Buying gasoline-powered cars will become as rare as riding horses in the next three years

![]() 10/27 2024

10/27 2024

![]() 527

527

Original content from New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 2,995 words, reading time: 8 minutes

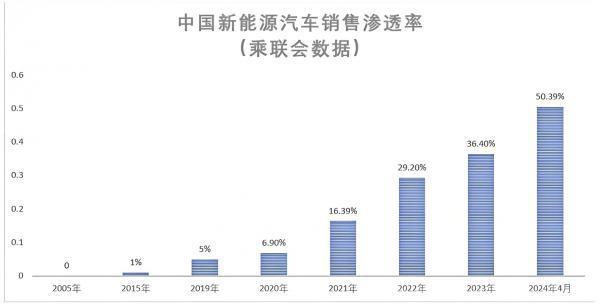

In the past three months, the domestic retail penetration rate of new energy vehicles has exceeded 50% consecutively, reaching 53.3% in September. This means that purchasing new energy vehicles has become the mainstream, while gasoline-powered vehicles are now in the minority.

Three years ago in 2021, domestic new energy vehicles had less than 15% market share. This leap in growth signifies that new energy vehicles have moved from the fringes to the center of the market.

According to the China Association of Automobile Manufacturers, in 2024, sales of traditional gasoline-powered vehicles generally declined across various market segments. For example, sales in the A-segment market decreased by 12.2%, and the B-segment market decreased by 4.2%.

As the penetration rate of new energy vehicles continues to soar, following the significant impact on the luxury gasoline-powered vehicle market, the mainstream family car market, once a source of pride for gasoline-powered vehicle manufacturers, has also suffered heavy blows.

Recently, Tesla CEO Elon Musk stated that a regular car costing $25,000 (approximately RMB 178,000) is "pointless" and "stupid." He believes that in the future, driving a non-autonomous gasoline-powered car will seem as "unusual" as riding a horse or using a flip phone.

Perhaps the global automotive market landscape will be fundamentally reshaped.

1. Electric cars have fully entered the RMB 150,000 market

In the past two years, "hit models" have emerged like mushrooms after rain.

Whether it's the AITO M7 that shook Ideal L7 or Xiaomi SU7, which caused a sensation in the entire automotive industry... it's no exaggeration to say that in today's domestic new energy market, "hit cars" have become the norm.

If you observe closely, you'll notice an interesting trend accompanying the endless stream of hit models: these vehicles are no longer blindly pursuing high-end positioning. Instead, while maintaining brand credibility, they offer attractive prices, aiming directly at the heartland of joint venture gasoline-powered vehicles.

Of course, this has helped domestic new car brands achieve impressive sales figures.

The RMB 100,000-level XPENG MONA M03 is one such example, with over 30,000 large orders within 48 hours of launch and over 10,000 deliveries in its first month on the market. XPENG sales representatives have even claimed that M03 orders have now reached 100,000.

Photo/XPENG MONA M03

Source/New Energy Outlook Photography

Thanks to the strong performance of XPENG MONA M03, XPENG delivered over 20,000 vehicles in September, achieving significant year-on-year and month-on-month growth and setting a new delivery record.

Less than a month after the launch of XPENG MONA M03, LETAO, NIO's second brand, officially launched its first product, the LETAO L60.

The LETAO L60, which supports battery swapping and rental, has a starting price of only RMB 149,900. This has led to "overwhelming orders" becoming a common refrain for NIO founder William Li and LETAO Brand President Ai Tiecheng following the LETAO L60's launch.

At the LETAO L60 launch event, Ai Tiecheng revealed that "orders have overwhelmed us." The following day at a media briefing, William Li reiterated, "Orders have overwhelmed us, with order volume expanding fivefold. I specifically instructed the server to expand capacity fivefold, but it's still a bit sluggish even at that level."

However, NIO does not disclose data beyond monthly deliveries, so the exact number of overwhelming orders for the LETAO L60 remains unknown. Market data statistics suggest that the number of large orders for the LETAO L60 exceeded 30,000 within 72 hours of its launch.

Photo/LETAO L60

Source/LETAO Official Website, New Energy Outlook Screenshot

In addition to the heavy hitters from XPENG and NIO, new players in the RMB 100,000-150,000 price range include Geely Galaxy E5 and SL03. The former, with a starting price of RMB 112,800, became the first A-segment pure electric SUV to sell over 10,000 units in its launch month.

As new players continue to push forward, established players are not to be outdone.

According to Tongchedi data, BYD models such as Qin L-DM, Haiou 06, Qin Plus-DM, Yuan Plus, and Song Pro-DM have long dominated the top 20 lists in the mainstream sedan and SUV markets in the RMB 100,000-150,000 price range.

2. Gasoline-powered cars pushed back

As new energy vehicles are rapidly changing the industry landscape, the gasoline-powered vehicle market is facing unprecedented challenges.

Data from the China Association of Automobile Manufacturers (CAAM) shows that from January to August 2024, sales of traditional fuel passenger vehicles in China declined to varying degrees across various market segments. Specifically, the A00 segment declined by 63.7%, the A0 segment by 3.5%, the A segment by 12.2%, the B segment by 4.2%, the C segment by 17.7%, and the D segment by an astonishing 39.6%.

It is evident that gasoline-powered vehicles are losing market share across all segments.

Looking at price ranges specifically, while traditional fuel passenger vehicles in the RMB 100,000-150,000 price range still occupy a significant market share, their sales have declined markedly. In the first eight months of this year, cumulative sales in this price range fell by 11.4% year-on-year to 3.193 million units.

