Volkswagen’s Layoffs Target Board, Removing 10 Members Simultaneously

![]() 01/30 2026

01/30 2026

![]() 535

535

Achieve 8 Billion Euros in Savings by 2030

Author: Wang Lei

Editor: Qin Zhangyong

Volkswagen is on a mission to swiftly reduce costs.

The major layoffs have now impacted the board. According to Volkswagen Group's comprehensive reorganization plan for its core brand group (Volkswagen Core Brand Group), the company intends to reduce the number of board members for Volkswagen's core brand group to 19 by this summer.

Currently, Volkswagen's core brand has 29 board members, meaning that nearly one-third of the board will be laid off.

Furthermore, the organizational structure will be streamlined even more, with each brand retaining only four board members. Simultaneously, the three core functions of R&D, procurement, and production will be consolidated and managed centrally at the group's headquarters in Wolfsburg, rather than being delegated to individual brands.

Thomas Schäfer, CEO of Volkswagen Passenger Cars, commented on the plan, stating, "The focus is on enhancing management efficiency and accelerating processes to create more competitive products."

Previously seen as a cumbersome giant struggling to adapt, Volkswagen is now boldly removing board members amidst the dual pressures of a persistent business downturn and the substantial costs of transitioning to electric vehicles. This move signals a "do-or-die" approach, with a new Volkswagen on the horizon.

01

A Brand-New Organizational Structure

This reorganization plan represents the largest organizational structure adjustment in Volkswagen Group's history.

Rather than merely reducing the board size to achieve cost-cutting goals, it's more accurate to say this is a strategic adjustment to align with a new organizational structure.

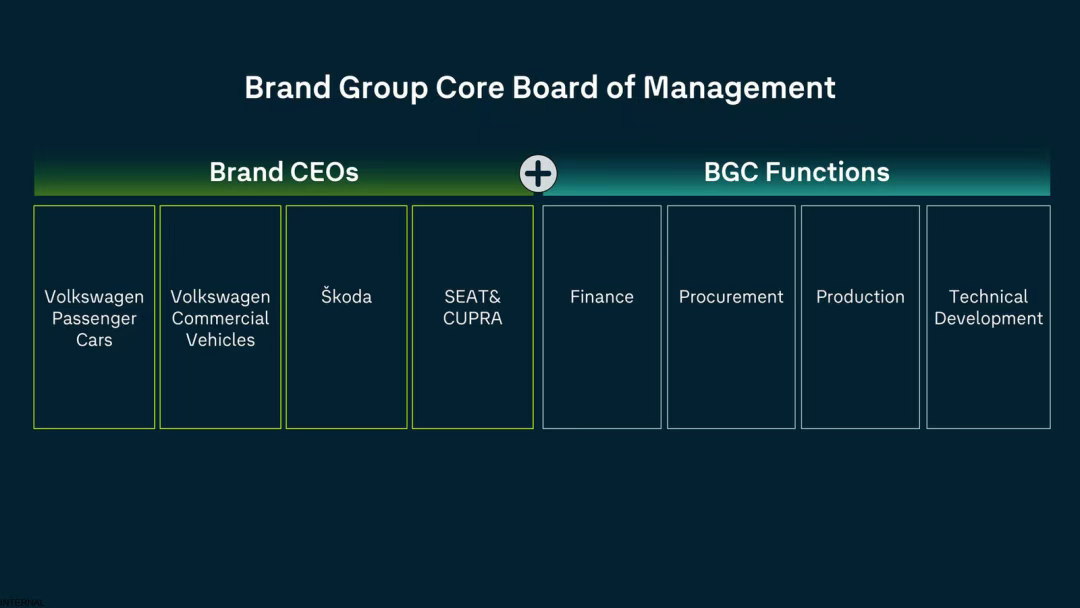

Specifically, after the adjustment, brands such as Volkswagen Passenger Cars, Skoda, SEAT/Cupra, and Volkswagen Commercial Vehicles, which are core clusters under Volkswagen Group, will have a more streamlined management structure.

Each brand will retain only four board members responsible for the core functions of operations (CEO), finance, sales, and human resources. Consequently, the number of board members will decrease from 29 to 19, with 10 positions being eliminated.

This includes the demotion of nine existing board members responsible for production, procurement, and R&D, who will be reassigned to positions below the board level. This is because functions such as R&D, procurement, and production for each brand will no longer be managed individually but will be centrally overseen by the headquarters in Wolfsburg, Germany, through the newly established Brand Core Management Committee (BGC) at a cross-brand level.

The Brand Core Management Committee was actually established earlier this year, suggesting that Volkswagen's reorganization plan may have been finalized last year.

The committee's chairman is Thomas Schäfer, the current CEO of Volkswagen Brand. Other members include the CEOs of Volkswagen, Skoda, SEAT/CUPRA, and Volkswagen Commercial Vehicles, as well as four core function leaders appointed by the group. These leaders are responsible for finance, procurement, production, and technology R&D.

