Wang Chuanfu's Aggressive Push, Carlos Tavares' Departure

![]() 12/05 2024

12/05 2024

![]() 555

555

TEAM

Typography: Yuni Mashi

Images: From the internet, infringement will be deleted

Produced by Qiancheng Digital Intelligence (Effect Marketing Intelligence Agency)

Wang Chuanfu, who controls costs to the core, is making foreign giant leaders tremble.

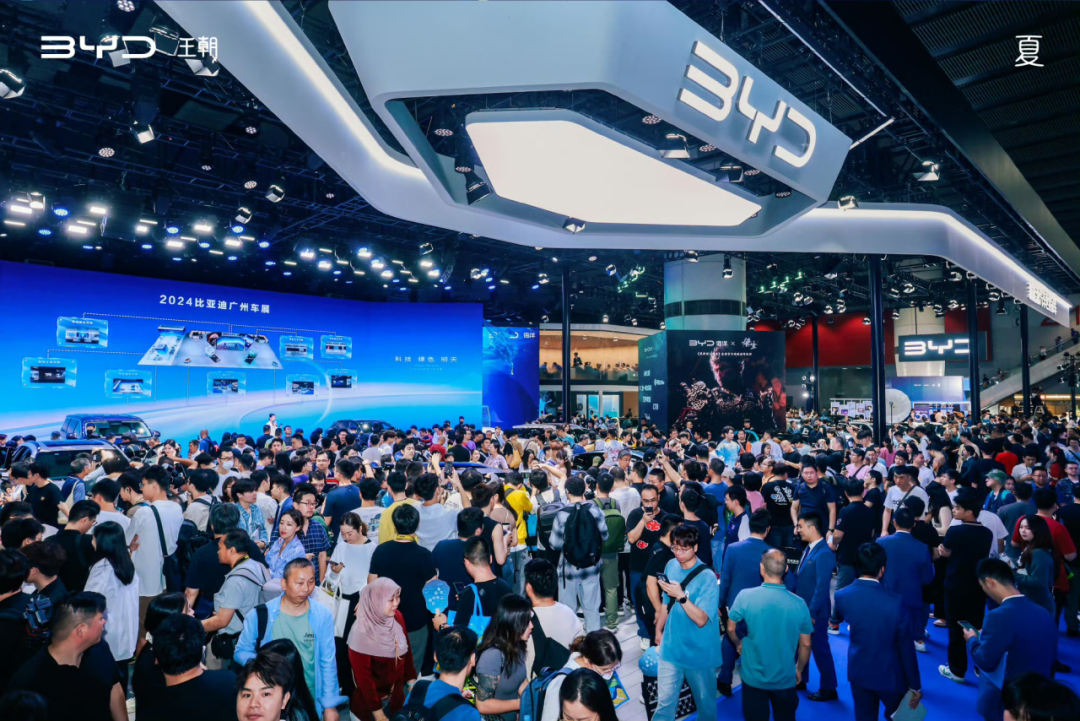

According to statistics from data and research company MarkLines, in the third quarter of this year, BYD ranked 6th in global sales with 1.13 million vehicles sold, surpassing Ford, one of the three major American automakers, for the first time, and was only 10,000 vehicles behind the 5th-ranked Stellantis Group. In November, BYD sales surged again, reaching 507,000 vehicles.

In the third quarter, Stellantis Group's global deliveries were 1.148 million, a year-on-year decrease of 20%. This also became the direct trigger for Carlos Tavares' resignation.

On December 1, 2024, Carlos Tavares, the first and only CEO of the Stellantis Group to date, submitted his resignation to the board of directors after serving for 3.5 years, ending his five-year contract period early.

This "cost killer" who led Stellantis to record profit performance in 2023 suddenly stepping down is deplorable. In the 2023 fiscal year, as the "helmsman," Carlos Tavares used extreme cost-cutting measures such as layoffs, brand closures, and industrial chain transfers, enabling Stellantis Group's net income to reach 189.5 billion euros, an increase of 6% from 2022; net profit increased by 11% to 18.6 billion euros. However, it then entered difficulties in 2024.

