Deconstructing GAC Group's 2024 and Searching for the Long Journey of China's Automobile Industry

![]() 11/05 2024

11/05 2024

![]() 546

546

Currently, China's automobile industry is in its best era, yet it is also a time of concern.

On the one hand, riding the wave of new energy, new forces have been expanding their territories, continuously impacting the established market structure, and rewriting the predicament of independent brands' originally low prices and quality. On the other hand, intra-industry competition has intensified, and price wars have put pressure on the profitability of the entire industry.

In the historic moment of overtaking in the automotive industry, China needs enterprises that truly adhere to long-term principles to take up the banner and push the industry towards high-quality development.

[Not Afraid of Adjustments, Focusing on the Long Term]

Throughout the history of global business, corporate growth follows a wavy curve, never a straight upward line. Today's world-renowned automotive giants, such as BMW, Ford, and General Motors, have all undergone trials and tribulations to achieve their current success.

Facing the unprecedented changes in the automotive industry in a century, traditional automakers are once again facing a new round of transformation. Meanwhile, the domestic market is facing a price war and profit pressure within the industry.

The latest data from the China Passenger Car Association (CPCA) shows that in the first nine months of this year, the domestic automotive industry generated revenue of 7.3593 trillion yuan, a year-on-year increase of 3%, but profits were 336 billion yuan, a year-on-year decrease of 1.2%. The profit margin in September was 3.4%, the lowest for the year. Clearly, price wars have led to a decline in profits across the automotive industry.

Performance adjustments by SAIC and GAC are inevitable and not isolated cases.

Analyzing financial reports involves more than just looking at data; it requires an understanding of the underlying factors and a long-term perspective. Breaking down GAC's third-quarter report, "one-time expenses for optimizing redundant capacity in joint ventures" was one of the main factors contributing to the third-quarter loss.

'Pessimists are always right, but optimists move forward.'

GAC Group has demonstrated positive changes. In the first three quarters, consolidated revenue was 74.04 billion yuan, and consolidated revenue in the third quarter was 28.232 billion yuan, a quarter-on-quarter increase of 15.41%. Car sales in the third quarter were 474,300 units, a quarter-on-quarter increase of 3.9%. Two consecutive quarters of quarter-on-quarter sales growth indicate that performance and sales are beginning to bottom out and rebound.

With 27 years of experience, GAC has strong resilience against risks and has continuously pursued reform and innovation, accumulating stronger growth momentum during the adjustment period.

On the reform front, GAC actively promotes strategies that are close to the market and customers. The new mechanism encourages engineers and designers, traditionally working in the background, to break away from the traditional 'engineer mindset' and become more attuned to the real needs of the frontline market, enhancing product competitiveness from the source.

GAC Group's headquarters officially relocated to Panyu Automobile City, where GAC Trumpchi, GAC AION, and GAC Research Institute are located, on November 2 this year, to promote centralized management, collaborative operations, and improve business management efficiency.

At the brand level, both independent and joint venture brands have made substantial progress. Honda plans to invest approximately 10 trillion yen (approximately 480 billion yuan) in electrification by fiscal year 2030, and GAC Honda will launch six new pure electric vehicle models by 2027. Toyota has established an independent electric vehicle division, BEV Factory, and released new technologies such as all-solid-state batteries with a range of 1,200 kilometers. The next generation of electric vehicles will be unveiled in 2026.

GAC AION, a unicorn with a valuation exceeding 100 billion yuan, sold 40,052 vehicles globally in October, firmly ranking among the top three mainstream pure electric vehicle brands. GAC AION is also one of the few automakers with full-stack self-research capabilities in EV+ICV. GAC Trumpchi has achieved an annual production and sales volume of over 500,000 units, with the GS4 model surpassing 1 million units in production and sales within three years. After three years of adjustment, it is actively transforming into a new energy technology enterprise.

GAC's 27-year journey has witnessed the growth and development of China's automotive industry. It has been listed in the Fortune Global 500 for 12 consecutive years, filling the gap of not having a Fortune Global 500 company in Guangzhou and becoming an important pole in the rise of China's automotive industry.

These long-term historical accumulations, including technological research and development capabilities, insights and understanding of automobiles, organizational evolution and management, manufacturing and production, and even economies of scale, are difficult for new forces to match.

During the transformation period of the automotive industry, fuel-based automakers like GAC and SAIC are undergoing deep adjustments. These fluctuations should be viewed rationally.

During downturns, the fear is not change but complacency. GAC is gathering momentum and energy to move towards longer-term development.

[Only Quality Automakers Will Ultimately Prevail]

Amidst overwhelming promotion, automobiles are seen as intelligent hardware similar to smartphones. Some enterprises rely on traffic-driven strategies, falling into the trap of exaggerated hype. However, ultimately, automobiles are major household consumer goods, long-term durable products, and a guarantee of a happy family life.

After incidents such as the Maybach three-color canopy incident, spontaneous combustion of new energy vehicles, and autonomous driving failures, consumers have placed higher demands on the quality of automobiles.

