Thalys' Performance Soars, but Why Does the Chairman Say 'I'm Afraid of Being Poor'?

![]() 11/15 2024

11/15 2024

![]() 508

508

"Unlike SAIC's rapid decline, Thalys has made the 'soul theory' disappear with its impressive performance."

@TechNewKnow Original

Thalys' performance has soared, but why does Chairman Zhang Xinghai still say he's 'afraid of being poor'?

On November 12, Zhang Xinghai, Chairman of Thalys Group Co., Ltd., said at the 31st Annual Meeting of the China Society of Automotive Engineers, 'I once said, 'I'm afraid of being poor,' but actually, I'm afraid of being poor in technology. I've been making minivans for 20 years, and there are always two major hurdles ahead of me. One is SAIC-GM-Wuling, and the other is Changan.'

Zhang Xinghai, Chairman (Founder) of Thalys Group

Zhang Xinghai mentioned that for the same minivan model, Changan is priced 2,000 yuan higher than Thalys, and Wuling is priced 5,000 yuan higher. This represents a 10% difference. For us, how do we squeeze out profits when we have to spend another 3,000 to 5,000 yuan? It's so difficult, which is why I'm afraid of being poor.

Therefore, in this situation, Thalys can only seek value through technology. Zhang Xinghai also mentioned that entrepreneurship is about persistence, persistence, and more persistence; innovation, innovation, and more innovation.

As competition intensifies in the domestic new energy vehicle industry, automakers are experiencing mixed fortunes. While profits of listed automakers such as GAC, SAIC, and others have plummeted, Thalys has achieved remarkable results, with Huawei playing a crucial role behind the scenes.

01

Choice is More Important Than Effort

Thalys' predecessor, Xiaokang Stocks, was established in May 2007 and once produced brands such as Dongfeng Xiaokang and Dongfeng Fengguang. It was listed in June 2016. In the second year after its listing, Thalys' revenue reached 21.934 billion yuan, a year-on-year increase of 35.46%; net profit reached 725 million yuan, a year-on-year increase of 41.14%, marking the company's best performance before its name change.

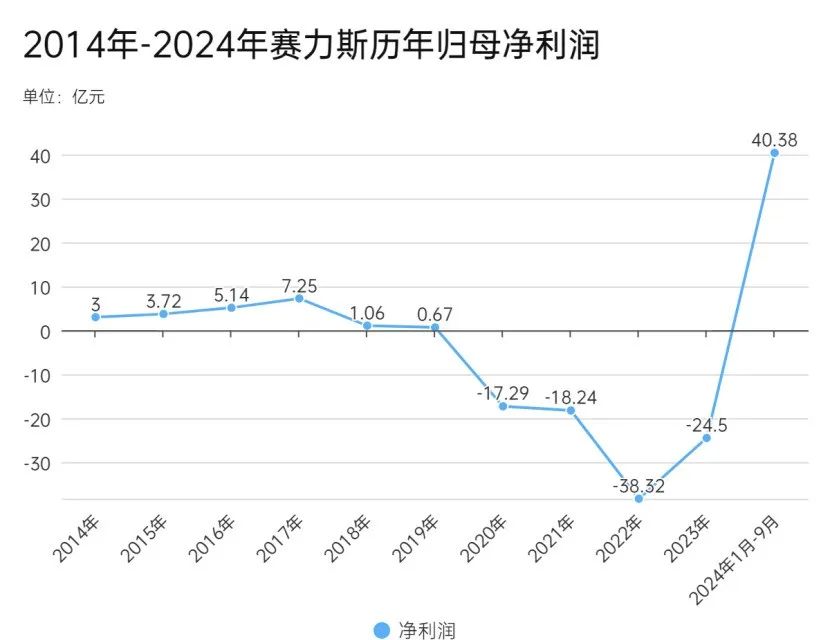

However, Thalys' performance subsequently declined continuously. From 2020 to 2021, the company's net profits were -1.729 billion yuan and -1.824 billion yuan, respectively, pushing the enterprise to a precarious position.

Data Source/Public Financial Reports

At that time, Thalys, still a marginal automaker, was one of the earliest listed companies to fully collaborate with Huawei in vehicle manufacturing. As early as 2019, Thalys disclosed its cooperation with Huawei. In 2020, the two parties jointly developed the Smart Selection SF5. In December 2021, the mid-size luxury SUV AITO M5, a collaboration between the two parties, was launched and delivered in March 2022, followed by the successive launches of AITO M7 and M9, forming the AITO series.

From an external perspective, Huawei is known for making smartphones, while Thalys specializes in vehicle manufacturing. However, Thalys relies on Huawei for its vehicle manufacturing, leading to the widely circulated 'soul theory'.

Chen Hong, the former chairman of SAIC, stated, 'There is a company that provides us with an overall solution. As a result, it becomes the soul, while SAIC becomes the body. SAIC cannot accept such an outcome. We must keep the soul in our own hands.'

This sentiment was a true reflection of the inner thoughts of most enterprises at that time.

However, in August this year, Jia Jianxu, the new president of SAIC Group, stated in a mid-year cadre conference that SAIC Group must learn to 'be humble' and 'keep a low profile but act with high visibility' to succeed in the future. The reason for 'being humble' may be due to poor sales. From January to October this year, SAIC Group's cumulative sales reached 3.051 million vehicles, a year-on-year decrease of 21.13%. However, SAIC's sales target for 2024 is 5.45 million vehicles, with a target completion rate of 56%.

Unlike SAIC's rapid decline, Thalys has made the 'soul theory' disappear with its impressive performance.

Thalys' third-quarter financial report revealed that it achieved revenue of 41.582 billion yuan and net profit attributable to shareholders of listed companies of 2.413 billion yuan. For the first three quarters, its revenue reached 106.627 billion yuan, a year-on-year increase of 539.24%; net profit attributable to shareholders of listed companies was 4.038 billion yuan, swinging from a loss to a profit, with a year-on-year increase of 276%.

02

Challenges Under the Halo

During these years of close collaboration with Huawei, Thalys has invested heavily in research and development.

In May this year, Zhang Xinghai stated at the National Youth Entrepreneurs Conference that Thalys' cumulative core R&D investment has exceeded 12 billion yuan, primarily invested in technologies such as trinity (battery, motor, and electronic control), range extension, electronic and electrical architecture, and intelligent driving. Additionally, the financial report revealed that Thalys' R&D expenses for the first three quarters of this year were 4.368 billion yuan, a year-on-year increase of 300.37%.

Besides the AITO series in collaboration with Huawei, Thalys also has some self-owned brands. However, based on the current situation, none of these brands have standout models.

Although AITO's sales are encouraging, multiple car accidents have put AITO in the spotlight. Recently, AITO M7 was exposed to have 'brake failure' and 'data tampering' after inspection. Although Thalys promptly responded that 'fact determination should be based on court findings,' it will still have some impact on the AITO brand.

Nowadays, more and more enterprises are choosing to collaborate with Huawei. However, Huawei and its collaborating automakers are 'untying the knot'.

In November last year, Huawei planned to integrate the core technologies and resources of its intelligent vehicle solutions business into a new company. On January 16 this year, Yingwang was officially registered. Thalys has recently paid the first transfer price of 2.3 billion yuan for a 10% stake in Yingwang.

Huawei has also intensively transferred trademarks and other assets to automakers. In July this year, Thalys acquired the AITO trademark held by Huawei for 2.5 billion yuan.

Looking at the entire automotive market, Thalys still faces many formidable competitors. To remain standing tall, it must rely on technology, and having a standout self-owned brand model remains crucial. Thalys must innovate, innovate, and innovate again.