Leapmotor: Annual Sales KPI Completion Rate Below 40%

![]() 07/10 2024

07/10 2024

![]() 564

564

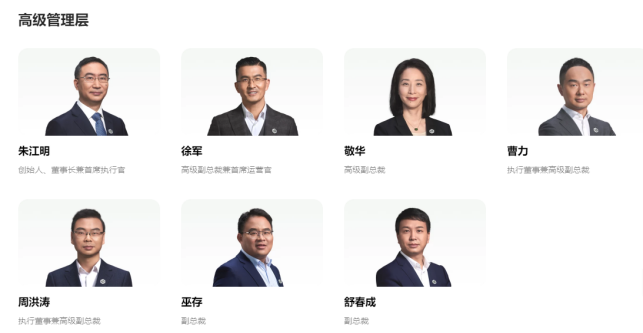

Since the end of 2023, there have been frequent changes in the senior management of Leapmotor (09863.HK). Recently, the departure of Leapmotor executive Zhang Weili once again sparked heated market discussions. As the head of marketing, he had only joined Leapmotor for a little over a year. Subsequently, Executive Director and Senior Vice President Cao Li will take charge of branding and marketing.

Stockstar has noticed that amidst the intense competition in the new energy vehicle market, Leapmotor achieved revenue and sales growth in the first quarter with its cost-effective products, but the company is still struggling with losses behind the glamor. After turning positive in 2023, its gross margin has now turned negative again.

In the first half of the year, Leapmotor's sales maintained a strong growth momentum, but its annual sales target completion rate was less than 40%. To boost product sales, Leapmotor sought an overseas outlet, planning to launch its automotive products in nine European countries starting from September this year, but the final sales figures still await time to test.

01

Departure of Huawei-affiliated Executive

Recently, media reported that Leapmotor's former Senior Vice President and Chief Marketing Officer Zhang Weili announced his resignation on social media due to personal reasons, having joined Leapmotor for less than two years.

According to information, Zhang Weili joined Leapmotor in September 2022 and was promoted to Senior Vice President and Chief Marketing Officer in January 2023. From 2014 to 2021, Zhang Weili served as Chief Marketing Officer for Greater China and Latin America at Huawei.

It is understood that in January 2023, Leapmotor adjusted its organizational structure, and Zhang Weili began overseeing the market and user operations department, primarily responsible for Leapmotor's brand PR, media placement, digital marketing, user operations, and related matters. During his tenure, Zhang Weili was also responsible for organizing multiple launch events, including the C11 extended-range version, the "four-leaf clover" centralized electronic and electrical architecture, the 5-seat SUV C10, and the 6-seat SUV C16.

Currently, Zhang Weili's position is temporarily filled by Cao Li, Executive Director and Senior Vice President of Leapmotor, who is responsible for the entire vehicle product line.

Stockstar notes that Leapmotor's official website shows that Zhang Weili's information has been removed from the executive team. Originally, Zhang Weili ranked after Leapmotor's founder, Chairman, and CEO Zhu Jiangming, and Senior Vice President and COO Xu Jun.

Stockstar notes that since the end of 2023, there have been consecutive changes in Leapmotor's management.

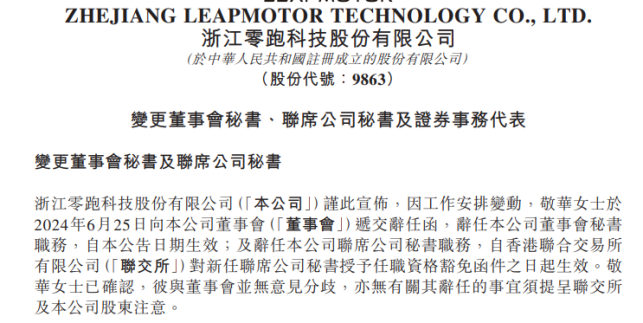

On June 25, Leapmotor announced that Jing Hua submitted his resignation letter to the company's board of directors on June 25 due to changes in work arrangements, resigning from his position as Secretary to the Board, effective from the date of the announcement; at the same time, he resigned from his position as Joint Company Secretary, effective from the date the Hong Kong Stock Exchange granted a waiver letter for the new Joint Company Secretary's qualification.

