Leapmotor: Becoming the Accelerating "Leading Small Ideal"?

![]() 11/12 2024

11/12 2024

![]() 504

504

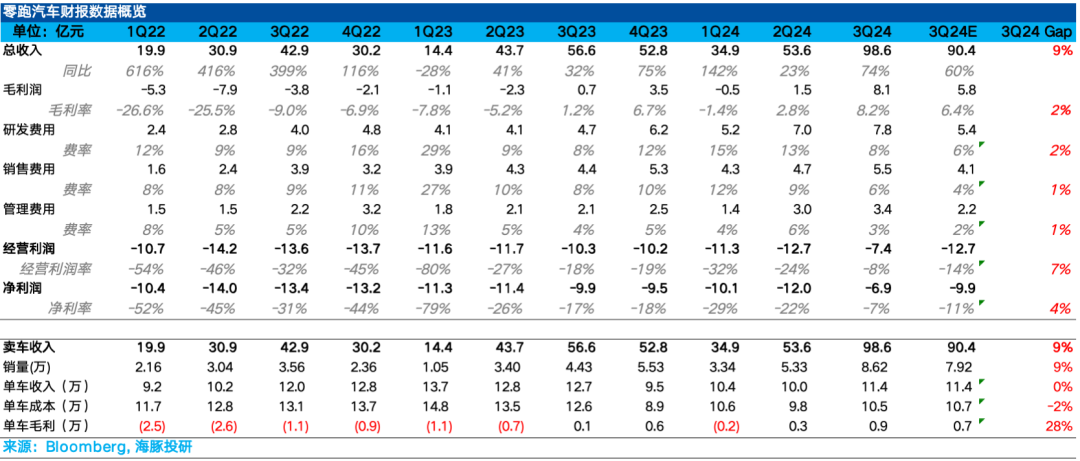

Leapmotor (9863.HK) released its third-quarter 2024 financial report after the Hong Kong stock market closed on November 11, Beijing time. Let's look at the key information:

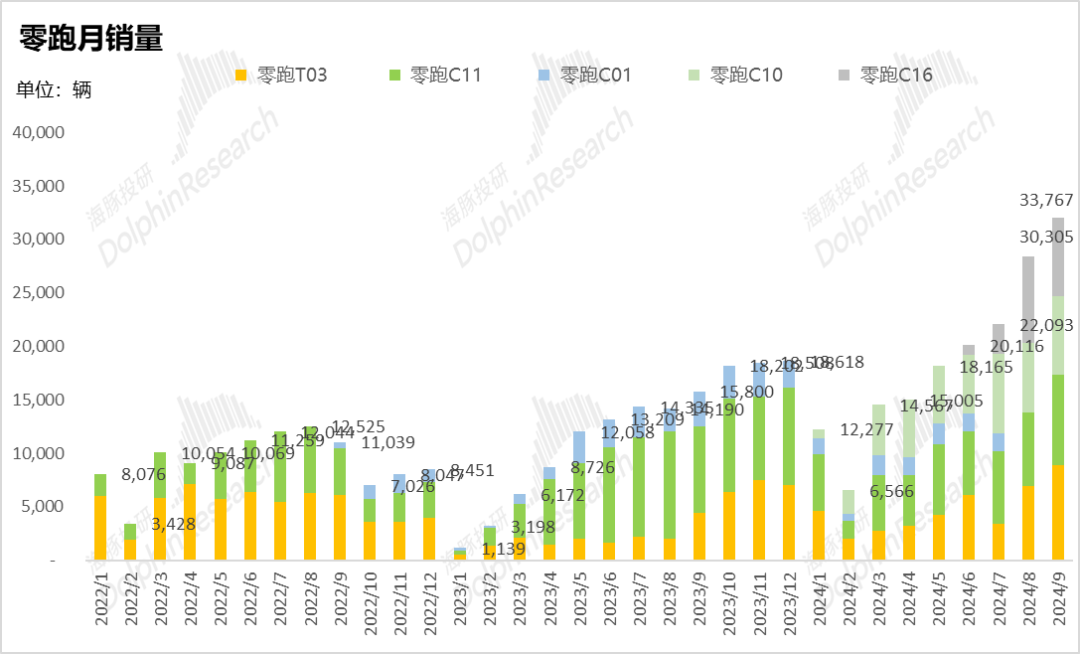

1. Average vehicle price returns to an upward trajectory: In the third quarter, Leapmotor's average vehicle price rebounded by RMB 14,000 quarter-on-quarter to RMB 114,000, recovering from the trough in the second quarter. This was mainly due to the improved sales structure brought about by the strong sales of the high-priced C16.

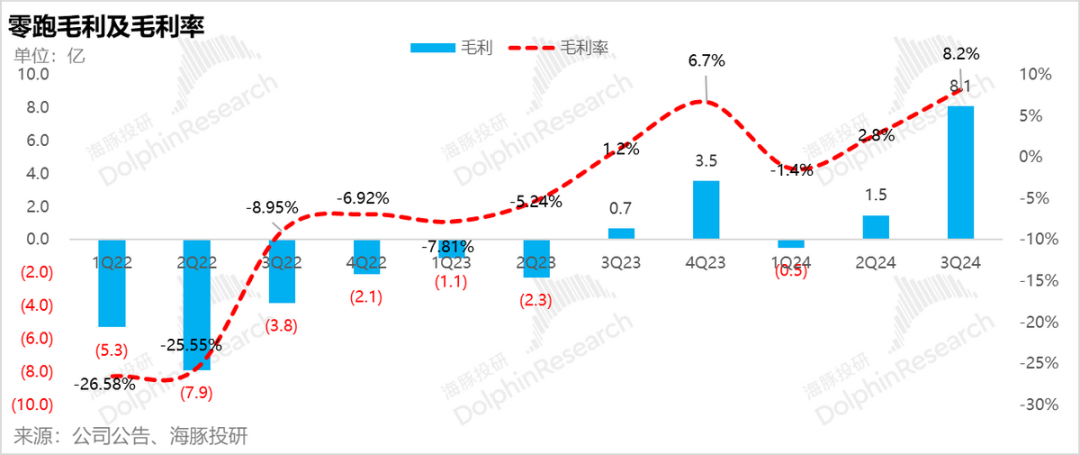

2. Surprising automotive gross margin: The automotive gross margin also rebounded by 5.5% quarter-on-quarter to 8.2% in this quarter, exceeding market expectations of 6.4% and the large bank's expectation of 6.7%. The rebound was mainly due to the increase in average vehicle price brought about by the strong sales of the high-priced, high-margin C16, as well as cost-side economies of scale and cost reductions in batteries.