As a precision industrial product, automobiles have their unique characteristics. They should never and should not follow the business logic of fast-moving consumer goods. No consumer would want to purchase a car with poor quality control, low safety factors, and minimal residual value.

Amidst a fragmented automotive competitive landscape, GAC Group views quality as the lifeblood of the enterprise and is committed to creating cars that remain in good condition after 15 years. For example, GAC Honda considers ample quality redundancy in its design and manufacturing. All models undergo over 400 processes from raw materials to market launch, with each process strictly adhering to a 120% pass rate.

It is said that one car owner has driven their Accord for over 1 million kilometers without any major repairs, and there are over 700,000 Accords currently in use with an age of 15 years or more. The saying 'GAC Honda cars never break down' and 'one car for three generations' is widely circulated in the automotive community.

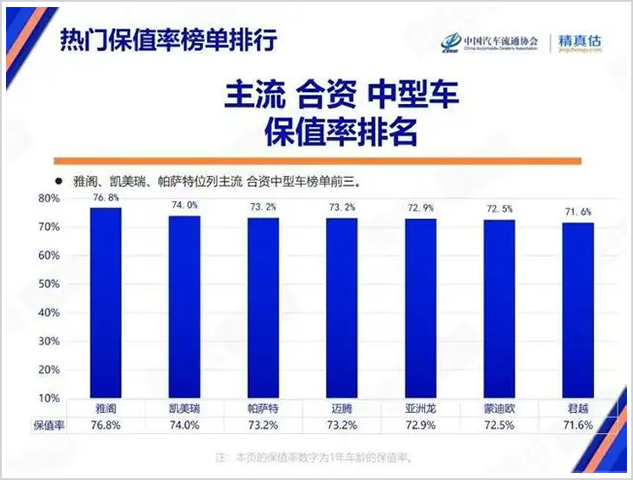

Residual value is an important reference indicator for evaluating the value of a car. According to a report released by the China Automobile Dealers Association, the Honda Accord has the highest residual value among mid-size cars at 76.8%.

After an initial period of rapid growth, it is inevitable that the growth rate of new energy vehicle sales will slow down. The sales growth rate of new energy brands represented by BYD has already slowed down. In the current era, it is impossible for new energy vehicles to completely replace fuel vehicles. With multiple routes coexisting, only quality automakers will ultimately prevail.

Short-term profit-seeking not only damages a company's reputation but is also detrimental to the long-term development of China's automotive industry. Pursuing temporary popularity does not guarantee sustained sales. Only by recognizing high-quality vehicles that have been meticulously crafted over a long period and are renowned for their quality can consumers buy with confidence.

GAC Honda, which adheres to quality and is determined to be 'engineers of time', will ultimately rise like a phoenix from the ashes and soar high in the market, time, and consumer tests by adhering to long-term principles in car manufacturing. Give such automakers a little more time and patience.

[The Long Journey of New Energy: True Colors in the Long Run]

Some netizens have explained why they do not buy new energy vehicles, questioning whether certain new force brands will still exist in a few decades.

In the wave of new energy vehicle startups, some enterprises have quickly gained popularity but also rapidly fallen. WM Motor's bankruptcy, HiPhi's suspension, and Enovate's halt in production are examples of failed business cases that have not only burned through huge amounts of financing but ultimately harmed consumers.

Automobiles are one of the most sophisticated and complex products in human industrial history, and the automotive industry has its own laws that must be followed. Price wars and internet celebrity-style strategies ultimately cannot escape the fundamental logic of automotive competition.

Although automakers like GAC and Great Wall may not be as promotional as Xiaomi, NIO, and Xpeng, they have deeply recognized the current issues. These enterprises are not blinded by superficial vanity but are focused on quality, technology, and strategy.

Learning from the past to guide the future. In the past few years, the rankings in the new energy vehicle industry have changed repeatedly, with no single enterprise able to dominate for long. In this marathon, traditional automakers still have strong potential to overtake.

In the Chinese market, Honda is moving faster, having already launched the e:N series and a new brand, 'Ye,' and will unveil the 'Ye' P product series and the new W pure electric architecture at the Guangzhou Auto Show.

Toyota is no exception, having announced plans to invest approximately 243 billion yuan in its pure electric business by 2030, with plans to launch 10 new pure electric vehicle models by 2025.

In terms of independent brands, GAC Group was the first domestic new energy automaker to use a dedicated pure electric platform, creating AION and Hyptec. Since its establishment in 2017, GAC AION has achieved a compound annual growth rate of 120%, becoming the fastest new energy automaker to reach one million cumulative production and sales of pure electric vehicles and a phenomenal player among new forces.

GAC has a keen sense of changing market demands.