From the appointments, it's evident that these are top-tier figures in their respective fields. In finance, David Powels, the current CFO of Volkswagen Passenger Cars, is in charge.

He has served as the Chief Financial Officer of Volkswagen Passenger Cars since October 2024. Previously, he was the First Vice President and Commercial Executive Vice President of SAIC Volkswagen, as well as a board member for finance and IT at SEAT.

In the production domain, Christian Vollmer oversees operations. Since August 2020, he has served as a board member for production and logistics at Volkswagen Passenger Cars, with extensive management experience across production bases in Wolfsburg, Slovakia, China, and other countries.

He has also served as the Technical Executive Vice President of SAIC Volkswagen and the Executive Vice President of Production and Logistics at SEAT, making him a key figure in driving the standardization and regional collaboration of Volkswagen's production network.

In procurement, Karsten Schnake is responsible. He originally oversaw procurement organizations for all brands and regions within Volkswagen Group. Since 1996, he has been involved in Volkswagen's procurement system, holding key positions in global supply chain coordination, crisis management, and strategic procurement in China.

In technology R&D, Kai Grünitz leads the efforts and is currently the Chief Technology Officer. Having served Volkswagen Group for nearly 30 years, he started in R&D at Skoda and has held positions such as Technical Director of Volkswagen Commercial Vehicles and board member for brand technology R&D at Volkswagen Passenger Cars. Today, Grünitz is considered a key figure in driving Volkswagen's next-generation electric vehicle models.

It's clear that under the new structure, Volkswagen Group's production network will undergo changes. To adapt to the new production model, Volkswagen Group's production plants will be managed by region rather than by individual brand.

Volkswagen will integrate its more than 20 factories of the core brand group clusters worldwide into five regions: Central Europe (including Germany), the Iberian Peninsula, Eastern Europe/India, North America, and South America.

Each region will have a regional manager responsible for cross-brand and cross-country management. Notably, the Chinese market has been listed separately. Volkswagen stated that due to its scale and uniqueness, management responsibility for the Chinese market will still be directly borne at the group level and will not be included in this regional integration.

Currently, the new management model has been first implemented on the Iberian Peninsula, namely in Spain and Portugal, where production plants have been integrated into a cross-brand cluster.

From Volkswagen's perspective, this new model will significantly save more expenses for the group. Just in production, it is expected that by 2030, the reorganization will accumulate savings of 1 billion euros (approximately 8.1 billion yuan) for the group.

This includes approximately 600 million euros in personnel costs and around 400 million euros in manufacturing costs. For example, the increased use of shared vehicle platforms, as part of cost-saving measures, has also led to cuts in the fixed salaries and bonuses of management committee members.

"We are shifting from a decentralized brand structure to a centralized decision-making architecture, which will make Volkswagen's core brand group more competitive. The focus is on improving management efficiency and accelerating the process of producing more competitive products. The new governance approach reduces costs and structure while raising our efficiency levels," Thomas Schaefer stated in a declaration.

02

Will It Be the Darkness Before Dawn?

Volkswagen's cost-cutting plan extends far beyond this.

As early as the end of 2024, Volkswagen planned to cut 35,000 jobs in Germany by 2030, reduce factory capacity, and lower employee bonuses and salaries. This plan is still ongoing, and the recently announced reorganization plan also mentions it.

According to Volkswagen's statement at the time, Volkswagen Group could reduce costs by 15 billion euros (approximately 114.3 billion yuan) annually, with labor cost reductions and capacity cuts contributing to approximately 4 billion euros (approximately 30.4 billion yuan) in annual savings.

However, after more than a year of implementing cost-cutting measures, the situation does not seem to have improved significantly.

Just last month, Volkswagen reportedly closed its first vehicle manufacturing plant in Germany—the Dresden factory producing the ID.3—in its 88-year history, formally ceasing vehicle production on December 16 last year. Subsequently, the site will be rented out to establish an innovation center.

Additionally, Volkswagen Group is significantly tightening its investment plans.

Oliver Blume, CEO of Volkswagen Group, stated in December 2025 that due to weak cash flow, Volkswagen is forced to strengthen expenditure control, and the company will reduce its five-year investment plan to 160 billion euros. From 2023 to 2027, this figure was 180 billion euros.

Weak demand from the business side and consecutive poor financial performances have forced Europe's largest automaker to initiate a series of historic adjustments.

Not long ago, Volkswagen Group announced its 2025 sales data. In 2025, Volkswagen Group sold 8.984 million vehicles globally, a decrease of 43,000 units or 0.5% year-on-year compared to 2024. While the overall performance was steady, there was significant polarization in regional markets.

There were notable declines in the key North American and Chinese markets, with year-on-year decreases of 10.4% and 8%, respectively. In particular, sales of Volkswagen Group's pure electric vehicle models in the Chinese market declined especially severely. While overall sales of Volkswagen Group's pure electric models increased by 32% year-on-year, sales in the Chinese market decreased by 44.3% year-on-year.