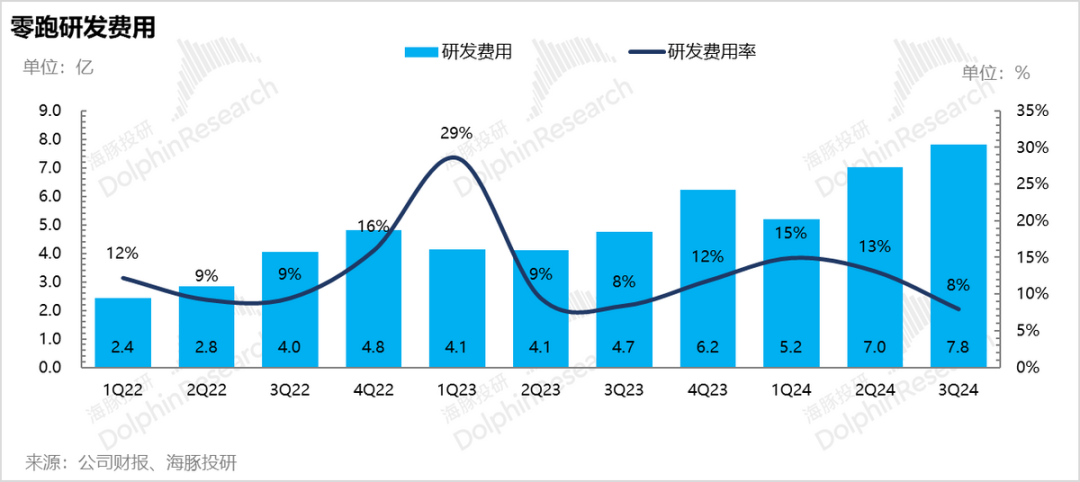

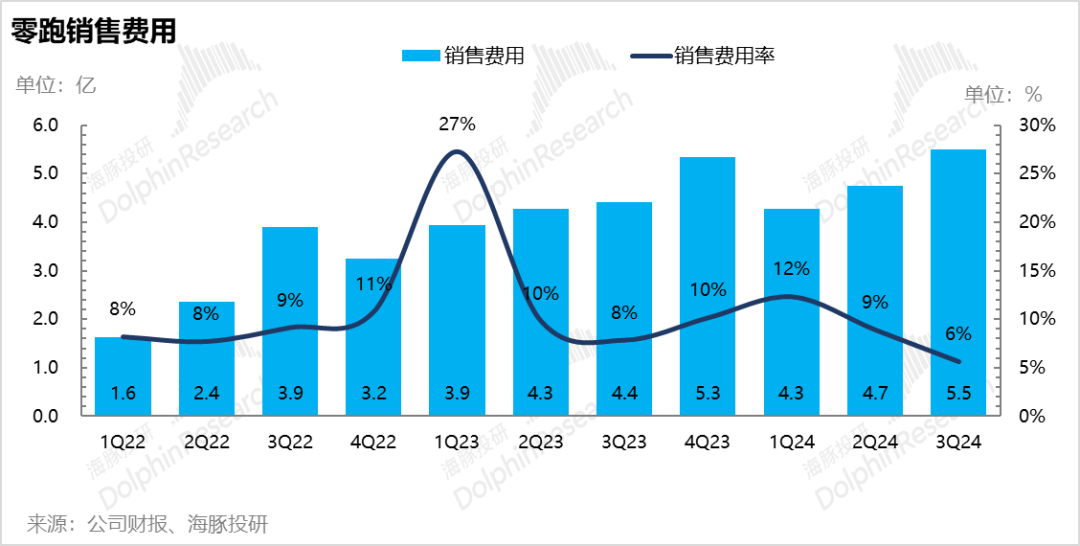

3. Operating expenses continue to increase quarter-on-quarter, but leverage effects are released: Operating expenses continued to increase quarter-on-quarter in this quarter. R&D expenses were mainly used for investment in new models and end-to-end intelligent driving development. Leapmotor increased investment in manpower, computing power, and equipment. Sales expenses were mainly due to increased advertising and promotional activities and the expansion of the sales team. However, due to strong sales in this quarter, leverage effects were released, and the operating expense ratio decreased by 10% quarter-on-quarter.

4. Achieving significant loss reduction: Due to the significant quarter-on-quarter rebound in gross margin and the release of leverage effects driven by strong sales, Leapmotor achieved significant loss reduction in this quarter. Operating profit increased by RMB 530 million quarter-on-quarter to -RMB 700 million, and the operating profit margin increased by 16% quarter-on-quarter to -8% in this quarter, with the inflection point for turning positive not far off.

5. Fourth-quarter guidance continues to improve: Leapmotor expects to exceed its full-year sales target of 250,000 vehicles. The gross margin in the fourth quarter is expected to continue the steady improvement trend from the third quarter, and the net loss is also expected to continue to narrow.

