Honda betrayed Honda! Fuel vehicles are the lifeline of Honda's new energy vehicles

![]() 10/14 2024

10/14 2024

![]() 484

484

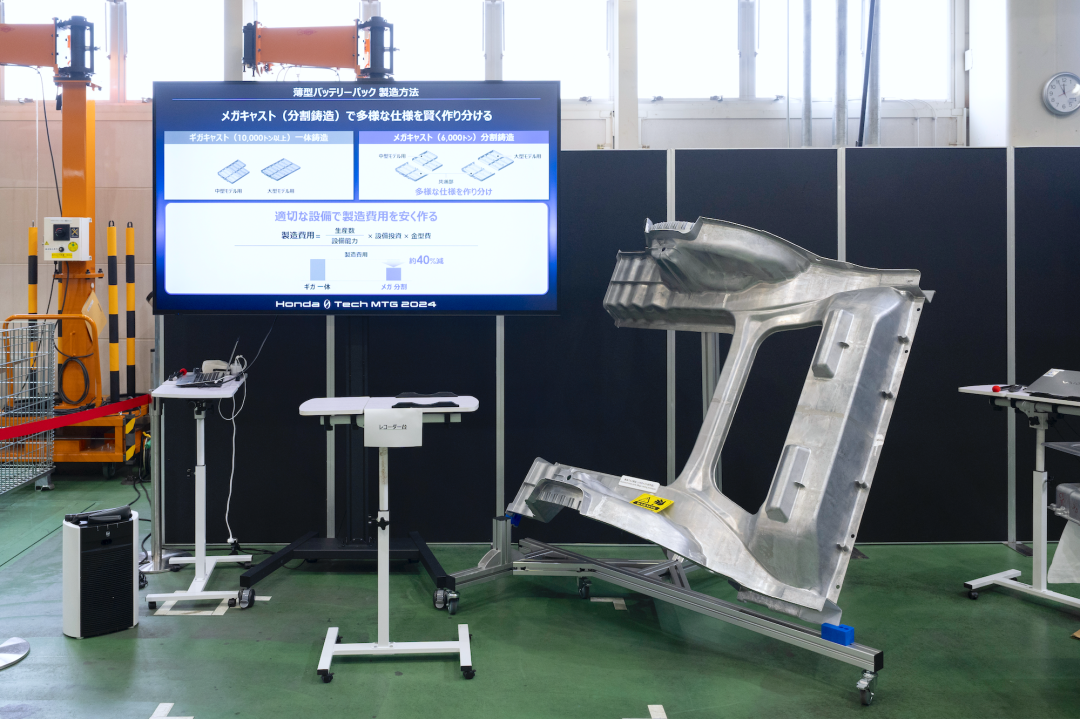

At the recently held "Honda 0 Tech Meeting 2024", Honda unveiled its "Honda 0" for the global market, featuring a brand-new design concept, manufacturing process, and automotive technology, set to officially meet global users in 2026. Honda's new energy vehicles will also embrace global challenges and opportunities.

However, China, the world's largest auto market in terms of sales, did not give Honda any room for hesitation. Honda has successively launched the e:N pure electric series and the "Ye" brand through its two joint ventures, Guangzhou Honda and Dongfeng Honda, creating a development divergence from Honda's global "0" brand.

Honda has just announced the commissioning of two dedicated new energy vehicle factories with a combined annual capacity of 240,000 units. However, as the sales of fuel vehicles continue to decline, the e:N pure electric series has been forgotten by Chinese consumers, and the first model of the "Ye" brand will only be launched at the end of the year. Will these two new factories face the threat of production cuts or even shutdown soon after they start operating?

Honda's two joint ventures in China originally had seven production lines with a combined annual standard capacity of 1.49 million units. However, their annual sales in 2023 were only 1.2341 million units, and from January to September 2024, they sold only 588,000 units, a year-on-year decline of nearly 30%.

Honda China plans to shut down the fourth factory of Guangzhou Honda and the second factory of Dongfeng Honda within the year, reducing annual fuel vehicle production capacity by 290,000 units. Nevertheless, with the official commissioning of the two new energy factories, each with a capacity of 120,000 units, the existing factories and production lines face the risk of production cuts or shutdowns.

For traditional automakers, especially joint ventures that have repeatedly failed in the new energy vehicle market, building dedicated factories for new energy vehicles may seem like a symbol of striving for breakthroughs but inevitably leads to enormous cost crises.

No matter how much joint ventures' new energy vehicle sales double, their scale can only compare to China's nascent new energy vehicle market in its early stages. It will take a long time for annual sales to reach 100,000 units, which also requires the support of multiple models.

As small-scale ventures with brand-new brands or series, coupled with brand-new platforms and components, they face immense challenges in cost control alone.