On the same day, the Leapmotor board of directors resolved to appoint Shen Ke as the company's Secretary to the Board and Joint Company Secretary. The term of office is effective from June 25. Given that Shen Ke does not yet possess the relevant qualifications or experience as a company secretary, Leapmotor will apply to the Hong Kong Stock Exchange for an exemption from strict compliance with Rules 3.28 and 8.17 of the Listing Rules, which is still pending approval from the Stock Exchange.

According to information, Shen Ke, 42, joined Leapmotor in May 2021. He works in the Board Office, responsible for the company's three-meeting affairs, information disclosure, securities compliance, ESG, and related work.

In the longer term, in December last year, Leapmotor Chairman Assistant Zeng Lintang resigned after a brief seven-month tenure, having previously worked at Ford for 14 years and Toyota for 9 years; in January this year, Leapmotor Co-founder and President Wu Baojun resigned due to the expiration of his labor contract and Leapmotor's decision not to renew it. Before joining Leapmotor, Wu Baojun worked at companies such as Peugeot, Guangqi Honda, Guangqi Toyota, and Zhongcheng Insurance.

02

Deep in Losses

According to information, Leapmotor was listed in September 2022, with its main business being the research and development, manufacture, and sale of new energy vehicles, as well as the research and development of core electrical and electronic components. Currently, it mass-produces and sells four smart pure electric vehicles: the T03 smart pure electric car, the C11 smart super-enjoyable electric SUV, the C01 smart luxury electric sedan, and the C10, the first global strategic model, as well as three super-extended-range vehicles: the C11, C01, and C10.

The first-quarter report showed that Leapmotor achieved revenue of 3.486 billion yuan, a year-on-year increase of 141.7% and a quarter-on-quarter decrease of 33.9%. Leapmotor attributed the year-on-year growth to the gradual market recognition of its products and the sales increase brought about by a richer product matrix; the quarter-on-quarter decrease was mainly due to the company's renewal and upgrade of its entire product line in the first quarter, adjustments to the production and sales of existing models, and the seasonal impact of the Spring Festival holiday.

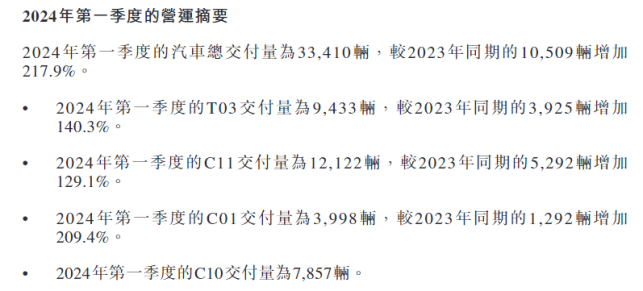

During the reporting period, Leapmotor delivered a total of 33,410 vehicles, a significant year-on-year increase of 217.9% but a quarter-on-quarter decrease of 39.61%. Among them, T03 deliveries increased by 140.3% year-on-year to 9,433 units; C11 and C01 deliveries were 12,122 units and 3,998 units, respectively, with growth rates of 129.1% and 209.4%; and new product C10 deliveries were 7,857 units. Thus, the delivery volume of the relatively higher-priced C series accounted for 71.77% of the total.

"From a product layout perspective, the proportion of the A0-segment T03 will gradually decrease to around 20%, and the remaining 80% will be products priced around 150,000 yuan. This is our future goal. Since C10 deliveries began in March and C16 deliveries in June, with the addition of these two products to our sales, the proportion of high-value-added sales will gradually increase," said Zhu Jiangming at the 2023 performance press conference.