Overall, Leapmotor delivered a good performance in the third quarter, with the most impressive being the quarter-on-quarter rebound in automotive gross margin, which directly contributed to the significant loss reduction in this quarter.

As Dolphin Insights has repeatedly mentioned in previous in-depth articles, we believe Leapmotor is a down-to-earth automaker with highly cost-effective models compared to competitors. However, it has been plagued by marketing and brand awareness issues. Judging from Leapmotor's recent sales momentum, its brand awareness has gradually increased. Dolphin Insights believes that the reasons for Leapmotor's recent surge in sales momentum are:

① The trade-in policy has been further upgraded, most benefiting new energy vehicle companies with pricing between RMB 100,000 and RMB 200,000, such as Leapmotor

② High cost-effectiveness of models, creating disruptive competition with competitor models: Leapmotor has brought 800V and intelligent driving to the RMB 150,000 price range, making its models highly cost-effective. At the same time, the model positioning is accurate. For example, the strong sales of the C16 are positioned as a 6-seat family SUV, with a pricing significantly lower than that of similarly positioned family SUVs like the Li Auto L6 and Huawei M7, covering the gap in the RMB 150,000-200,000 family SUV segment and thus forming differentiated competitiveness.

Looking ahead to the fourth quarter, Leapmotor's current order momentum remains strong, with a net increase of over 40,000 orders in October. With the sales peak season and overseas expansion driving further increases in deliveries, Dolphin Insights expects Leapmotor's fourth-quarter deliveries to reach 120,000-130,000 units, driving annual deliveries to 290,000-300,000 units, far exceeding Leapmotor's previously set sales target of 250,000 units for 2024.

At the same time, as the model mix continues to improve in the fourth quarter, driven by economies of scale and annual price reductions from suppliers, the gross margin will further increase quarter-on-quarter, achieving continued loss reduction and sustained improvement in operating performance.

Regarding overseas expansion, Leapmotor's overseas expansion had a limited impact in 2024 (with an expected contribution of only 6,000-10,000 units this year). However, its impact will be fully realized in 2025 (with Leapmotor expecting overseas models to contribute 60,000-100,000 units in 2025).

Compared to other new-energy vehicle startups, Leapmotor still has differentiated advantages in overseas expansion:

① Leveraging Stellantis' brand recognition and channels: On the one hand, this can help Leapmotor quickly open up the European market and gain a head start in overseas expansion. On the other hand, by leveraging Stellantis' own sales channels, Leapmotor can avoid profit concessions and enjoy greater profit margins.

② Using Stellantis' overseas factories and adopting the SKD model for exports to Europe: Leapmotor sells components to Leapmotor International, which then uses Stellantis' existing overseas factories for assembly and production. Although there are still restrictions on the proportion of locally produced components in Europe, the export resistance is significantly reduced compared to other new-energy vehicle startups.

③ In addition to being the second-largest market in Europe, Stellantis' largest market is still North America. However, due to policy and tariff issues, there is currently a lack of new energy vehicle companies in North America (including Leapmotor). But in the long run, with the support of Stellantis' channels and local factories, Leapmotor still has room for imagination.

Judging from Leapmotor's current valuation, with a 2024 P/S multiple of 1.5x, its brand awareness in China has been established, its operating performance continues to improve in the fourth quarter, and its overseas expansion is just beginning. Compared to other new-energy vehicle startups, Dolphin Insights believes that such a valuation is still reasonable given Leapmotor's differentiated advantages.

Detailed Analysis Below

I. Gross Margin Exceeds Expectations in the Third Quarter

The most concerning aspect for investors in Leapmotor's latest results is the gross margin of its automotive business.

Leapmotor had already guided in previous conference calls that the gross margin of its automotive business would rebound quarter-on-quarter in the third quarter, with a gross margin of over 5% in July. Therefore, the market and large banks expected the gross margin of Leapmotor's automotive business in the third quarter to be 6.4%/6.7%. However, Leapmotor's actual automotive gross margin for the third quarter was 8.2%, exceeding market and large bank expectations.