According to data from the China Passenger Car Association (CPCA), the RMB 100,000-150,000 price range has long been the mainstream in China's passenger car market. In the first eight months of this year, this price range accounted for 33% of the market, far exceeding other price ranges.

However, in this market once dominated by gasoline-powered vehicles, new energy vehicles are gradually gaining ground, and the market position of gasoline-powered vehicles is being eroded.

CPCA data shows that in September 2024, sales of passenger vehicles in the RMB 100,000-150,000 price range in China totaled 1,020,871 units, accounting for 24.55% of the market share.

Among the top ten best-selling models, only three were gasoline-powered vehicles, with the remaining seven being new energy vehicles: Song PLUS NEV, Qin L, Qin PLUS, Haiou 06 DM-i, Xianyi, Lavida, Yuan PLUS, Suteng, Song L DM-i, and J7.

Photo/Sales Ranking in the RMB 100,000-150,000 Price Range in September 2024

Source/CPCA, New Energy Outlook Screenshot

This trend indicates that new energy vehicles are gradually becoming consumers' preferred choice.

An experienced driver with over 20 years of driving shared on their social media account that after owning three gasoline-powered vehicles, their next car will be electric.

Why are electric cars a better choice? This experienced driver explained, "Driving an electric car for commuting within the city is not just about saving money; the intelligent driving features of electric cars alleviate the fatigue of driving in urban traffic. In short, intelligent driving is my core need when choosing an electric car."

A netizen who was once a die-hard fan of gasoline-powered cars even mocked early electric car owners as "pure chumps." However, he has now become one himself.

The netizen stated that his choice of an electric car was partly due to quota restrictions and partly because of the attractive price. "Furthermore, the various energy replenishment systems for electric cars are already very well-established. Aligning with the development of the times, electric cars have become the mainstream and the optimal choice."

3. The final defense of gasoline-powered cars breached?

The wave of new energy vehicles is sweeping through the entire automotive market at an unprecedented pace, with electric cars becoming the dominant force from luxury to mid-to-high-end markets.

The data speaks for itself. In 2024, a goal originally set for 2035—for new energy vehicles to exceed a 50% penetration rate—was achieved 11 years ahead of schedule.

Photo/China's new energy vehicle sales penetration rate exceeded 50% in April 2024

Source/CPCA, New Energy Outlook Screenshot

Now, as the final stronghold of gasoline-powered cars comes under attack, it is foreseeable that the penetration rate of new energy vehicles will increase significantly further. To further support this prediction, New Energy Outlook consulted with nearly 100 consumers and found that nearly 70% of those surveyed mentioned that their next car would be electric.

Based on this, it is not difficult to estimate that by 2027, the domestic penetration rate of new energy vehicles is expected to reach 70%.

Behind this trend, strong national policy support has played a crucial role. Measures such as increasing scrappage and replacement subsidies, reducing or exempting purchase taxes, and offering free license plate registration have significantly reduced consumers' vehicle purchase costs and stimulated demand for new energy vehicles.

According to the latest replacement policy, the state has increased subsidy standards for eligible scrapped and replaced vehicles, with gasoline-powered passenger vehicles and new energy passenger vehicles eligible for subsidies of RMB 15,000 and RMB 20,000, respectively. Although these standards represent significant increases from the previous RMB 7,000 and RMB 10,000, respectively, it is clear that subsidies for new energy vehicles are still significantly higher than those for gasoline-powered vehicles.

Favorable policies are naturally beneficial to new energy vehicles, but the more direct factor driving consumers to abandon gasoline-powered cars in favor of electric ones is that electric cars can better meet their needs.

Firstly, for consumers in the RMB 100,000-150,000 price range, cost savings are of utmost concern, making affordability a key selling point.

This is why when the LETAO L60 was launched, William Li and Ai Tiecheng repeatedly helped consumers calculate vehicle usage costs and "price calculations."

Ai Tiecheng not only detailed that the monthly battery rental fee for the LETAO L60 is equivalent to the cost of a tank of fuel but also bluntly stated that insurance premiums for the LETAO L60 are low, allowing for three years without returning to the dealership for service, with only brake fluid replacement required in the third year.

Secondly, consumers' desire for both affordability and better driving experiences and intelligent features gives electric cars a significant advantage over gasoline-powered vehicles at the same price point. Especially in terms of smart cockpits and intelligent driver assistance systems, the gap between gasoline-powered and electric cars is even more apparent.

After all, electric cars in the RMB 150,000 price range can now be equipped with L2+ intelligent driving capabilities, enabling nationwide city NOA (Navigate on Autopilot) functionality.

Thirdly, and perhaps most crucially, as electric cars continue to improve, consumers' anxieties regarding charging and range are gradually disappearing.

In the early days, battery range and charging convenience were the top concerns for electric car buyers, posing significant obstacles to adoption. Today, advancements in battery technology and the proliferation of charging stations have made features like "600km NEDC driving range" and "15-minute charging for 400km range" increasingly standard across many models.

For example, the Geely Galaxy E5, priced at RMB 125,800, has a driving range of 530km, while the XPENG MONA M03, priced at RMB 129,800, boasts a range of 620km.

Wang Zhiwu, President of Huawei's Intelligent Charging Network Business Unit, predicts that by 2028, high-voltage fast-charging models will account for over 60% of the market. This suggests that consumers' concerns about slow and difficult charging will soon be addressed.

Photo/Huawei's 2024 Charging Network Industry Top Ten Trends Conference

Source/Internet, New Energy Outlook Screenshot

From both a price and performance perspective, as well as the overall experience, the advantages of gasoline-powered cars are nearly exhausted, and their replacement seems imminent.