Meanwhile, the outdated factories established during the fuel vehicle era suffer from automation and efficiency levels below the industry average. Amid severe overcapacity, they can only secretly reduce or halt production, exacerbating the distortions in the company's overall operations.

Traditionally, joint ventures build new factories primarily to address capacity shortages rather than introduce new models. However, Honda's commissioning of two new energy factories coincides with its most severe overcapacity crisis.

Honda has no global models to introduce to the Chinese market, leaving only a handful of existing models like the Accord, Haoying, CR-V, and Civic to maintain its presence in the mainstream market. Building new factories, especially dedicated to new energy vehicles, seems more like a desperate move for Honda.

Flexible production is an eternal pursuit for a modern factory, especially against the backdrop of increasing market uncertainty.

It seems that Honda has been hit so hard by the Chinese auto market that it has forgotten its strengths and fallen into chaos.

As one of Toyota's oldest factories, the Motomachi Plant in Japan still produces various models across different platforms, powertrains, and sizes, embodying the ultimate image of factory flexibility.

Meanwhile, both the fifth plant of Guangzhou Toyota and the new energy factory of FAW Toyota produce not only the bZ series of pure electric vehicles but also gasoline and hybrid vehicles, enabling Toyota to promptly respond to the rapidly changing Chinese auto market.

As an aside, Toyota's two new energy factories were built and commissioned during their peak times in the north and south, a stark contrast to the internal and external environment facing Honda's new energy factories today.

If Honda's two new factories, each with a capacity of 120,000 units, are solely dedicated to producing new energy vehicles, they will soon face the threat of shutdown.

Of course, we also believe that these two dedicated new energy factories have sufficient capabilities and will inevitably produce Honda's fuel vehicle models unless Honda's new energy vehicle sales surge overnight, which underestimates the capabilities of domestic automakers.

As for Honda's all-new automotive design and manufacturing processes outlined in its "0 Plan," they are currently unrelated to these two factories. Honda is determined to segregate the Chinese market from its global operations, fostering independent development.

In addition to Dongfeng Honda's joint venture Self owned brand - Lingxi, Guangzhou Honda is expected to unveil a new energy vehicle adopting Guangzhou Automobile's electric technology at the Guangzhou Auto Show in November, potentially becoming the first to do so.

Honda has embraced a fragmented development strategy in the new energy vehicle era, ultimately leading to a divergence between Honda global and Honda China.

Honda indeed boasts rich experience in developing exclusive models for the Chinese market, such as the Lingpai and Guandao, as well as its first joint venture Self owned brand - Lianxiang. Although creating exclusive new energy models for China is a reluctant move for Honda, it is also what the company should do.

With China's new energy vehicle market leading the global market by over five years, and given the plummeting sales of fuel vehicles, Honda China is unlikely to wait for the global rollout of Honda's "0 Plan" in 2026.

However, Volkswagen and General Motors' multi-model and low-price strategies in China's new energy vehicle market have not proven effective. Toyota China, on the other hand, has slowed down, awaiting the collective launch of global new energy vehicles in 2026.

Honda should deeply reflect and understand that while new energy vehicles can leverage the momentum of strong fuel vehicle sales, they stand little chance of breakthrough without a solid foundation in the traditional market.

Honda's global "0 Plan" is supported by the sustained growth of fuel vehicle sales in North America and Japan. However, Honda China's "Ye" brand of new energy vehicles, intended as a lifeline for fuel vehicles, may ultimately struggle to survive on their own.

It may seem paradoxical, but for Honda to succeed in selling new energy vehicles and gain recognition from Chinese consumers, it must first restore its sales position in the fuel vehicle market.

Honda's success in new energy vehicles does not lie in the advanced manufacturing processes and quality standards touted by Guangzhou Honda and Dongfeng Honda for their dedicated new energy factories, nor in how the "Ye" brand struggles to understand Chinese consumer needs and piles on smart features.

Of course, it's easier to restore the reputation of fuel vehicles and promote new energy vehicles, but if Honda truly wants a foothold in China's new energy vehicle market, fuel vehicles are the only way forward.

Just like Chery Automobile, which pursues parallel tracks for fuel and new energy vehicles, mutually empowering both markets to achieve a 1+1>2 effect, BYD's successful model is irreplicable, especially for joint ventures.

Toyota and Volkswagen have gone to great lengths to maintain their positions in the fuel vehicle market, introducing new technologies, refreshes, and all-new models to the Chinese market. Meanwhile, General Motors has even launched a "one-price" strategy for massive discounts in the fuel vehicle market.

Forgetting history is betrayal, and abandoning one's strengths spells inevitable failure. Honda should know this all too well.

Without its past, Honda China has no future. And without fuel vehicles, where will Honda's new energy vehicles go?