From the perspective of vehicle economics:

a) The average vehicle price was RMB 114,000, benefiting from improved model mix

The average vehicle price was RMB 114,000 in the third quarter, rebounding by RMB 14,000 quarter-on-quarter, mainly benefiting from improved model mix: The high-priced, high-margin C16, which started deliveries in June, was fully delivered in the third quarter. The proportion of C16 in the model mix increased by 19.4% quarter-on-quarter to 21%, while the proportion of the low-priced, low-margin T03 continued to decline by 3%-4% quarter-on-quarter in sales mix. The improvement in sales mix drove an increase in the average vehicle price in this quarter.

b) The average vehicle cost was RMB 105,000, lower than market expectations of RMB 107,000

Due to the increased proportion of high-priced, high-margin C16 in this quarter, manufacturing costs were higher, resulting in an increase of RMB 7,000 quarter-on-quarter in average vehicle cost. However, it was still lower than market expectations of RMB 107,000. The reasonable cost control was mainly due to the following reasons: benefiting from ongoing cost management efforts, economies of scale from increased sales, and continued declines in battery costs driven by upstream lithium carbonate prices.

c) The gross profit per vehicle was RMB 9,000, exceeding market expectations of RMB 7,000

Driven by the rebound in average vehicle price and reasonable cost control, the gross profit per vehicle increased by RMB 6,000 quarter-on-quarter, driving an increase of 5.5% quarter-on-quarter in overall gross margin to 8.2% in this quarter.

II. Gross Margin in the Fourth Quarter is Expected to Continue to Rebound Driven by Strong Sales

In the third quarter, Leapmotor's deliveries rebounded by 62% quarter-on-quarter, ranking among the top in new energy vehicle startups. Dolphin Insights believes the reasons for Leapmotor's strong sales are as follows:

① The trade-in policy has been further upgraded, most benefiting new energy vehicle companies with pricing between RMB 100,000 and RMB 200,000:

In the third quarter, the trade-in policy was further upgraded, with subsidies for purchasing new energy vehicles after scrapping increased from RMB 10,000 to RMB 20,000. Scrapped models are approximately 13 years old, and scrapped model users are more price-sensitive and prefer models with lower subsidized prices, further benefiting new energy vehicle companies (such as Leapmotor) with pricing between RMB 100,000 and RMB 200,000.

② High cost-effectiveness of models, creating disruptive competition with competitor models

Leapmotor's mid-to-large SUV C16, which has a higher pricing and gross margin, started deliveries in June. The C16, which is equipped with 800V throughout, is the first vehicle company to bring 800V to the RMB 160,000 price range. Positioned as a 6-seat family SUV, its pricing is significantly lower than that of similarly positioned family SUVs like the Li Auto L6 and Huawei M7, covering the gap in the RMB 150,000-200,000 family SUV segment and thus forming differentiated competitiveness.

At the same time, 24 models have added intelligent driving versions equipped with NVIDIA Orin X chips (with a computing power of 254 TOPS) and one LiDAR. The starting price of the intelligent driving version is a minimum of RMB 165,800 (C10 range-extended version), making it the lowest-priced model with similar intelligent driving hardware configurations among delivered models, creating differentiated competition with competitor models.

Looking ahead to the fourth quarter, Leapmotor's current order momentum remains strong, with a net increase of over 40,000 orders in October. It is expected that in the fourth quarter, with:

① The sales peak season and overseas expansion driving further increases in deliveries: The fourth quarter is the sales peak season for new energy vehicle companies. Coupled with Leapmotor's official overseas expansion in the fourth quarter, mainly focusing on the T03 and C10 models, it is expected to contribute approximately 6,000-10,000 units to sales in 2024. Dolphin Insights expects Leapmotor's fourth-quarter deliveries to reach 120,000-130,000 units, driving annual deliveries to 290,000-300,000 units, far exceeding Leapmotor's previously set sales target of 250,000 units for 2024 and further releasing economies of scale.

