Dancing with the Masses: Horizon Robotics' High-Risk Gamble

![]() 11/06 2024

11/06 2024

![]() 578

578

Volkswagen Group has become Horizon Robotics' largest investor, contributing 40.4% and 37.6% of its revenue in 2023 and the first half of 2024, respectively. However, the high concentration of customers makes Horizon highly susceptible to fluctuations in performance.

@Tech New Knowledge original

Although Horizon Robotics failed to secure the title of "first autonomous driving chip IPO," as the largest IPO in Hong Kong this year, it can be considered a transformation.

Looking back at its path to listing, Horizon Robotics faced numerous obstacles. During the three years of preparation, in addition to addressing issues such as its equity structure, regulatory requirements, and changes in the financing environment, it also went through multiple changes in listing location, from the U.S. stock market, the A-share STAR Market, to the Hong Kong stock market.

Fortunately, these three years coincided with the rapid development of smart vehicles, and Horizon Robotics' impressive performance attracted investments from numerous investors, including Alibaba and Baidu.

From the perspective of investors in the primary market, the secondary market, and the overall business volume, although Horizon Robotics ranks second, its comprehensive strength far exceeds that of the first-ranked Black Sesame Technology.

However, the development of the autonomous driving industry is also accompanied by some " Savage growth " (unrestrained growth) phenomena. Behind Horizon Robotics' seemingly glorious exterior, there are actually many uncertainties. Facing rapid technological iterations and fierce market competition, it is difficult for any company to dominate.

01.

Three Opportunities to 'Survive'

From Horizon Robotics' development journey, there are three key turning points that laid the foundation for its growth.

Yu Kai, the founder of Horizon Robotics, who was previously the deputy director of Baidu Research Institute, resigned in 2015 and launched the first automotive-grade chip "Journey" and the first chip for IoT scenarios, "Rising Sun," within just two years.

Like mobile phone chips, automotive chips require significant investment and have long payback periods. However, thanks to the development of the security and surveillance industry, internet chips became Horizon Robotics' early "cash cow." But this business had limited growth potential, and achieving qualitative change required automotive chips.

In 2019, the gears of the intelligent automotive industry began to turn, and Horizon Robotics reached its first turning point.

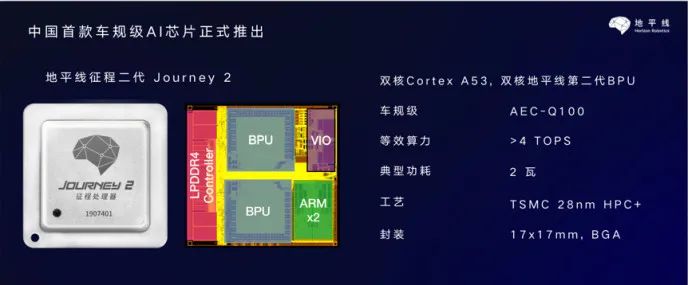

At that time, Horizon Robotics was the only domestic manufacturer capable of supplying autonomous driving chips, and with its ultra-high cost-effectiveness, it gained the "appreciation" of Changan Automobile, which integrated the second-generation Journey chip into its flagship model, the UNI-T. The high cost-effectiveness of this model helped it surpass 100,000 sales in just nine months after its launch, catapulting Horizon Robotics' automotive chips into the spotlight.

An early Horizon Robotics employee stated that the company had struggled to obtain orders from automakers. "For volume-oriented joint venture automakers, they lack the motivation to change suppliers, especially when it comes to procuring Chinese suppliers for underlying technologies like chips. Additionally, the payment cycle is typically over five years, which is unacceptable for startups like us."

The employee recalled that considering the technical difficulty of autonomous driving chips, "Yu Kai considered for at least a month before daring to accept Changan's cooperation intent." Accepting Changan's order was both an opportunity and a gamble.

At that time, Horizon Robotics' strategy was to offer lower prices and better services for lower-level autonomous driving. "If our hardware performance can't compete with competitors, we'll use service to outdo them." A failure would mean that efforts in automotive chips would be in vain. To meet Changan's needs, Horizon Robotics' R&D team remained on standby 24/7 for an extended period.

The collaboration with Changan also brought a second important partner: Lixiang One. At that time, Lixiang One had no mass production experience, and Horizon Robotics hadn't widely implemented higher-level autonomous driving. However, to secure Lixiang One, Horizon Robotics sacrificed most of its profits and shortened the development cycle to eight months. Fortunately, the collaboration was successful, and Lixiang One achieved significant sales based on its hard power.