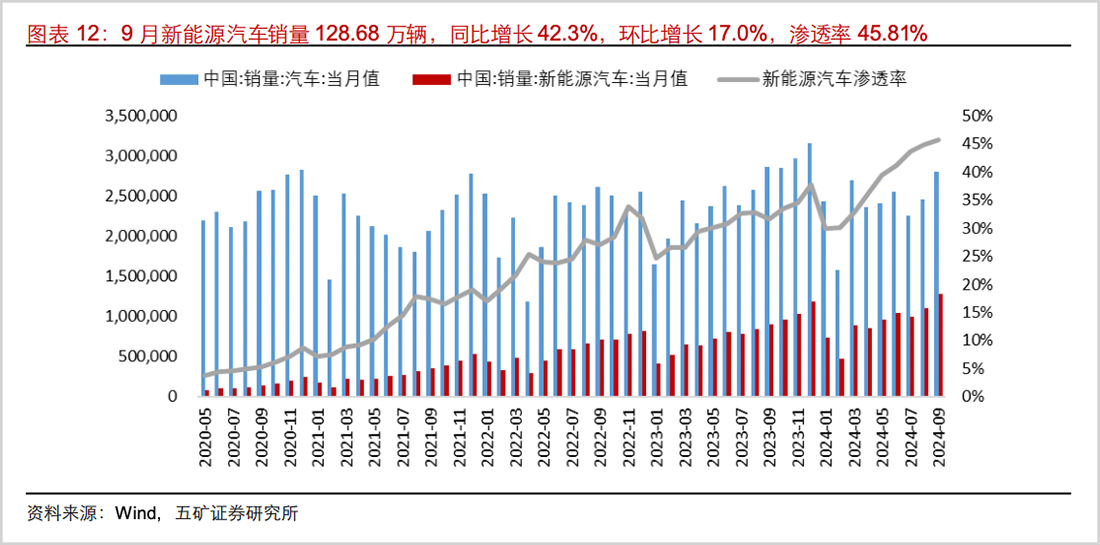

In the first nine months of this year, overall new energy vehicle sales increased by 37.4% year-on-year. Among them, plug-in hybrid vehicle sales increased by 78.5% year-on-year, while pure electric vehicle sales only increased by 17.6%.

With the slowdown in pure electric vehicle sales growth, PHEV and REV have become new growth drivers in the new energy vehicle market, presenting an opportune moment for GAC, which has a diverse route layout.

Since 2013, GAC's multi-path layout has become systematic, with technology comprehensively covering EV, PHEV, HEV, REV, FCV, etc. Adapting to market changes, GAC AION will launch REV models in 2024, and GAC Trumpchi is actively embracing new energy by launching three PHEV models in 2023.

In the first half of 2024, the sales ratio of GAC's new energy and energy-saving vehicles increased to 40.63%. By next year, GAC Group's independent brand hybrid and plug-in products will experience a true explosion.

In terms of intelligence, GAC has achieved fruitful results through both technological research and development and capital investment. Within six months, GAC invested 2.5 billion yuan in the autonomous driving sector, led the C round of investment in Didi's autonomous driving division, cooperated in mass producing Robotaxi, invested in WeRide and Pony.ai, and incubated China's 'first Robotaxi IPO,' Ruqi Chuxing, which has also listed on the US stock market.

The second half of the intelligence era has already begun, and GAC is not lagging behind. The three technological foundations of the 'AI Big Model Platform,' 'Xingling Electronic and Electrical Architecture,' and 'Connected Big Data Platform' are all at the leading level. GAC is also one of the first automakers in China approved to conduct L3 autonomous driving road tests. Next year, GAC Trumpchi will become the first brand to equip all its sedans, SUVs, and MPVs with the Qiankun intelligent driving and HarmonyOS systems.

In the past, the intelligence of Japanese automakers was pointed out as needing improvement. GAC Toyota is jointly developing intelligent cockpits and intelligent driving with Huawei, Tencent, and Momenta to deepen localized research and development. Through collaboration, they can create 'new joint venture vehicles' that better understand Chinese consumers. GAC Honda's first electric vehicle factory will also be commissioned by the end of the year, and it has released the 'Yunxin Zhiyuan' strategy for comprehensive innovation and advancement into a new era of automobiles.

In the marathon of the historic transformation of the automotive industry, being an early starter does not guarantee victory. Only by adhering to quality, technology, and excellence over the long term and continuously pursuing reforms can latecomers overtake.

Moreover, the automotive industry is a globally competitive sector. Data shows that fuel vehicles dominate overseas markets. In the first eight months of this year, China's fuel vehicle exports were 2.6 times that of new energy vehicles, with the slowest growth in pure electric vehicles. Fuel vehicles still have huge potential in overseas markets.

▲Exports of the three major passenger car types from January to August 2024, Source: China Automobile Dealers Association

As the manufacturing industry embraces the wave of going overseas, internationalization has become an important engine for achieving the goal of 'trillion GAC.' In recent years, GAC's overseas expansion has been rapid, with exports reaching 95,000 units in the first three quarters of this year, a year-on-year increase of 112%. Currently, GAC has a presence in 68 countries and regions, with the Southeast Asian base under accelerated construction. Based on GAC Group's extensive overseas network layout, it is not impossible to recreate a GAC in the international market.

All these changes indicate that GAC's 'deep squat is nearing its end, and it is about to enter a phase of energy accumulation and leap.'

Disclaimer

This article contains content related to listed companies based on the author's personal analysis and judgment based on information publicly disclosed by listed companies according to legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Watch assumes no responsibility for any actions taken based on this article.

——END——