② Continued improvement in model mix: The proportion of C-series models in October sales further increased to 80%, driving a further increase in average selling price (ASP) per vehicle;

③ Annual price reductions from suppliers at the end of the year: The previous round of annual price reductions from suppliers was reflected in the fourth quarter of last year, and this year's fourth quarter may also benefit from cost reductions brought about by annual price reductions from suppliers.

Sales in the fourth quarter are expected to continue to increase by 39%-50% quarter-on-quarter, with the gross margin also expected to maintain the steady improvement trend from the third quarter, and the net loss is also expected to continue to narrow.

IV. Operating Expenses Continue to Increase, but Operating Leverage is Released

In R&D, Leapmotor adheres to in-house research and development, with previous efforts focusing more on electrification. However, the R&D focus in 2024 is on new models and intelligent driving development. The 24 new models have introduced intelligent driving versions, successfully bringing intelligent driving to the RMB 150,000-200,000 price range. In sales, Leapmotor still positions itself as a manufacturing company and primarily uses dealers, so the proportion of manufacturing personnel is the largest.

1) R&D Expenses: For intelligent driving and new model development

Leapmotor's R&D expenses in the third quarter were RMB 780 million, an increase of RMB 80 million quarter-on-quarter:

In R&D, Leapmotor adheres to in-house research and development, focusing on all key software and hardware in smart electric vehicle core systems and electronic components. The company produces and supplies its own three-electric core components and some controllers, demonstrating strong vertical integration capabilities in the supply chain. Currently, the self-produced and self-supplied portion accounts for approximately 60% of the bill of materials (BOM).

1) Leapmotor is continuously increasing investment in intelligent driving R&D. Building on the already realized high-speed NAP and urban NAC intelligent driving functions, it is focusing on the research and development of "end-to-end large model" intelligent driving and will continue to increase investment in manpower, computing power, and equipment to ensure the research and development of end-to-end AI large models and mass production delivery in 2025.

Leapmotor plans to equip its new LEAP 3.5 architecture with high-level intelligent driving functions based on the "end-to-end large model" for high-speed and urban areas in the first half of 2025, aiming to join the first tier of intelligent driving and create differentiated competitiveness through intelligent driving compared to models of the same price range.

2) Launch of new models: Leapmotor will launch the new B10 model in October, positioned as a compact SUV focusing on the RMB 100,000-150,000 market and scheduled for domestic launch around the first quarter of 2025. In the next two years, seven new models will be launched, and R&D expenses will also be invested in new model development.

Leapmotor previously expected its full-year 2024 R&D expenses to increase by 50% year-on-year, implying fourth-quarter R&D expenses of over RMB 880 million, an increase of at least RMB 100 million quarter-on-quarter.

2) Selling Expenses: Increased by RMB 80 million quarter-on-quarter due to increased advertising and promotional activities and the expansion of the sales team

Leapmotor's selling expenses in the third quarter were RMB 550 million, an increase of RMB 80 million quarter-on-quarter, mainly due to the increase in sales personnel and increased investment in advertising and promotional activities.

Leapmotor continues to adhere to the "1+N" channel development model, accelerating channel expansion and transformation to further expand coverage in blank cities and accelerate channel sink in county-level cities.

In the third quarter, Leapmotor net added 19 sales outlets and 34 service outlets, newly covering 17 cities. Channel sink also reached more customers with a budget of RMB 100,000-200,000 for car purchases, accelerating sales conversions.

3) General and Administrative Expenses: Relatively well-controlled

General and administrative expenses in this quarter were RMB 340 million, an increase of RMB 40 million quarter-on-quarter, which was relatively well-controlled, mainly due to the increase in administrative personnel with business expansion and the increase in taxes and surcharges.",