions, particularly the 'Heihe-style' severe cold, have heightened consumer concerns about the driving range of new energy vehicles, leading some potential buyers to switch to fuel vehicles or postpone their purchasing decisions.

On a deeper level, the promotional activities conducted by automakers at the end of 2025 to rush towards annual sales targets have already overdrawn a significant amount of consumer demand. Promotional tactics such as purchase tax guarantees, cash discounts, and other incentives offered by various brands have prematurely released a large amount of personal and corporate car purchasing demand. When 2026 arrived, the market had already entered a demand vacuum period.

△2026 New Energy Vehicle Purchase Tax Policy Adjustments

The Price War Persists

Faced with the market downturn, mainstream automakers responded swiftly. In the first week of the new year, numerous models were launched with attractive promotional offers. BMW adjusted the official prices of 31 models, with the BMW i7 M70L seeing a direct price reduction of 301,000 yuan and the BMW iX1 experiencing a reduction of up to 24%. FAW Toyota even halved the starting price of its pure electric sedan bZ3, with a direct reduction of 76,000 yuan, bringing the price of joint venture electric vehicles below 100,000 yuan. In addition to direct price reductions, many automakers have also come up with innovative strategies. Xiaomi YU7 and Tesla have adopted a strategy of 7-year low-interest policies, while GAC Trumpchi has launched a 70,000 yuan subsidy package, and Zeekr has introduced insurance subsidies and purchase tax subsidies. This price reduction strategy has indeed yielded short-term effects, but such continuous price reductions and promotions are eroding the gross profit margins of automakers, while interest-free and subsidized interest policies are increasing capital costs, leaving companies trapped in a dilemma of 'exchanging sales volume for market share and profits for survival.'

Meanwhile, some automakers are 'competing on technology,' accelerating the shift of resources originally allocated for market promotion towards investments in solid-state batteries, advanced intelligent driving, and overseas localization production. The planned annual production capacity of overseas factories in 2026 has exceeded 2 million units. Additionally, intelligence has become a key aspect of differentiated competition among automakers. Data shows that the penetration rate of new vehicles with Level 2 autonomous driving has increased from 57.3% in 2025 to 64% in 2026. Cost reductions are the core driving force behind this trend—the hardware cost of highway NOA has decreased from 5,000-8,000 yuan in 2022 to 1,500-3,000 yuan in 2026, enabling intelligent driving functions to enter the 'thousand-yuan era.'

△The 2026 Auto Market Price War Continues

Commentary

The 2026 auto market has commenced with a biting chilly spell, which is not accidental but rather an inevitable pain as the industry transitions from policy-driven and scale expansion to market-driven and value creation. As the marginal effect of price wars diminishes, the real competition has shifted to the deep cultivation of core technologies, global layout, and user experience. This presents both challenges and opportunities, as the auto market is undergoing accelerated reshuffling.

(This article is original to Heyan Yueche and may not be reproduced without authorization)