One is a new energy vehicle leader who continuously expands outward and recruits talents to build a technological "fish pond," while the other is an "iron-fisted leader" who squeezes internally and frequently lays off employees for a blood transfusion. Both Wang Chuanfu and Carlos Tavares control costs almost brutally, but they have taken two different paths and reached different outcomes.

Wang Chuanfu's aggressive push and Carlos Tavares' departure highlight a clear sign: Chinese automakers are advancing while others are retreating in the global automotive market, signaling a change in the global automotive landscape.

Wang Chuanfu expands outward, while Carlos Tavares contracts inward

Both are extreme cost controllers, but 58-year-old Wang Chuanfu and 66-year-old Carlos Tavares have taken different routes.

Carlos Tavares' primary iron-fisted method behind extreme cost reduction is layoffs. During his tenure, once the goals he sets cannot be achieved, the only outcomes for those managers are job transfers or departures.

According to incomplete statistics, during Carlos Tavares' leadership of the PSA and FCA merger, Stellantis laid off more than 50,000 employees, with a layoff rate of 15.5%. Entering 2023, Stellantis again laid off employees on a large scale, offering voluntary buyouts to 40,000 employees throughout the year.

The extreme layoff measures put tremendous pressure on Stellantis' executives and employees, to the point that after his resignation, the United Auto Workers union in the United States directly stated that "Carlos Tavares' departure is good news."

Unlike Carlos Tavares' methods, Wang Chuanfu's cost reduction began with recruiting talents. During the battery manufacturing period, when Wang Chuanfu could not afford nickel battery automation equipment, he began recruiting a large number of workers, using cheap labor to replace expensive mechanized production lines. With a small workshop and over 20 people, Wang Chuanfu built a production line capable of producing 4,000 nickel-chromium batteries per day with just over 1 million yuan, and the cost was lower than that of Japan.

In 2024, the global automotive market faced tremendous competitive pressure, and many automakers began laying off employees to reduce costs. However, Wang Chuanfu continued to recruit talents. Currently, BYD has 11 major research institutes and 110,000 engineers; in 2023, BYD's total number of employees reached 703,000, with 133,000 new recruits.

From the perspective of treating talents, Wang Chuanfu and Carlos Tavares have essential differences. When Carlos Tavares' extreme cost reduction led to the exploitation of many employees, Wang Chuanfu bluntly stated, "Even if all our assets, including factories, patents, and stocks, disappear, as long as our engineers are still here, we can rebuild anytime." The "technology fish pond" composed of talents also makes BYD's ultra-low prices unreplicable.

Regarding cost reduction, Carlos Tavares contracted inward and sacrificed less important assets to protect the core. Wang Chuanfu expanded outward and continued to push aggressively.

It is reported that during his tenure at PSA, Carlos Tavares reduced 45 models to 26 and cut down 7 vehicle platforms to 2. Stellantis also continuously sold or closed some brands, especially in the Chinese market. For example, GAC FCA exited the Chinese market, and Dongfeng Peugeot and Dongfeng Citroen transitioned to a "light asset business model."

Such meticulous calculations only allowed Stellantis to have a brief highlight in 2023, and then in 2024, it gradually declined, even more desolate than before the highlight. Especially in the American market, Stellantis' sales declined severely, falling below one million for the first time in the first three quarters. In the first half of the year, its adjusted operating profit was 8.5 billion euros, a year-on-year decrease of 5.7 billion euros.

In contrast, BYD, which is accelerating its global expansion, has entered 96 countries and regions worldwide and established multiple production bases in Europe, Southeast Asia, and South America. Its footprint has not only spread to the doorsteps of foreign companies but has also seen rapid growth in performance. In the third quarter, revenue reached 201.125 billion yuan, surpassing Tesla for the first time.

BYD's "low-cost control" has made foreign automakers nervous. Behind it is technological innovation. Its breakthroughs in core technology areas such as batteries, hybrids, and electric vehicle platforms are difficult to replicate. This is the accumulation of Wang Chuanfu's 30 years of effort.