Of course, for Horizon Robotics, the most important customer is the Volkswagen Group. The 2020 black swan event made Volkswagen urgently need a Chinese chip supplier. According to sources, Volkswagen initially chose Huawei as its joint venture partner but ultimately switched to Horizon Robotics in 2022 due to disagreements on transaction prices and content.

From Changan to Lixiang One to Volkswagen, the expansion in scale also drove Horizon Robotics' revenue growth. The prospectus shows that from 2021 to 2023, Horizon Robotics' revenue continuously increased from 467 million yuan to 1.552 billion yuan in 2023, with a compound annual growth rate of 82.3%. Over the past three years, gross profits were 331 million yuan, 628 million yuan, and 1.094 billion yuan, respectively, maintaining a gross profit margin of around 70%.

Looking back, Horizon Robotics' success essentially stemmed from its earlier grasp of domestic substitution opportunities and the timing of rapid autonomous driving development. However, this " Savage growth " (unrestrained growth) also means that Horizon Robotics' foundation is not solid.

02.

Rapid Growth Sows Hidden Dangers

From Horizon Robotics' prospectus and financial reports, it is evident that the majority of its revenue is concentrated in five major customers. In the first half of 2024, Horizon Robotics' revenue was approximately 935 million yuan, with a year-on-year growth rate of 151.6%, and these five customers accounted for 77.9% of total revenue.

Although we cannot confirm the specific identities of these five customers, market rumors suggest that in 2023, the top five customers of Horizon Robotics were Lixiang One, Freetech, SAIC, Inmotion, while in the first half of 2024, the top five customers were Corejourney, NavInfo, Lixiang One, Freetech, and BYD.

Among them, the most notable is Corejourney, backed by the Volkswagen Group.

In November 2023, Volkswagen Group's software subsidiary CARIAD officially established a joint venture with Horizon Robotics, Corejourney (Beijing) Technology Co., Ltd. Volkswagen Group invested approximately 2.4 billion euros in this collaboration and holds a 60% stake in the joint venture. Since 2023, Horizon Robotics has licensed algorithms and software related to advanced driver assistance systems and autonomous driving solutions to Corejourney, essentially providing Volkswagen with autonomous driving systems.

The Volkswagen Group has become Horizon Robotics' largest investor, contributing 40.4% and 37.6% of total revenue in 2023 and the first half of 2024, respectively. On the bright side, partnering with a financially strong, established German automaker undoubtedly presents stable growth opportunities for Horizon Robotics, both in terms of resources and business.

However, it cannot be ignored that the high concentration of customers significantly impacts Horizon Robotics when major customers experience performance fluctuations. If the development of key customers falls short of expectations, Horizon Robotics' revenue stability and sustainability will face challenges.

According to Volkswagen Group's financial report, global sales in the third quarter declined by 7.1% year-on-year to 2.176 million vehicles; pure electric vehicle sales also decreased by 9.8% year-on-year to 189,000 vehicles during the same period. In the third quarter of this year, Volkswagen Group's net profit fell by 63.8% year-on-year to 1.57 billion euros, and its operating profit declined by 41.7% to 2.86 billion euros.

"The decline in Volkswagen Group's profits will inevitably lead to cost reductions for employees and factories. It's only a matter of time before they start compressing costs for supply chain enterprises and extending payment cycles," said an analyst focusing on the automotive supply chain.

From Horizon Robotics' business perspective, its main revenue-generating products are currently the low-to-mid-range Horizon Mono and Horizon Pilot. Although it possesses high-level autonomous driving capabilities, these have not yet been fully validated. During this process, the unit price of Horizon Mono has been declining, and Horizon Pilot also began to reduce prices in the first half of 2024 to increase sales.

According to the prospectus, although revenue from product solution business increased by 15.62% year-on-year in the first half of 2024, gross profit margin decreased by 8.8% year-on-year. This reflects that while Horizon Robotics' sales are expanding, it is facing pressure from downstream automakers to lower prices, resulting in decreased profits.

On one hand, profits are gradually decreasing, and on the other hand, there are continuous investments in R&D and sales costs. Balancing the contradiction between the market and finances is an issue that Horizon Robotics needs to address.