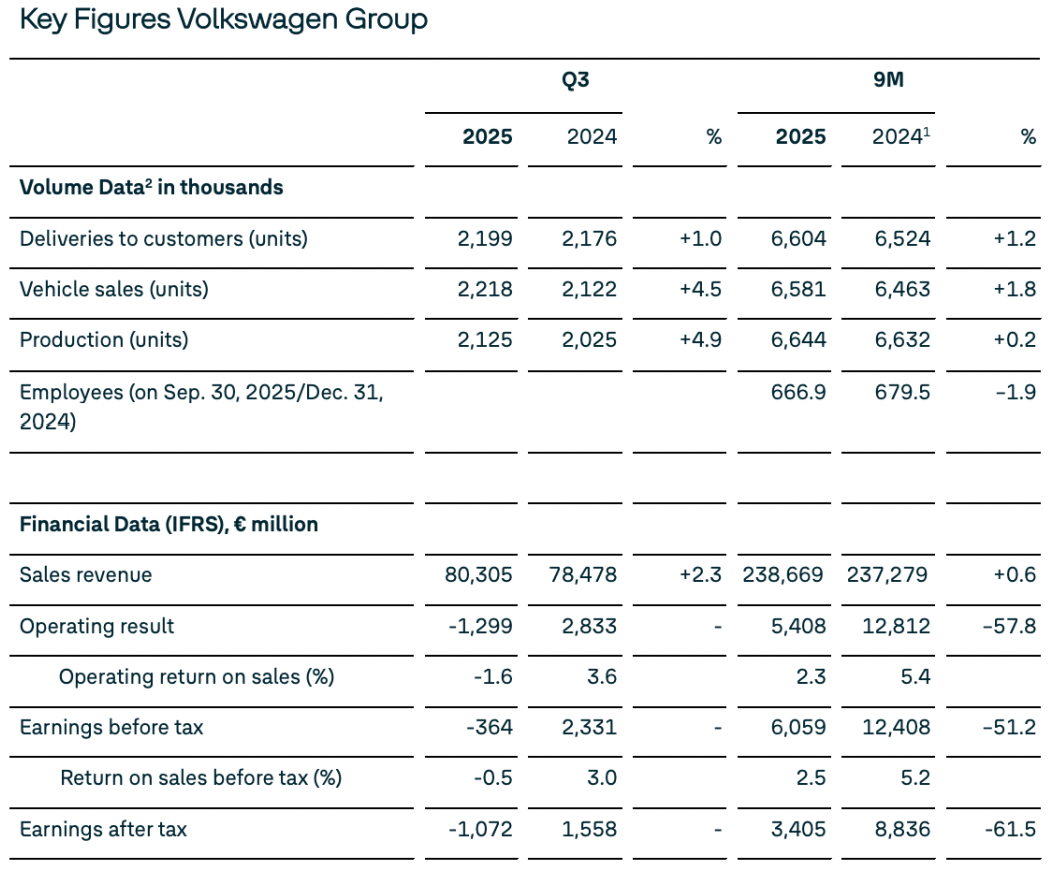

Additionally, in terms of financial performance, Volkswagen, the second most profitable automaker globally, experienced its first quarterly loss in five years. According to Volkswagen's third-quarter financial report, revenue in the third quarter was 80.305 billion euros, a year-on-year increase of 2.3%. However, the operating loss was 1.299 billion euros, compared to an operating profit of 2.833 billion euros in the same period last year, turning from profit to loss.

More severely, the net loss was 1.072 billion euros, compared to a net profit of 1.558 billion euros in the same period last year, a year-on-year decrease of approximately 168.8%. This was also Volkswagen's first quarterly loss in nearly five years. In the first three quarters of this year, Volkswagen Group's net profit decreased significantly by 61.5% year-on-year to 3.4 billion euros.

Moreover, Volkswagen Group has repeatedly lowered its performance expectations this year, expecting the operating profit margin to be only 2%-3% in 2025.

Facing dual pressures from the business and financial sides, Volkswagen Group has bluntly stated that it is directly related to the sales declines in its two major markets. Compared to the tariff policy challenges Volkswagen faces in the North American market, which are difficult to control,

the Chinese market represents Volkswagen's best battleground. In the upcoming 2026, it is evident that Volkswagen's plans in China are quite aggressive.

Oliver Blume, CEO of Volkswagen Group, stated that Volkswagen Group plans to launch more than 20 new models in 2026 and specifically mentioned "launching more innovative models in the Chinese market's model offensive." In other words, there will be pure electric, plug-in hybrid, and extended-range models.

By 2027, the number of these new energy vehicle models will increase to over 30, and by 2030, it will further expand to approximately 50, with around 30 being pure electric models.

Next, domestic automakers seem to face artillery fire from Volkswagen.