However, Carlos Tavares, who is past his early sixties, urgently needs achievements to prove himself. Therefore, compared to the time-consuming and labor-intensive effort of vigorously researching and developing electrification and intelligent innovation, whose benefits cannot be highlighted in the short term, he is more willing to focus on short-term solutions such as layoffs and product line cuts.

This is why Stellantis' market share in the American consumer market has been shrinking continuously. The current situation of Stellantis is a microcosm of the prevalent situation faced by foreign automakers.

Chinese automakers advance, foreign automakers retreat

Carlos Tavares' departure is not a particularly noteworthy event. Because his "iron-fisted methods" of cost reduction have become the common practice of current foreign giant leaders. The decline of the Stellantis Group is a dangerous microcosm of the entire European automotive market and even global foreign automakers.

Cost reduction has become the first hurdle for foreign automakers to survive. Due to a significant drop in profits, Volkswagen plans to close at least three domestic factories, lay off tens of thousands of employees, and reduce salaries by 10% for all staff. This is the first time Volkswagen has closed a factory since its establishment in 1937. Although the German Metalworkers' Union IG Metall hopes to prevent this situation, Volkswagen still insists on it.

According to Deutsche Presse-Agentur reports, on December 2 of that year, nine of Volkswagen's ten factories in Germany went on strike, halting production lines. As of the afternoon of the 2nd, a total of approximately 66,000 Volkswagen employees participated in the strike.

"The situation in the European automotive industry is grim, with a difficult economic environment in front and fierce competitors behind. The competitiveness of the German manufacturing industry is further lagging behind, and Volkswagen must act decisively," stated Volkswagen CEO Herbert Diess.

The "cold winter" in the European automotive market has spread to the Japanese automotive market. Reuters reported that on December 2, Nissan Motor's Chief Financial Officer (CFO) Makoto Uchida was expected to resign soon due to deteriorating performance at Nissan.

Due to deteriorating performance, Nissan Motor had announced layoffs of 9,000 employees on November 7 and would reduce global production capacity by 20%.

While foreign automakers are struggling to cope with their own problems, Chinese automakers are stepping up the pressure.

In August of this year, BYD ranked second globally in sales with 385,100 vehicles, second only to Toyota and surpassing traditional automotive giants such as Volkswagen, Ford, and others.

In the third quarter, Geely Auto's sales increased to 820,000 vehicles, ranking 9th in global auto sales; another automaker, Chery Automobile, ranked 12th. In the third quarter alone this year, the cumulative sales of these three Chinese automakers increased by 27% year-on-year, an increase of 550,000 vehicles, close to Mercedes-Benz's total sales in the third quarter.

Most importantly, unlike the declining sales of foreign automakers, the sales of Chinese automakers are continuously growing, and the gap between the two camps is gradually narrowing.

"If there were no trade barriers, Chinese automakers could eliminate most automakers in the world and dominate globally," revealed Elon Musk, CEO of Tesla, a fact.

Currently, Chinese local automakers face huge tariffs. The additional tax rate for BYD is 17%, Geely is 18.8%, and SAIC Motor is 35.3%.

In fact, the European market has mixed feelings towards Chinese automakers. They fear the large-scale expansion of Chinese automakers but also desire their involvement. On the one hand, they aim to achieve their sales target of phasing out fuel vehicles by 2035. On the other hand, they hope to utilize the localized production of Chinese automakers to provide suitable jobs for locally laid-off residents.

It is reported that due to the plight of the European automotive industry, upstream suppliers such as Bosch, ZF, Continental, and Schaeffler have also laid off employees. Bosch will lay off 5,550 employees, Schaeffler plans to lay off 4,700, and ZF plans to lay off 14,000 in Germany alone in the coming years.

Whether it's Carlos Tavares stepping down, Volkswagen, which once announced it would never lay off employees, or the decline of the European automotive market, they all prove to the world that in the rapidly changing era of new energy, nothing is eternal.

For those leaders of foreign giants, nothing is more important than a reform as drastic as scraping poison from the bone. However, the Chinese are more ambitious and decisive in taking bold actions.