It is noteworthy that despite continuous revenue growth, Horizon Robotics' losses are also expanding. From 2021 to the first half of 2024, the company's cumulative losses have exceeded 20 billion yuan. This phenomenon of "increasing revenue without increasing profits" is mainly attributed to significant R&D investments. Specifically, Horizon Robotics' R&D expenditures from 2021 to the first half of 2024 were 1.144 billion yuan, 1.88 billion yuan, 2.366 billion yuan, and 1.42 billion yuan, respectively.

While this intense R&D investment has consolidated the company's technological forefront position, it has also deteriorated its financial situation, with an asset-liability ratio reaching 299%.

03.

Intensifying Competition Squeezes Profits

For autonomous driving enterprises, even after a successful IPO, intensified industry competition and pressure for commercial profitability remain as swords hanging over their heads.

In addition to relying on major customers, Horizon Robotics must also be concerned about whether there will be opportunities like those with Changan, Lixiang One, and Volkswagen in the fiercely competitive market.

An automotive industry expert stated, "Horizon Robotics' advantage lies in its strong technical team with rich R&D experience. Their Journey series chips also have certain advantages in performance and cost-effectiveness. However, compared to Black Sesame Technology, Horizon Robotics' later IPO has somewhat affected its market share expansion."

Another automotive industry expert said that Huawei excels in marketing, and Horizon Robotics needs to strengthen its efforts in this area. "Huawei has rich ToB experience and car manufacturing experience. In the long run, Horizon Robotics needs to strengthen cooperation with more automakers to enhance its brand influence."

Furthermore, the price war among automakers has intensified since last year, spreading from OEMs to some upstream solution providers, further compressing profit margins in the industry chain. To reduce costs, many enterprises have begun pursuing in-house R&D technologies.

BYD and Geely, two traditional new energy automakers, have also made early layouts in the autonomous driving chip field: The former announced the successful tape-out of its self-developed 4nm process, Armv9 architecture chip this year, and it is rumored that the Tenzing Z9GT will be the first to integrate the custom BYD9000 chip; The latter's Xinchip Technology, a subsidiary of Geely, also reportedly "successfully developed the world's first 7-nanometer chip, 'Longying 1,' that meets automotive standards and has officially entered mass production."

Horizon Robotics' major customers, such as Lixiang One and NIO, have also begun laying out in-house chip R&D. NIO has announced the successful tape-out of its 5nm intelligent driving chip, "Shenji NX9031," and Lixiang One also plans to complete the tape-out of its self-developed chip in 2024.

This trend will undoubtedly have a significant impact on Horizon Robotics' future market share. An internal NIO source said, "Automakers' in-house chip R&D is mainly to better master core technologies, enhance product competitiveness, and differentiate themselves. For Horizon Robotics, this will indeed reduce our dependence on their chips."

However, this source also pointed out the industry status quo, "Autonomous driving enterprises can continue to cooperate with us by continuously improving their technological level, providing better services, and more comprehensive customized solutions."

In fact, the entire autonomous driving industry needs to consider the uncertainty brought by Huawei. Although there are no profitable autonomous driving vendors in China, Huawei's Intelligent Automotive Solutions BU achieved profitability in the first half of 2024 through its three-electric business, meaning that Huawei's Intelligent Automotive Solutions BU can use other businesses to support the R&D of intelligent driving.

Moreover, Huawei not only self-develops lidar and intelligent cockpit systems but also involves other core hardware and software, including autonomous driving chips, which have impacted suppliers in the autonomous driving field.

Frankly, due to the lack of consensus on technological routes, domestic autonomous driving suppliers are still in a state of chaos with extremely low fault tolerance. This has led to price wars that not only bring market pressure but also raise doubts from investors and consumers.

According to the "2024 McKinsey China Automotive Consumer Insights Report," although Chinese consumers' acceptance of intelligent driving is increasing due to price wars, their willingness to pay for it has declined. McKinsey's survey results show that the proportion of respondents willing to pay for intelligent driving decreased from 42% in 2022 to 28%.

The decline in consumers' willingness to pay has also caused some investors to question the commercialization process and long-term profitability of autonomous driving technology. "Although it is a B2B business, ultimately, C-end users foot the bill. If their willingness to pay is not high, automakers or autonomous driving enterprises will ultimately bear the costs and risks."

From a business model perspective, the profitability dilemma of intelligent driving is a given fact. Currently, no enterprise has found the ideal model. As for the future path, perhaps no one knows for sure, but the growth of any new thing is bound to be tortuous. We might as well give these enterprises a bit more patience.

- The end -