With both revenue and delivery volumes increasing significantly year-on-year, Leapmotor's profit side also showed improvement, but it is still mired in losses. The net loss in the first quarter was 1.013 billion yuan, compared to a loss of 1.133 billion yuan in the same period of 2023.

From a product perspective, Leapmotor's gross margin in the first quarter was -1.4%, an improvement of 6.4 percentage points from -7.8% in the same period last year, but a significant decline from 6.7% in the fourth quarter of last year. Leapmotor explained that the year-on-year improvement was mainly due to the scale effect brought about by increased sales and ongoing cost reduction efforts; the quarter-on-quarter decrease was mainly due to promotions for the 2023 model year of the entire product line in the first quarter and the rise in per-vehicle manufacturing costs due to decreased sales.

Stockstar notes that this year, the price competition among various new energy vehicle brands has intensified, and to boost sales, Leapmotor has also implemented several rounds of price cuts. For example, the 2023 Leapmotor C01 received a maximum cash discount of up to 32,000 yuan across its entire lineup, the 2023 Leapmotor C11 received a direct cash discount of 19,000 yuan across its entire lineup, and the 2023 Leapmotor T03 200 Lite version received a direct cash discount of 15,000 yuan.

It is worth mentioning that benefiting from the increase in the average selling price of products, the reduction in the average manufacturing cost per electric vehicle, and ongoing cost management, Leapmotor's gross margin last year increased from -15.4% in 2022 to 0.5%, marking the first time it turned positive. However, judging from the first-quarter situation, the positive gross margin did not last long.

03

Seeking Breakthroughs Overseas

According to the delivery volume ranking of new forces in the Chinese market, in the first half of this year, NIO (09866.HK) delivered 189,000 new vehicles, ranking first among new forces in terms of sales for the first half of the year. AITO ranked second with a slight margin, delivering 181,200 vehicles. Leapmotor followed closely behind ZEEKR and NIO, ranking fifth with 86,700 vehicles sold in the first half of the year, less than 1,000 vehicles behind NIO. Compared to the same period last year, sales increased by 94.81%.

In June alone, Leapmotor delivered 20,100 vehicles, a year-on-year increase of 52.3%, with monthly sales exceeding the 20,000-unit mark for the first time.

Stockstar understands that Leapmotor's target is to achieve annual sales of 250,000 to 300,000 vehicles this year, which means its deliveries need to double compared to 2023. However, judging from the annual target completion rate, Leapmotor has only achieved 28.9% to 34.68% of its annual sales target in the first half of the year, with the progress bar still below 40%.

To achieve its annual target, Leapmotor has launched several new products this year, including the C10 and C16, which have already started deliveries, as well as a 5-seat A-segment SUV model planned for launch at the end of the year.

At the same time, Leapmotor has also vigorously entered the overseas market this year. On October 26, 2023, Leapmotor and Stellantis Group officially announced their cooperation to jointly establish Leapmotor International, with Stellantis Group and Leapmotor holding 51% and 49% of the shares, respectively. In the Leapmotor International joint venture, Leapmotor plays the role of brand and product output, while Stellantis Group provides global market resources and influence.

Leapmotor International plans to launch Leapmotor vehicles in nine European countries starting from September this year: France, Italy, Germany, the Netherlands, Spain, Portugal, Belgium, Greece, and Romania; and plans to expand to a total of 200 sales outlets, including the Stellantis&You network, by the end of this year, with plans to expand the sales network to 500 outlets by 2026.

Currently, the Leapmotor International management team is preparing for the launch of the T03 and C10 electric vehicle models in Europe. At the same time, Leapmotor International also plans to introduce these models to India, Asia Pacific (excluding Greater China), the Middle East and Africa, and South America starting from the fourth quarter of 2024.

Regarding overseas sales targets, Zhu Jiangming said that in 2024, "we hope to achieve sales of several thousand or even 10,000 vehicles," and in 2025, "we hope to achieve sales of tens of thousands or even 100,000 vehicles." (This article was first published on Stockstar, Author | Lu Wenyan)

- End -